Punteggio

charles SCHWAB

Stati Uniti | 5-10 anni |

Stati Uniti | 5-10 anni |https://www.schwab.com/

Sito ufficiale

Indice di valutazione

Influenza

Influenza

AAA

Indice di influenza NO.1

Stati Uniti 9.97

Stati Uniti 9.97 Contatto

Licenza Forex

Licenza Forex

Nessuna licenza di trading sul forex trovata. Si prega di essere consapevoli dei rischi.

- Questo broker non è soggetto a una regolamentazione valida per il mercato forex. Si prega di essere consapevoli del rischio!

Informazioni di base

Stati Uniti

Stati Uniti Gli utenti che hanno visualizzato charles SCHWAB hanno visualizzato anche..

IC Markets Global

EC markets

TMGM

fpmarkets

Fonte di ricerca

linguaggio

Analisi di mercato

Consegna del materiale

Sito web

schwab.com

162.93.215.103schwab.com.hk

162.93.210.100tdameritrade.com

198.200.171.204tdameritrade.com.sg

198.200.171.26tdameritrade.com.hk

198.200.170.20

Relazioni Genealogia

Società collegate

Allen, Peter Blake

Funzionario esecutivo

Data iniziale

Stato

Impiegato

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Allen, Peter Blake

Governatore

Data iniziale

Stato

Impiegato

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Beatty, Jonathan

Funzionario esecutivo

Data iniziale

Stato

Impiegato

CHARLES SCHWAB & CO. INC.(District of Columbia (United States))

Divulgazione normativa

Domande e risposte Wiki

Does Charles Schwab have any cons?

As much as I appreciate the services offered by Charles Schwab, there are a few areas where I believe they could improve, especially when it comes to the Charles Schwab leverage options available. Schwab offers leverage of up to 2:1 for equities in margin accounts, meaning I can borrow up to 50% of the value of the securities I am trading. While this is typical for most brokers, some advanced traders, including myself, would appreciate a bit more flexibility, especially when trading higher-risk assets like options or futures. For someone like me who trades actively, this conservative approach can sometimes limit my ability to execute more aggressive strategies. Furthermore, Schwab is primarily focused on the U.S. market, and as such, investors looking for easy access to international markets may find this platform limiting. While Schwab does offer global accounts, their international trading options are somewhat restricted compared to brokers that are more focused on global diversification. Another drawback I encountered is that while Schwab offers great customer service, their thinkorswim® platform, which is geared toward advanced traders, can be quite complex for beginners. I recall feeling slightly overwhelmed by the sheer number of tools and features, which I didn’t initially know how to use effectively. For novice traders, this can be a bit intimidating and could potentially delay the learning curve. However, once I became familiar with it, thinkorswim® provided some of the most powerful trading tools I’ve ever used. In conclusion, while these cons are notable, I still find Schwab to be a great platform due to its overall reliability, excellent educational resources, and transparent fee structure.

Is Charles Schwab regulated? Is it safe and legit?

In my experience, Charles Schwab is a reliable and secure brokerage, despite its regulatory status with the SFC being revoked. Schwab operates under U.S. financial regulations, and it is a member of SIPC (Securities Investor Protection Corporation), which offers protection for customers' securities, up to $500,000, including $250,000 in cash. This SIPC protection gives me confidence that my assets are secure, and it provides peace of mind in case of unforeseen circumstances. Additionally, Schwab Bank is FDIC-insured, which means that any funds in my Schwab Bank accounts are covered up to $250,000 per depositor, further adding to the safety of my funds. Although the revocation of SFC regulation might seem concerning for non-U.S. investors, the extensive regulatory framework that Schwab adheres to within the United States ensures that I am well-protected as an investor. When I first registered and logged into my Charles Schwab account, I found that Schwab makes security a top priority, which reassured me. While the revoked status from SFC might limit Schwab's activities in some regions, its extensive regulatory background and customer protection mechanisms make it a trustworthy platform for me. Therefore, despite this revocation, I still feel comfortable with Schwab’s overall security and regulatory compliance.

Which payment methods does Charles Schwab support for deposits?

