Resumo da empresa

| TD Resumo da Revisão | |

| Fundação | 1998 |

| País/Região Registrada | Canadá |

| Regulação | Sem Regulação |

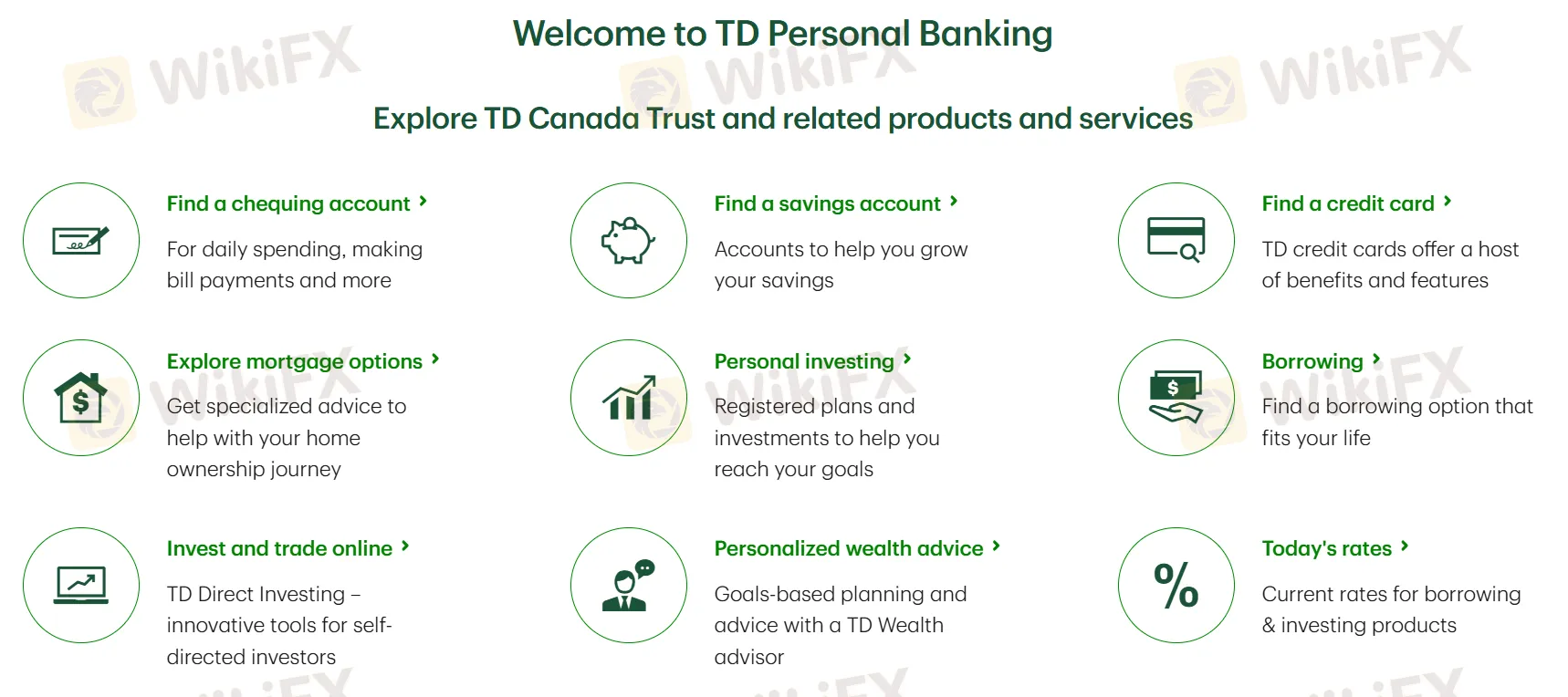

| Produtos e Serviços | Contas correntes e poupança, cartões de crédito, opções de hipoteca, investimento pessoal, empréstimos, investimento e negociação online, consultoria de patrimônio personalizada |

| Plataforma/App | TD App |

| Suporte ao Cliente | Inglês: 1-800-983-8472, Francês: 1-800-983-8472, Mandarim: 1-877-233-5844 |

Informações sobre TD

TD é uma empresa de negociação online que oferece serviços abrangentes de banco pessoal, incluindo cartões de crédito, hipotecas e várias opções de investimento acessíveis por meio de seu aplicativo TD fácil de usar. No entanto, atualmente não é regulamentado por nenhuma autoridade financeira.

