Şirket özeti

| HUA TAI İnceleme Özeti | |

| Kuruluş Yılı | 1991 |

| Kayıtlı Ülke/Bölge | Çin |

| Düzenleme | CFFEX |

| Piyasa Araçları | Hisse senetleri, opsiyonlar, kıymetli metaller |

| Hizmetler | Varlık saklama hizmetleri, işletme dışsourcing hizmetleri |

| Hesap Türü | Gerçek Hesap |

| Kaldıraç | 1:2'ye kadar |

| İşlem Platformu | MD5, Zhangle Uygulaması |

| Ödeme Yöntemi | Banka Transferi |

| Müşteri Desteği | Telefon: 955597 |

| E-posta: 95597@htsc.com | |

| Fiziksel Adres: No. 228, Jiangdong Orta Yolu, Nanjing, Jiangsu Eyaleti, Çin | |

HUA TAI Bilgileri

HUA TAI, 1991 yılında kurulan Çin'de kayıtlı bir aracı kurumdur. Sunduğu işlem enstrümanları hisse senetleri, opsiyonlar, kıymetli metalleri kapsamaktadır. CFFEX tarafından düzenlenmektedir.

Artıları ve Eksileri

| Artıları | Eksileri |

| Düzenlenmiş | Komisyon bilgisi yok |

| Geniş işlem enstrümanları yelpazesi | Minimum depozito hakkında net bilgi yok |

| Çoklu hizmetler sunuluyor | Sınırlı hesap türleri sunuluyor |

| Deneme hesabı yok | |

| MT4 desteklenmiyor |

HUA TAI Güvenilir mi?

HUA TAI, Çin'de CFFEX tarafından düzenlenmektedir. Mevcut durumu düzenlenmiştir.

| Düzenlenmiş Ülke | Düzenleyici Kurum | Düzenlenmiş Kuruluş | Lisans Türü | Lisans Numarası | Mevcut Durum |

