회사 소개

| Taishin Securities 리뷰 요약 | |

| 설립 연도 | 2009 |

| 등록 국가/지역 | 대만 |

| 규제 | 타이페이 거래소 |

| 시장 상품 | 증권, 선물, 주식, ETF, 채권, 상품, 파생상품, 채권 |

| 거래 플랫폼 | / |

| 고객 지원 | 24/7 라이브 채팅 |

| 전화: 02-4050-9799 (월요일부터 금요일까지, 오전 8시부터 오후 5시까지) | |

| 이메일: ec@tssco.com.tw | |

Taishin Securities 정보

Taishin Securities은 대만에서 설립되었으며 타이페이 거래소에서 규제를 받는 온라인 거래 플랫폼으로 증권, 선물, 주식, ETF, 채권, 상품, 파생상품, 채권을 거래할 수 있습니다.

장단점

| 장점 | 단점 |

|

|

|

|

Taishin Securities이 신뢰할 만한가요?

Taishin Securities은 대만의 타이페이 거래소에서 규제 받는 "증권 거래" 라이센스를 보유하고 있습니다.

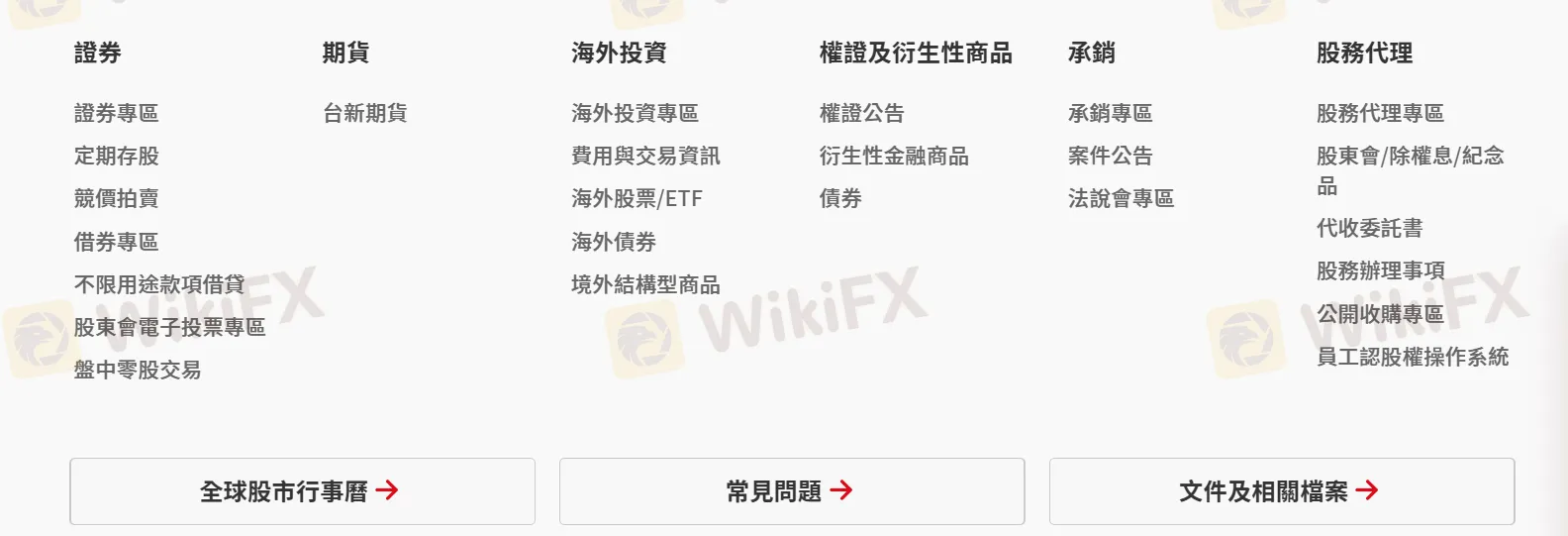

Taishin Securities에서 무엇을 거래할 수 있나요?