One of the reasons I continue using Charles Schwab is the variety of methods available for depositing funds. Schwab supports electronic funds transfers (EFT), which allow me to quickly transfer money from my bank account to Schwab. I also appreciate that Schwab accepts wire transfers and checks for deposits, giving me flexibility depending on my situation. I’ve personally used EFT for deposits, and it’s always been a smooth and fast process. Additionally, Schwab allows direct deposit, which is a great feature if I want to automate my contributions. Having the ability to easily deposit funds into my Schwab account ensures that I can invest whenever I want without worrying about the logistics of funding my account. Schwab’s deposit methods are reliable and easy to use, which is why I’ve never encountered any issues when adding funds to my account.

Can I know the details about Charles Schwab's fees?

One of the things I value about Charles Schwab is their transparency regarding fees. As a regular user of their services, I was relieved to discover that they offer commission-free trading for most online stocks, ETFs, and options. This was particularly appealing to me as an active trader, because avoiding commissions means I can keep more of my investment returns. However, I did notice that for options trades, Schwab charges a $0.65 fee per contract, which is fairly typical across the industry. I also encountered some mutual fund transaction fees, particularly for those outside Schwab's OneSource® program, which can go up to $74.95 per trade. Despite these exceptions, I find Schwab’s overall fee structure to be highly competitive. Additionally, Schwab does not charge account maintenance or inactivity fees, and the Charles Schwab minimum deposit requirement for most accounts is $0, which makes it very accessible. I also appreciate that Schwab provides detailed information on all fees upfront, so there are no surprises. I was able to easily find all the pricing details on their website, which helped me make an informed decision. The absence of hidden fees and the simplicity of their pricing structure makes Schwab an appealing option for me. Overall, I feel that Schwab’s fees are reasonable for the value it provides, and I haven’t encountered any unexpected charges.

Recensioni utenti6

Cosa vuoi valutare

inserisci...