| Çin | CFFEX | 华泰期货有限公司 | Vadeli İşlemler Lisansı | 0011 | Düzenlenmiş |

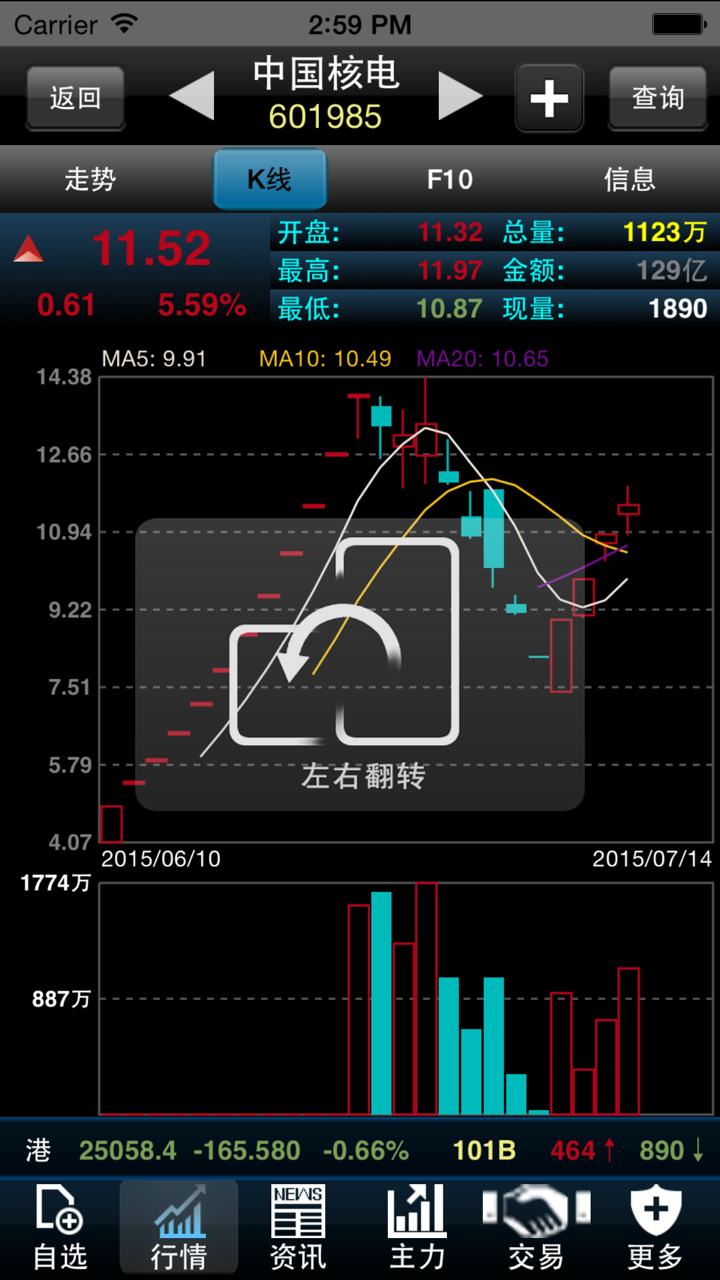

HUA TAI Üzerinde Ne İşlem Yapabilirim?

HUA TAI traderlere hisse senetleri, opsiyonlar, değerli metaller gibi ticaret yapma imkanı sunar.

| Ticaret Yapılabilir Enstrümanlar | Desteklenir |

| Hisse Senetleri | ✔ |

| Opsiyonlar | ✔ |

| Değerli metaller | ✔ |

| Forex | ❌ |

| Emtialar | ❌ |

| Endeksler | ❌ |

| Vadeli İşlemler | ❌ |

Hizmetler

HUA TAI varlık saklama hizmetleri, işletme dışsourcing hizmetleri sunar. Varlık saklama hizmetleri varlık saklama, değerleme hesaplama, yatırım denetimi, fon yerleştirme gibi hizmetleri içerir. İşletme dışsourcing hizmetleri

pay kaydı, hesap denetimi, değerleme hesaplama, bilgi açıklama gibi hizmetleri içerir.

Hesap Türleri

HUA TAI traderlere 1 tür hesap sunar - Canlı Hesap.