Taishin Securities 플랫폼을 통해 고객은 증권, 선물, 주식, ETF, 채권, 상품, 파생상품, 채권을 거래할 수 있습니다.

| 거래 가능한 상품 | 지원 |

| 증권 | ✔ |

| 선물 | ✔ |

| 주식 | ✔ |

| ETF | ✔ |

| 채권 | ✔ |

| 상품 | ✔ |

| 파생상품 | ✔ |

| 채권 | ✔ |

| 외환 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 옵션 | ❌ |

계정 유형

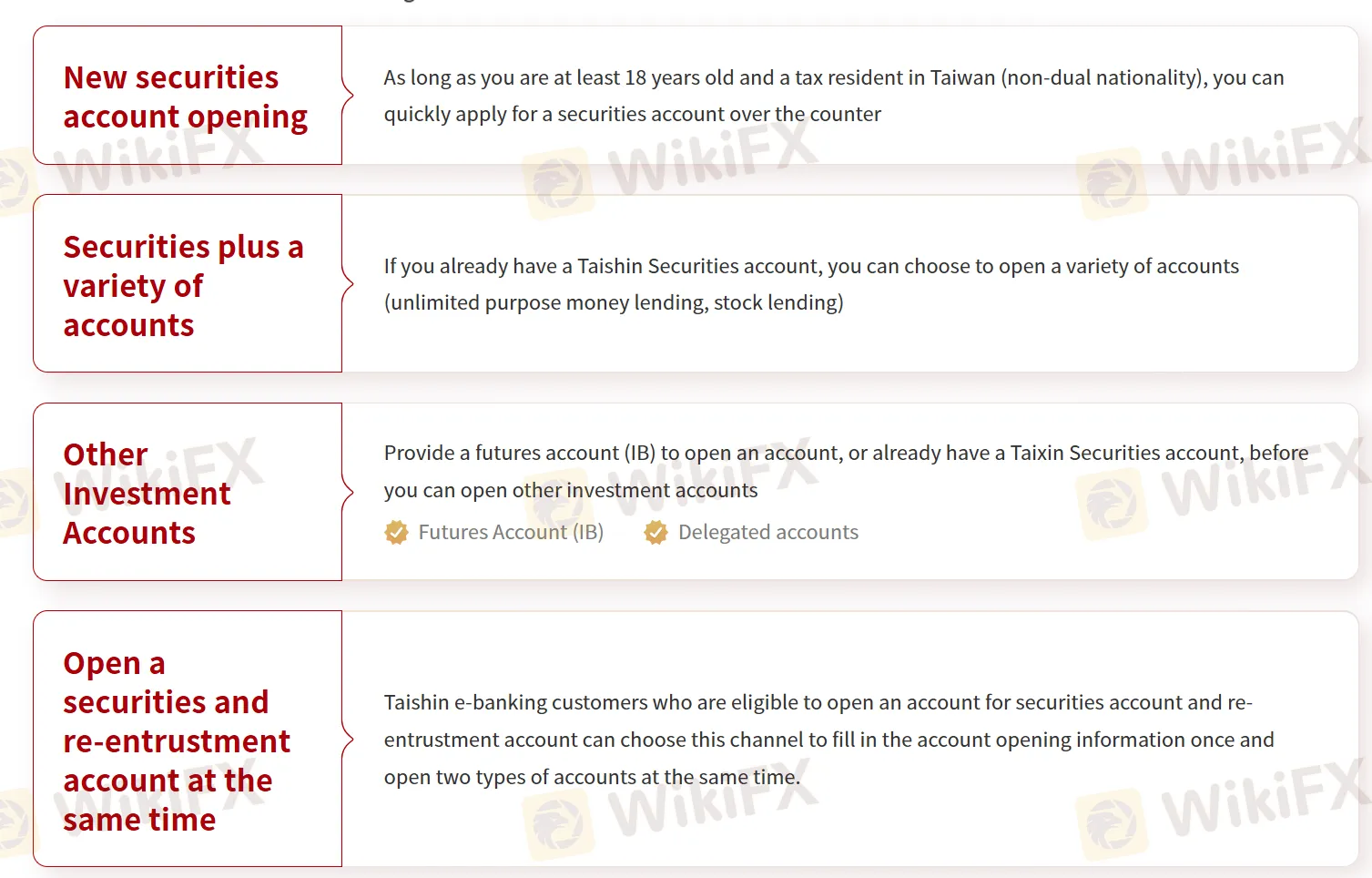

Taishin Securities은 네 가지 계정 유형을 제공합니다:

- 신규 증권 계좌 개설: 대만에 거주하는 18세 이상의 개인(이중 국적이 아닌)을 대상으로 하며, 증권 계좌에 대한 빠른 맞춤식 신청을 허용합니다.

