회사 소개

| Phillip Securities 리뷰 요약 | |

| 설립 | 1920 |

| 등록 국가/지역 | 일본 |

| 규제 | FSA |

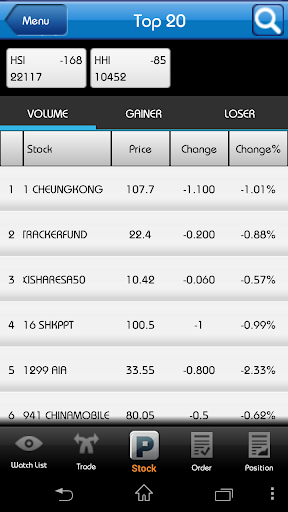

| 시장 상품 | 증권, ETF |

| 데모 계정 | ❌ |

| 레버리지 | / |

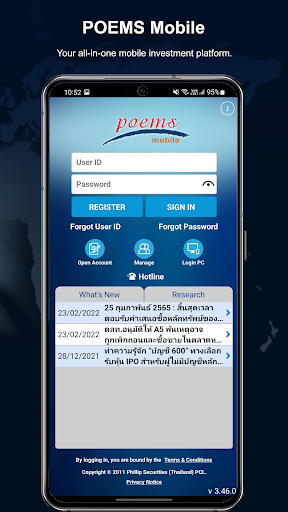

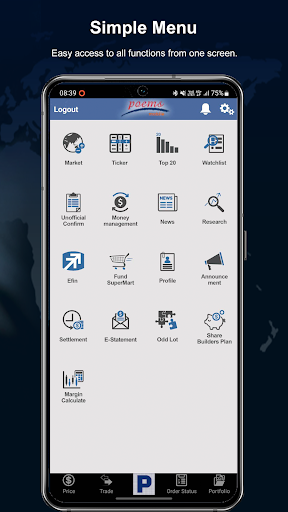

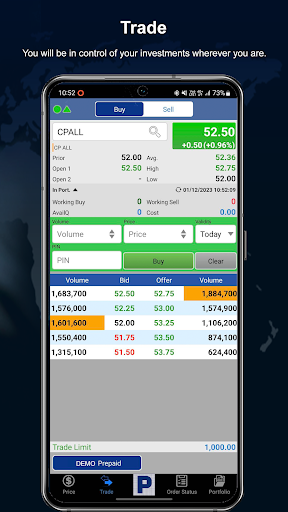

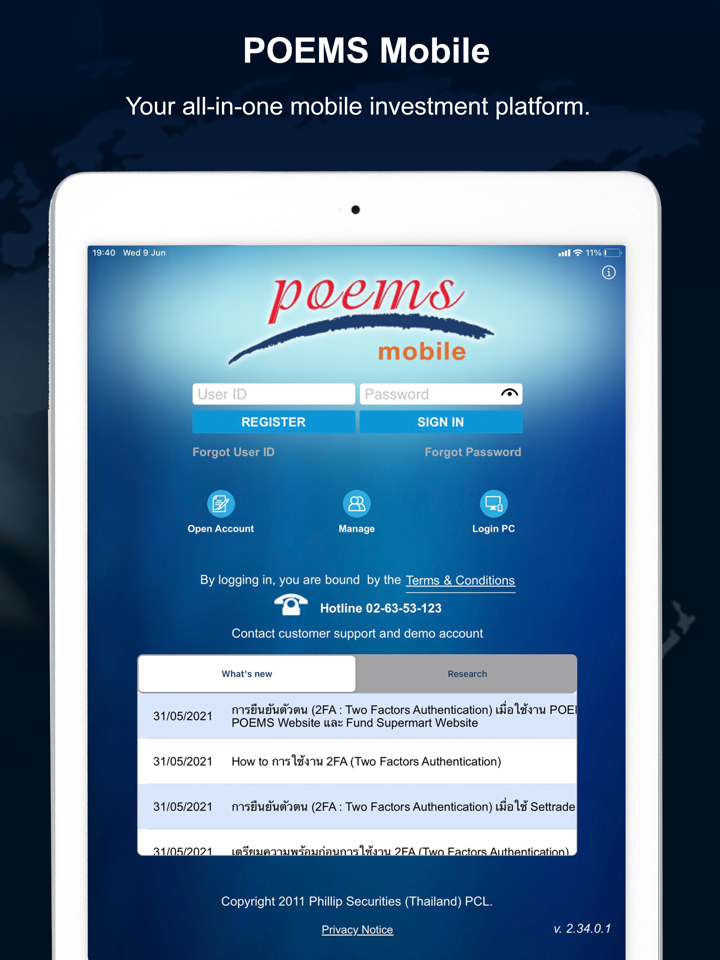

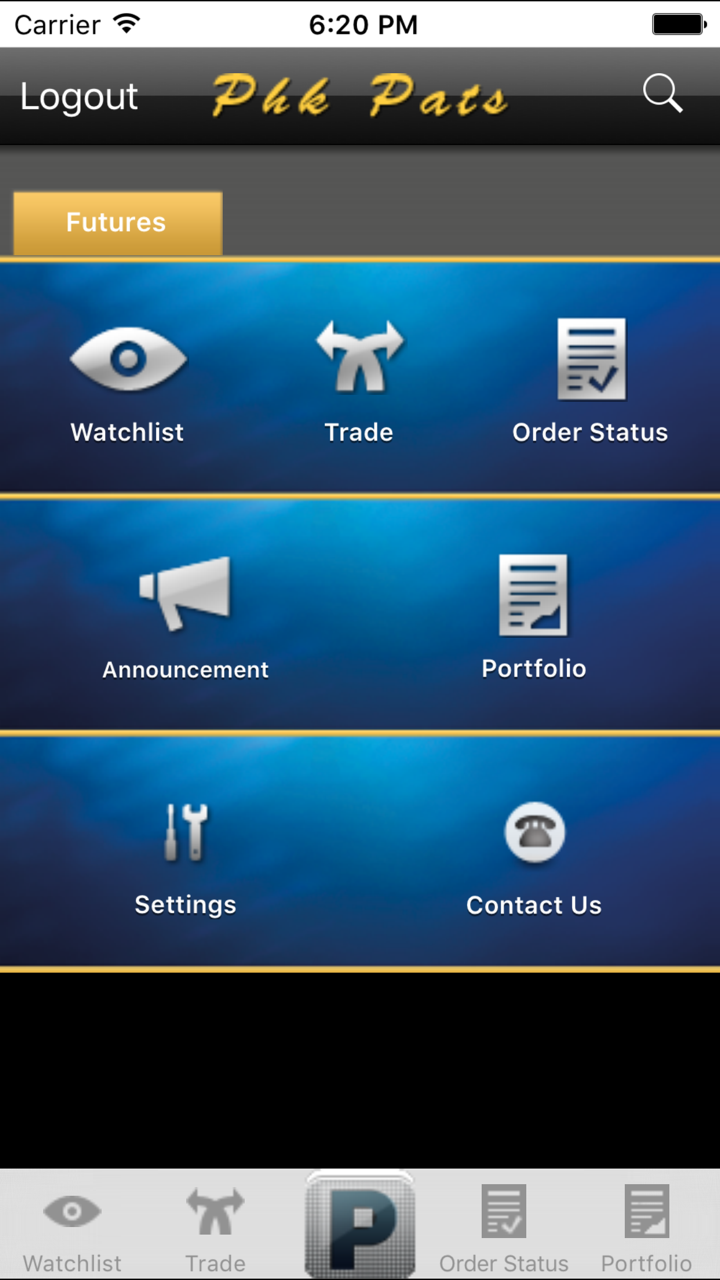

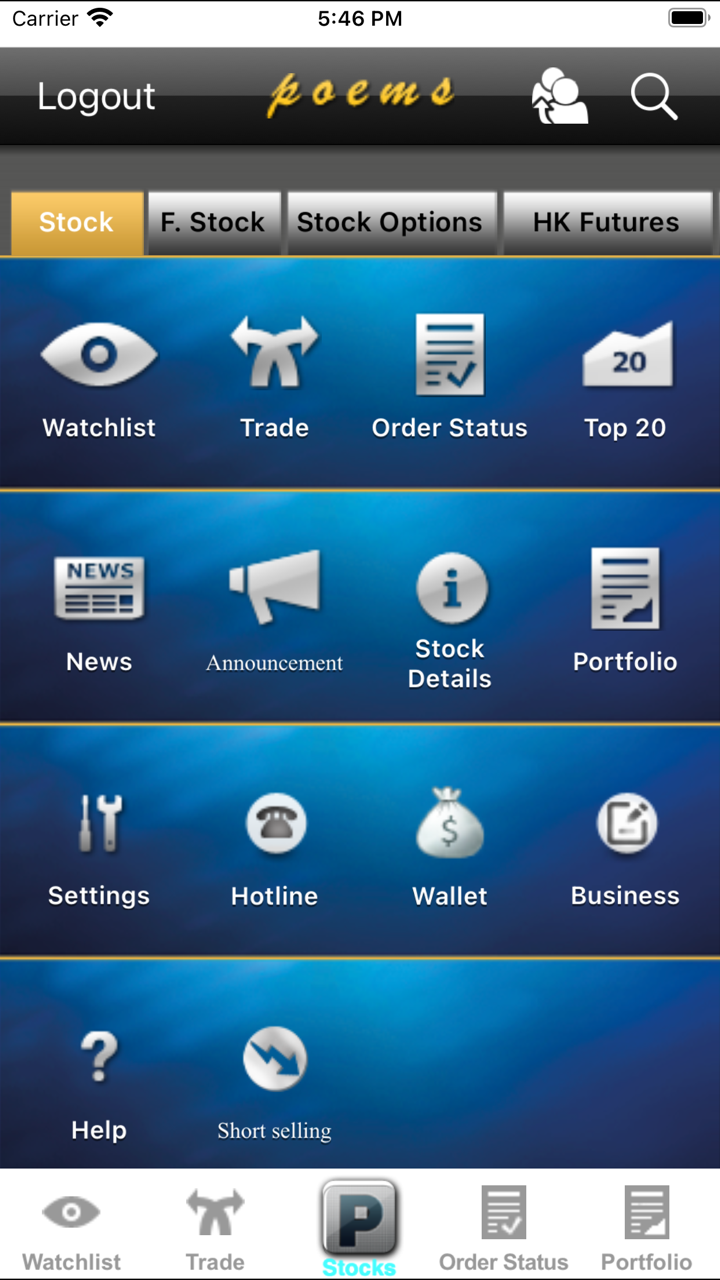

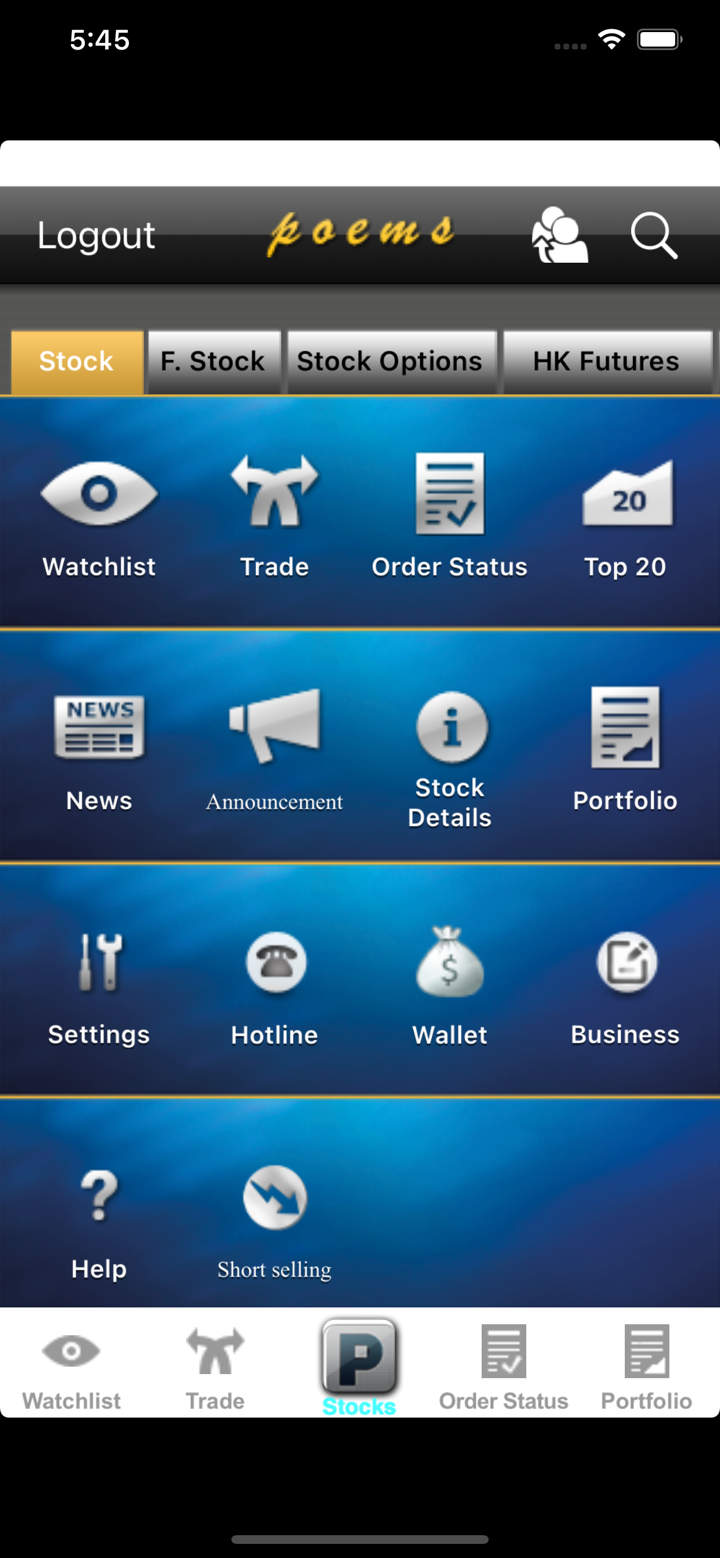

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: +81-3-4589-3303 | |

| 주소: 일본 도쿄 중구 니혼바시 카부토초 4-3, 103-0026 | |

Phillip Securities은 필립 캐피탈 그룹의 일환으로 1920년부터 오랜 역사를 가지고 있습니다. 이 증권 중개업체는 2002년에 필립 캐피탈 그룹의 일부가 되었습니다. 일본 FSA의 규제를 받고 있으며, 제품 제공으로 고객은 TSE, OSE 및 TOCOM의 세 가지 국내 거래소에서 거래할 수 있습니다.

장단점

| 장점 | 단점 |

| 오랜 역사의 운영 | 데모 계정 없음 |

| 세 개의 사무실을 갖춘 글로벌한 존재감 | 투명성 부족 |

| FSA 규제 |

Phillip Securities의 신뢰성

네, Phillip Securities은 금융 서비스 규제청(FSA)의 규제를 받고 있습니다. 상호는 Retail Forex License No. 関東財務局長(金商)第127号을 보유하고 있습니다.

| 규제 상태 | 규제 받음 |

| 규제 기관 | 금융 서비스 규제청(FSA) |

| 라이선스 기관 | Phillip Securities Securities Co., Ltd. |

| 라이선스 유형 | Retail Forex License |

| 라이선스 번호 | 関東財務局長(金商)第127号 |

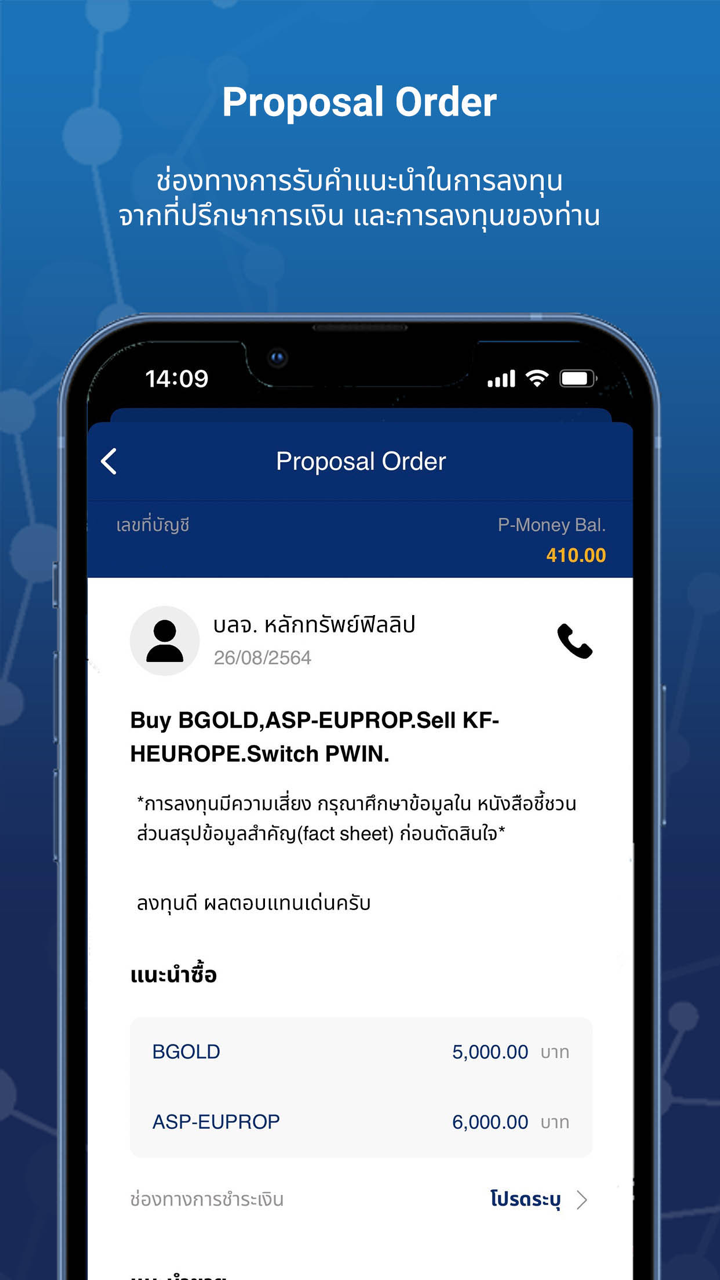

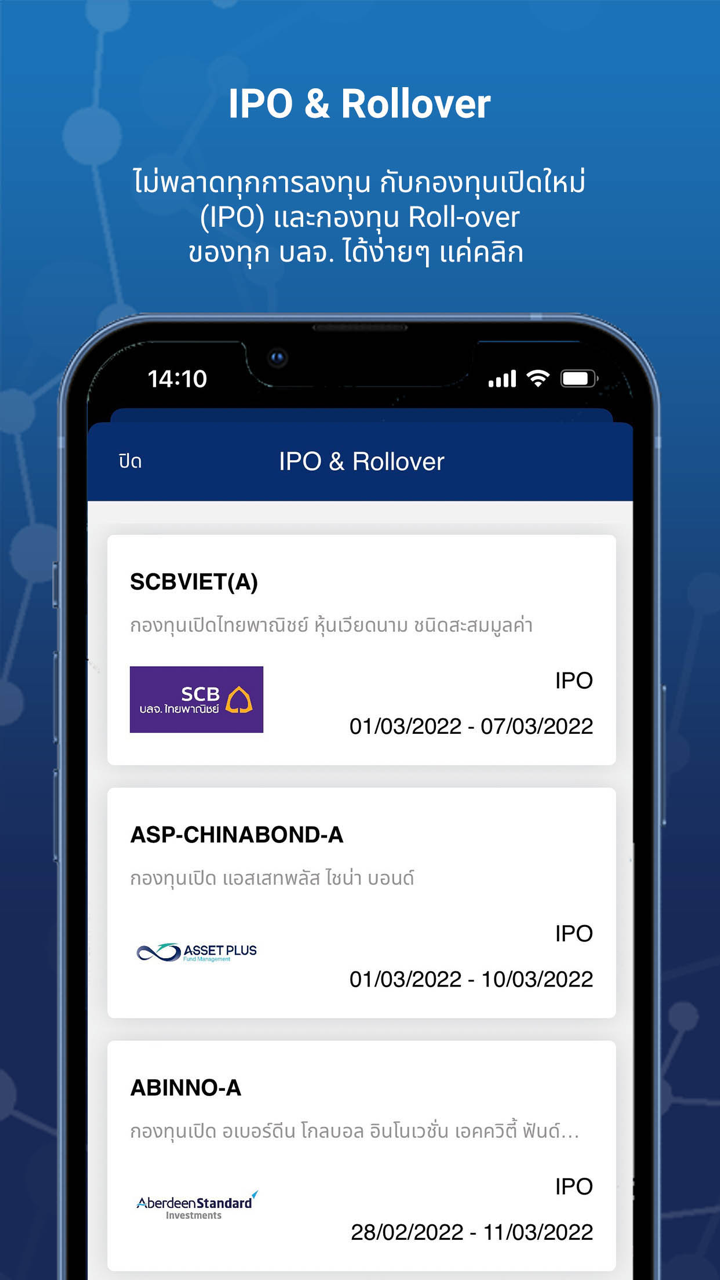

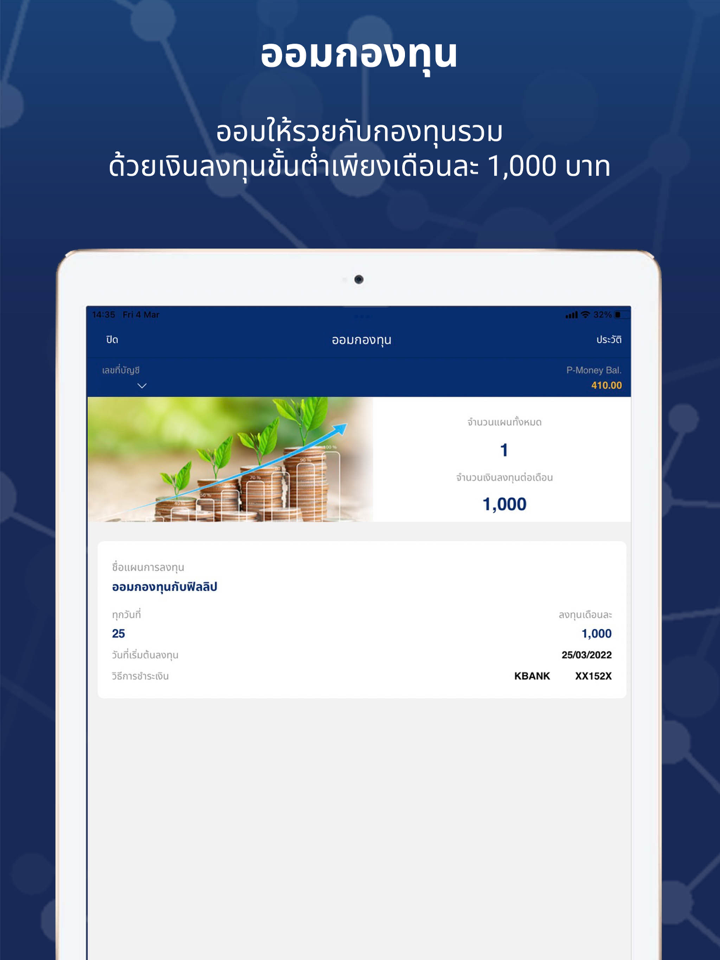

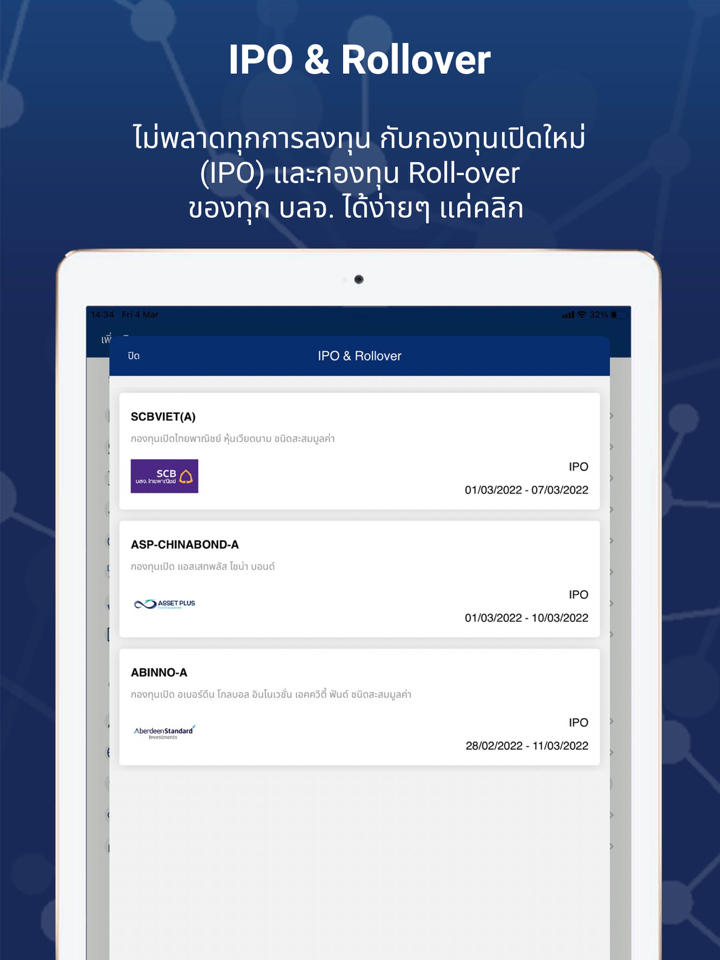

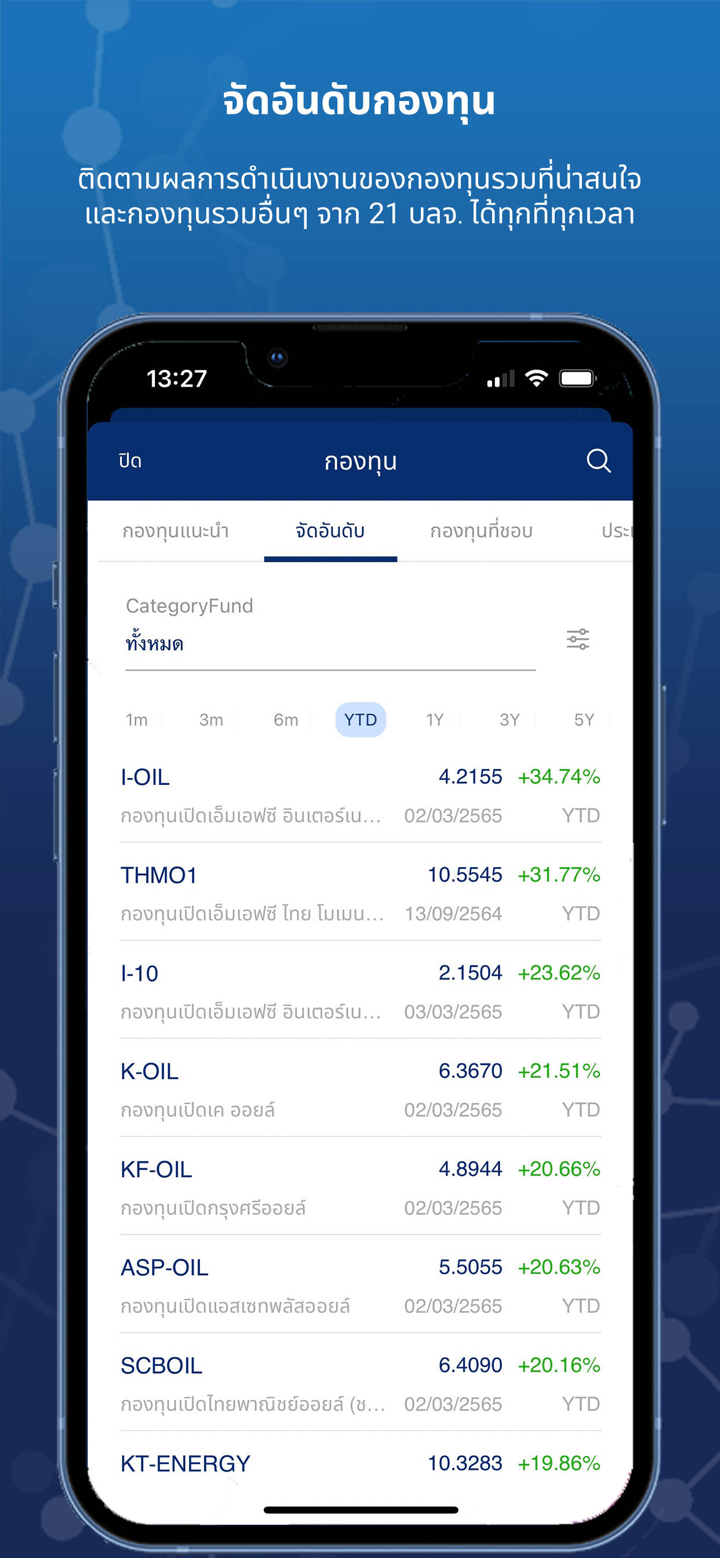

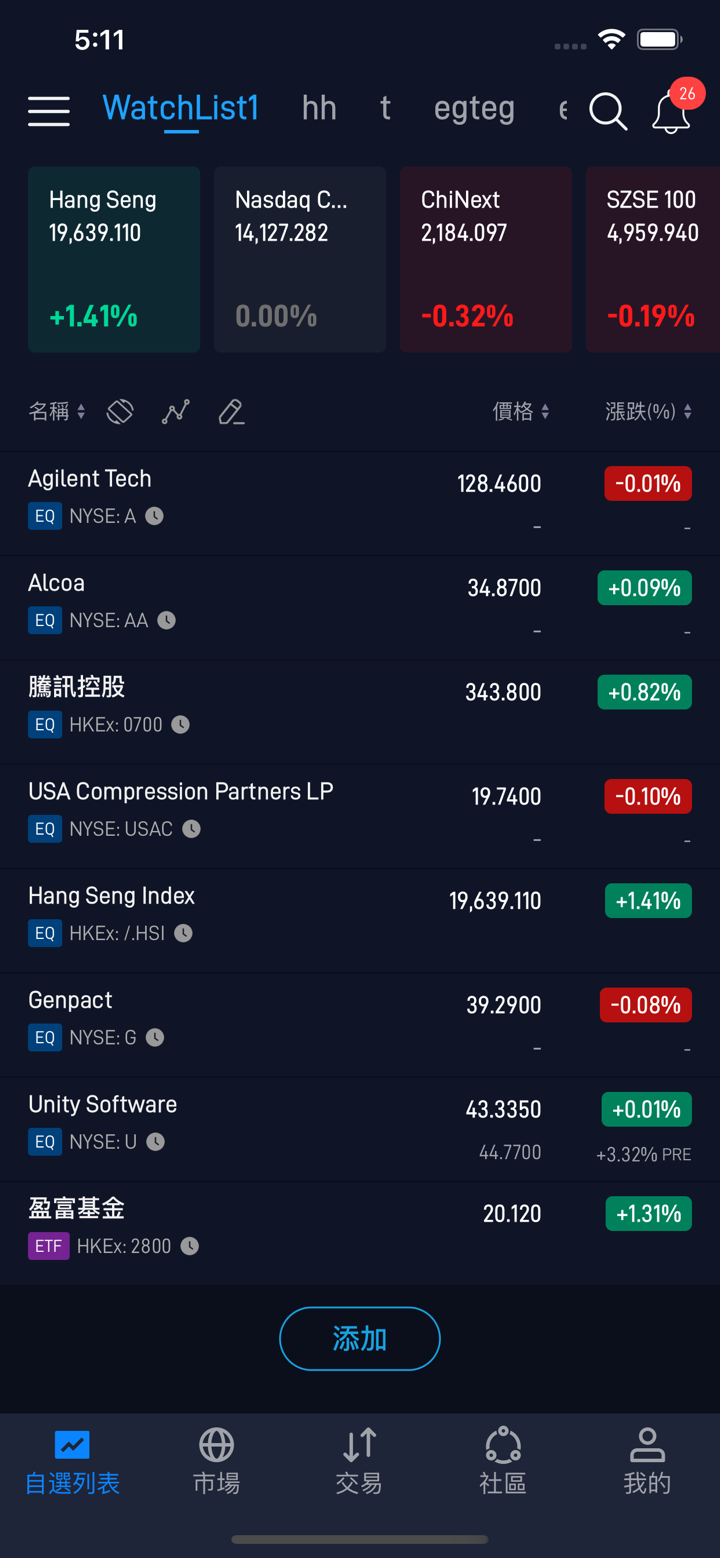

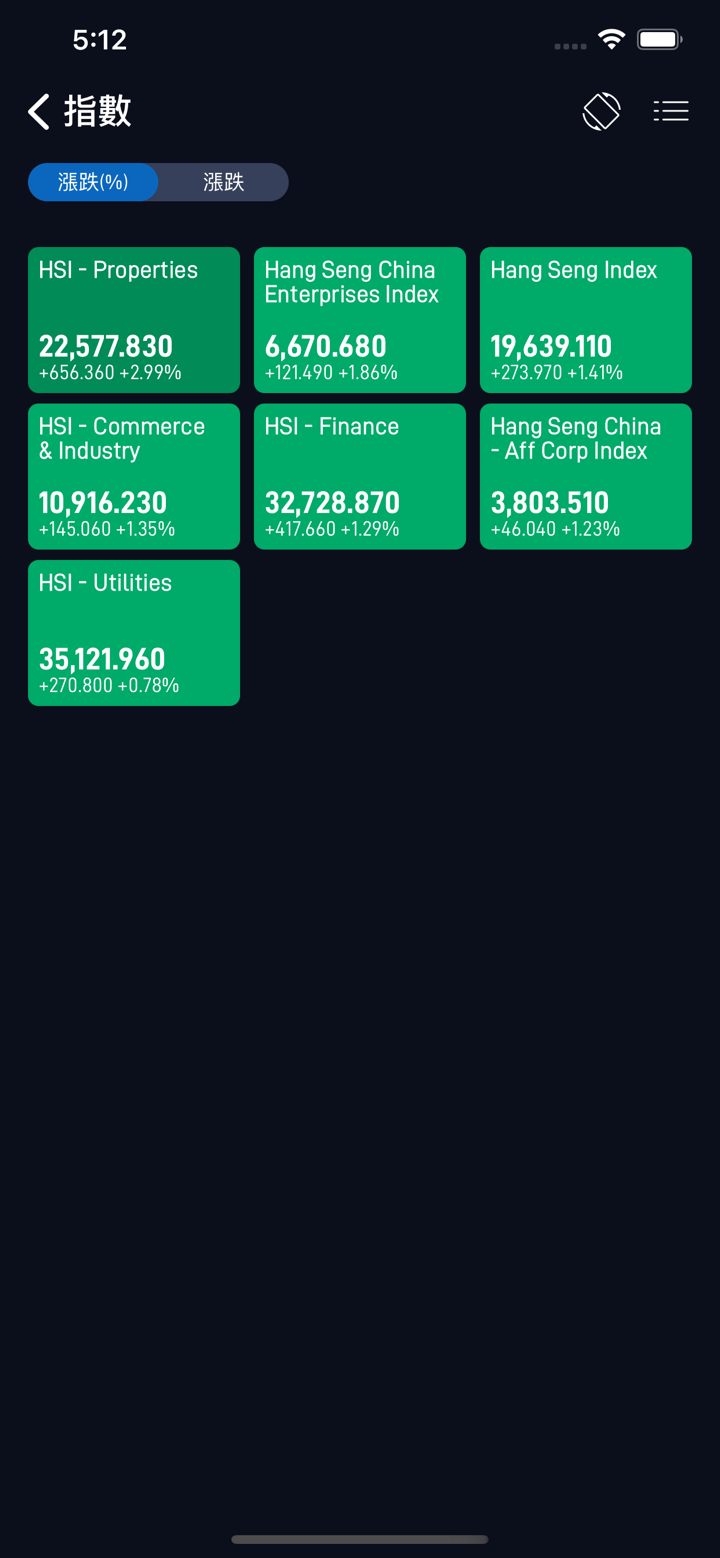

제품 및 서비스

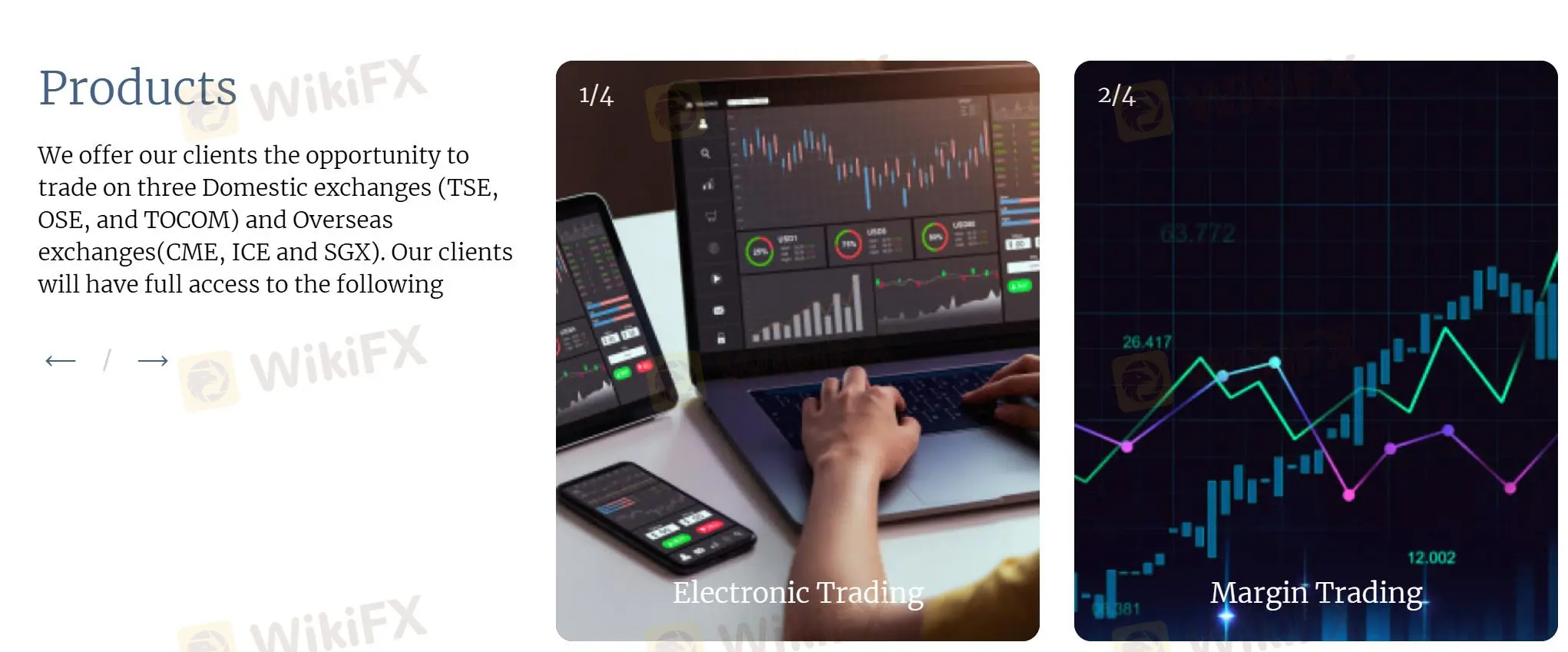

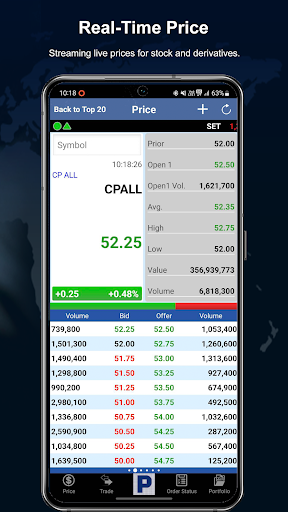

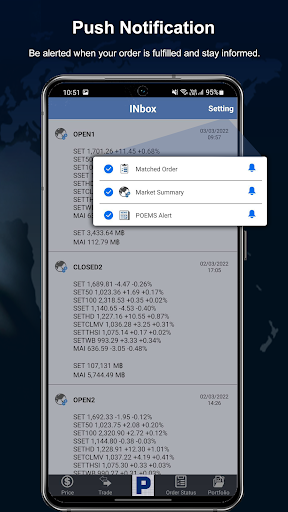

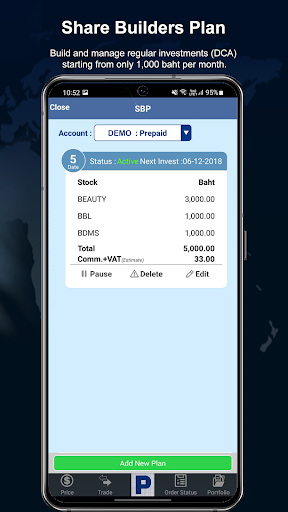

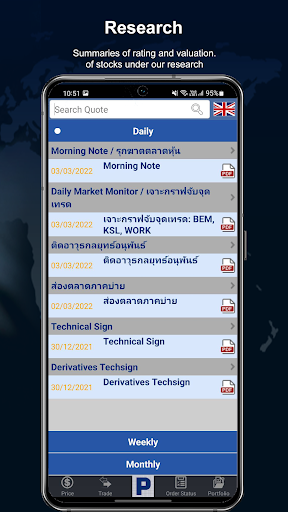

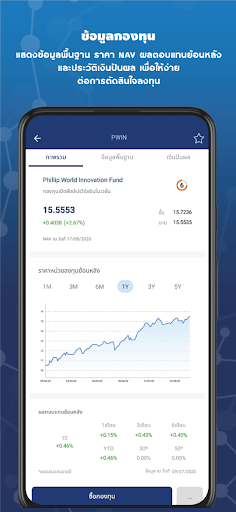

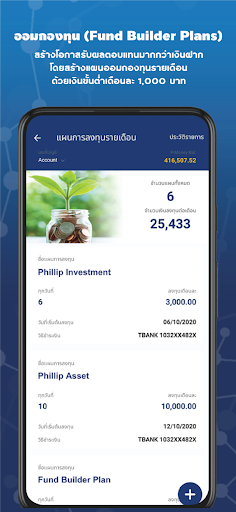

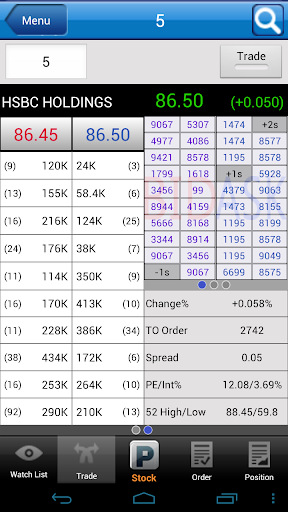

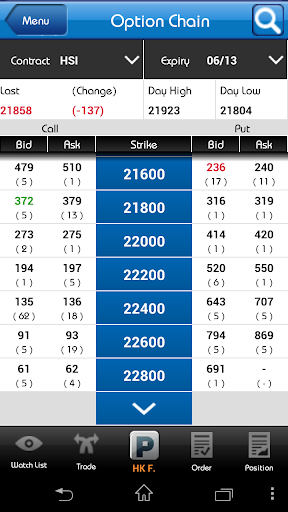

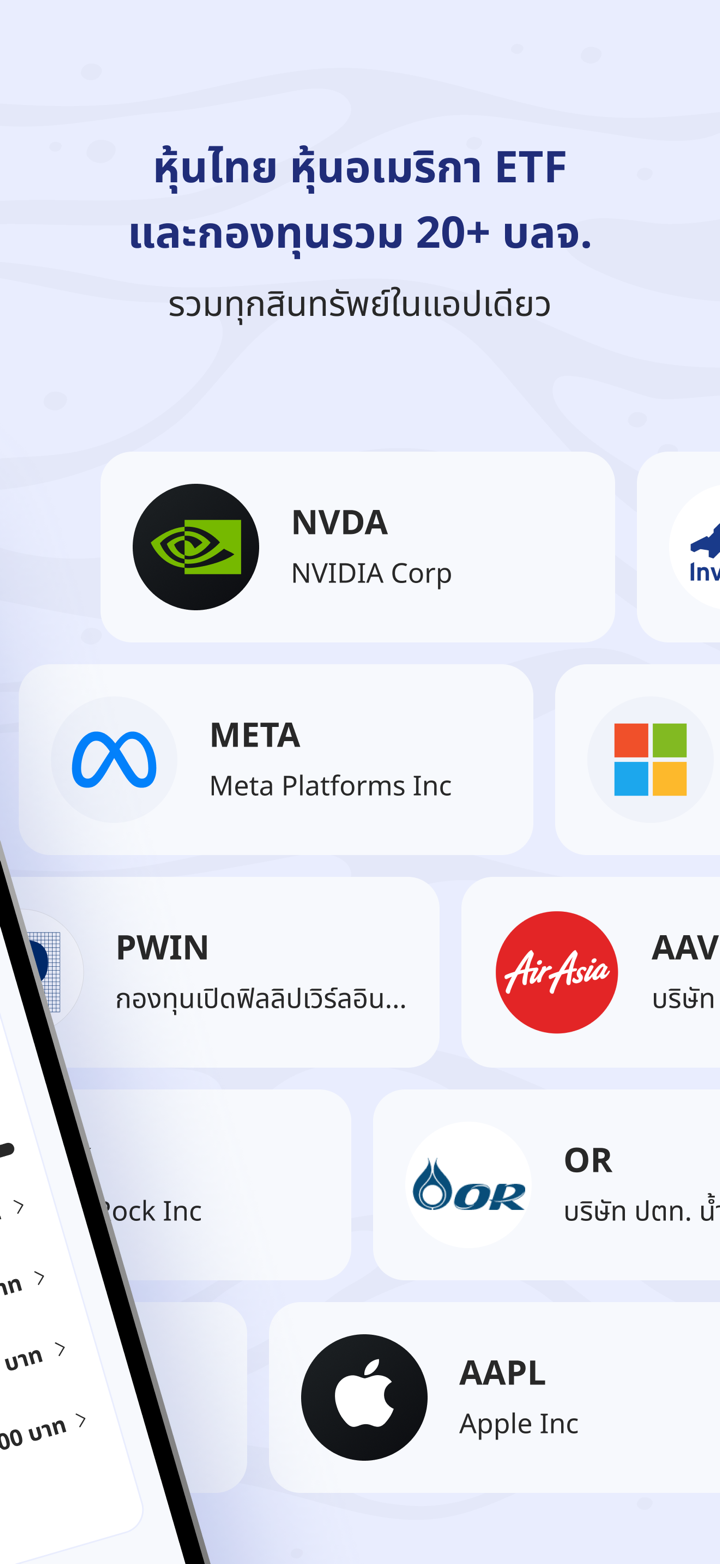

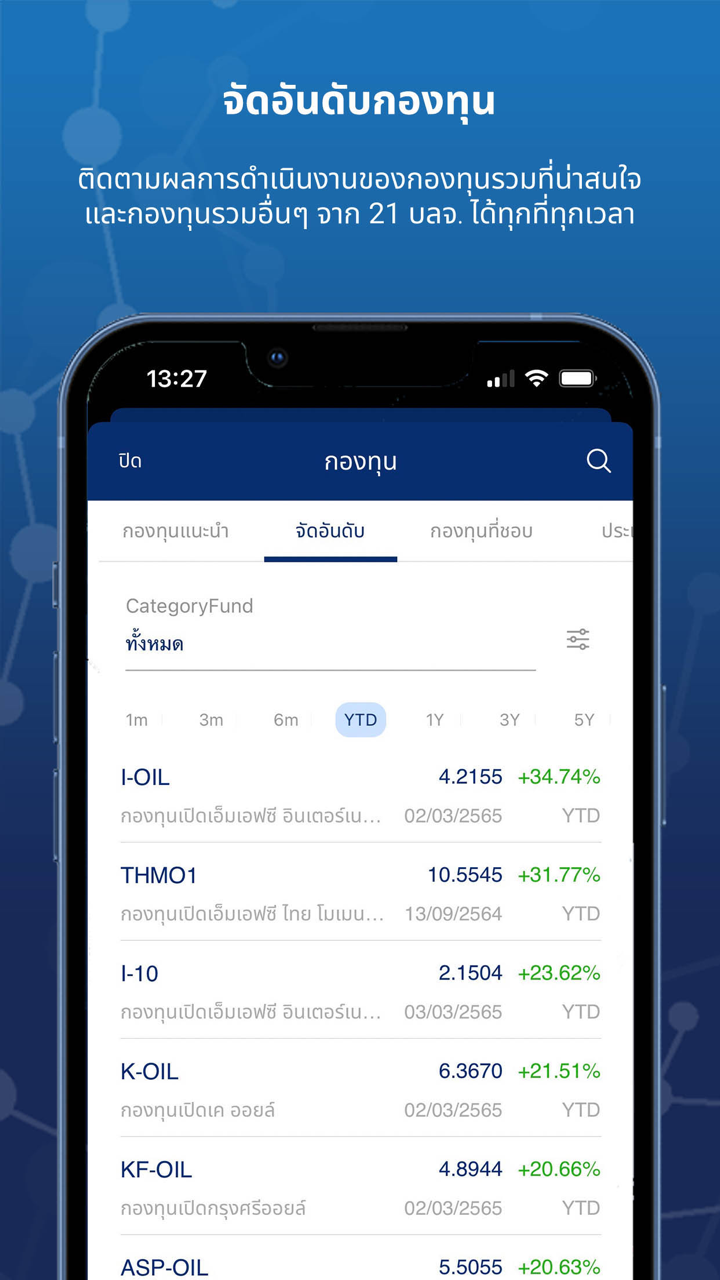

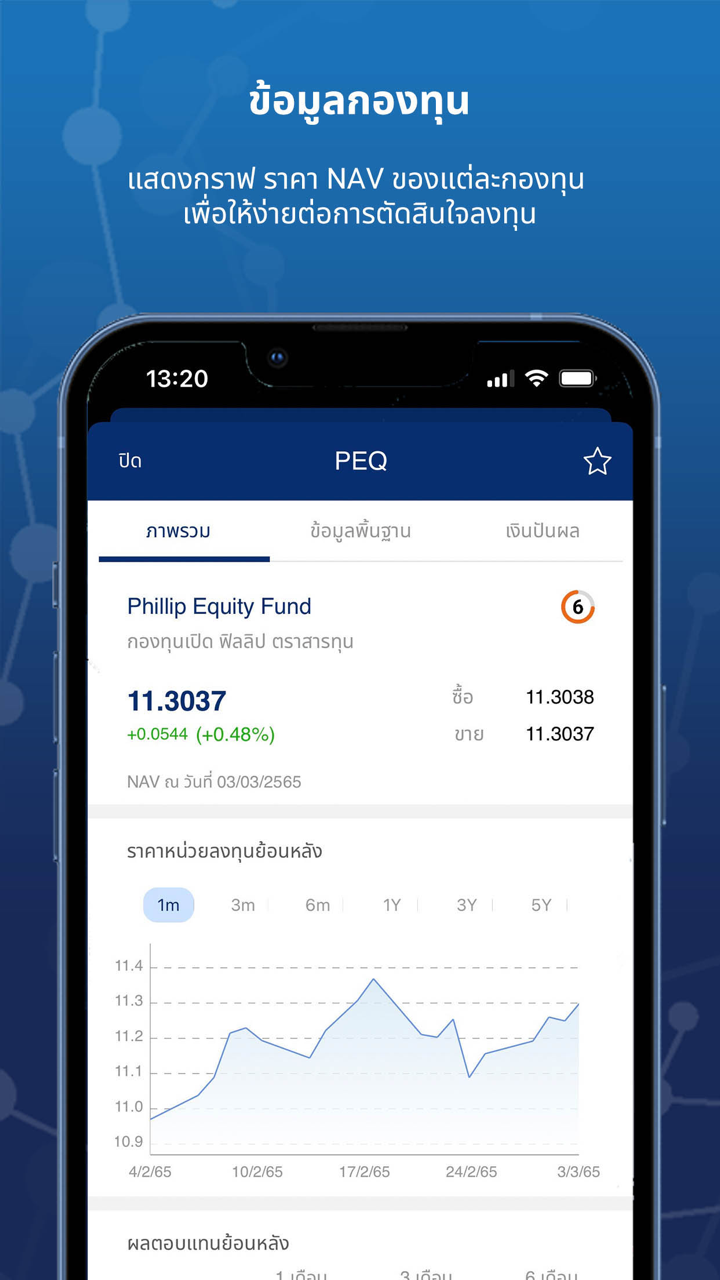

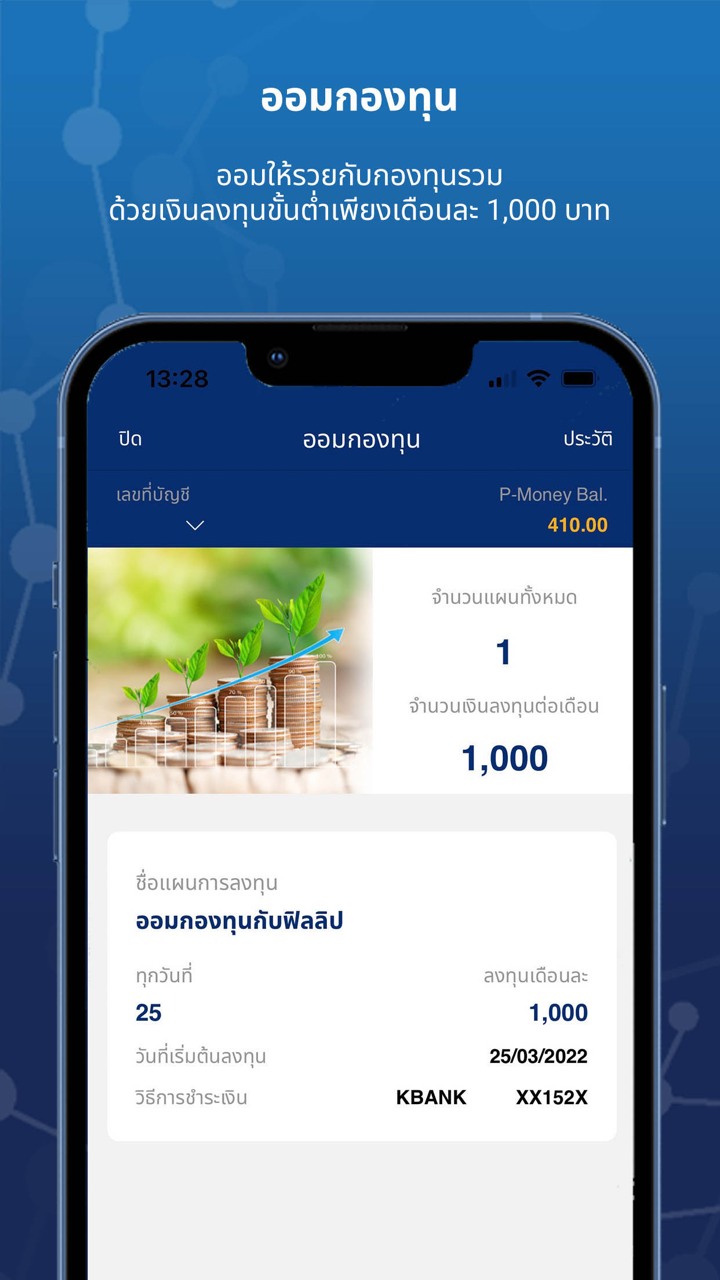

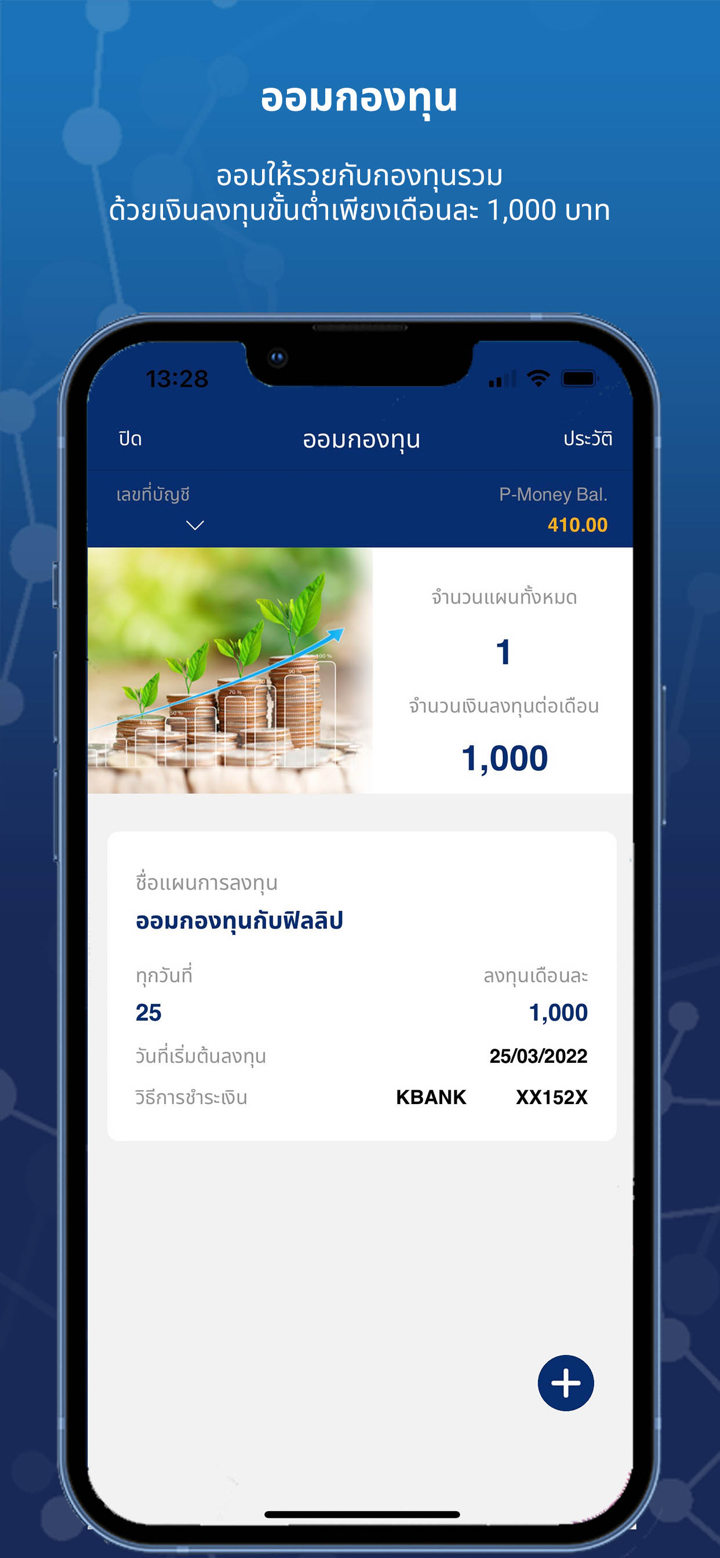

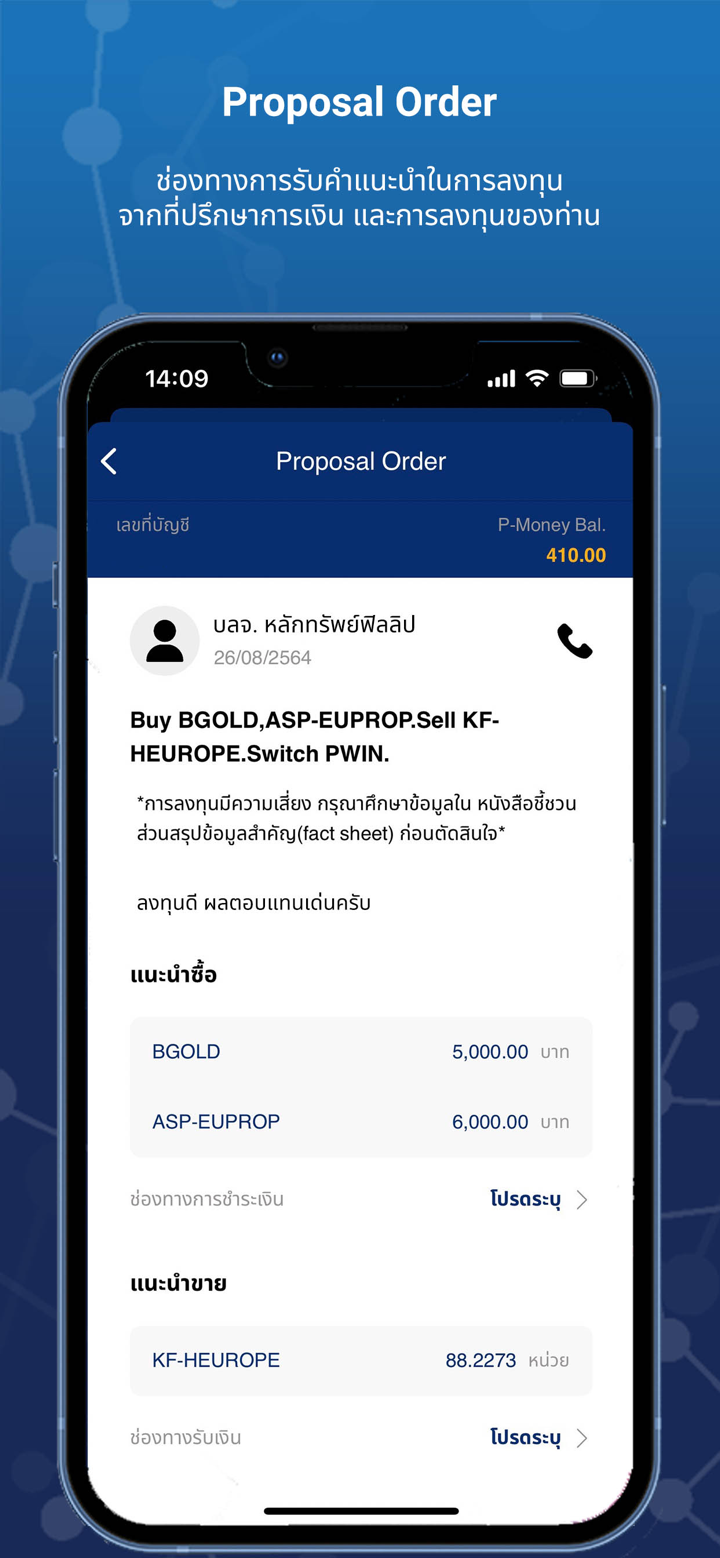

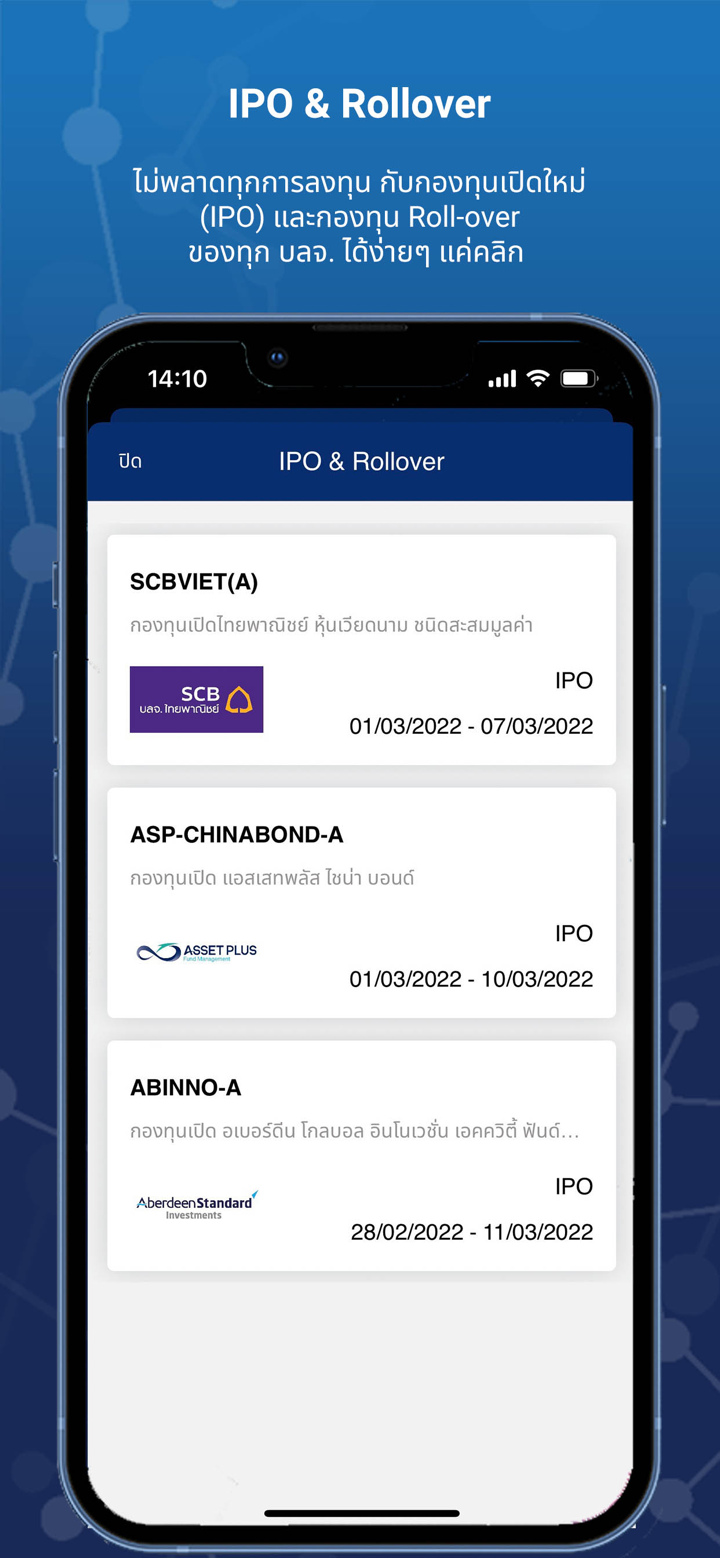

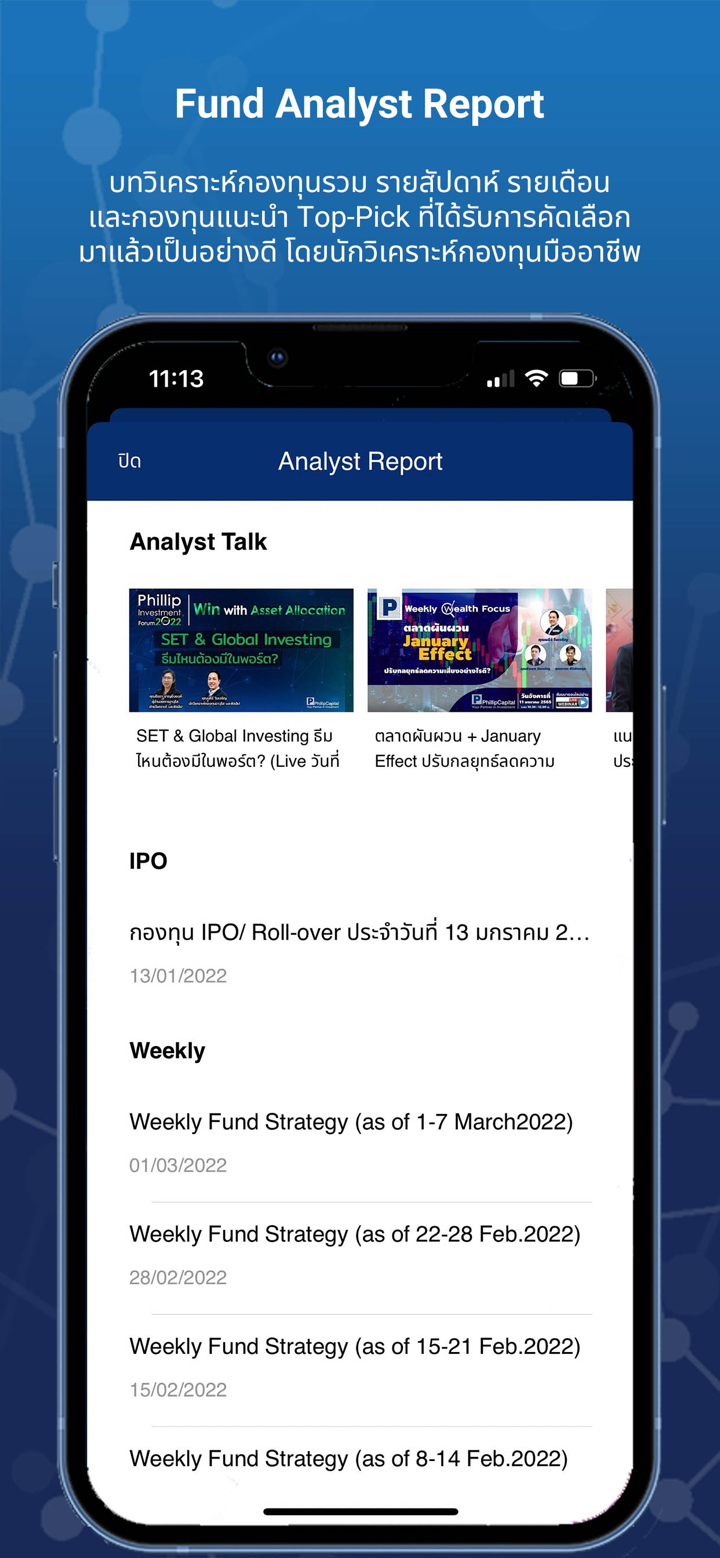

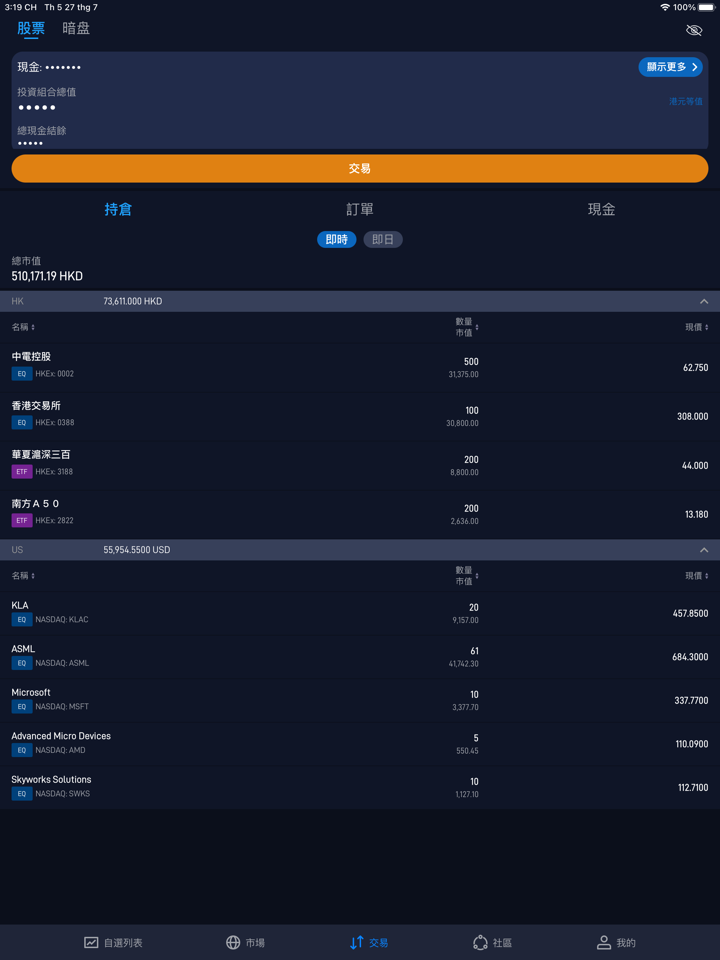

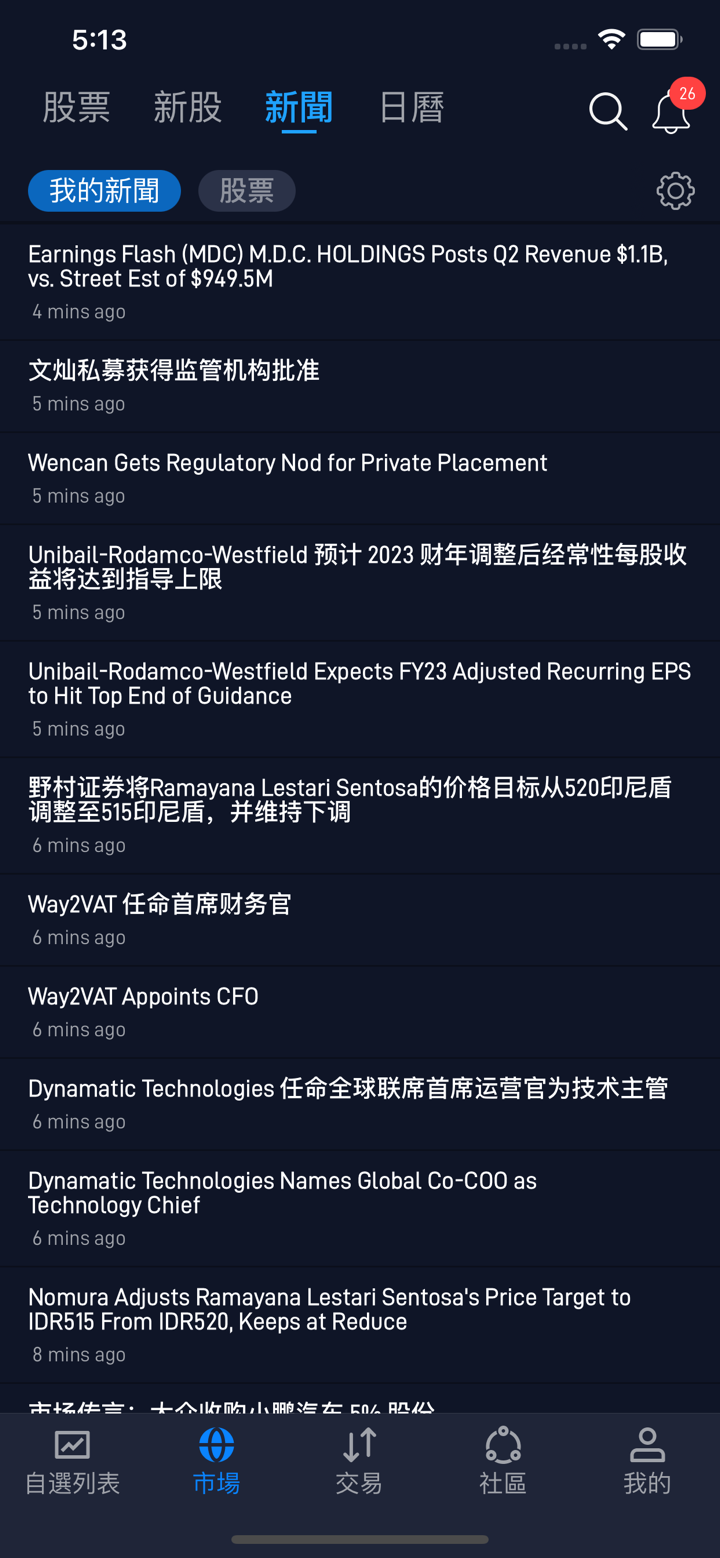

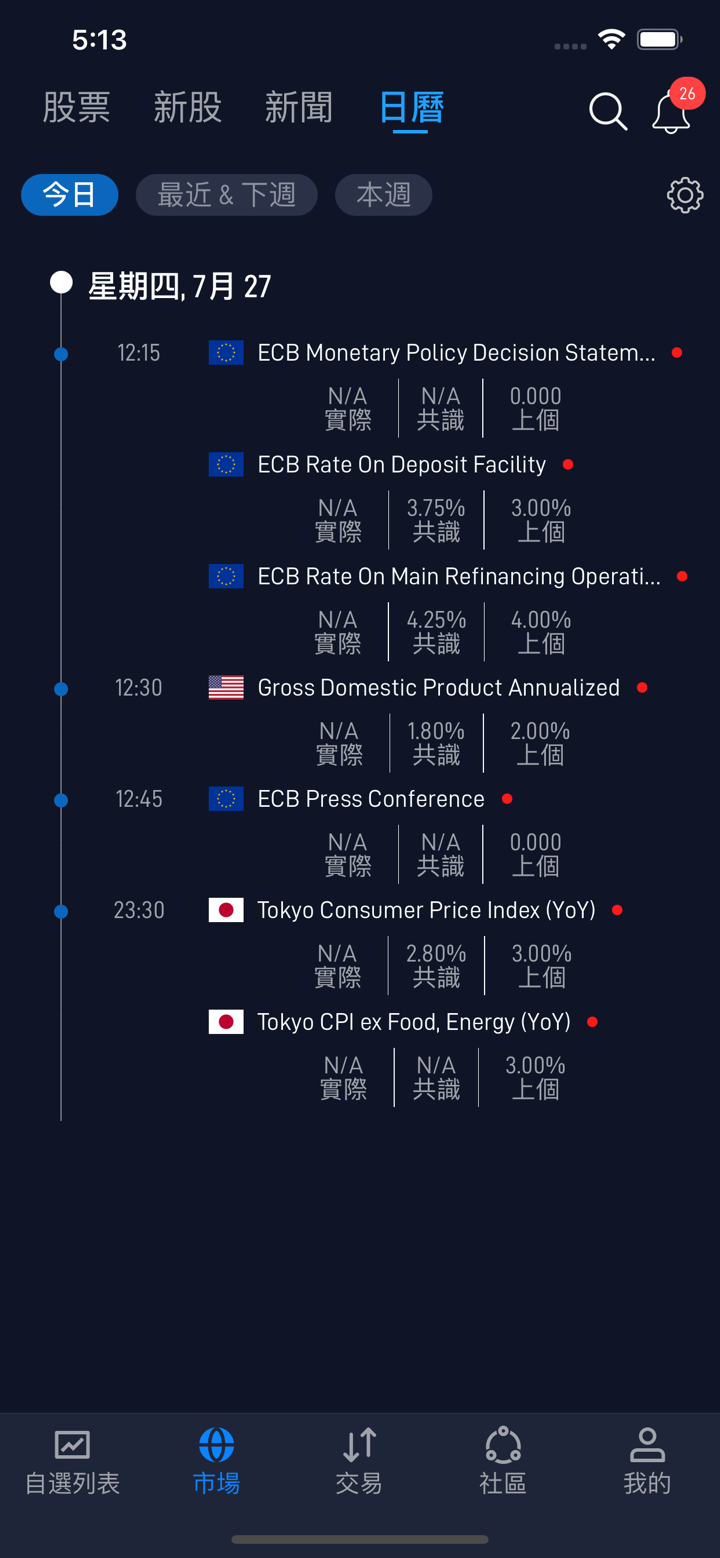

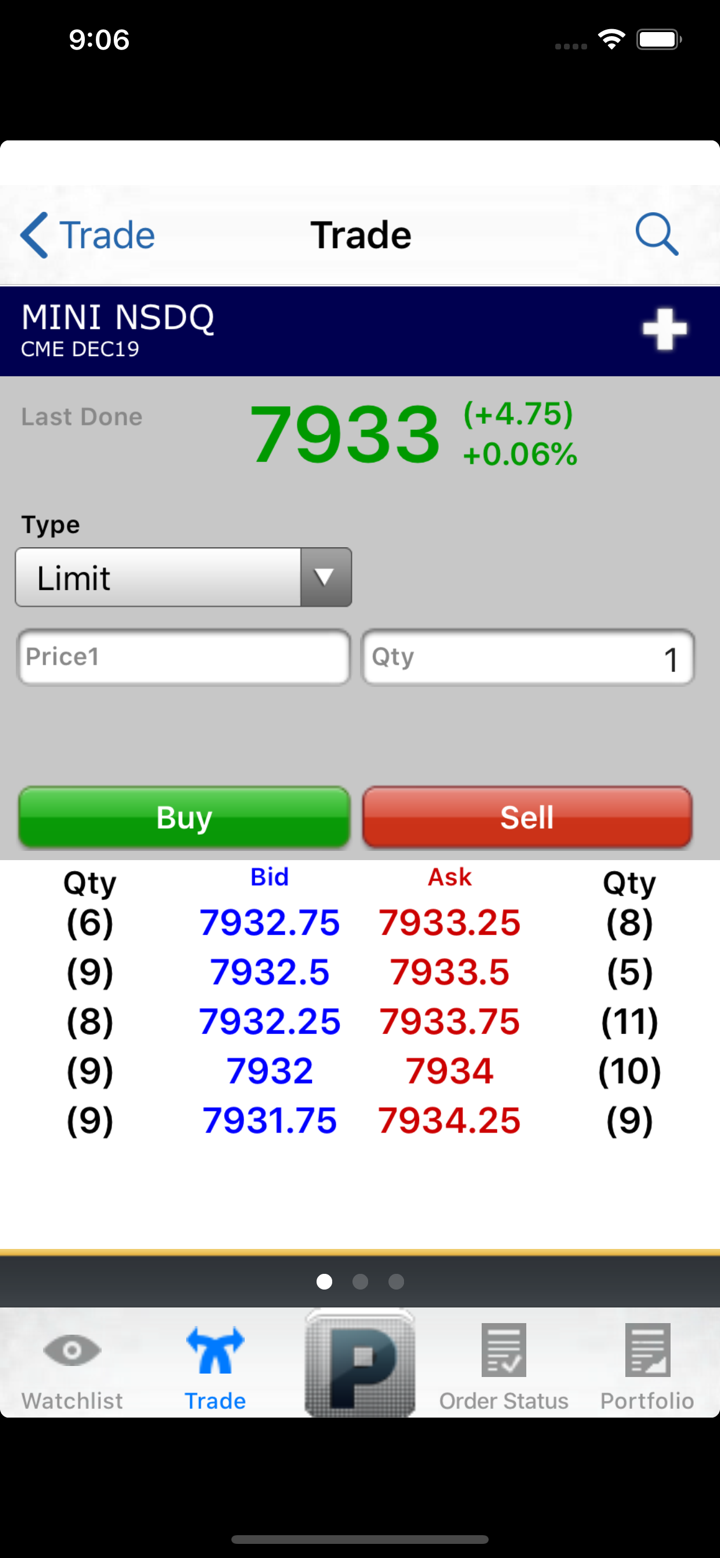

Phillip Securities은 국내 거래소 (TSE, OSE, TOCOM) 및 해외 거래소 (CME, ICE, SGX), ETF 및 마진 거래를 포함한 제품을 제공합니다.

또한, 투자 상담, 보관인 대리 서비스, 외부 연결 옵션, 저지연 옵션 및 결제 옵션과 같은 관련 서비스도 제공합니다.

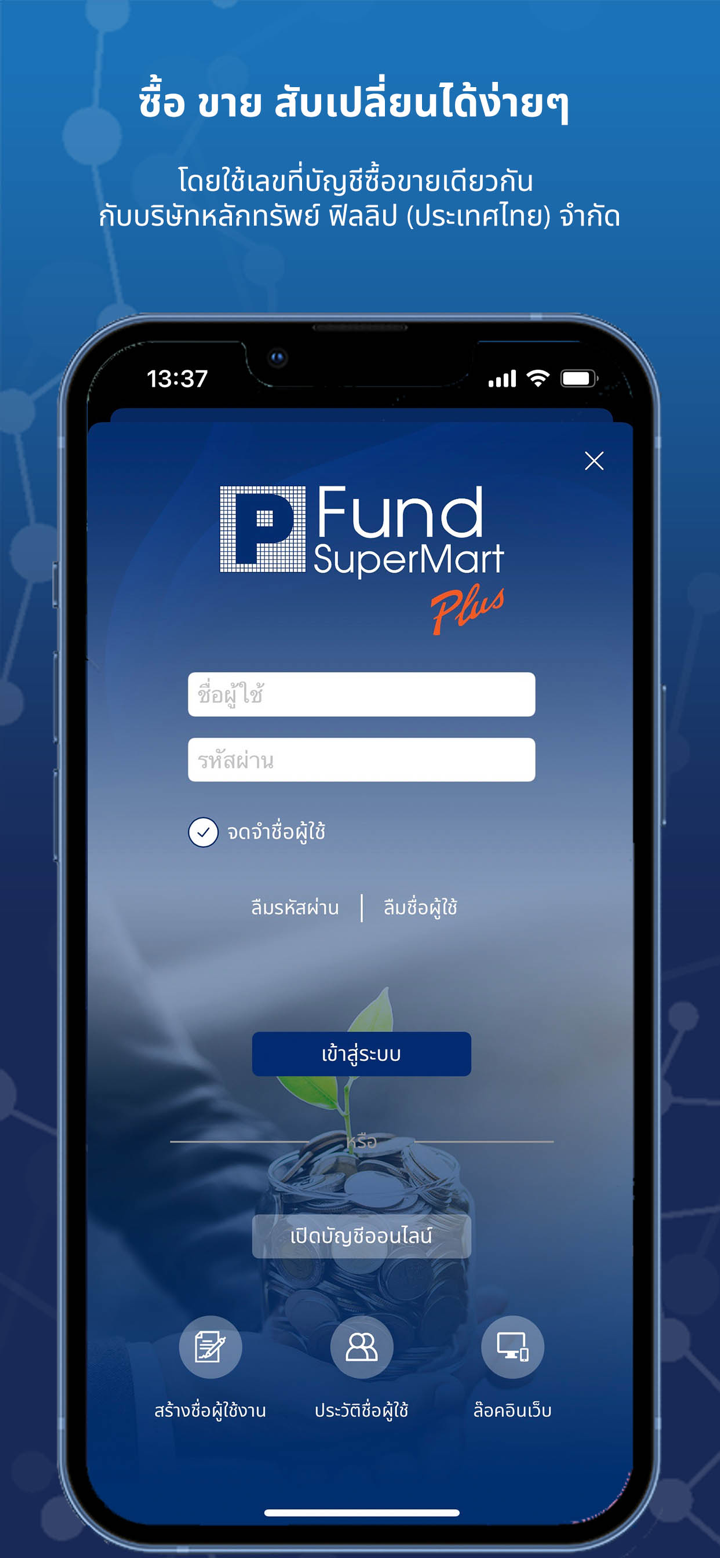

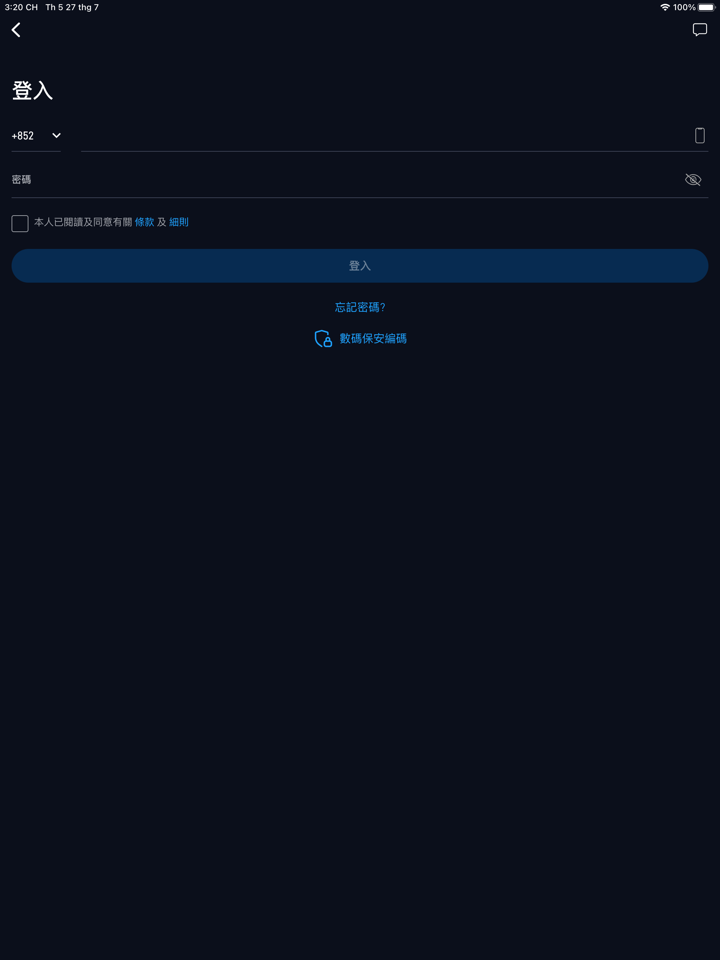

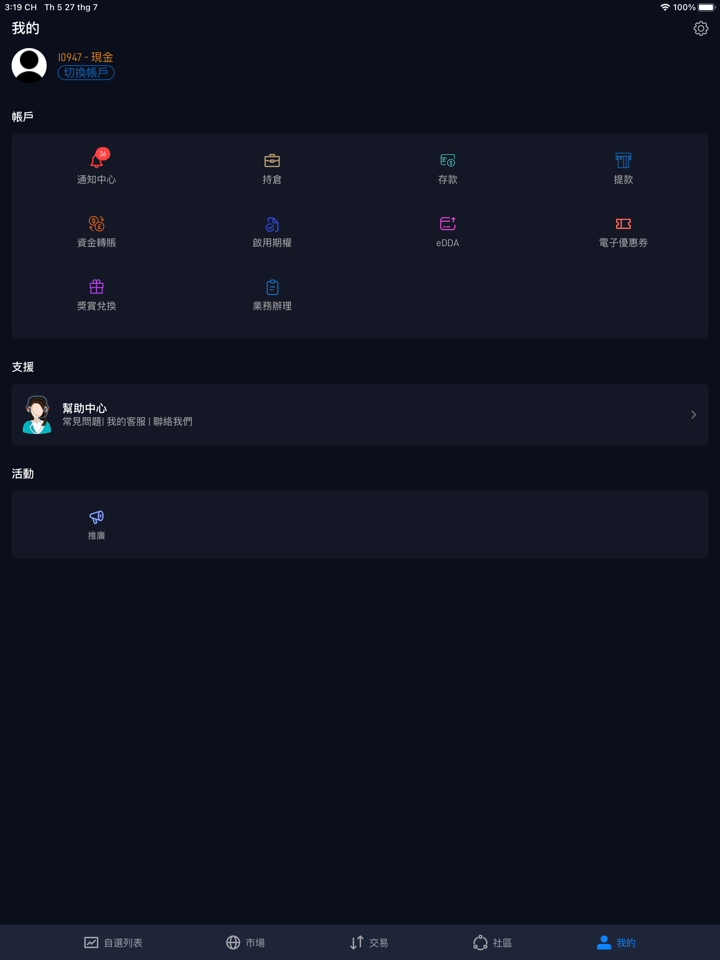

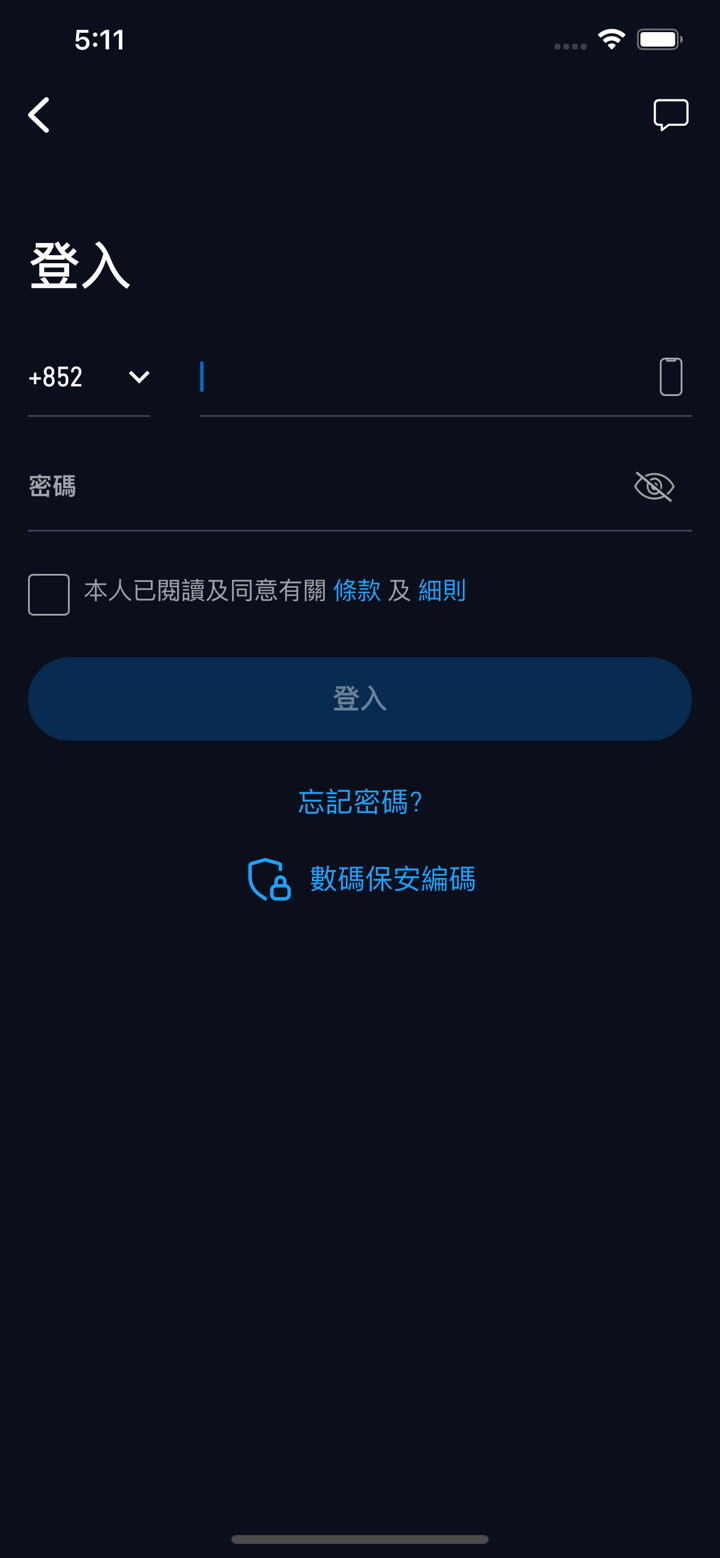

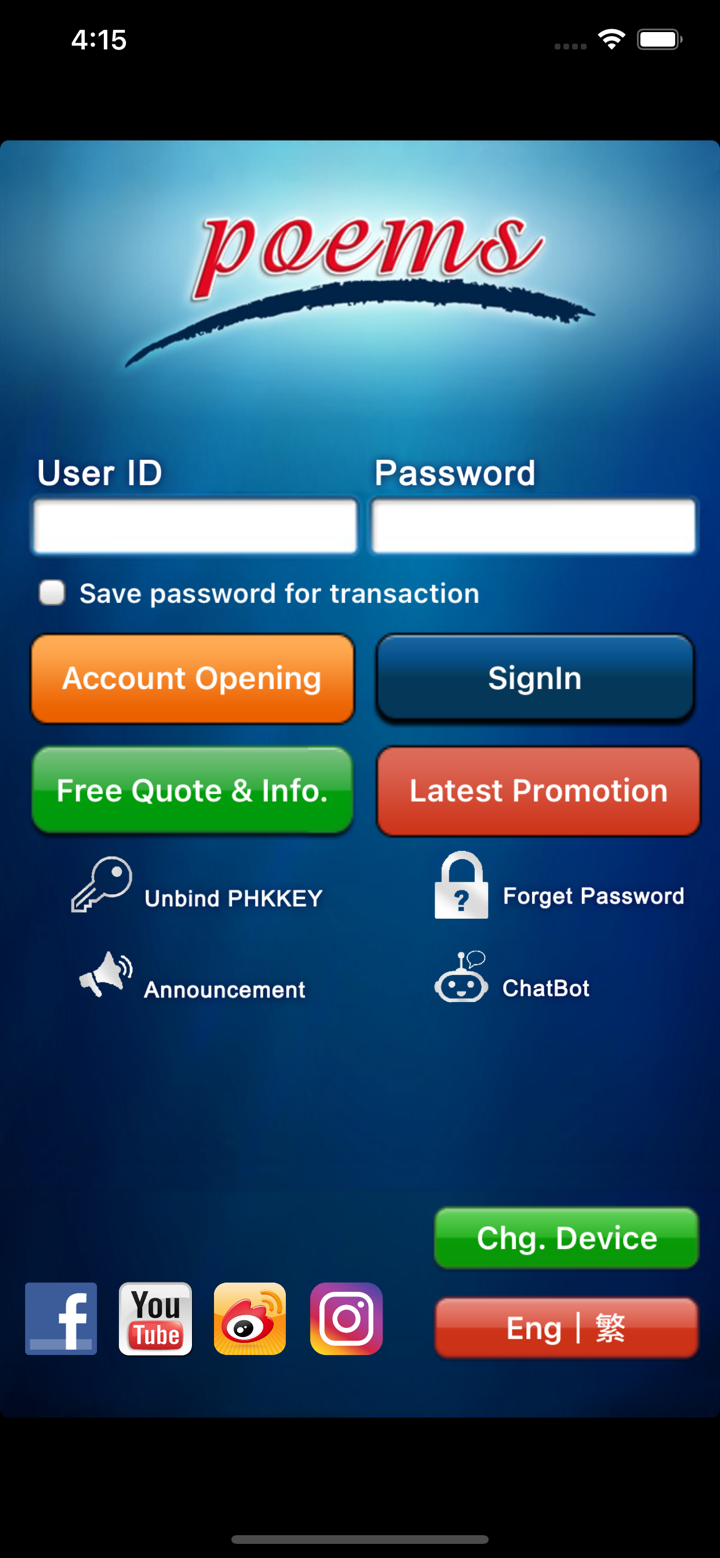

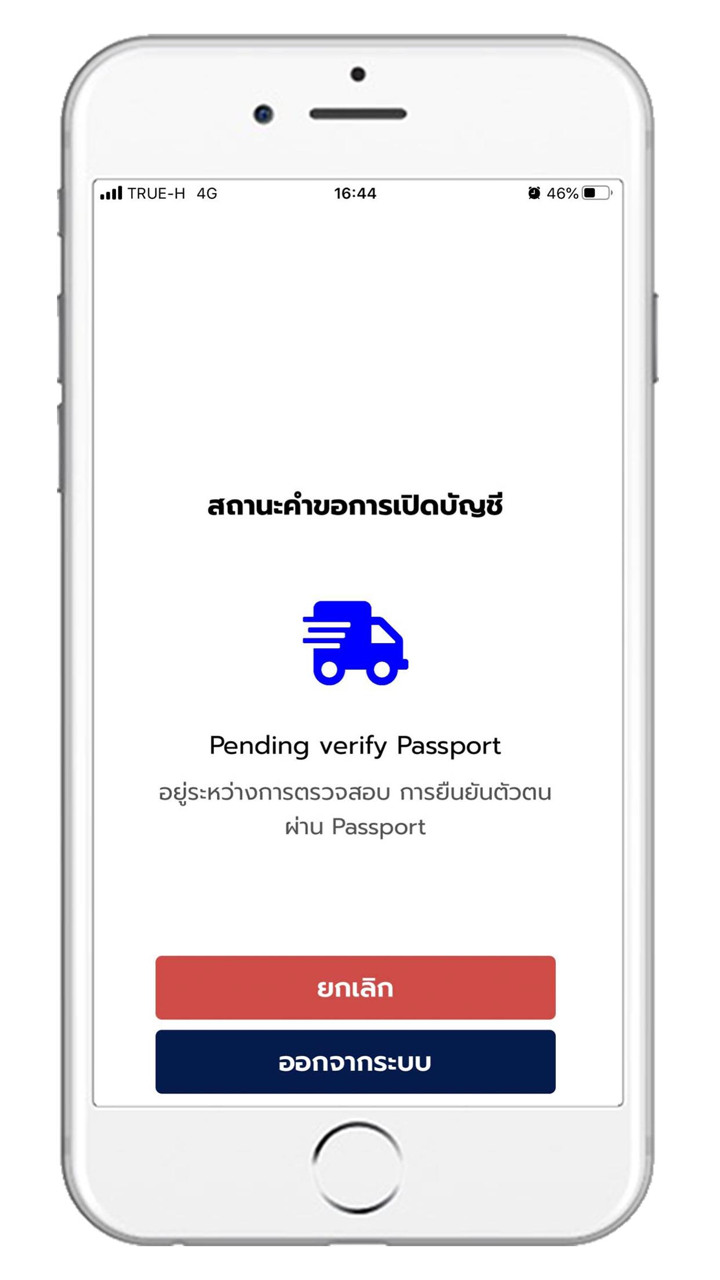

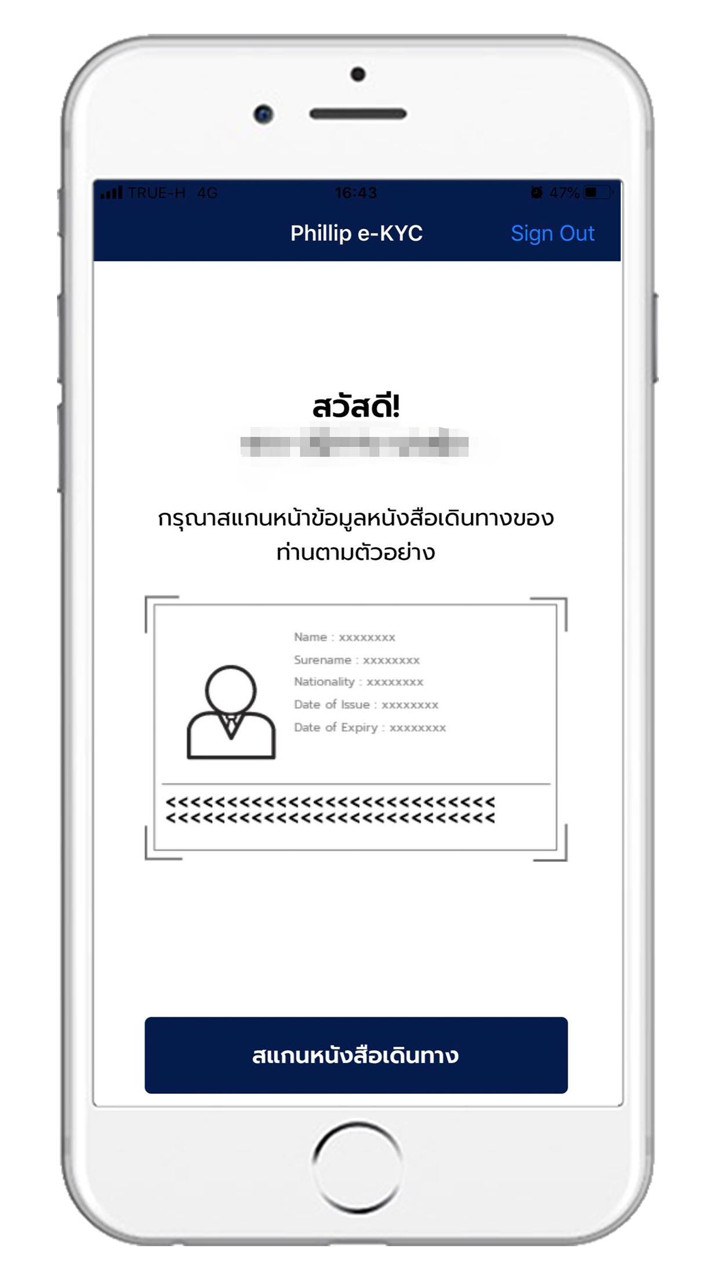

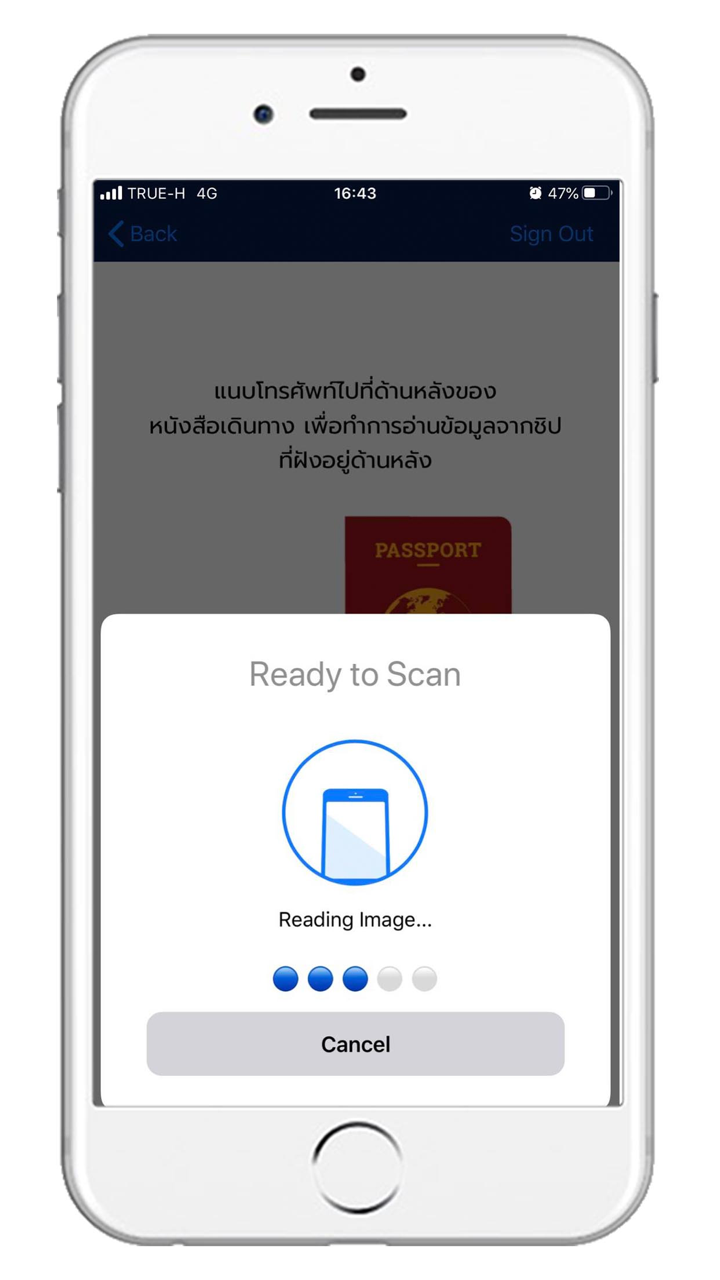

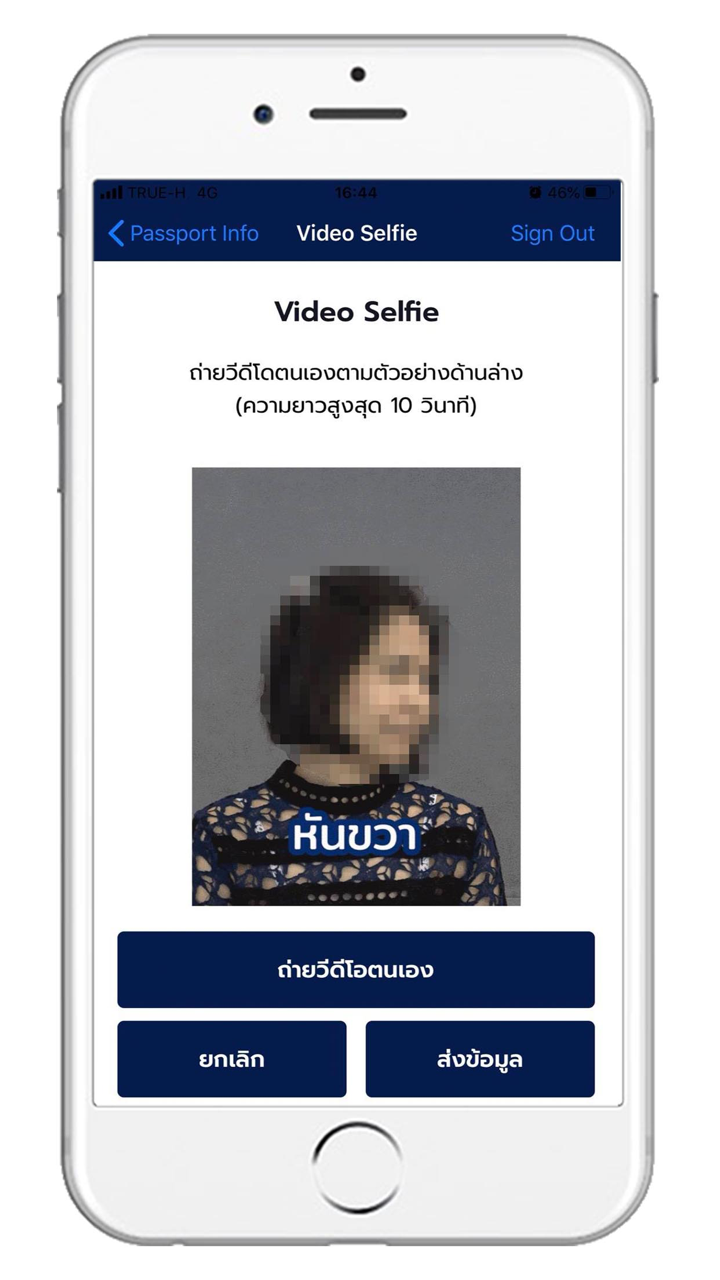

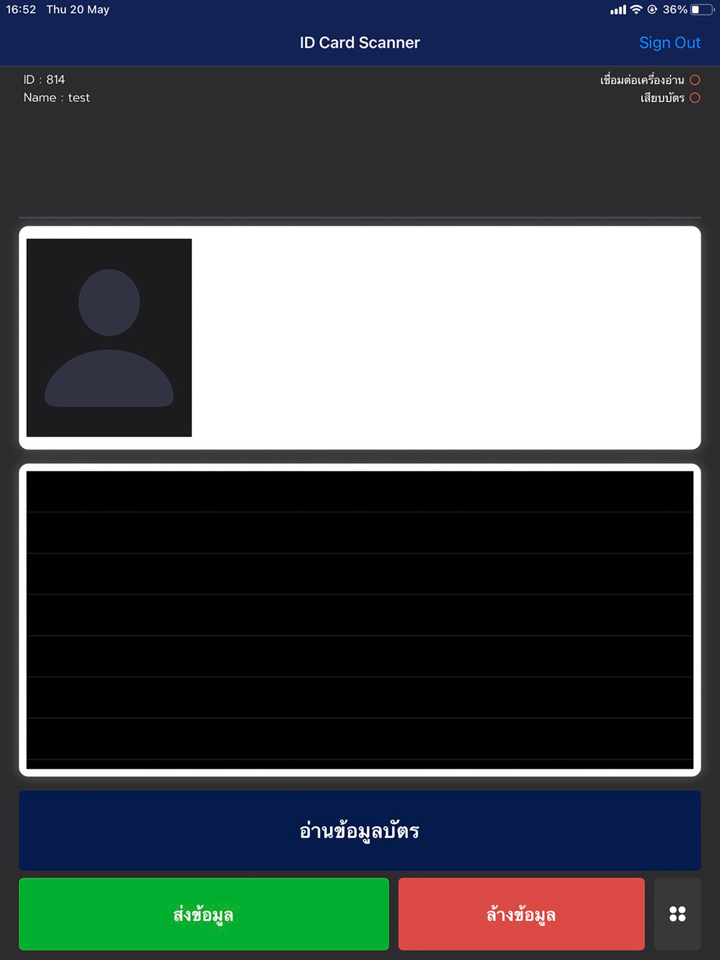