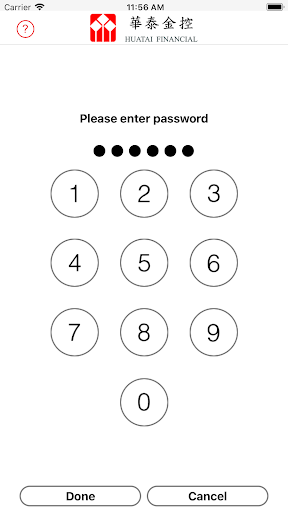

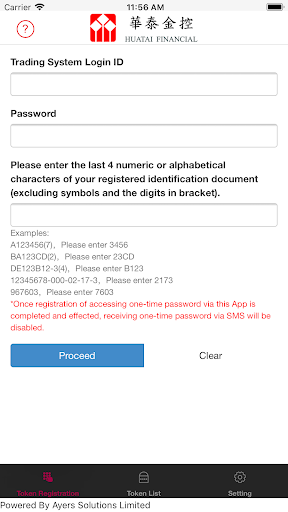

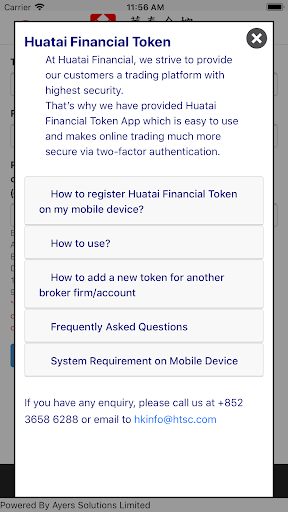

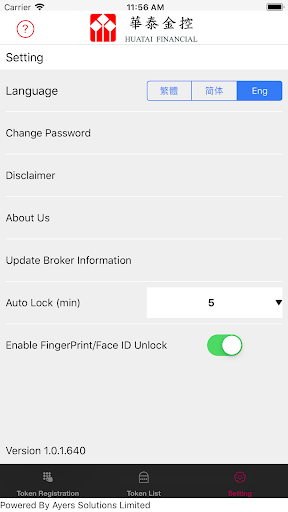

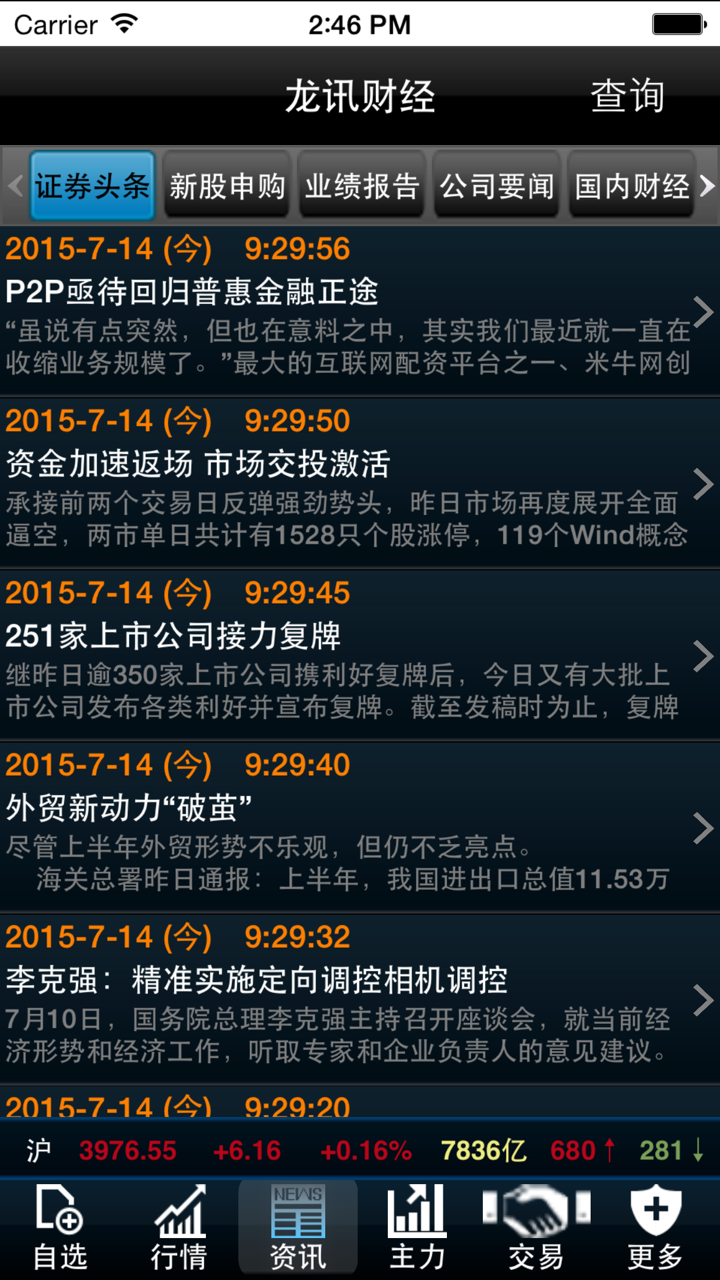

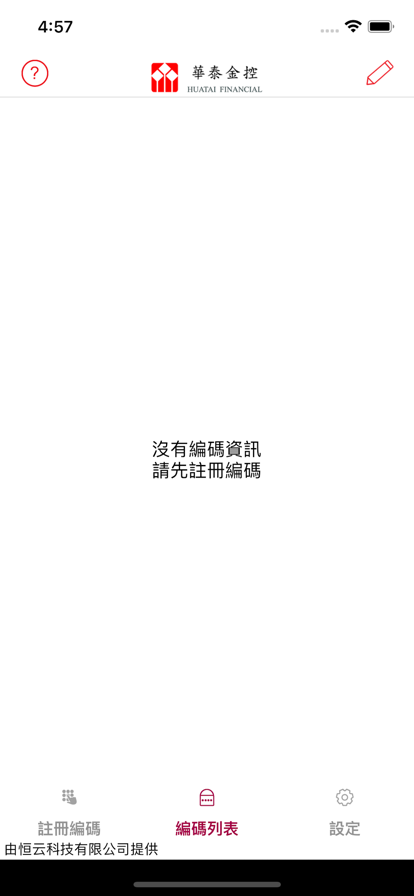

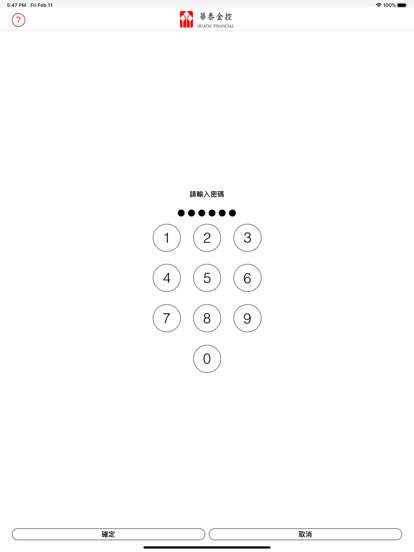

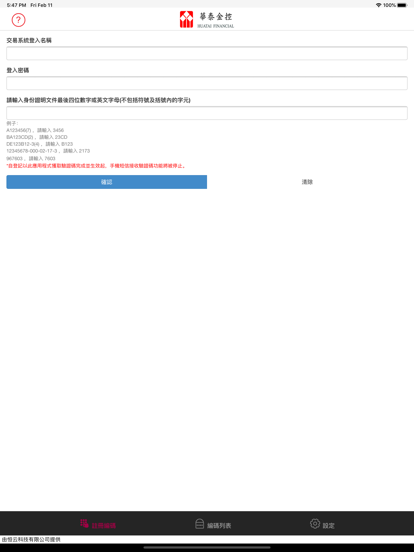

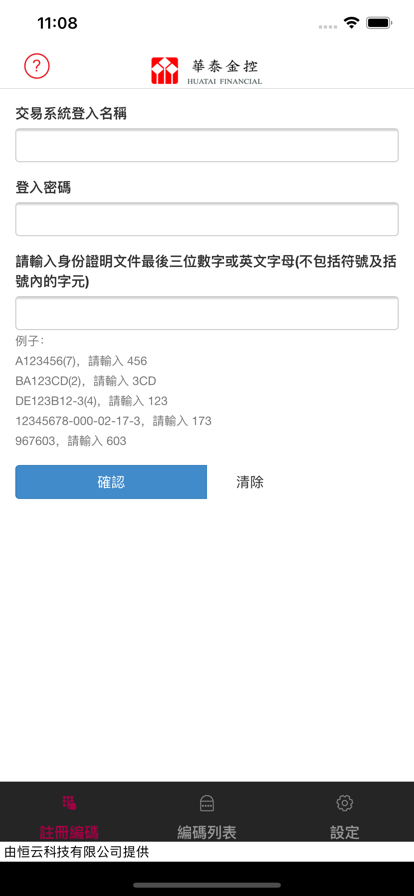

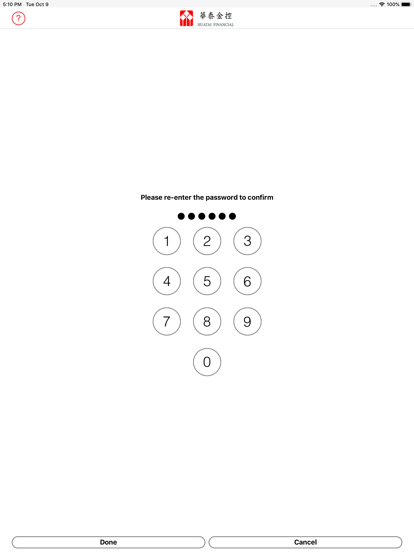

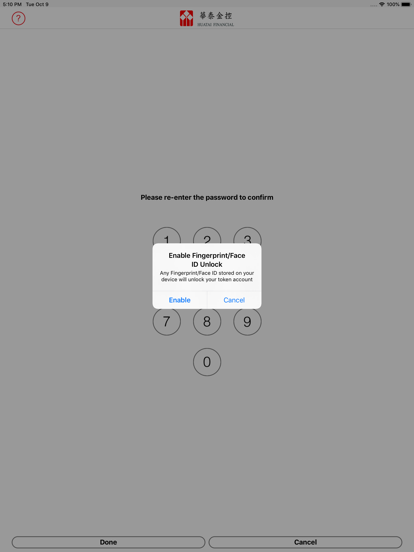

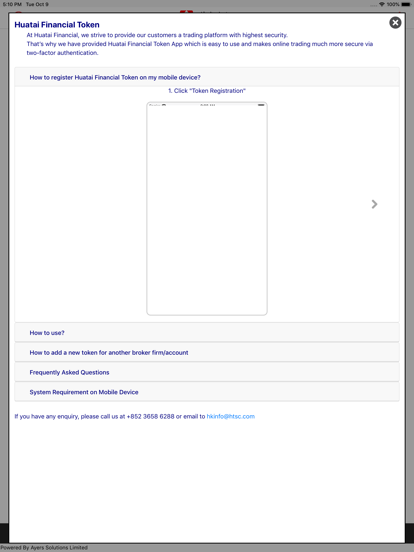

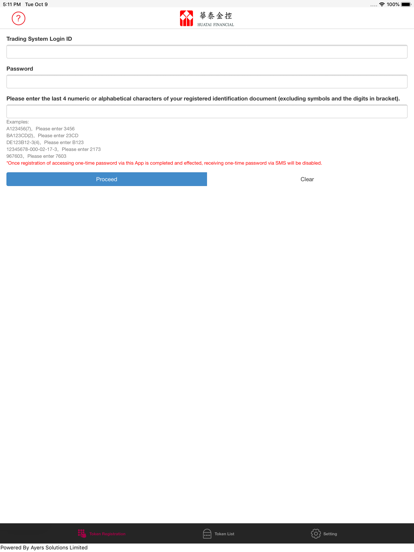

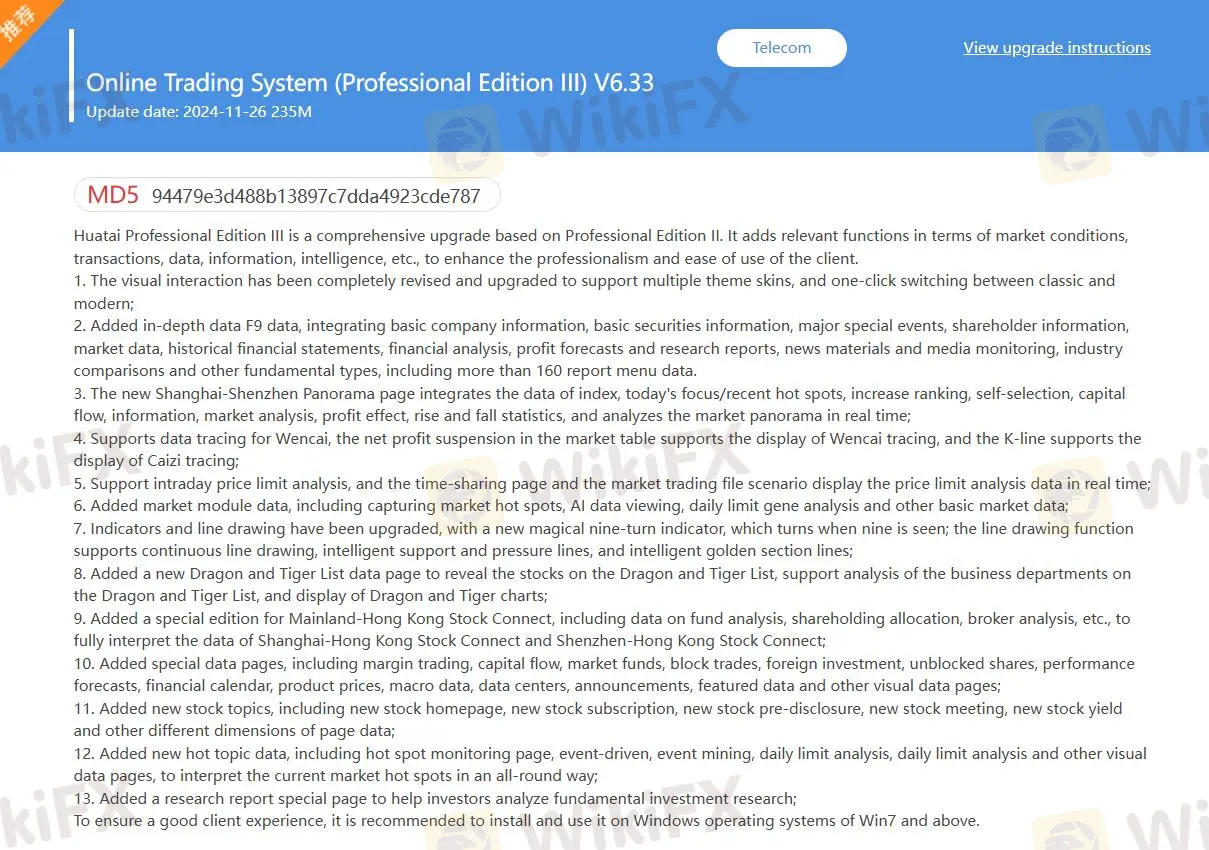

Ticaret Platformu

HUA TAI'nin ticaret platformları MD5, Zhangle App'tir ve PC, Mac, iPhone ve Android'de traderlara destek sağlar.

| Ticaret Platformu | Desteklenir | Kullanılabilir Cihazlar |

| MD5 | ✔ | Web |

