Şirket özeti

| Blackrockİnceleme Özeti | |

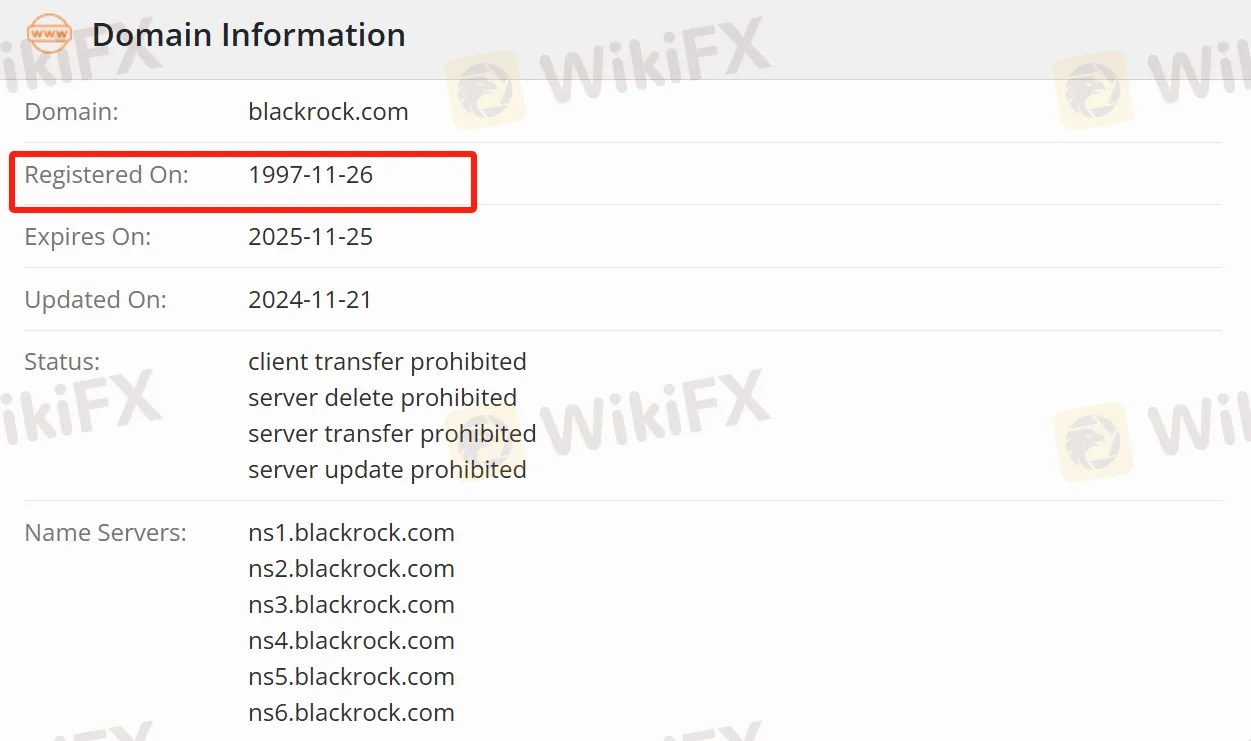

| Kayıt Tarihi | 1997-11-26 |

| Kayıtlı Ülke/Bölge | Hong Kong |

| Düzenleme | Düzenlenmiş |

| Ürünler ve Hizmetler | Hisse Senetleri, Sabit Gelirler, Dijital Varlıklar, Emtialar, Gayrimenkul ve ETF'ler |

| Müşteri Desteği | 202-414-2100/302-797-2000 (Washington); +27 (0) 21 403 6441 (Afrika); +57 (1) 319 2598 (Bogotá); 31 (0) 20 549 5200 (Amsterdam), vb. |

| Instagram, LinkedIn, Twitter, YouTube, TikTok | |

Blackrock Bilgiler

BlackRock, bireylerin mali refahını sağlamaya yardımcı olan küresel bir yatırım, danışmanlık ve risk yönetimi çözümleri sağlayıcısıdır. Bir fintech sağlayıcısı olarak, 135 farklı dil konuşan çeşitli geçmişlere sahip 19.000'den fazla çalışanı ve 42 ülkede faaliyetleri bulunmaktadır. Müşteri tabanı bireyler ve ailelerden, finansal danışmanlardan, eğitim ve kar amacı gütmeyen kuruluşlardan, emeklilik planlarından, sigorta şirketlerinden, hükümetlerden ve daha fazlasından oluşmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| Düzenlenmiş | Belirsiz ücret yapısı |

| Düzenlenmiş | Büyük iş ölçeğinden kaynaklanan kişiselleştirme eksikliği |

| Bol yatırım deneyimi | |

| Çeşitli müşteri tabanı |

Blackrock Güvenilir mi?

BlackRock yasal ve uygun bir kuruluştur. Global finansal piyasada uzun yıllardır faaliyet göstermekte olup birçok ülkede finansal düzenleyici otoriteler tarafından denetlenmekte ve düzenlenmektedir.

| Düzenlenen Ülke | Düzenleyici Otorite | Düzenlenen Kuruluş | Lisans Türü | Lisans Numarası | Mevcut Durum |

| SFC | BlackRock Asset Management North Asia Limited | Vadeli işlem sözleşmelerinde işlem yapma | AFF275 | Düzenlenmiş |

| MAS | LACKROCK (SINGAPORE) LIMITED | Perakende Forex Lisansı | Yayınlanmamış | Düzenlenmiş |

| ASIC | BLACKROCK INVESTMENT MANAGEMENT (AUSTRALIA) LIMITED | Yatırım Danışmanlığı Lisansı | 000230523 | Aşıldı |