Prós e Contras

| Prós | Contras |

| Vários serviços bancários pessoais | Plataforma não regulamentada |

| Estrutura de taxas pouco clara |

TD é Legítimo?

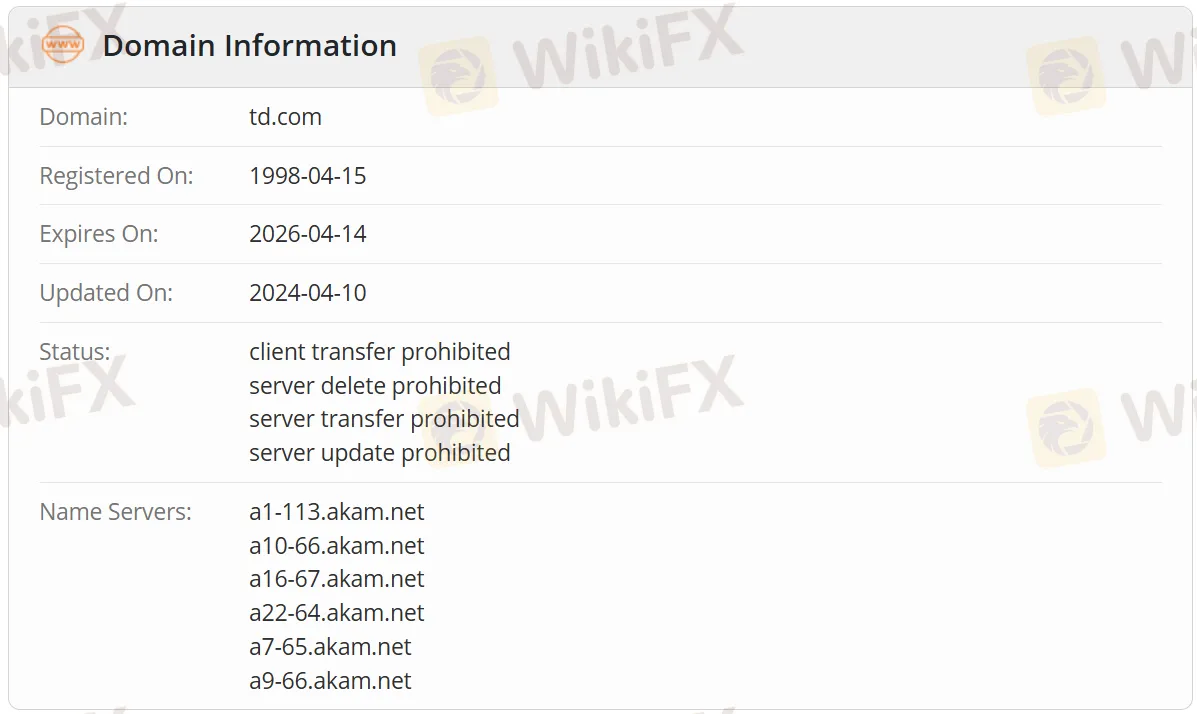

Não. TD é uma plataforma não regulamentada. O nome de domínio td.com foi registrado no WHOIS em 15 de abril de 1998 e expira em 14 de abril de 2026. Seu status atual é "proibição de transferência de cliente, proibição de exclusão/transferência/atualização do servidor".

Produtos e Serviços

TD oferece produtos e serviços, incluindo contas correntes e poupança, cartões de crédito, opções de hipoteca, investimento pessoal, empréstimos, investimento e negociação online, consultoria de patrimônio personalizada, etc.

Plataforma/App

| Plataforma/App | Suportado | Dispositivos Disponíveis |

| TD App | ✔ | Apple, Android |