公司简介

| RKFS Review Summary | |

| 成立日期 | 2020-06-08 |

| 注册国家/地区 | 印度 |

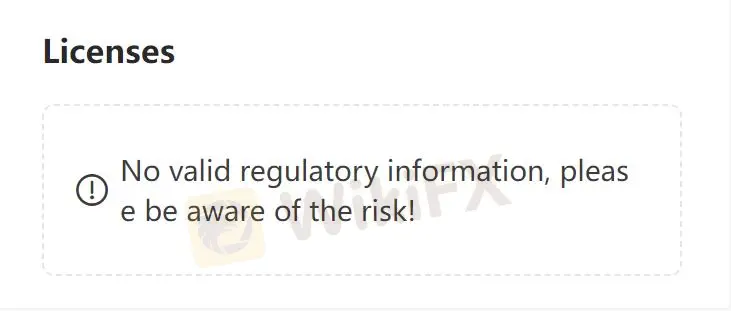

| 监管 | 未受监管 |

| 市场工具 | 证券、共同基金、股票、保险、咨询服务等 |

| 模拟账户 | 未提及 |

| 交易平台 | Sanjhi Poonji(Web、Android和iOS)和后端 |

| 最低存款 | 无限制 |

| 客户支持 | 电话:+91-011-485644440+91-7834834444 |

| 电子邮件:Mcustomercare@rkfml.com | |

| 在线聊天 | |

| 社交媒体(Facebook、Instagram、LinkedIn、YouTube等) | |

RKFS 信息

RKFS 是一家金融咨询公司,提供包括证券、共同基金、股票、保险、咨询服务等各种产品和服务。有免佣金的证券账户和RKFS-INDIA INX全球账户。

优点和缺点

| 优点 | 缺点 |

| 各种产品和服务 | 未受监管 |

| 24/7在线支持 |

RKFS 是否合法?

RKFS 未受监管,相对于受监管的公司来说,安全性较低。

RKFS 有哪些产品和服务?