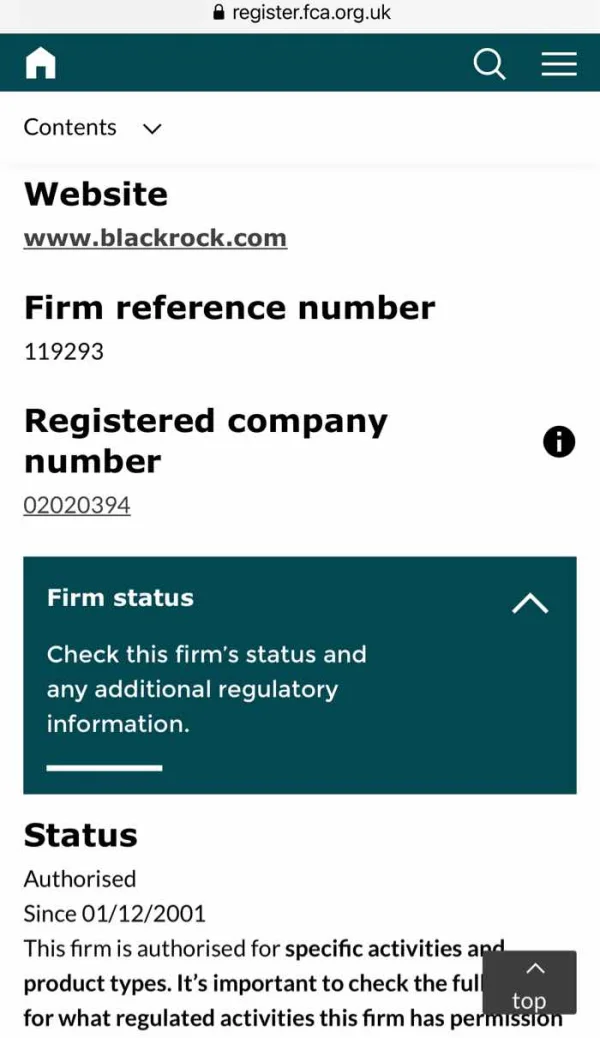

| FCA | BlackRock International, Limited | Yatırım Danışmanlığı Lisansı | 178638 | Aşıldı |

Blackrock Hangi Ürün ve Hizmetleri Sunmaktadır?

BlackRock'ta bireyler ve aileler emeklilik, ev alımları ve çocukların eğitimi gibi hedefler için yatırım yapabilirler; finansal danışmanlar farklı gelir seviyelerindeki müşterilere yatırım planlaması konusunda yardımcı olmak için platformunu kullanabilirler; emeklilik planları çeşitli profesyoneller için emeklilik birikimlerini yönetebilir; ve hükümetler altyapı projeleri ve diğer girişimler için fonları BlackRock aracılığıyla toplayabilirler. Ayrıca, müşteri tabanı arasında finansal danışmanlar ve sigorta şirketleri bulunmaktadır.

Ayrıca, yatırımcılar bölgesine bağlı olarak çeşitli borsa yatırım fonu (ETF) ürünleri seçebilirler. ABD pazarı için iShares aracılığıyla, sunulanlar arasında Hisse Senetleri, Sabit Gelirler, Dijital Varlıklar, Emtialar, Gayrimenkul vb. bulunmaktadır. ABD pazarı için BlackRock aracılığıyla, ürünler iShares ETF'leri ve Yatırım Fonları içerirken, Avustralya için sunulanlar arasında Hisse Senetleri, Sabit Gelirler, Gayrimenkul ve daha fazlası bulunmaktadır.

| Varlıklar | Desteklenen |

| Hisse Senetleri | ✔ |

| Sabit Gelirler | ✔ |

| Dijital Varlıklar | ✔ |

| Emtialar | ✔ |

| Gayrimenkul | ✔ |

| ETF'ler | ✔ |

Daha fazla varlık bilgisi için lütfen resmi web sitesini ziyaret etmek için tıklayın.