| Zhangle App | ✔ | Mobil |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |

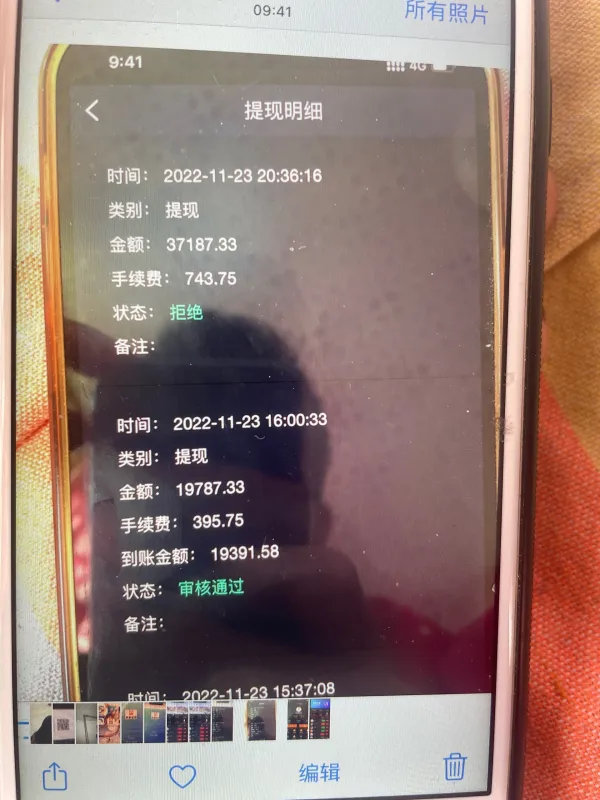

Para Yatırma ve Çekme

Para yatırma ve çekme yöntemi banka transferidir. ICBC kartı, ABC kartı, CCB kartı, BOC kartı vb. gibi aşağıdaki banka kartlarını destekler.