회사 소개

| MGM Review Summary | |

| 설립 | 2003 |

| 등록 국가/지역 | 파키스탄 |

| 규제 | 규제되지 않음 |

| 시장 기구 | 주식 중개, 주식 보관 서비스, 기업 금융, 온라인 주식 거래 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | KITS, 원격 거래 터미널, 웹 기반 거래 |

| 최소 입금액 | / |

| 고객 지원 | 주소: 라호르, 19-Khyaban-e-Aiwan-e-Iqbal, LSE Plaza, 지상 층 G-10호 |

| 이메일: mgmsecurities@mgm-lse.com / mgmsecurities@yahoo.com / info@mgm-lse.com | |

| 전화: 042-36279181-2 / 042-36280761 / 042-36310753 | |

| 휴대폰: 0333-4296005 | |

MGM 정보

2003년에 설립되어 파키스탄에 등록된 MGM은 기업 금융, 인터넷 주식 거래, 주식 중개 및 주식 보관 서비스를 제공합니다. 다양한 서비스를 제공하고 있지만 규제 검토를 받지 않으므로 투자자에게 위험을 초래할 수 있습니다.

장단점

| 장점 | 단점 |

| 다양한 거래 서비스 제공 | 규제되지 않음 |

| 온라인 거래를 위한 다양한 플랫폼 제공 | 데모 계정 없음 |

| 수수료 정보 없음 |

MGM의 신뢰성

MGM은 등록 국가인 파키스탄에서 규제를 받지 않으며 FCA (영국) 또는 ASIC (호주)와 같은 인정받은 규제 기관으로부터 어떠한 라이선스도 소지하고 있지 않습니다. 잠재적인 위험에 대해 주의하시기 바랍니다.

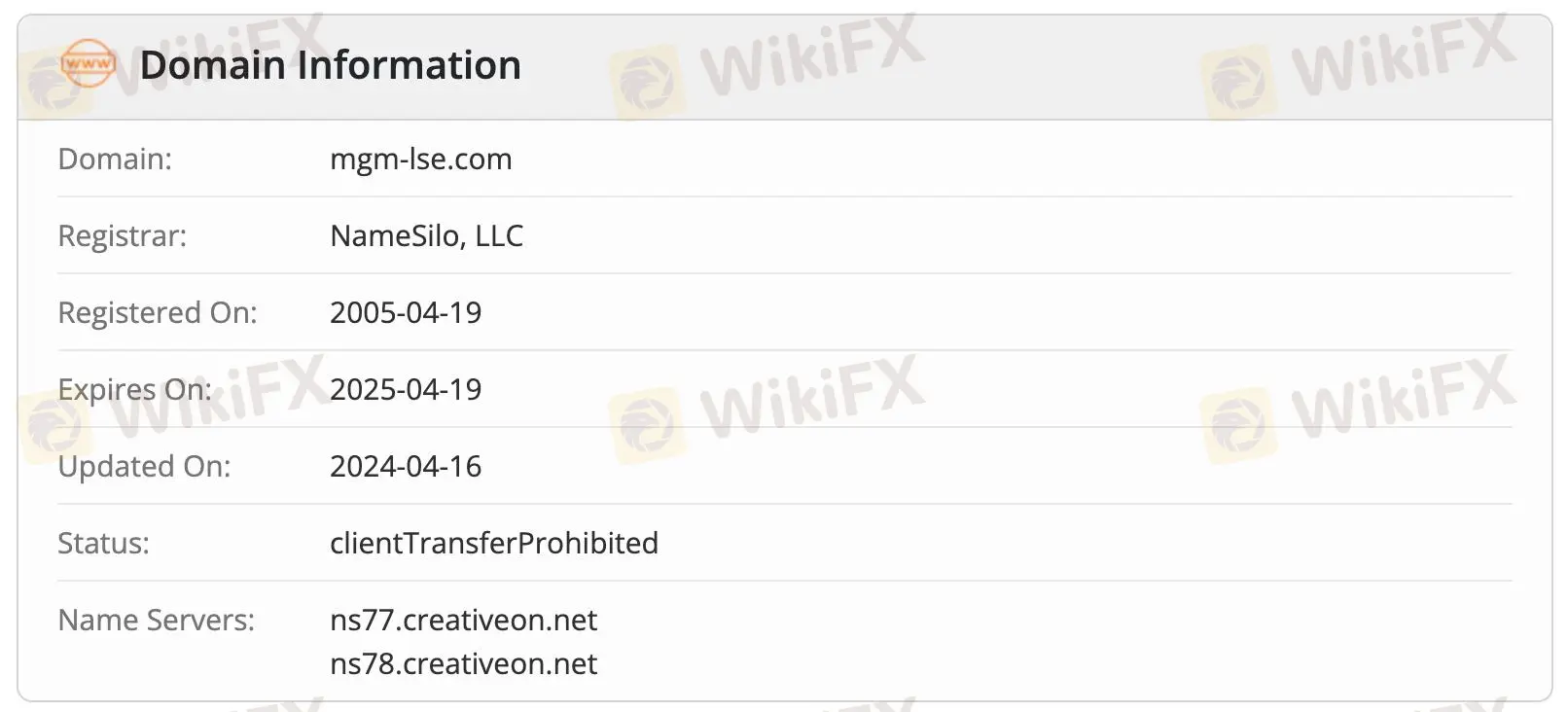

2005년 4월 19일에 등록된 mgm-lse.com은 현재 clientTransferProhibited 상태로 사용 중이며, 이는 제한된 관리적 통제를 나타냅니다.

MGM의 서비스

MGM은 다양한 플랫폼을 통해 주식 거래, 주식 보관 서비스, 기업 금융 및 온라인 주식 거래를 제공합니다.

| 서비스 | 지원 |

| 주식 중개 | ✔ |

| 주식 보관 서비스 | ✔ |

| 기업 금융 | ✔ |

| 온라인 주식 거래 | ✔ |

| 원격 거래 단말기 | ✔ |

| 웹 기반 거래 | ✔ |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 어떤 유형의 트레이더에게 적합한가요? |

| KITS | ✔ | 데스크톱 | 고급 도구가 필요한 활발한 트레이더 |

| 원격 거래 단말기 | ✔ | 데스크톱 | 기관 및 전문 트레이더 |

| 웹 기반 거래 | ✔ | 웹 (브라우저) | 편리성과 유연성을 추구하는 소매 트레이더 |