Amerika Birleşik Devletleri

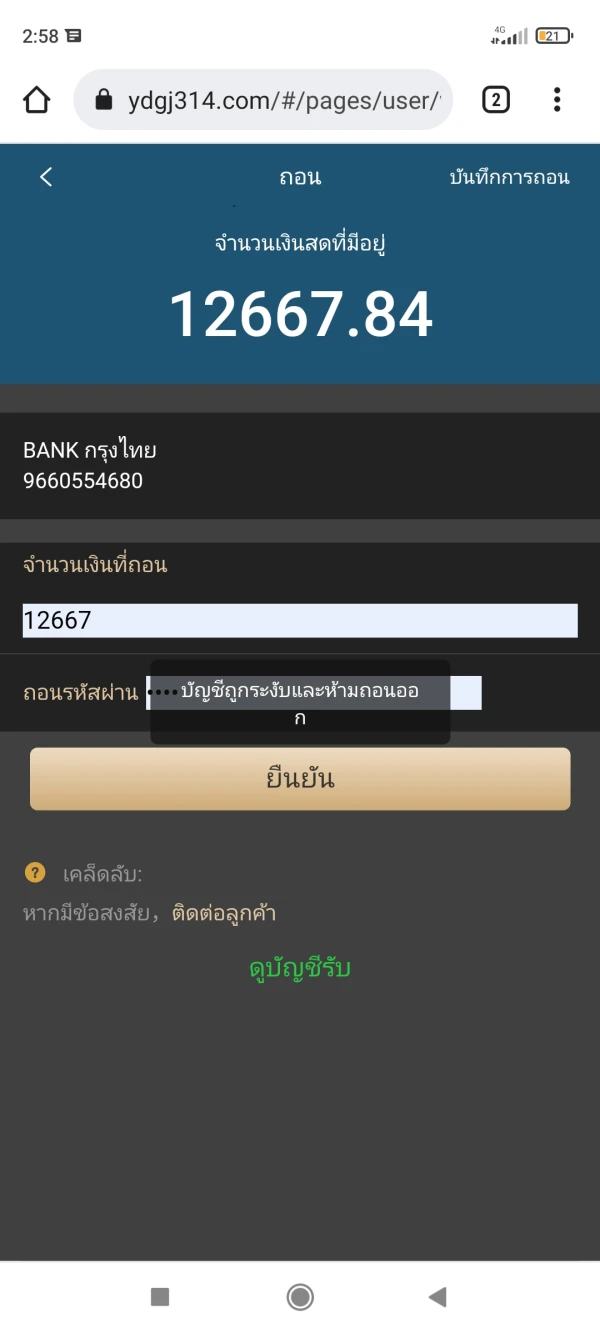

这个公司目前(2020年11月末)来看是受到FCA强监管的,请看图片。不知为何该APP跟它有仇似的显示超限经营。

Teşhir

FX3248546053

Kanada

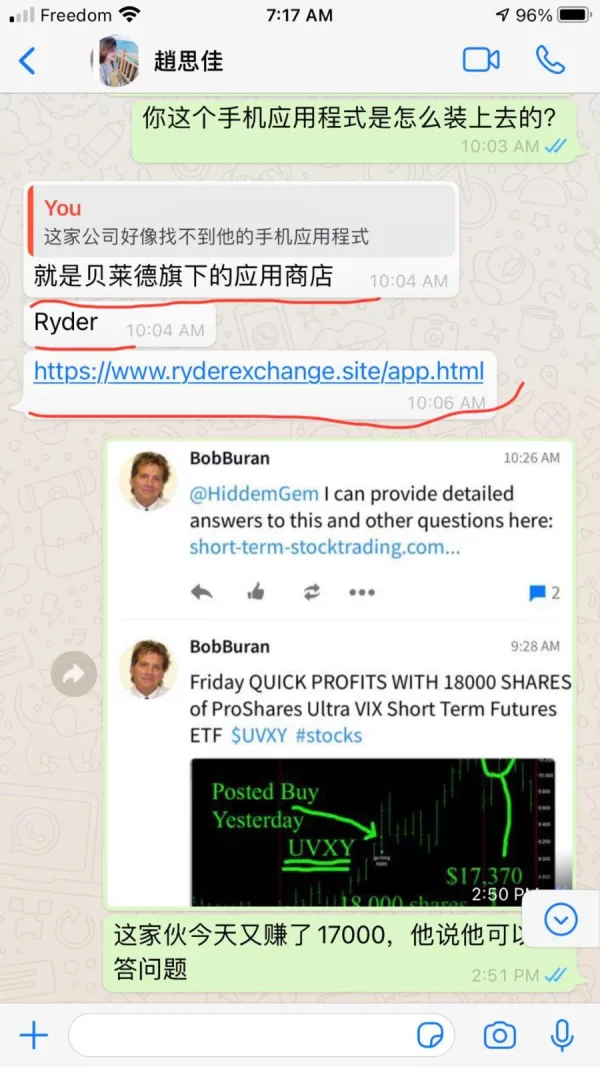

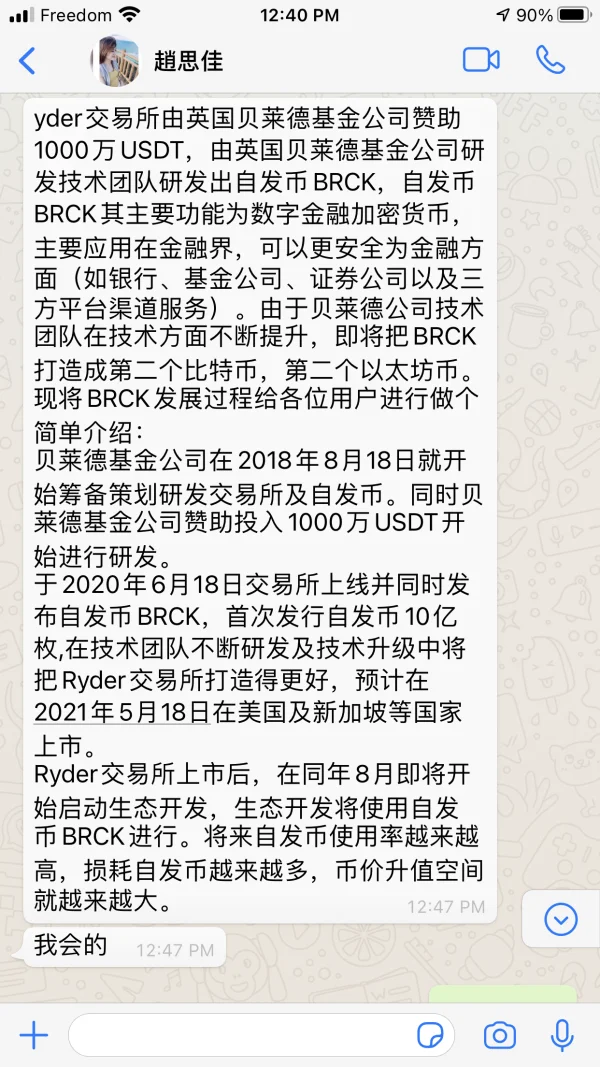

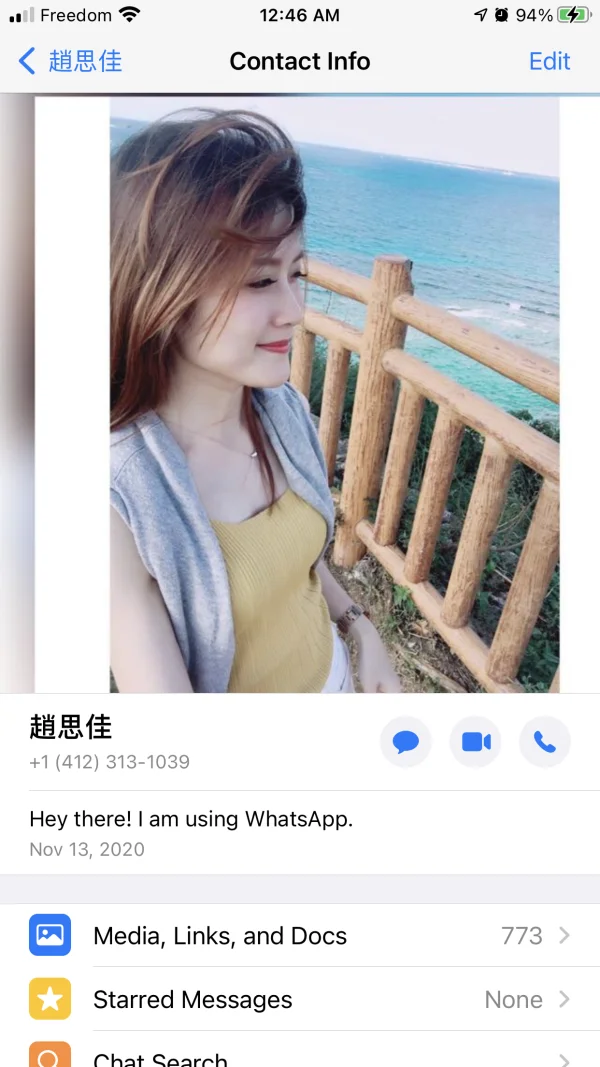

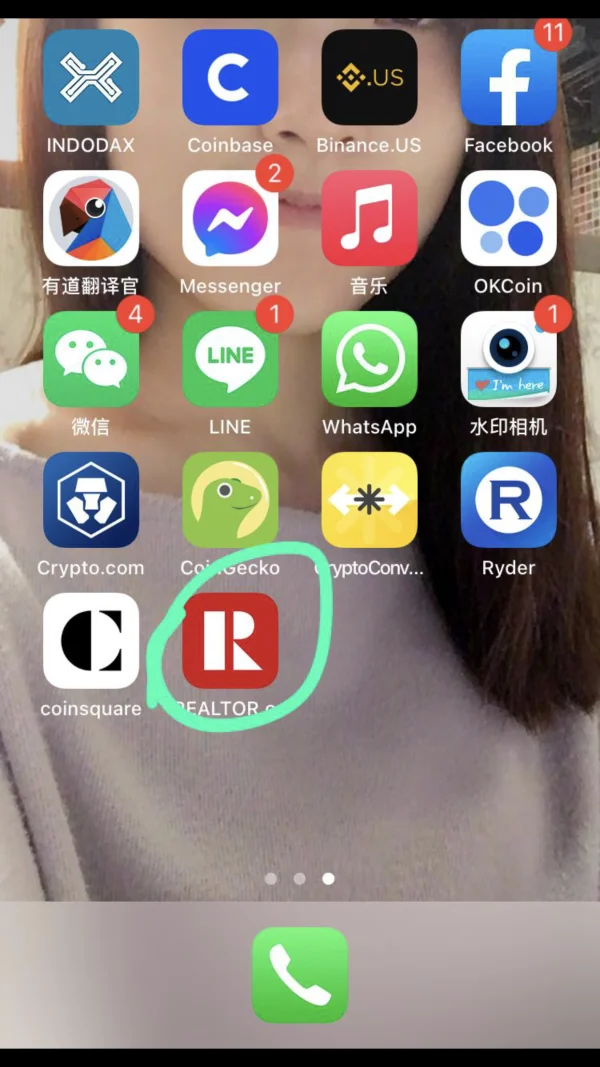

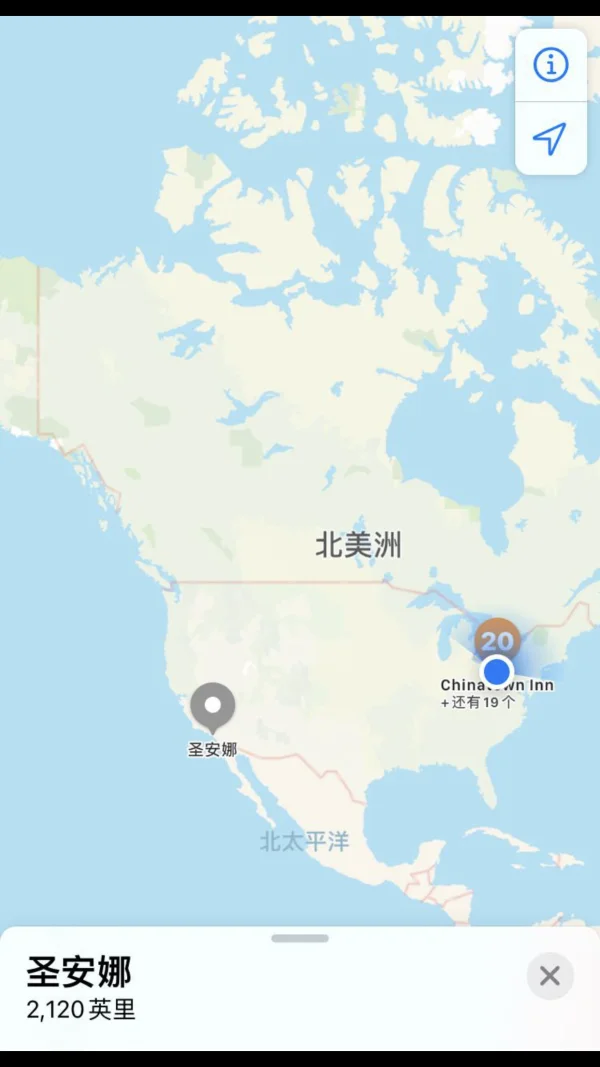

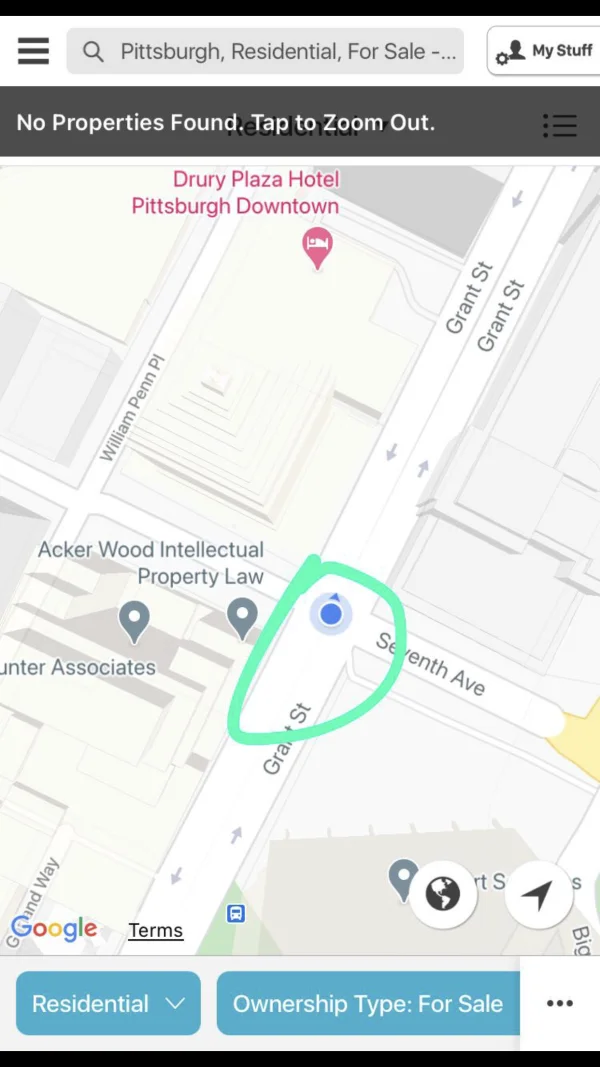

