Resumo da empresa

| KOSEI SECURITIES Resumo da Revisão | |

| Fundação | 1997 |

| País/Região Registrada | Japão |

| Regulação | FSA |

| Produtos de Negociação | Ações, Obrigações, Fundos de Investimento, ETFs/REITs, Futuros, Opções e Seguros/iDeco |

| Plataforma de Negociação | / |

| Depósito Mínimo | / |

| Suporte ao Cliente | Tel: 0120-06-8617 |

| Endereço: 2-1-10 Kitahama, Chuo-ku, Osaka | |

Informações sobre KOSEI SECURITIES

A sede da Kosei Securities está localizada em Kitahama, Chuo-ku, na cidade de Osaka. Seus negócios abrangem negociação de títulos, fundos de investimento, futuros e opções, agência de seguros de vida, entre outros, além de fornecer serviços especiais como contas específicas (declaração de imposto simplificada) e contas NISA (isenção de impostos para investimentos de pequena escala).

Prós e Contras

| Prós | Contras |

| Regulado pela FSA | Estrutura de comissões complexa |

| Garantia de segurança dos fundos | Suporte em inglês insuficiente (principalmente em japonês) |

| Combinação de online e offline | |

| Longa história operacional | |

| Diversos produtos de negociação | |

| Informações transparentes sobre taxas |

KOSEI SECURITIES é Legítimo?

Kosei Securities está listada na Bolsa de Valores de Tóquio e regulada pela Agência de Serviços Financeiros (FSA) do Japão. Com o número de licença 近畿財務局長(金商)第14号, é uma empresa de valores mobiliários legalmente registrada.

| Autoridade Reguladora | Status Atual | País Regulamentado | Entidade Licenciada | Tipo de Licença | Nº de Licença |

| Agência de Serviços Financeiros (FSA) | Regulamentado | Japão | KOSEI SECURITIES株式会社 | Licença de Forex de Varejo | 近畿財務局長(金商)第14号 |