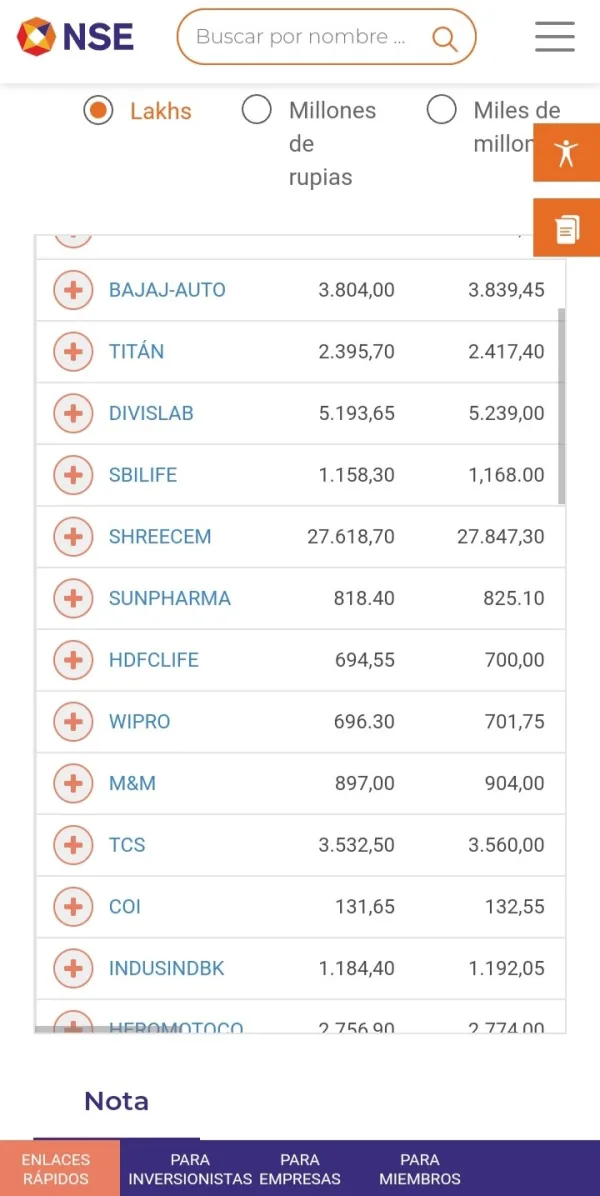

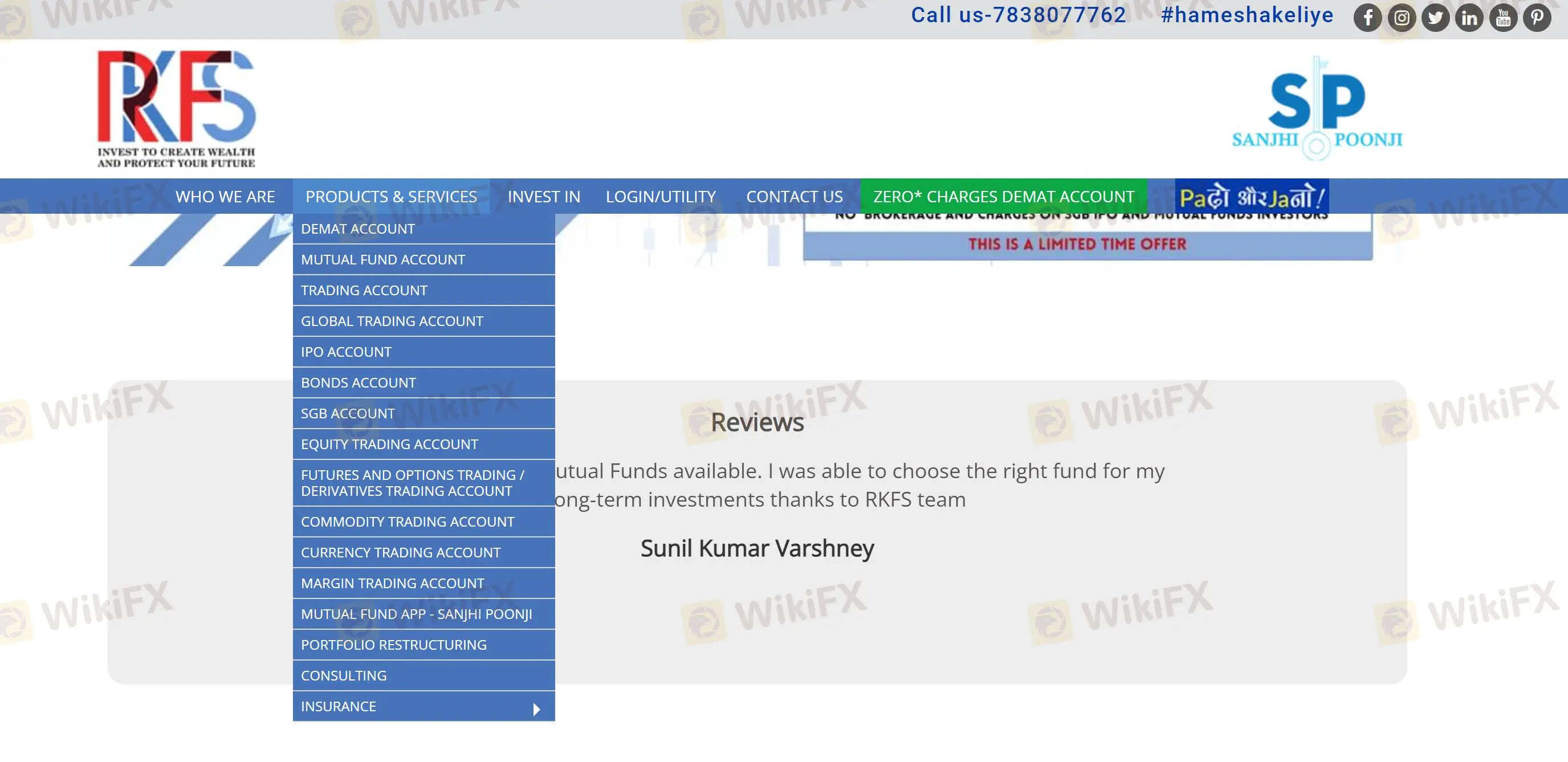

交易者可以开设账户投资多种交易资产,包括证券、共同基金、IPO、股票、期权、期货和保证金交易,以及ETF、货币、债券等,还提供保险和咨询服务。

| 可交易工具 | 支持 |

| 证券 | ✔ |

| 共同基金 | ✔ |

| IPO | ✔ |

| 股票 | ✔ |

| 期权和期货 | ✔ |

| 保证金交易 | ✔ |

| ETF | ✔ |

| 货币 | ✔ |

| 共同基金 | ✔ |

| 保险 | ✔ |

| 咨询 | ✔ |

账户类型

RKFS提供证券账户和RKFS-INDIA INX全球账户账户。GA允许投资者通过一个集成账户全球投资股票、ETF、期权、期货、货币、债券、共同基金,除了提供以上资产服务外,证券账户还可以投资IPO、大宗商品等。

| 账户类型 | 支持 |

| 证券账户 | ✔ |

| RKFS-INDIA INX全球账户(GA) | ✔ |

RKFS费用

佣金为零。

交易平台

RKFS可以通过Sanjhi Poonjis Android、iOS或Web版本投资公共基金。其他资产投资可以通过后台了解和下载。

| 交易平台/软件 | 支持 | 可用设备 |

| Sanjhi Poonji | ✔ | Web、Android和iOS |

存款和取款

最低存款额度为无限制。RKFS支持在线资金转账,合作银行有HDFC和ICICI银行。

客户支持选项

交易者享受增值服务,如全天候在线支持。RKFS支持通过电话和电子邮件以及社交媒体(包括Facebook、Instagram、LinkedIn、YouTube等)进行联系。

| 联系方式 | 详细信息 |

| 电话 | +91-011-485644440+91-7834834444 |

| 电子邮件 | Mcustomercare@rkfml.com |

| 在线聊天 | ✔ |

| 社交媒体 | Facebook、Instagram、LinkedIn、YouTube等 |

| 支持语言 | 英语 |

| 网站语言 | 英语 |

| 实际地址 | R. K. Financial Services (RKFS)A-7, 区块 B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |