公司简介

| 大陆期货 评论摘要 | |

| 成立时间 | 2002 |

| 注册国家/地区 | 中国 |

| 监管 | 由CFFEX监管 |

| 市场工具 | 期货 |

| 模拟账户 | / |

| 交易平台 | 益盛极星9.5,博易云,大陆期货无限Pro,中国期货快速在线交易,文华盈顺云市场软件 |

| 最低存款 | / |

| 客户支持 | 微信,微博,24/5客户服务 |

| 电话:021-54071888(交易),021-54071111(证券) | |

大陆期货 信息

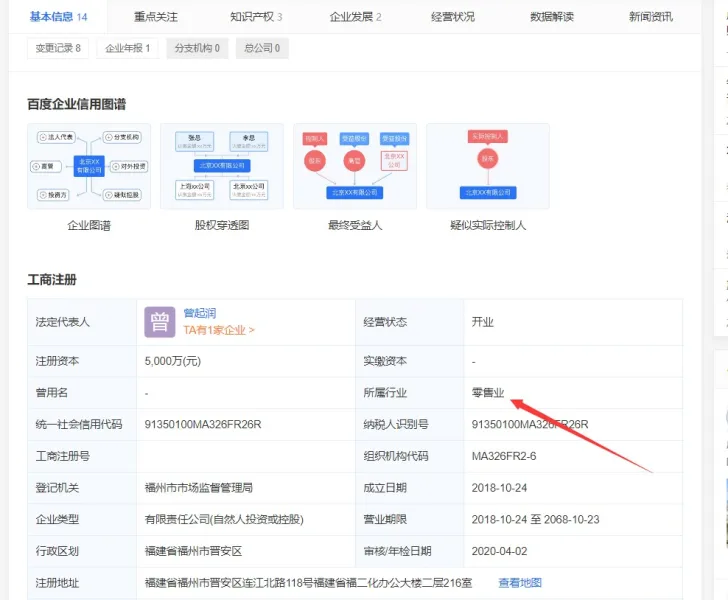

大陆期货 是一家受监管的经纪商,成立于2002年,总部位于中国。主要专注于期货交易,提供不同类型的期货交易服务。此外,在中国由CFFEX监管。

优缺点

| 优点 | 缺点 |

| 监管良好 | 没有最低存款信息 |

| 运营时间长 | |

| 多种客户支持渠道 |

大陆期货 是否合法?

是的。大陆期货已获得中国金融期货交易所(CFFEX)颁发的许可证号0188,可提供服务。

| 监管机构 | 当前状态 | 监管国家 | 受监管实体 | 许可证类型 | 许可证号 |

| 中国金融期货交易所(CFFEX) | 已监管 | 中国 | 上海大陆期货有限公司 | 期货许可证 | 0188 |

我可以在大陆期货上交易什么?

| 交易资产 | 支持 |

| 期货 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金(ETFs) | ❌ |

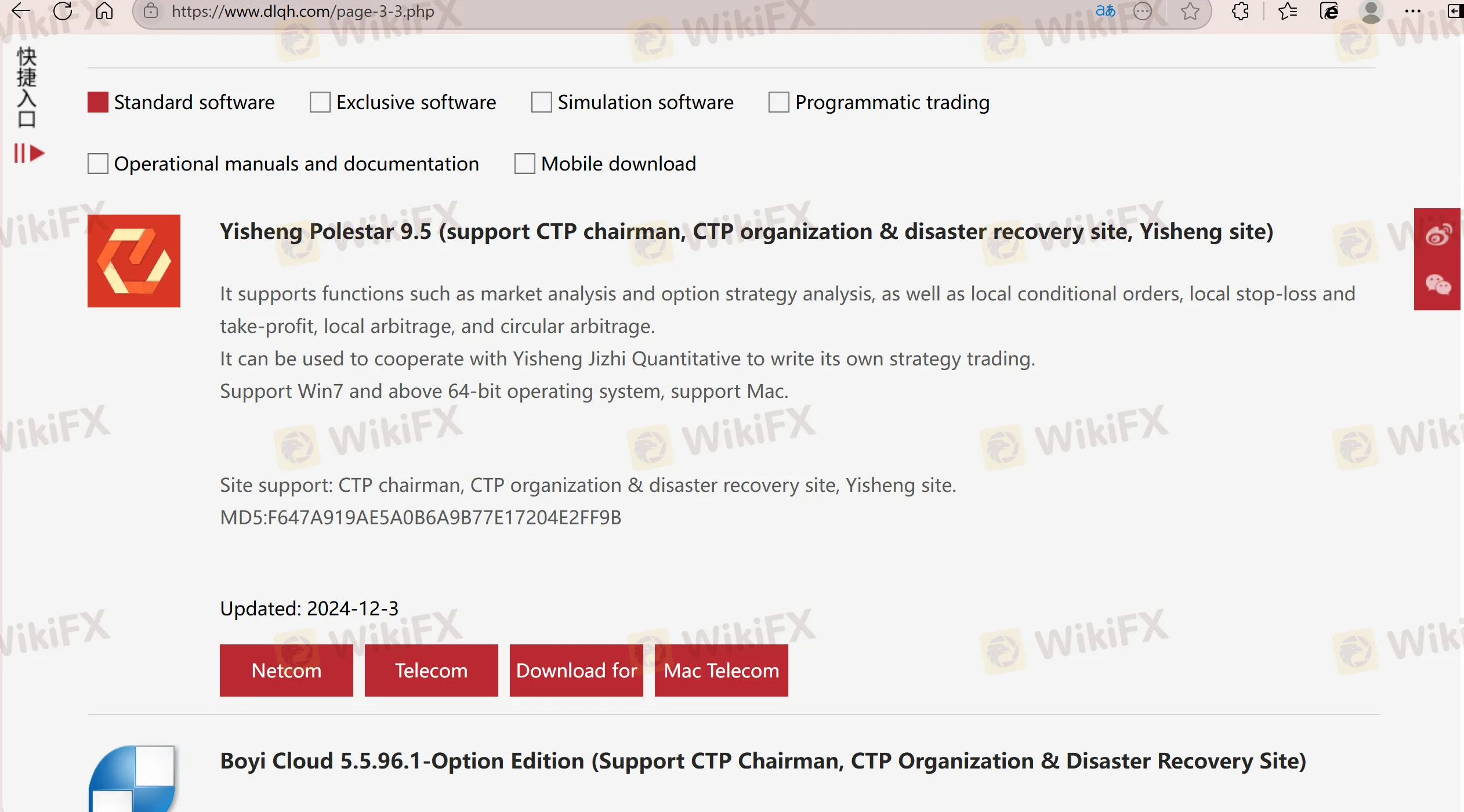

交易平台

| 交易平台 | 支持 | 可用设备 |

| 亿升极星9.5 | ✔ | 移动设备 |

| 博易云 | ✔ | 移动设备 |

| 大陆期货无限Pro | ✔ | 移动设备 |

| 中国期货快速在线交易 | ✔ | 移动设备 |

| 文华盈顺云市场软件 | ✔ | 移动设备 |