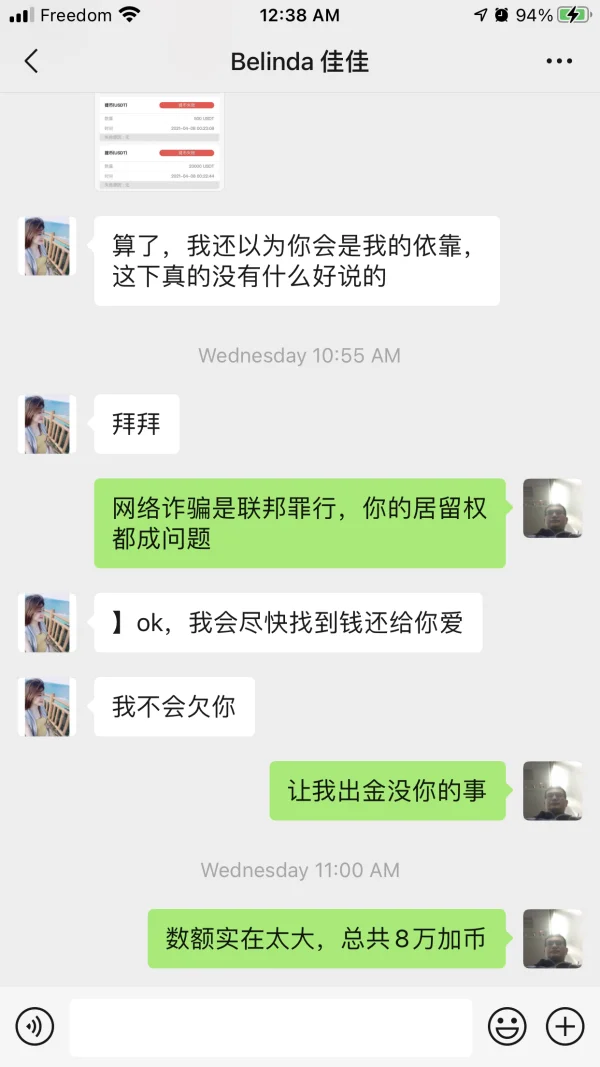

交易平台无法出金:本人加拿大国籍, 住Calgary, 在2021年2月底在Facebook上认识“赵思佳” , https://www.facebook.com/profile.php?id=100057196732746 中国国籍,美国永久居民, 交换了电话号码, 她的是+1(412)313-1039, 她推荐交易平台:https://www.ryderexchange.site/wap,名称是莱德. 并声称交易平台和加密货币BRCK/USDT将在5月上市。(1USDT=1美元),我存入1700 USDT, 提取500 USDT,成功。我存入15000 USDT, 提取1300 USDT,成功。“赵思佳”此时以年介34岁,生育最重要为由,和我建立未婚夫妻关系,并要求我说出所有的财产,并进一步要求我存入30万 USDT到这个交易平台以作为以后共同婚房费用。在交易平台我总资产50000 USDT时, 提取3200 USDT,成功。在交易平台我总资产80000 USDT时,提取32000 USDT,失败。此时被交易平台以IP地址有问题为由要求做高级认证。高级认证成功后再提款500 USDT,失败,被交易平台告知要交税22000 USDT才可以提款。询问“赵思佳”,她说她的钱也提不出来,交易平台说她的账户异动,她已经向当地警察和FBI报案。隔天后我要求“赵思佳”出示她的提款截图,她说已经提款数次,跟以前说法相矛盾,我方知被骗。要求“赵思佳”出示她的报警截图证据,没有回应。“赵思佳”以相互不信任为由结束未婚夫妻关系。此时我已经向交易平台充值8万多加拿大货币。我警告“赵思佳”网络诈骗是犯罪,她不再跟我联络,然后在Facebook上把我屏蔽。“赵思佳”电话号码+1(412)313-1039,查实并非她本人身份证注册。“赵思佳”的活动范围大约在美国宾夕凡利亚州匹兹堡的唐人街一带。“赵思佳”声称她爸爸开了建筑公司。

Teşhir

FX3248546053

Kanada

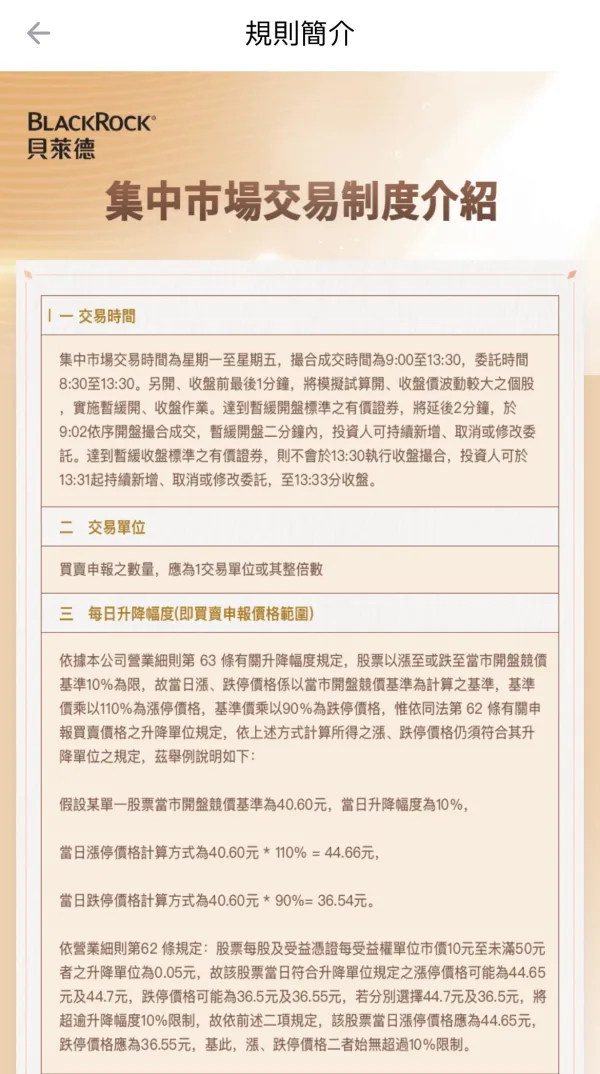

*家住美国宾夕法尼亚州匹兹堡唐人街附近的女骗子“赵思佳”声称Ryder交易平台是由英国贝莱德基金公司赞助1000万USDT,并研发出自发币 BRCK/USDT, 将于五月份上市。

Teşhir

tombita

Peru

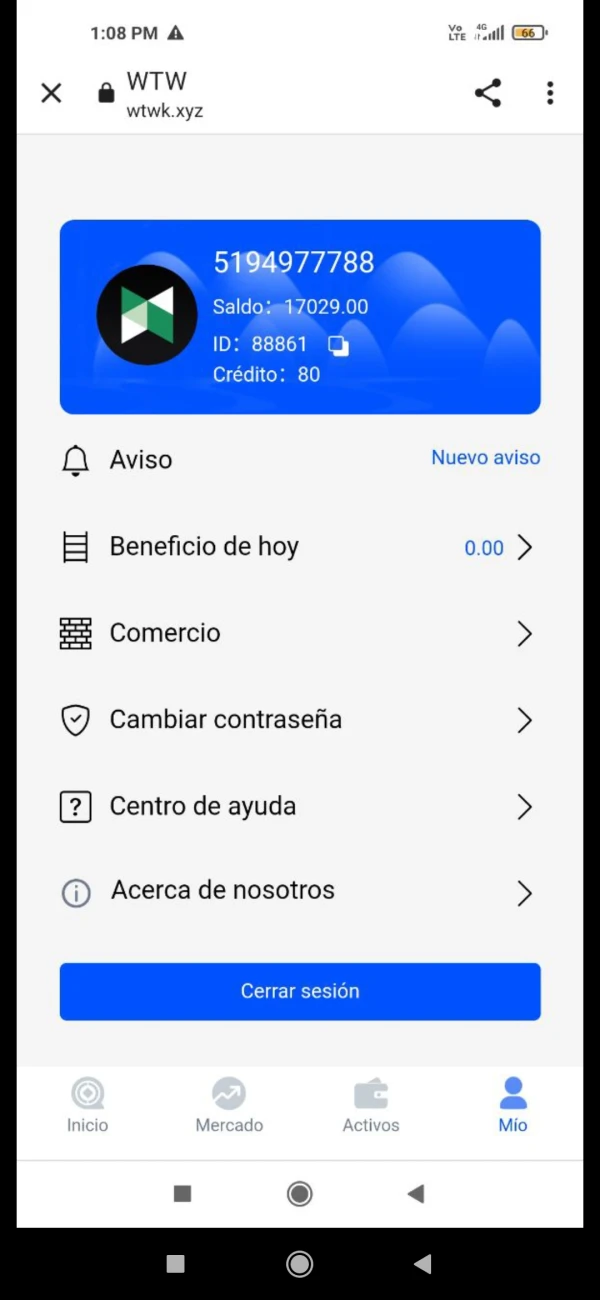

Bana verilmesi gereken çekim. Ama bana başka, büyük bir miktar çekim yapmam gerektiğini söylüyorlar.