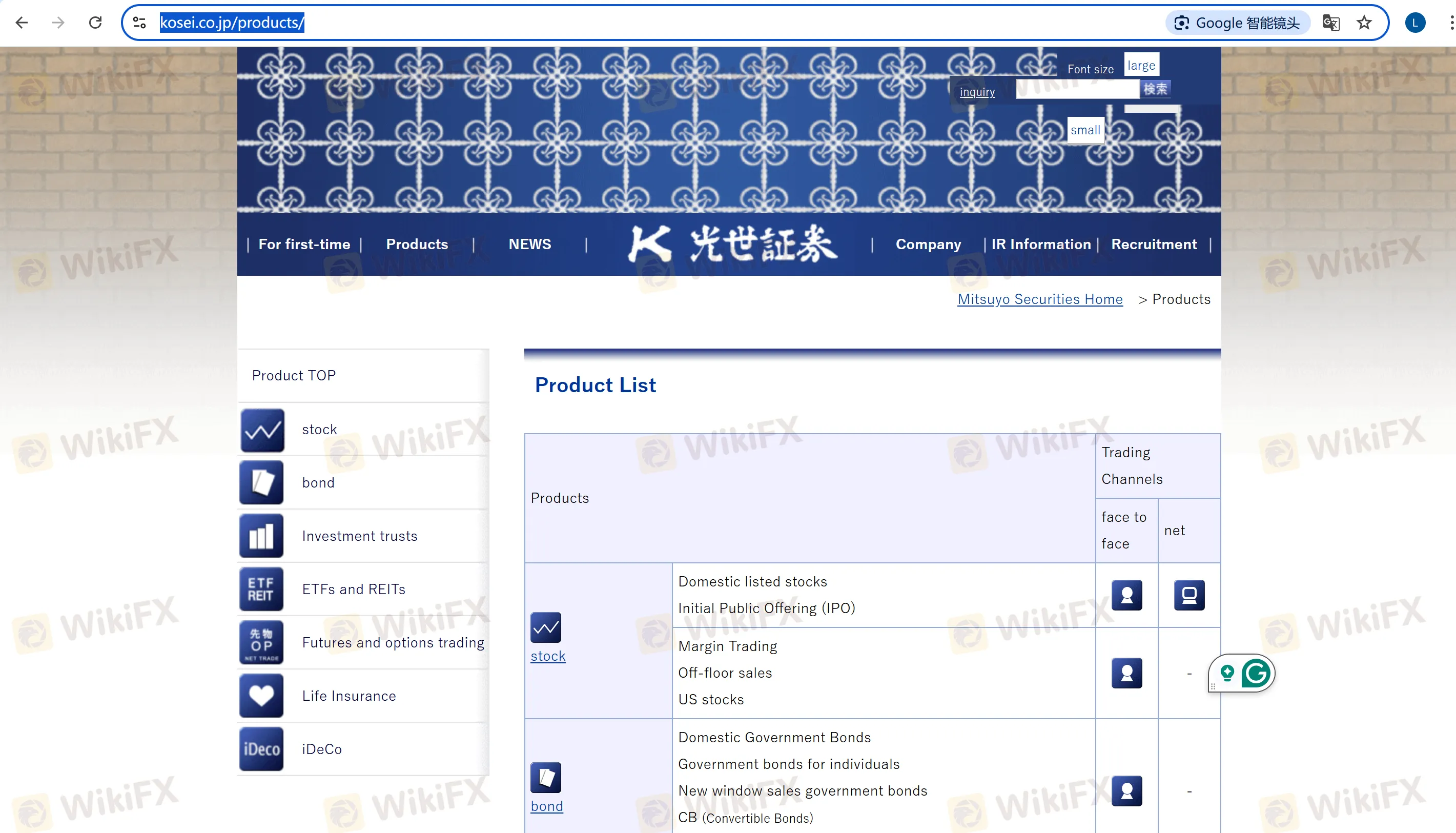

O que posso negociar na KOSEI SECURITIES?

| Produtos de Negociação | Suportado | Detalhes |

| Ações | ✔ | Ações listadas domésticas, ações dos EUA, ofertas públicas iniciais (IPOs) e negociação de margem |

| Obrigações | ✔ | Obrigações do governo individuais, obrigações corporativas, obrigações denominadas em moeda estrangeira e obrigações conversíveis |

| Trustes de Investimento | ✔ | Trustes de investimento em ações, trustes de investimento em obrigações corporativas e fundos do tipo hedge |

| ETFs/REITs | ✔ | Trustes de investimento listados, trustes de investimento imobiliário (por exemplo, Índice TOPIX REIT) |

| Futuros e Opções | ✔ | Futuros do Nikkei 225, opções do TOPIX, futuros de metais preciosos (padrão-ouro) e futuros de índice de commodities (petróleo bruto CME) |

| Seguros/iDeco | ✔ | Serviços de agência de seguros de vida, Nomura iDeco (contas de pensão) |

Tipo de Conta

Conta Específica: Calcula lucros e perdas em nome dos clientes, lida com pagamentos de impostos e simplifica declarações fiscais anuais.

Conta NISA: Uma conta isenta de impostos para investimentos de pequena escala, com um limite de investimento anual de ¥1.000.000. Dividendos e receitas de vendas são isentos de impostos por 5 anos.