- 증권 및 다양한 계좌: 기존 Taishin Securities 계좌 소유자를 대상으로 하며, 무제한 목적 자금 대출 및 주식 대출과 같은 옵션을 제공합니다.

- 기타 투자 계좌: 선물 계좌(IB)를 제공하거나 이미 Taishin Securities 계좌를 보유한 경우에만 선물 계좌(IB) 및 위임 계좌와 같은 기타 투자 계좌를 개설할 수 있습니다.

- 증권 및 재위탁 계좌 동시 개설: 자격을 갖춘 태신 전자뱅킹 고객이 한 번의 신청 정보 작성으로 증권 및 재위탁 계좌를 동시에 개설할 수 있습니다.

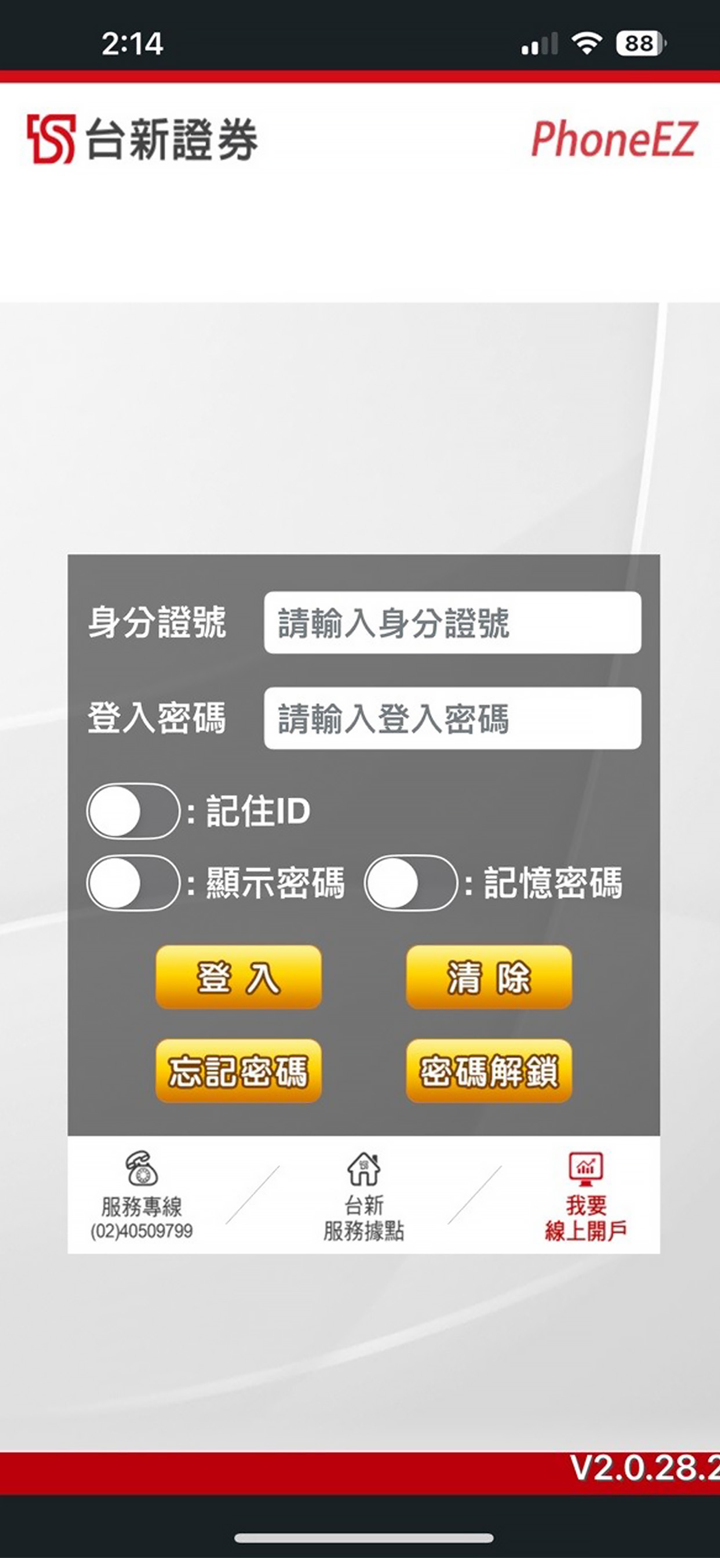

거래 플랫폼

| 거래 플랫폼 | 지원되는 앱 | 사용 가능한 장치 | 적합한 대상 |

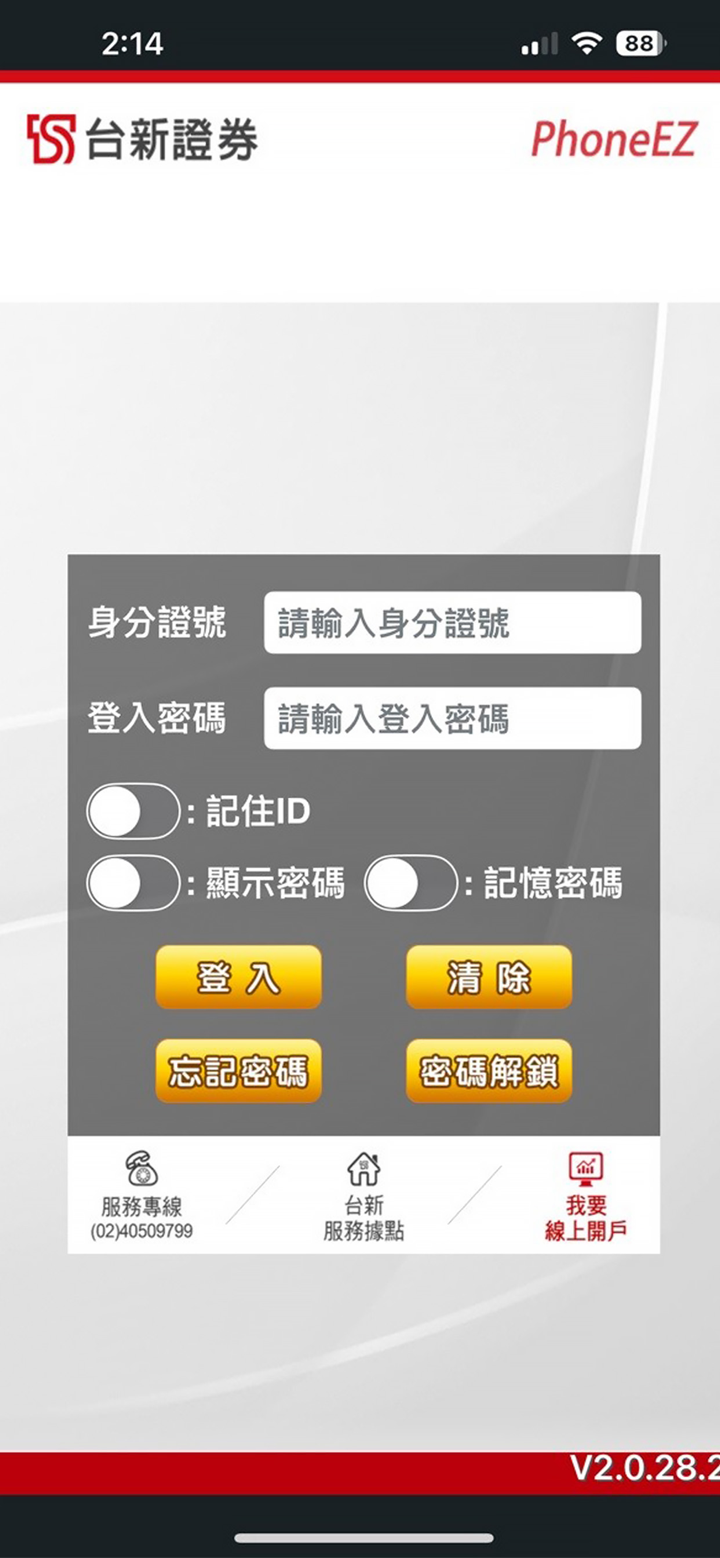

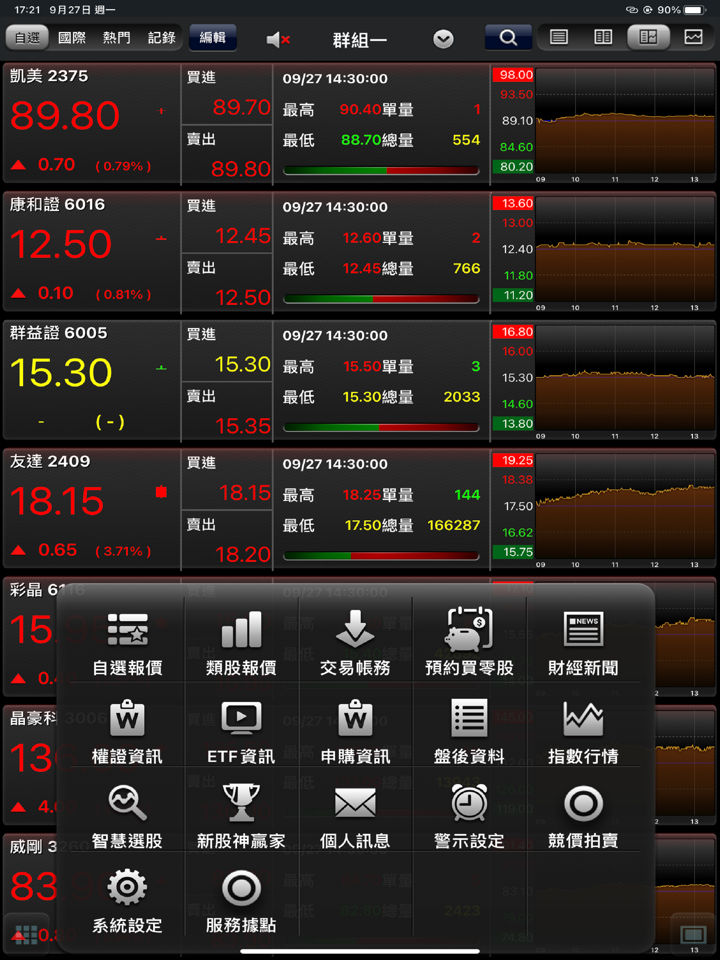

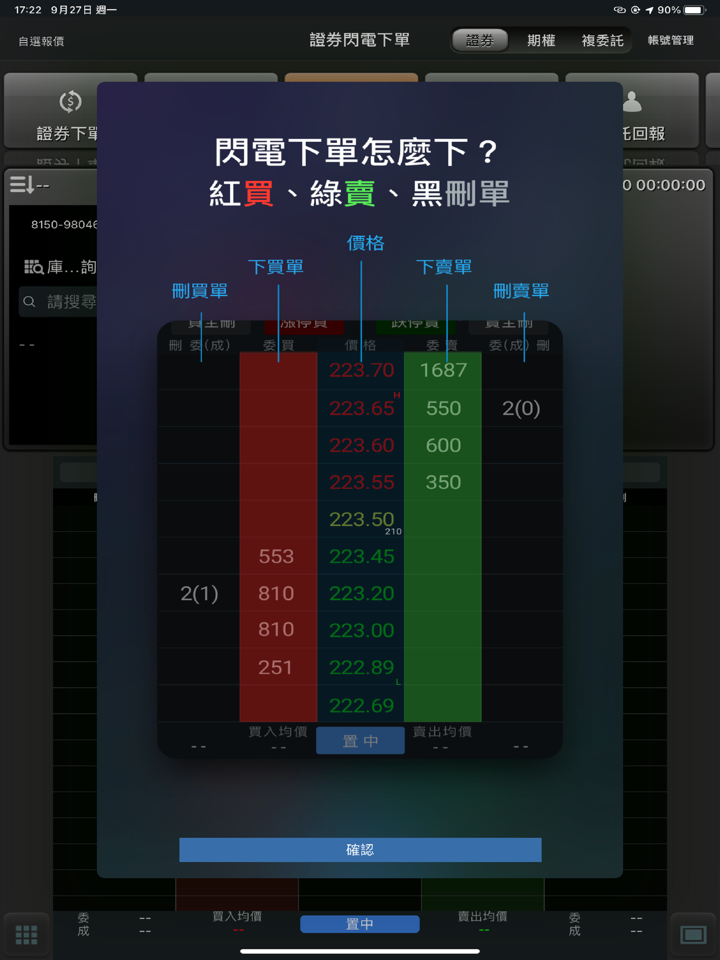

| 앱 거래 | Woojii, PhoneEZ | 모바일 앱 | 모바일 사용자 |

| 컴퓨터 거래 | Super Smart Star, Taishin Express Hand, WEB Trading, API Trading, Global Futures Star | 데스크톱, 웹 브라우저, API | 데스크톱 사용자, 알고리즘 거래 |

| 음성 거래 | 음성 거래 | 모바일 | 음성 주문 |

| 인증 영역 | 인증 영역 | 명시적으로 나열되지 않았으며, 인증 관리를 위해 아마도 데스크톱 기반일 것으로 예상됩니다. | 인증 관리 |