Imranali Khatri

1-2年

Could you give a comprehensive overview of the fee structure at Qian Kun Futures, covering details like commissions and spreads?

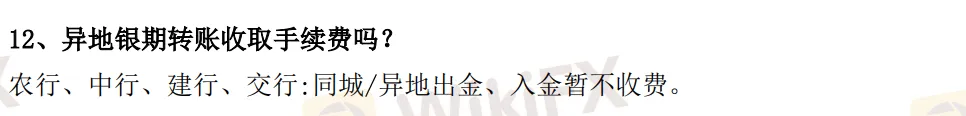

Drawing from my experience as a trader who prioritizes transparency and clarity, I paid close attention to Qian Kun Futures’ approach to fees. The available information on their fee structure is quite limited, which raised a few concerns for me. What is explicitly stated is that Qian Kun Futures charges no fees for deposits or withdrawals via bank wire, which removes a common cost that some brokers pass on to clients. However, aside from the note that the transfer must be between accounts with the same name and that the minimum account balance should be above 100 yuan, there is no published detail about trading commissions, spreads, or other transaction-related charges.

This lack of transparency makes it difficult for me to accurately anticipate my total trading costs. In the futures market, these costs—whether spread, commission per lot, or potential platform fees—are essential for effective trade planning and risk control. Without clear figures, it becomes challenging to compare Qian Kun Futures fairly against other brokers I’ve used.

For me, understanding all potential fees is a top priority before opening an account. Qian Kun Futures’ omission of detailed commission and spread information compels me to exercise caution. I would personally contact their customer service directly and request precise details before making funding decisions or executing live trades. In summary, while bank transfer fees are not passed on, the overall fee structure lacks the clarity I need for informed, confident trading.

Broker Issues

Fees and Spreads

Sanford

1-2年

Could you break down the total trading costs involved when trading indices such as the US100 with Qian Kun Futures?

As a trader who assesses brokers with a cautious and methodical approach, I found Qian Kun Futures to be a rather specialized platform. According to my review of their offerings, they do not provide access to indices such as the US100—Qian Kun Futures is licensed to conduct futures business in China and focuses exclusively on futures instruments. Their platform does not mention support for forex, commodities, indices, stocks, cryptocurrencies, or other asset classes beyond listed futures. Therefore, the option to trade the US100 or other indictive products simply isn't available there.

More broadly, I observed that trading costs on this broker are somewhat opaque. The platform provides very limited data about commissions, spreads, or trading conditions. What they do make clear is that deposits and withdrawals via bank wire are typically fee-free, which removes some friction on the funding side. That said, for prudent risk management, I consider the overall lack of cost transparency a potential issue. Without specific information on fees per contract, exchange costs, or margin requirements, it's hard for me—or any trader—to fully calculate total trading costs. In summary, if trading indices such as the US100 is your main goal, Qian Kun Futures would not fit, and for general futures trading, I would recommend seeking brokers with clearer cost structures and greater product transparency for informed decision making.

Broker Issues

Fees and Spreads

mohdfazlan

1-2年

What is the usual timeframe for withdrawals from Qian Kun Futures to reach a bank account or e-wallet?

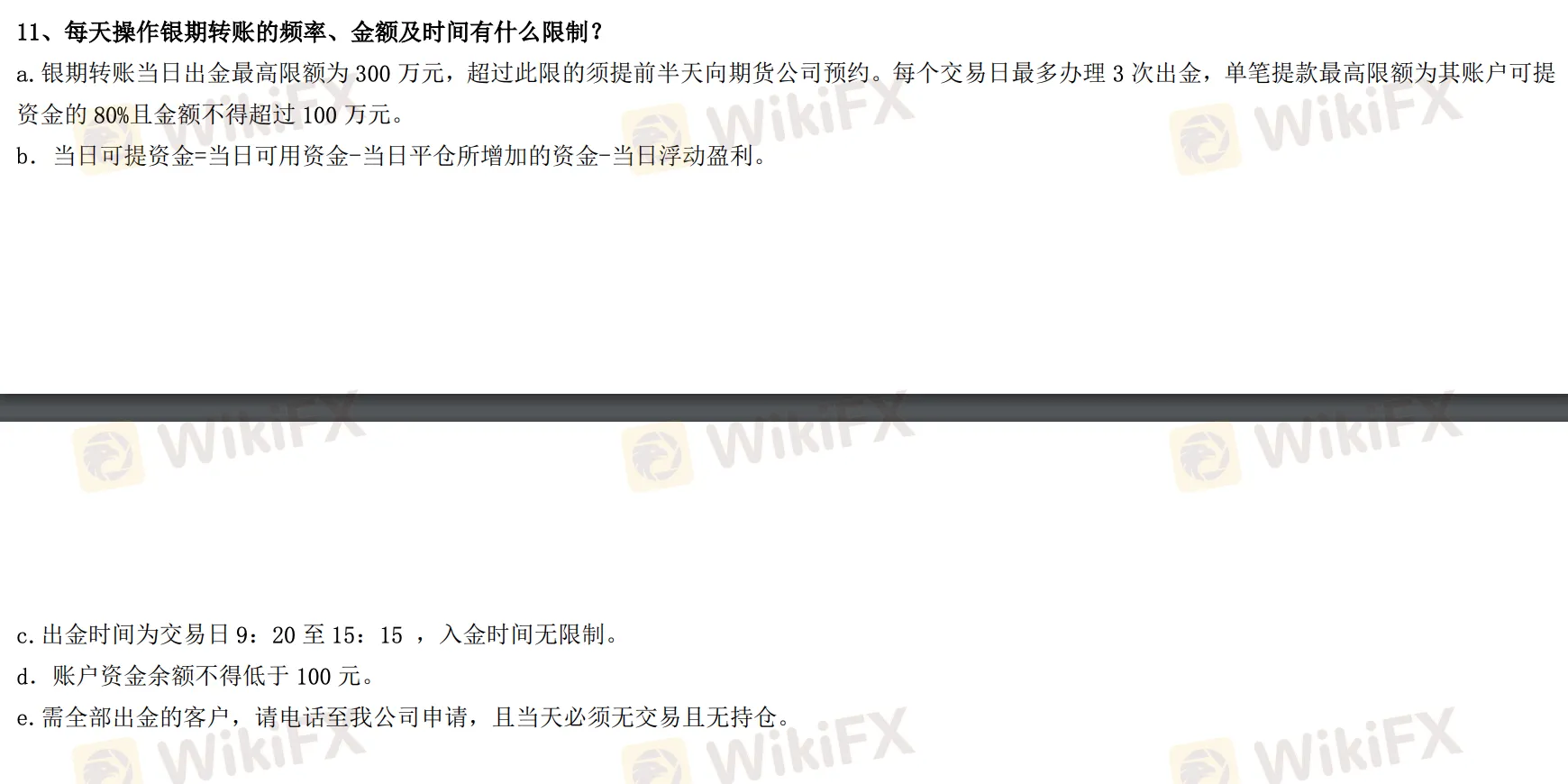

Speaking as someone with years of hands-on trading experience, I approach brokers like Qian Kun Futures with a focus on safety and clarity, especially regarding fund withdrawals. From what I’m able to gather, Qian Kun Futures processes deposits and withdrawals exclusively via bank wire, and both transactions must use the same account holder information. There are no charges detailed for these services, which might seem reassuring at first. However, in my evaluation, the broker does not clearly state any specific timeframes for how long a withdrawal takes to reach your bank account. This lack of transparency makes it difficult for me to set firm expectations regarding the speed of fund transfers.

In my experience, well-established, regulated brokers typically offer clear guidelines—often promising withdrawal processing within a certain number of business days. The absence of this detail here requires extra caution, as it can potentially impact cash flow and trading flexibility. Given that Qian Kun Futures is regulated in China and only processes withdrawals via bank wire, I would expect that, under normal circumstances, transfers might take anywhere from a few business days up to a week, depending on the banks involved and any regulatory checks.

For peace of mind, I always recommend reaching out to the broker’s support directly before making large deposits, to ask about typical withdrawal processing times and whether any additional documentation might be required. This careful approach is especially important with brokers that provide minimal detail on this essential aspect of trading.

Broker Issues

Withdrawal

Deposit

Sergey5

1-2年

What are the key advantages and disadvantages of trading through Qian Kun Futures?

Based on my personal experience and thorough evaluation, Qian Kun Futures presents a very particular set of advantages and limitations that are important to understand before opening an account. For me, one reassuring aspect was their regulation—Qian Kun Futures holds a China Financial Futures Exchange (CFFEX) license, which indicates some degree of official oversight. The company appears to have been operating for a relatively long time in China, and the availability of multiple trading platforms, like Qiankun Market II and Wind Information Financial Terminal, is a positive point if you appreciate having options in terms of interface and tools.

However, as a trader who values transparency and clear product offerings, I found some notable drawbacks. Most critically, Qian Kun Futures only offers futures trading and does not provide access to forex, commodities, indices, stocks, or cryptocurrencies. This narrow product range significantly limits any opportunities for diversification. I am always cautious when there is a "suspicious scope of business" label, as this often points to either unclear operations or business practices outside typical regulatory expectations, and here, the lack of demo accounts stands out. For me, the inability to test strategies or the platform before committing real funds is a significant disadvantage. Additionally, while their website claims there are no withdrawal fees and the deposit/withdrawal process uses standard bank wires, details on minimums and transaction times are not clearly specified.

Most concerning is the overall lack of transparency about trading conditions. Personally, this would stop me from committing significant capital, as I regard clear and open disclosure of fees, margin levels, and account requirements as essential to prudent trading. In summary, while Qian Kun Futures might offer reliability within regulated futures markets in China, I would approach with caution and only proceed if their very narrow product range fits your trading needs and you are comfortable with the information gaps.