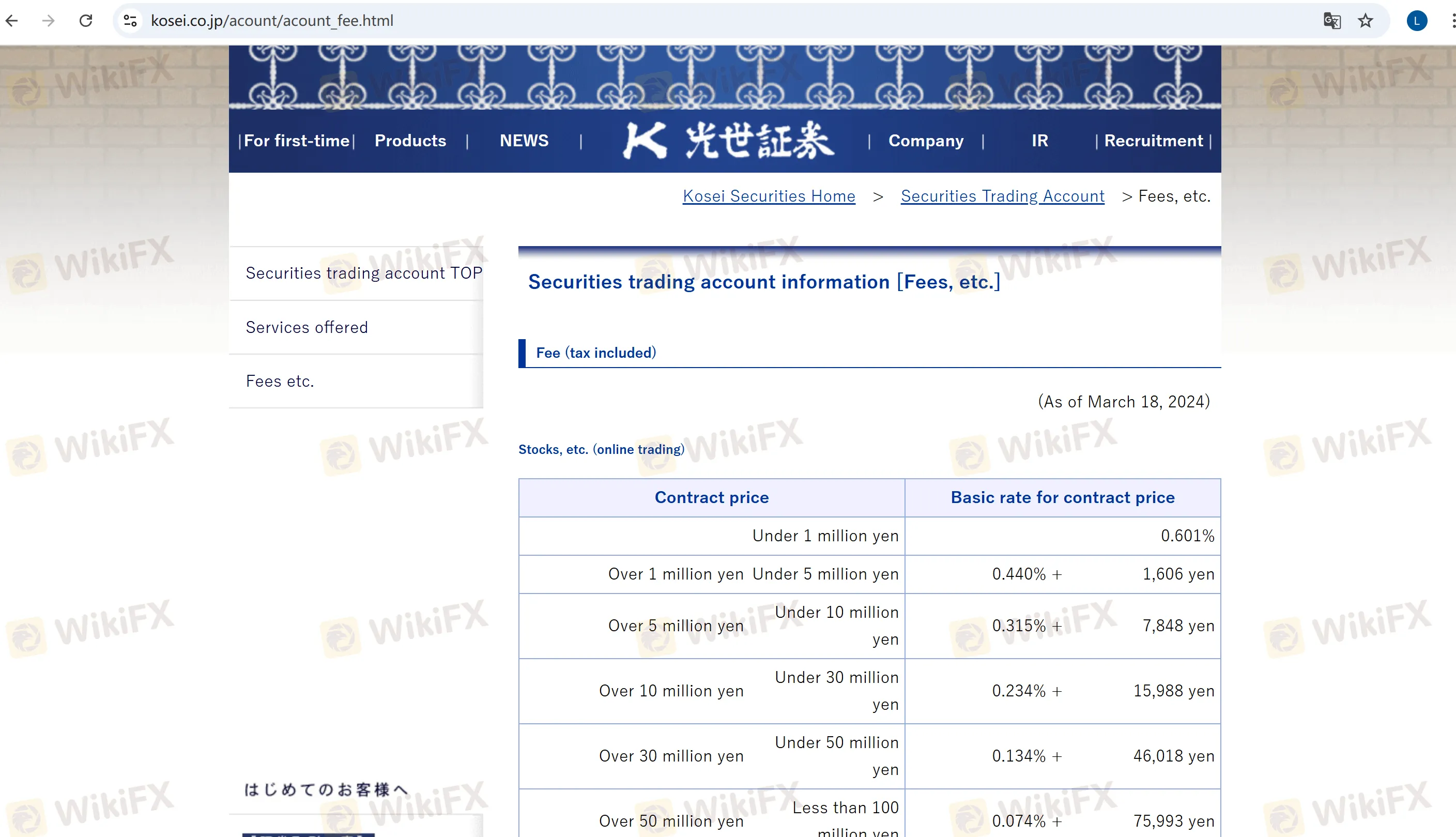

Taxas da KOSEI SECURITIES

Principais Taxas de Comissão:

Ações (Online): 0,601% para transações abaixo de ¥1.000.000 (mínimo de ¥1.100). Para montantes acima de ¥1.000.000.000, as taxas estão sujeitas a negociação individual.

Ações dos EUA: Uma taxa fixa de 0,495% (mínimo de ¥550). As taxas da SEC serão temporariamente dispensadas a partir de 13 de maio de 2025.

Futuros & Opções (Online): 0,022% para futuros de índice, 0,0044% para futuros de obrigações do governo, com uma taxa mínima de ¥440.

Taxa de Manutenção da Conta: ¥2.200 anualmente (isenta para clientes que possuem 100+ ações da empresa).

Outras Taxas:

Taxas de Empréstimo de Margem (Lado Comprador): Margem institucional: 1,64%–1,92% (juros anuais); Margem geral: 2,14%–2,42%.

Para obter informações mais detalhadas sobre as taxas da conta, visite o site oficial.