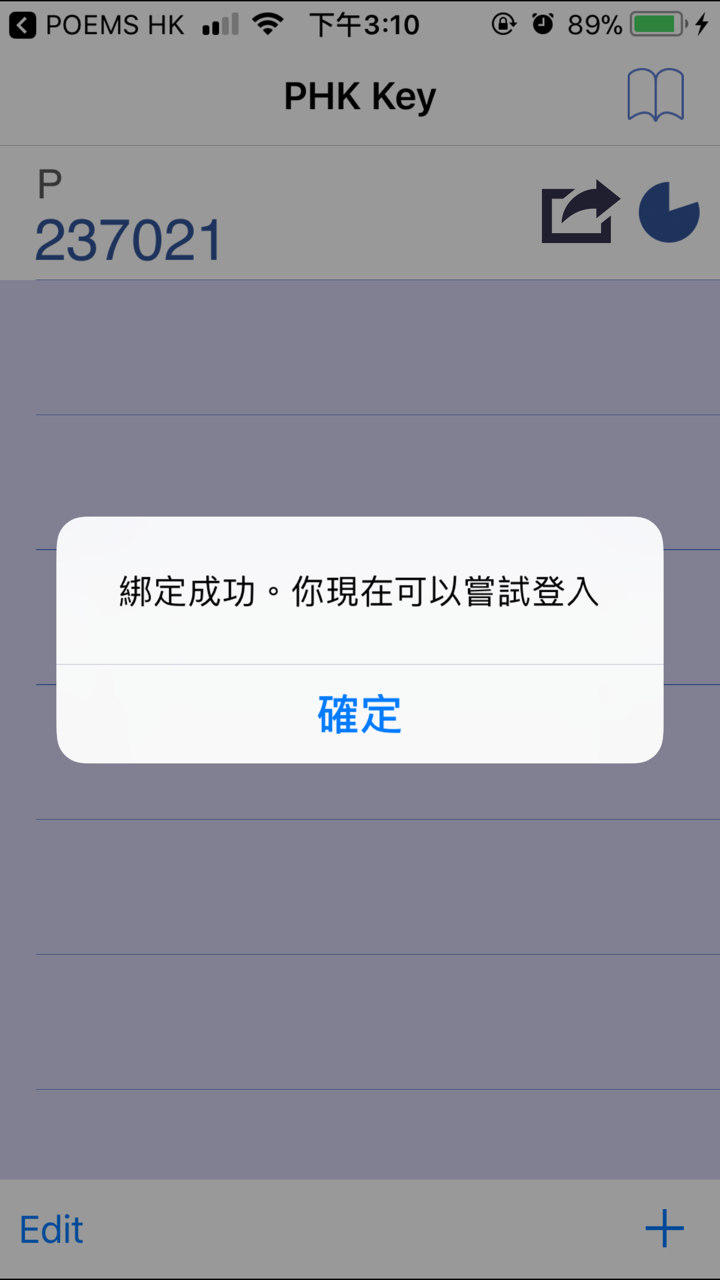

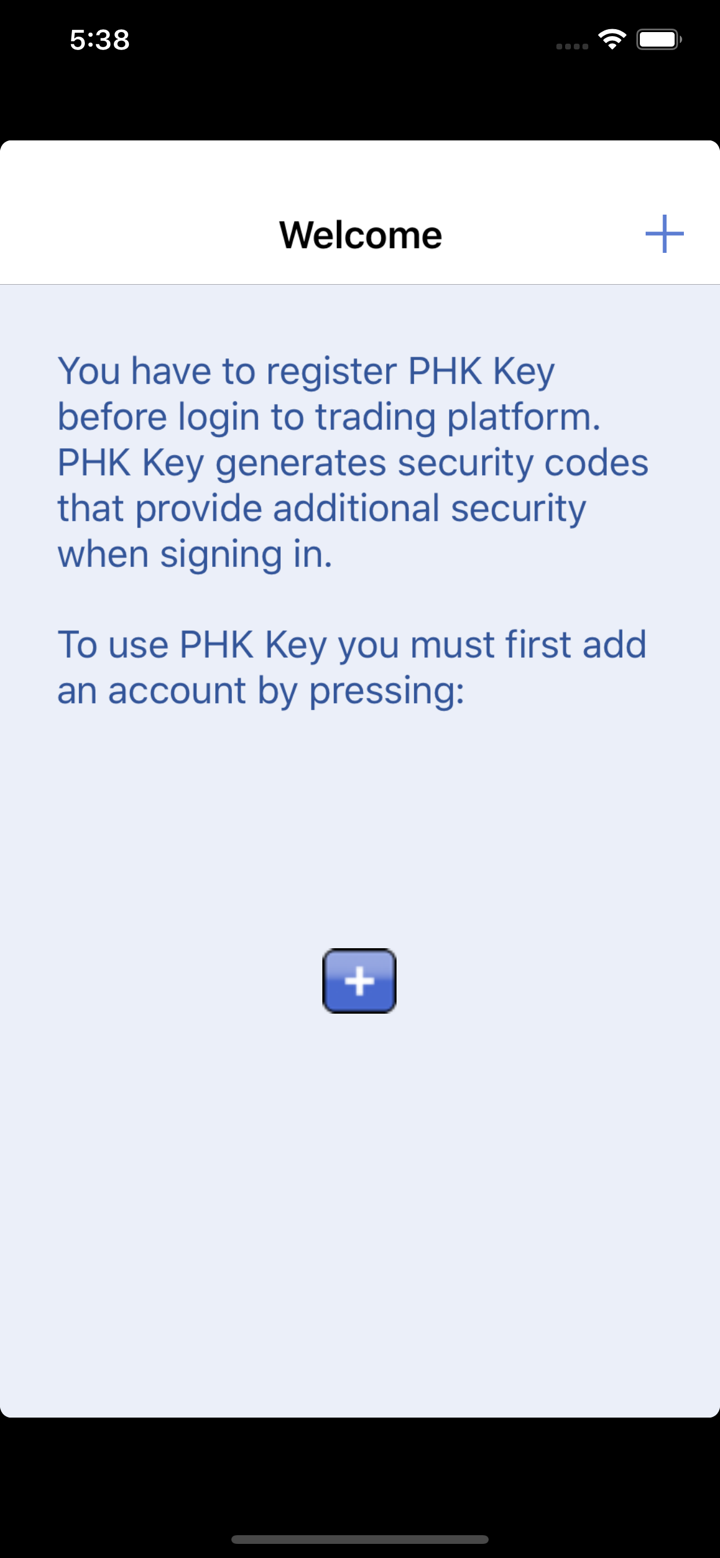

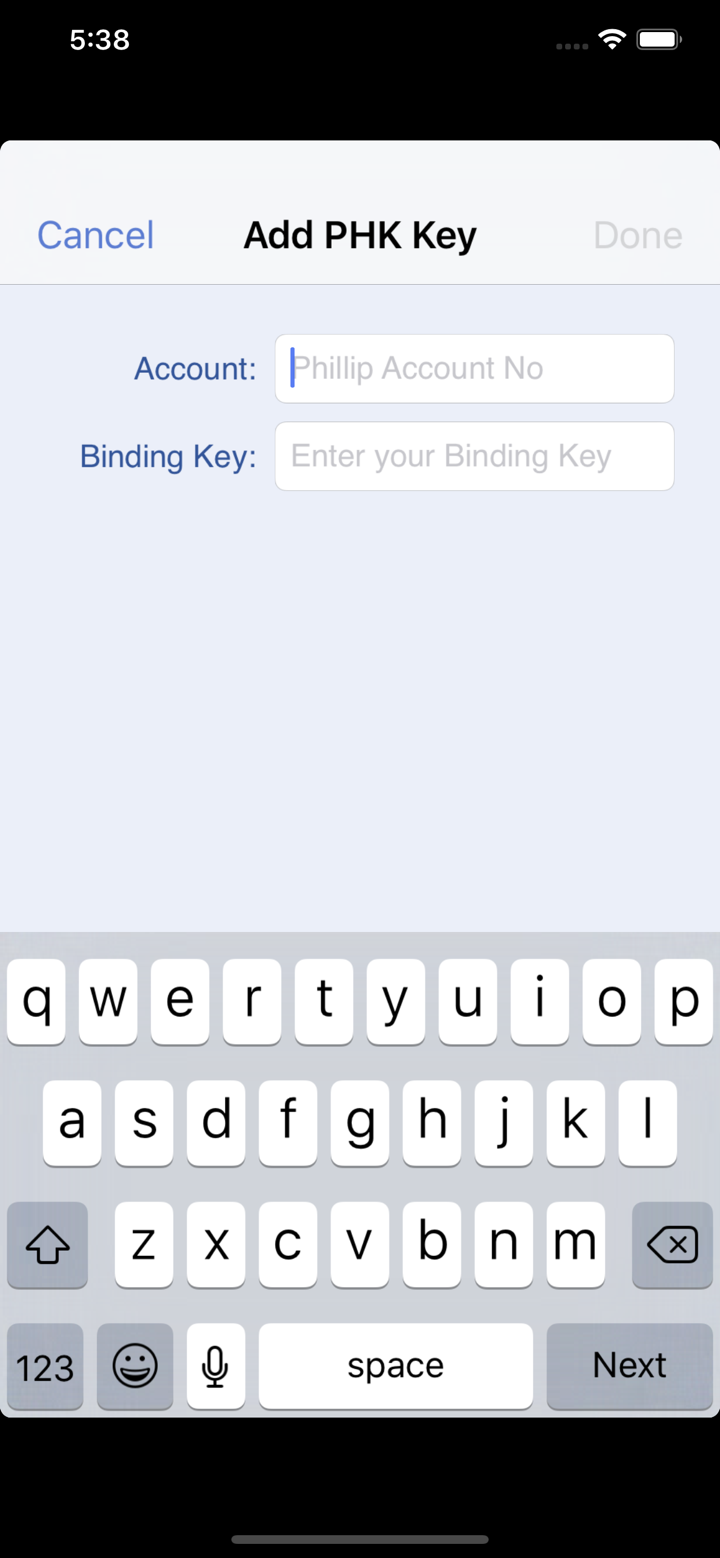

계정

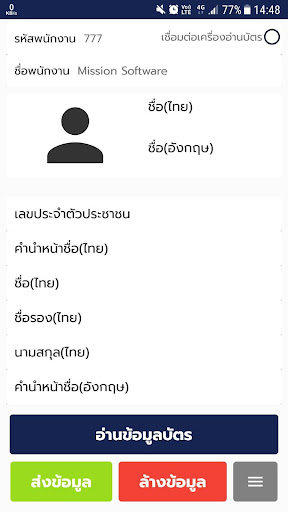

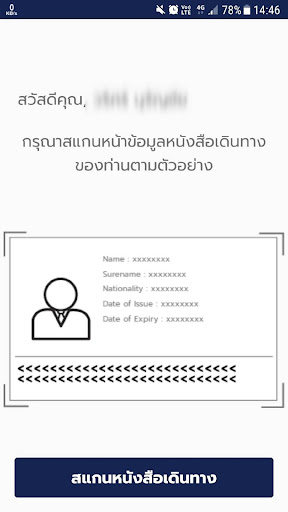

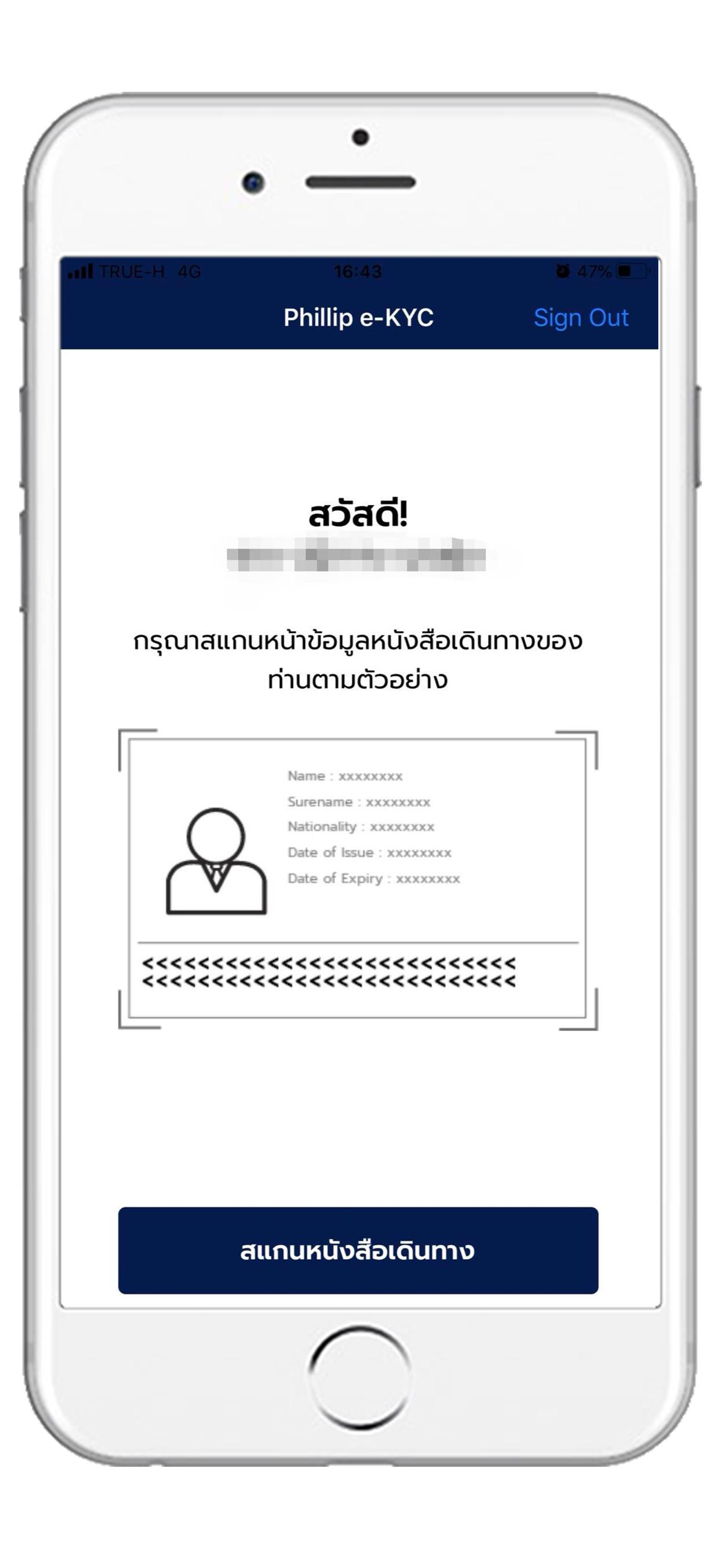

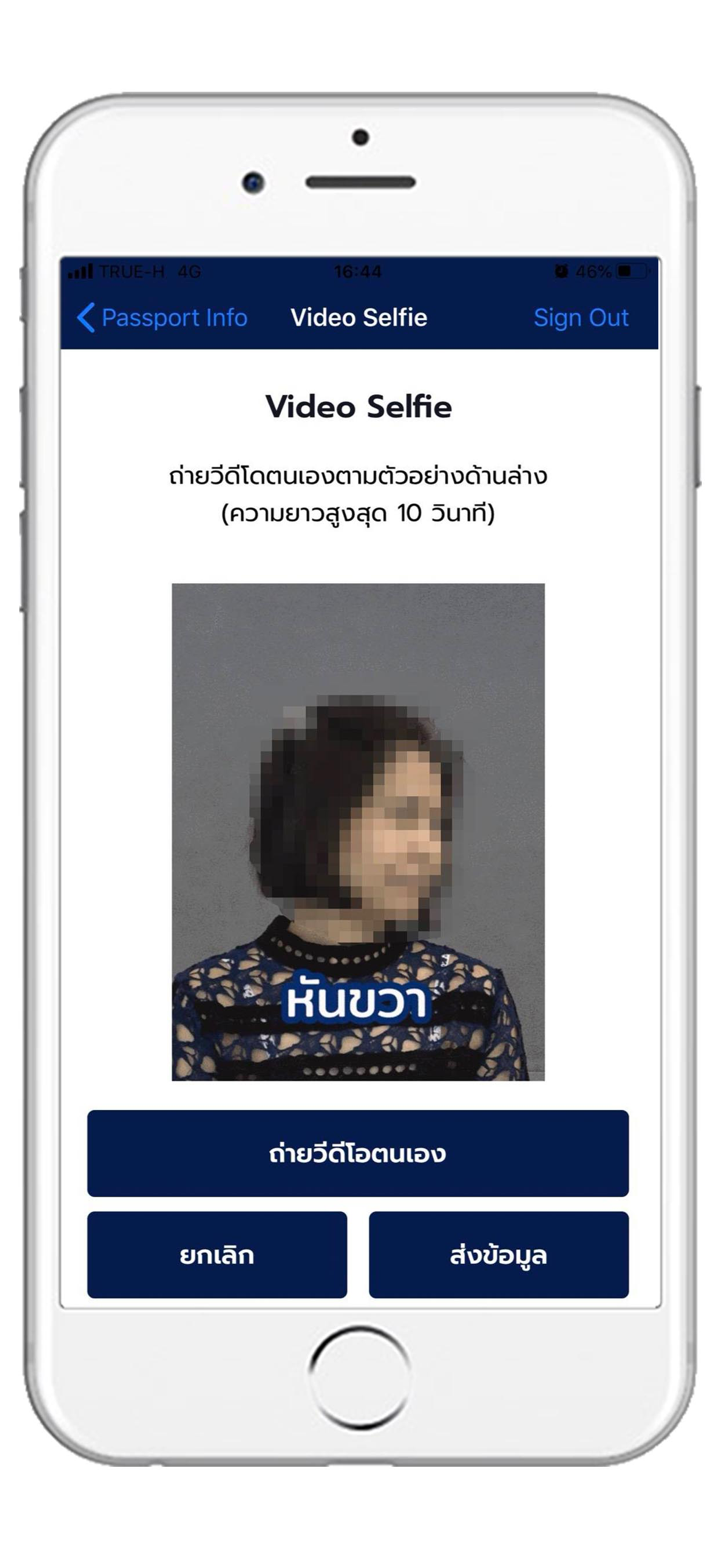

계좌 Phillip Securities를 개설하려면 계좌 신청 양식을 작성하면 됩니다. 그들은 싱가포르, 홍콩, 호주, 미국, 영국 및 케이맨 제도를 포함한 대부분의 관할권에서 계좌 개설 신청을 받는다고 주장합니다.