Teşhir

FX1245234069

Amerika Birleşik Devletleri

15 yılı aşkın bir süredir piyasada olan bu şirketin aynı zamanda bir dolandırıcı olduğuna inanmak zor. Dürüst olmak gerekirse, wikifx'i kontrol etme alışkanlığım olmasaydı buraya aptalca yatırım yapardım.

Doğal

FX3644586767

Tayvan

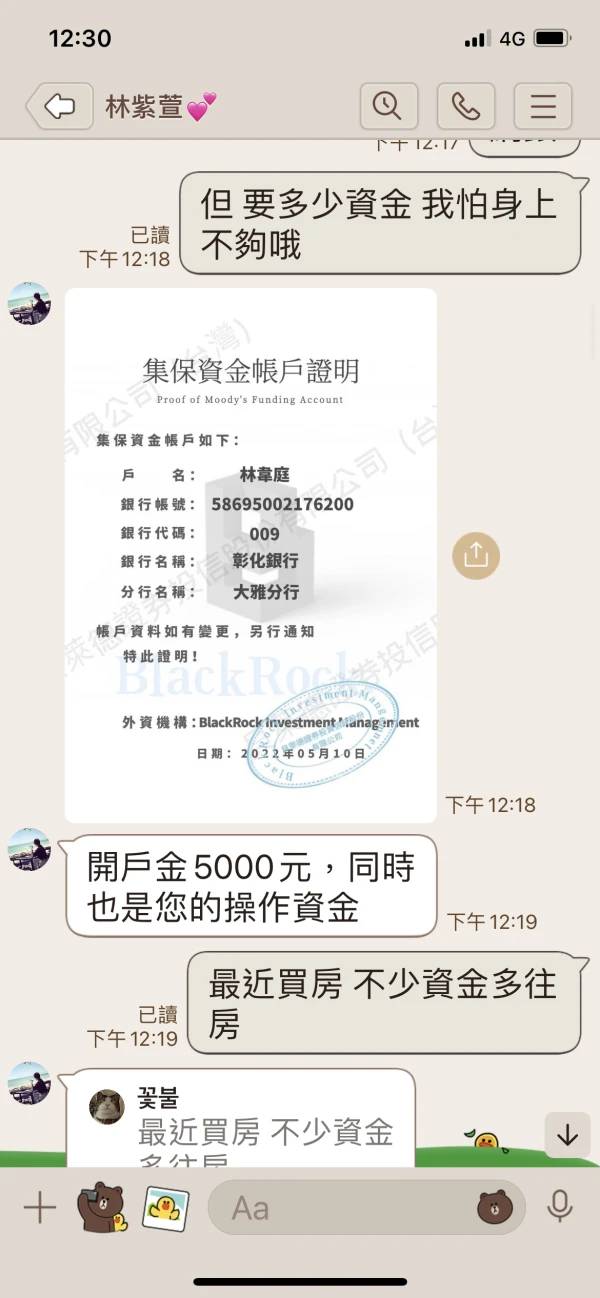

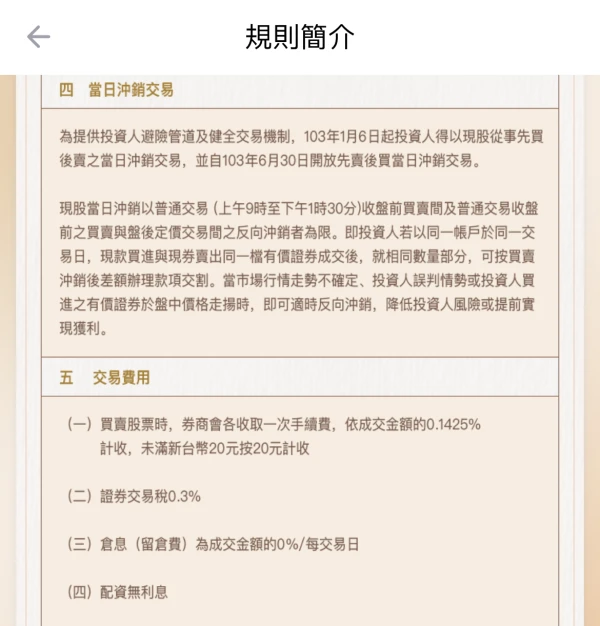

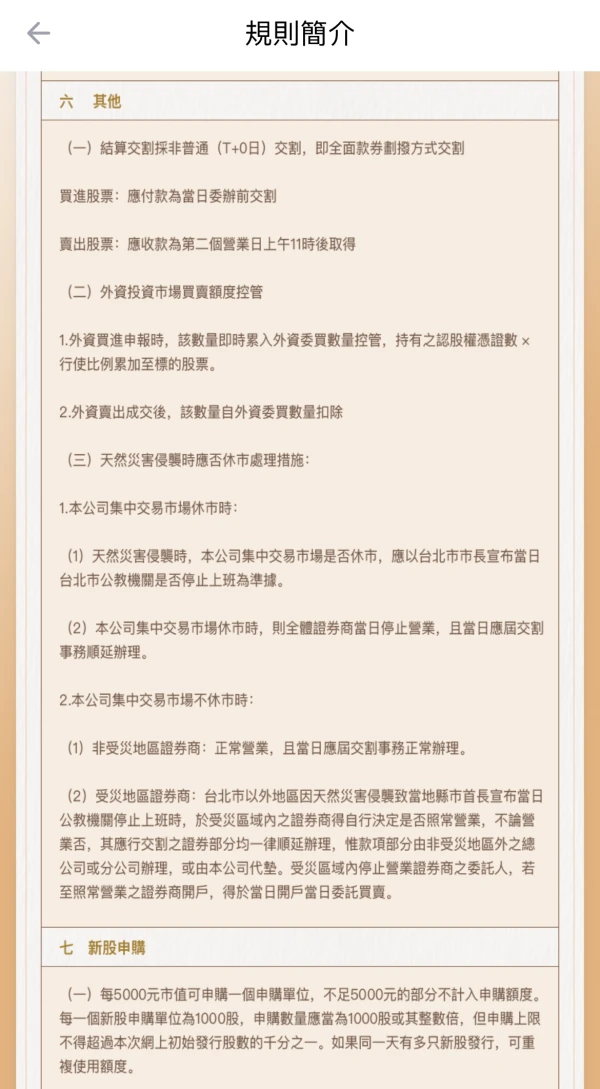

小心假投資 真詐騙 入金要5000開戶 之後又隔日沖 抽籤股 又鉅額 再來圈購 一直強迫被害人入金 等到要出金時說 對方帳戶有問題要繳保證金或 各種理由無法出金 才得知受騙

Teşhir

FX4802127712

Tayland

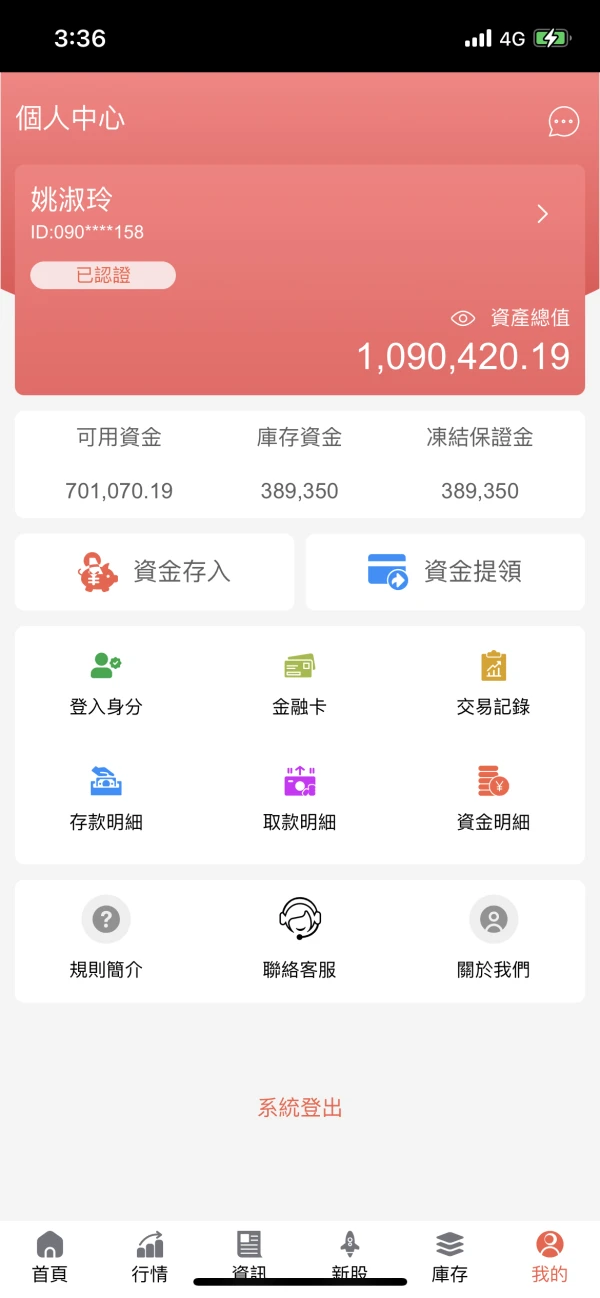

ไอดีผมถูกระงับได้ไง แล้วคุณบอกอีก 3เดือนผมจะถอนได้นิ สรุป ผมจะได้เงินคืนหรือไม่ หรือว่า 12667 จะโกงคับขอเหตุผลด้วย คุณเป็นบอกเองว่าถอดได้

Teşhir

FX1305625852

Malezya

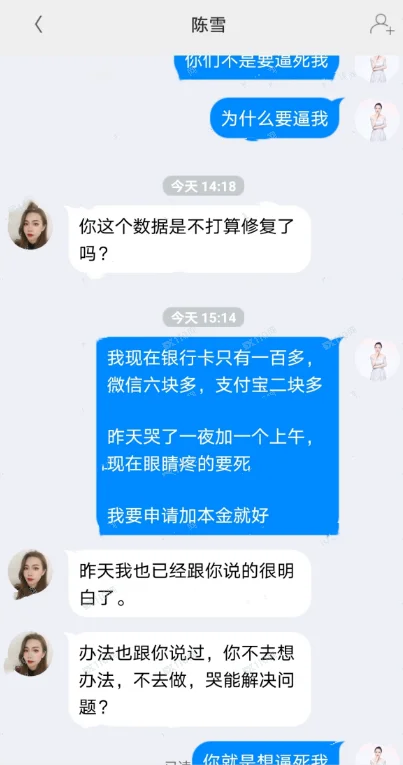

大家一定要警惕这个平台在这里你会一直提现失败,说你没有完成任务,然后那些客服接待员还会一直引诱你借钱继续加本金,今天发在这里曝光他不是请谁来可怜我,是让大家警惕不要再做这个平台了,擦亮眼睛!

Teşhir

FX3248546053

Kanada

I met "赵思佳" on Facebook, She recommended Ryder Exchange,I deposited 1700 USDT then successfully withdrew 500 USDT; I deposited 15000 USDT then successfully withdrew 1300 USDT.When my total assets were 50000 USDT and successfully withdrew 3200 USDT . When my total assets were 80000 USDT and failed to withdraw 32000 USDT.after I successfully completed advanced certification, I failed to withdraw 900 USDT and then no permission to withdraw.

Teşhir