FX2478212096

일본

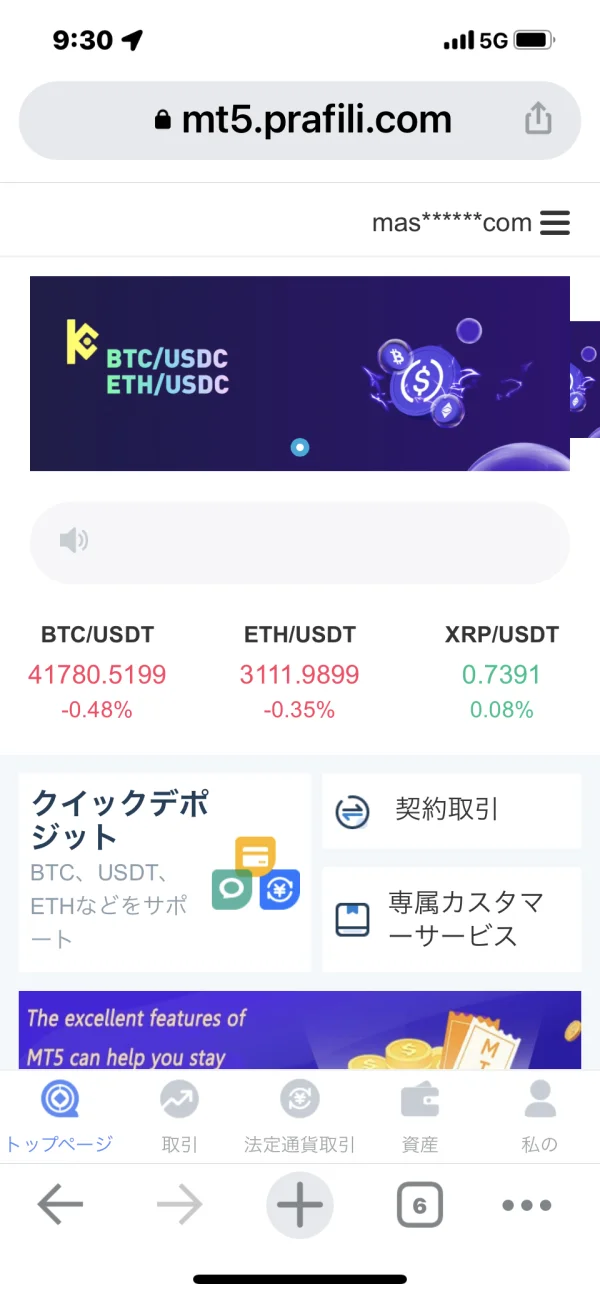

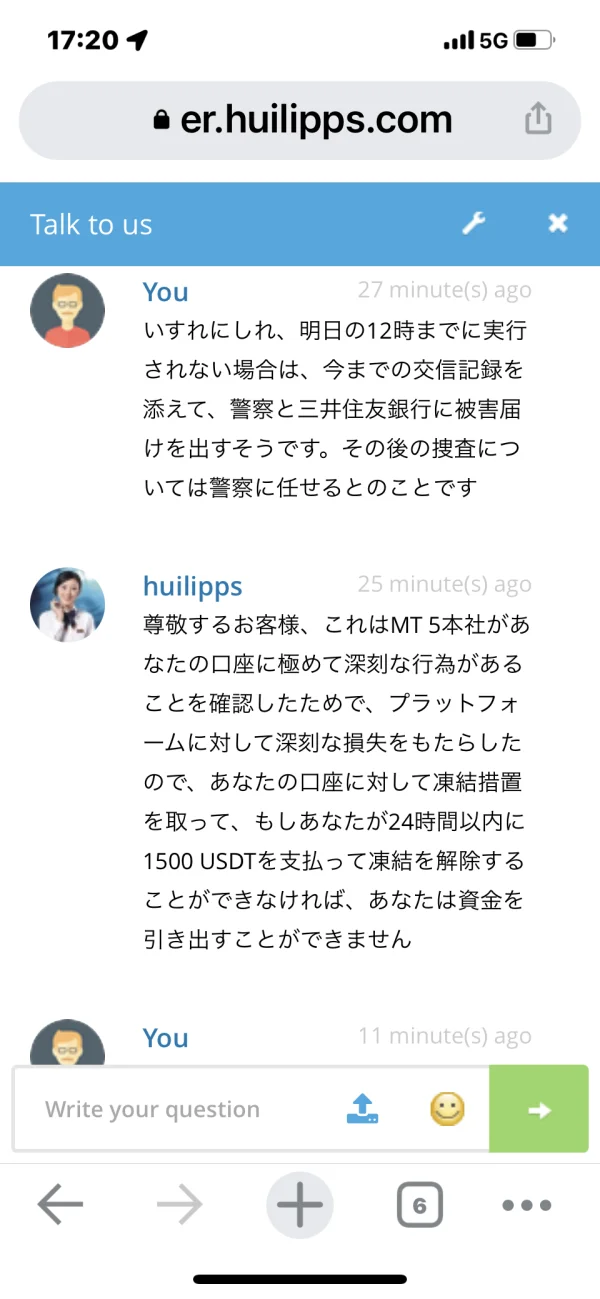

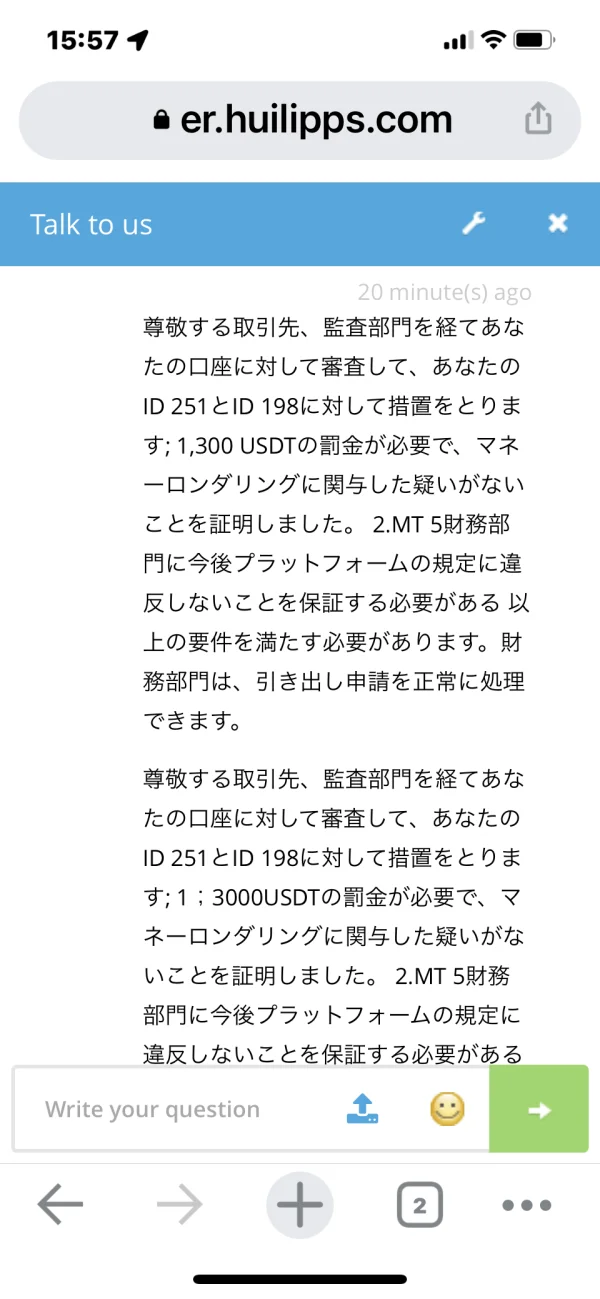

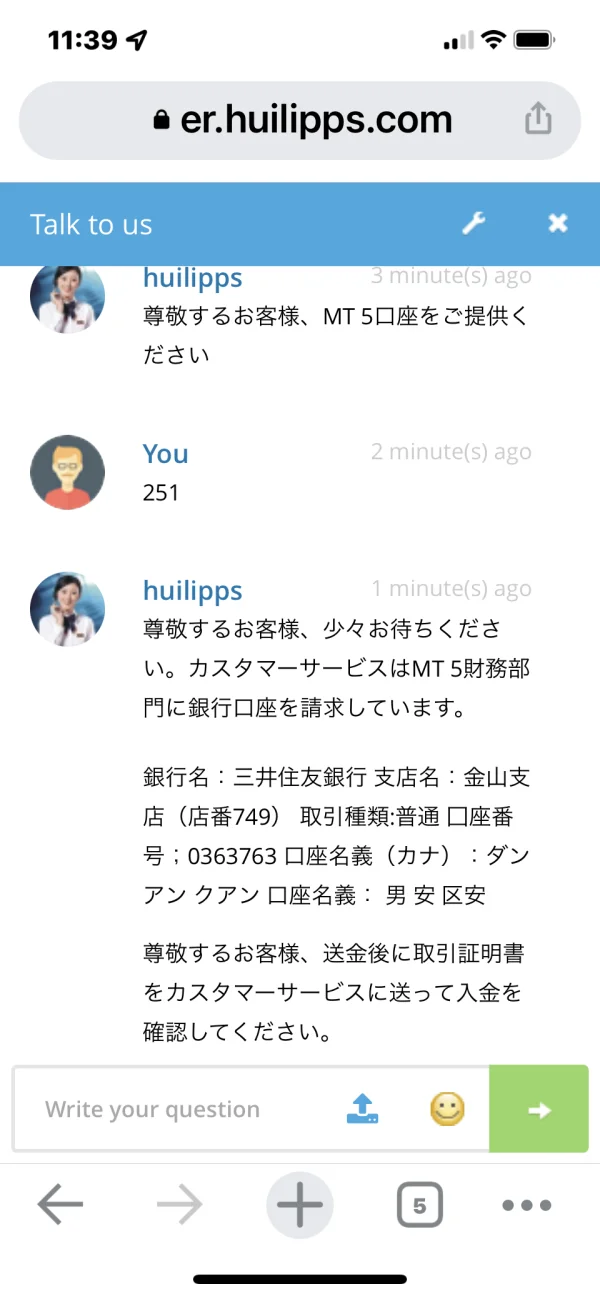

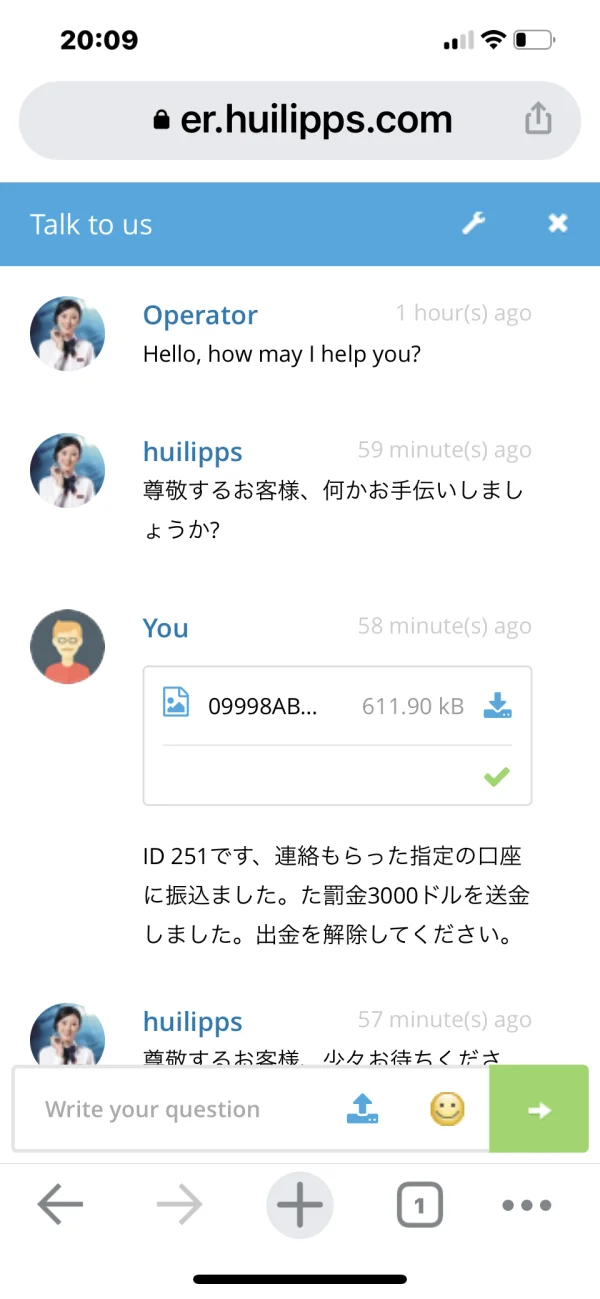

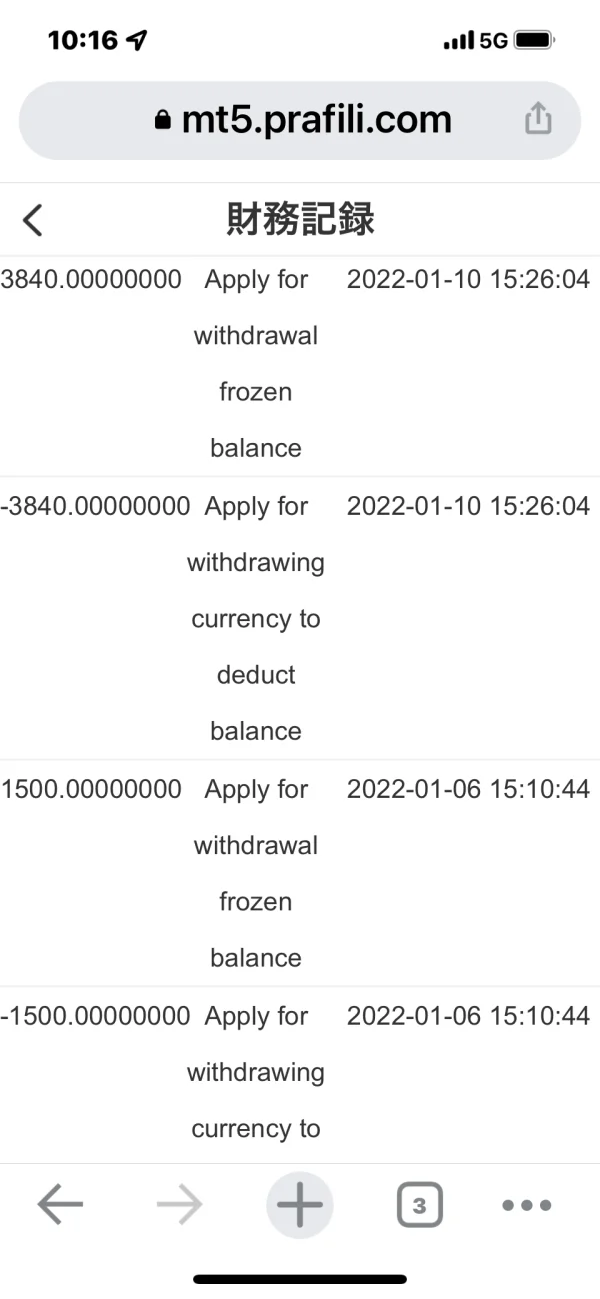

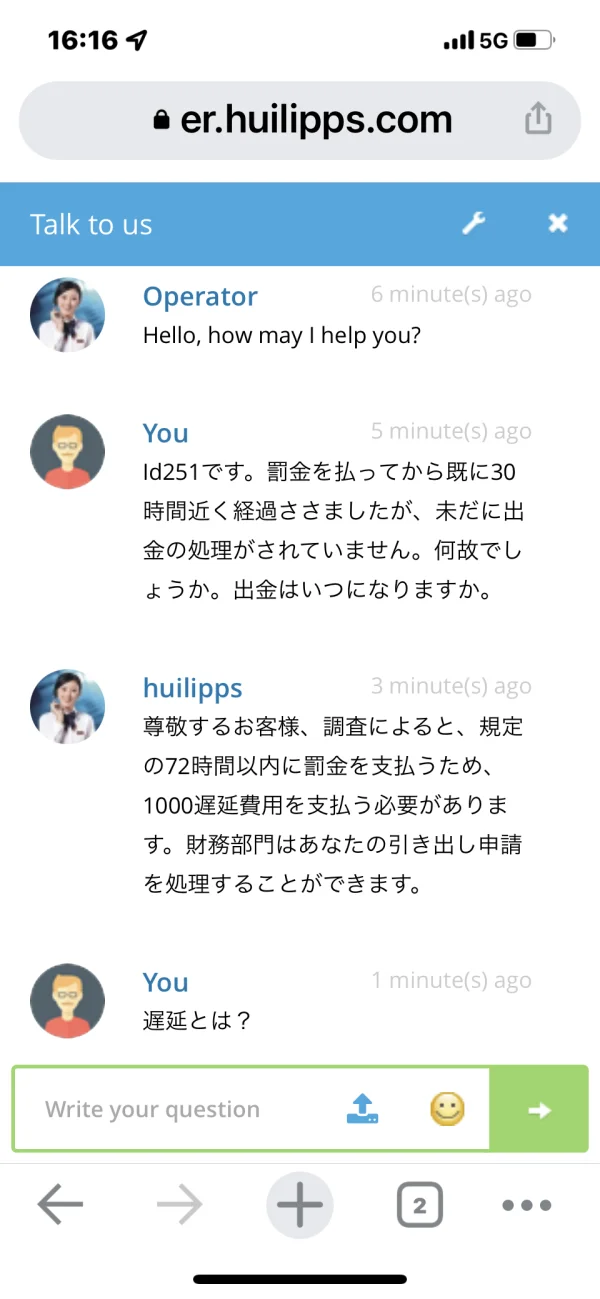

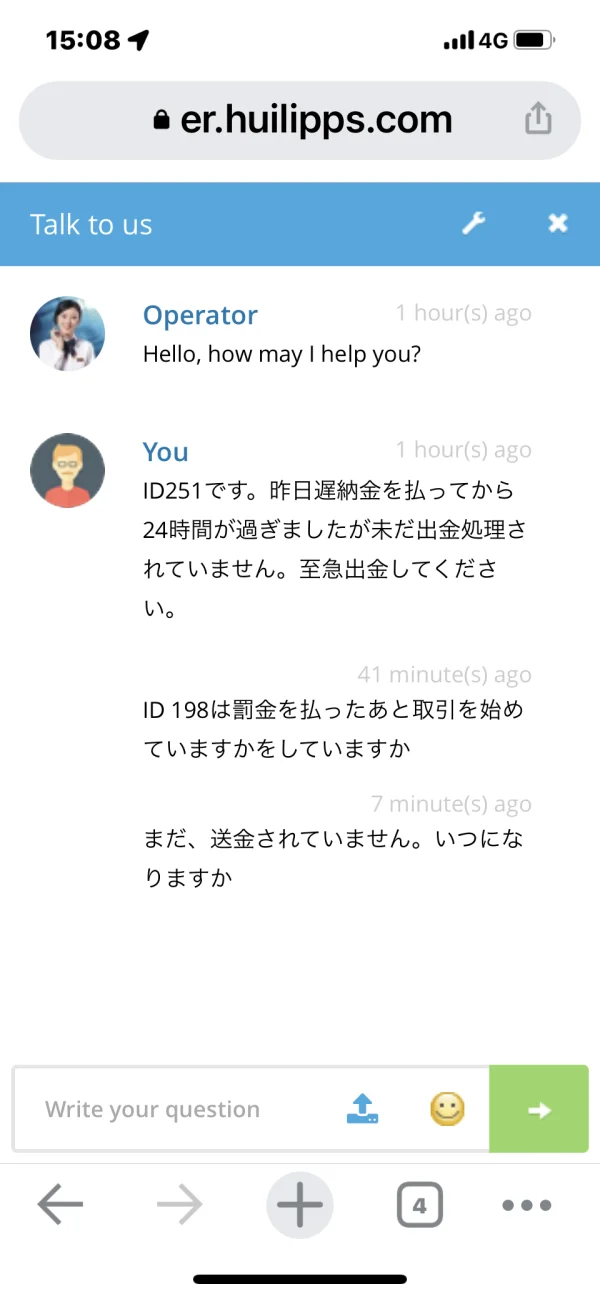

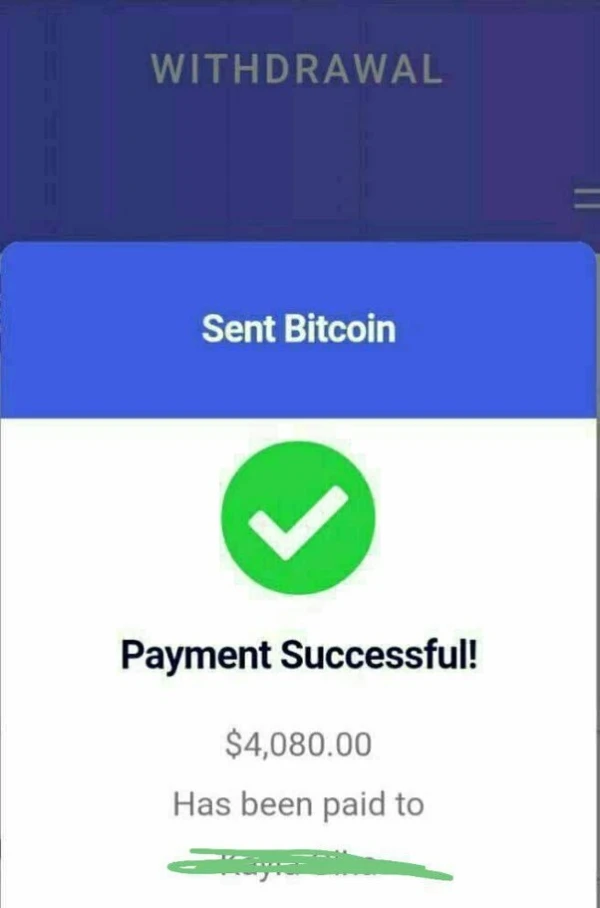

페이스북에서 만난 한 여성이 나를 LINE으로 안내해 금전적 거래를 권유했다. 거래 플랫폼은 mt5.prafili.com입니다. ID251은 개인용으로 발급받았는데 여자(ID198)가 내 통장에 2000달러를 넣고 대신 같은 금액을 넣으라고 했다. 그래서 먼저 30,000엔을 계좌개설하고 70,000엔 다음 100,000엔을 지정된 스미토모은행 개인계좌로 송금하고 거래로 시작해서 5340달러가 되어서 출금신청을 했을때 의심을 받았습니다 돈세탁을 하고 벌금 3000달러를 냈습니다. 그 후 출금신청이 늦어져서 1000달러를 요구했는데 매번 냈습니다. 아직 지급되지 않았고 $1500를 요구받았습니다. 아직 돈을 받지 못했습니다.

신고

79699

일본

나는 기술적 인프라에 감동받았습니다. 그들의 전자 거래 시스템은 신뢰할 수 있으며, 거래를 효과적으로 관리하는 데 도움이되는 고급 기능을 제공합니다.

좋은 평가

Abel Gert

네덜란드

필립 증권 경험 3개월이 지났지만, 정말로 감명받았습니다! 빠른 인출, 낮은 수수료, 그리고 가장 좋은 점은 5성급 고객 서비스입니다.👍👍👍

좋은 평가

FX1383707667

콜롬비아

신뢰할 수 있는 브로커입니다. 무슨 말이 더 필요합니까? 저는 3년 동안 여러 브로커와 거래를 했습니다. 하지만 거래자들의 조건과 혜택으로 판단하면 필립증권은 훌륭합니다. 실제로 돈은 요청한 순간부터 48시간 안에 인출되지만 돈의 안전과 보안을 위해 사기꾼에게 부딪히는 것보다 기다리는 것이 좋습니다.

좋은 평가