Commento 6

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora

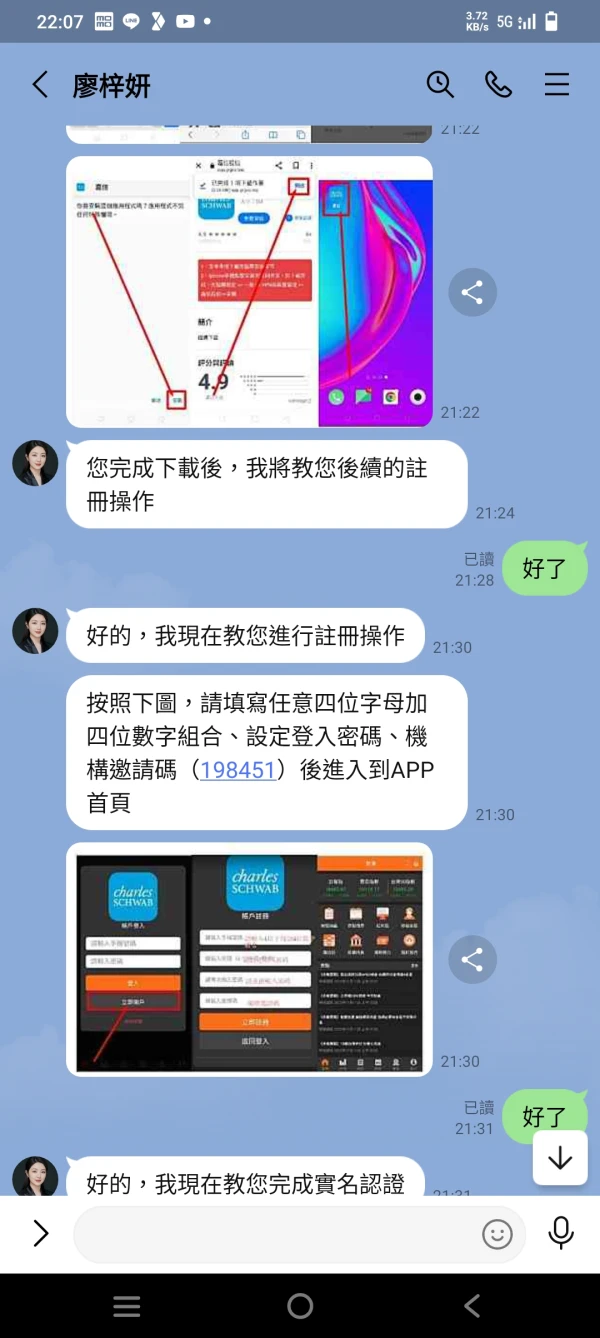

王爺爺

Taiwan

Questo fondo di investimento in titoli utilizza esattamente lo stesso metodo di HSBC. Prima ti darà 20.000 yuan tramite lotteria e poi ti dirà di investire 100.000 yuan. Gli investitori stranieri stanno aumentando i loro investimenti di 150.000 in 3 giorni. Anche con il tuo preside ne hai 270.000, che possono tenere il passo con l'operazione. I guadagni di questi 3 giorni sono tuoi. Dopo 3 giorni, investirai completamente 170.000, lasciando solo il capitale e 3 giorni di profitti operativi. All'inizio ti sarà consentito prelevare una piccola somma, poi gradualmente non saranno consentiti prelievi. Alla fine, si accordano con te e ti chiedono di rimettere prima la metà del profitto, quindi ti rimetteranno il capitale e il profitto. Quanto sopra è questo nuovo metodo di truffa. Spero che nessuno venga ingannato come me.

Esposizione

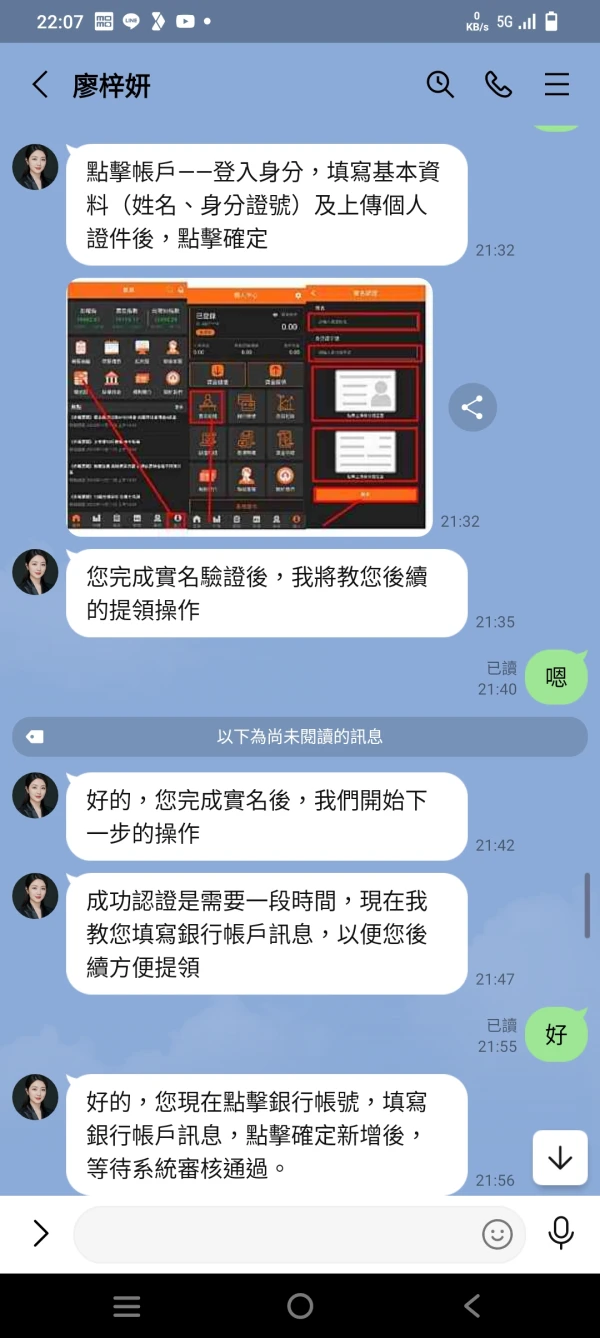

kang Rona

Indonesia

Qualcuno può aiutarmi riguardo al prelievo di fondi? Ho paura che ci sia una frode... e che siano stati investiti molti soldi... da CE. Devo pagare un'imposta del 15% sul valore di prelievo...

Esposizione

Gerhard Van Wyk

Sud Africa

mi sono iscritto il 4 maggio ogni volta che chiedono una commissione e ogni volta che mentono sul pagamento. Sono molto abili con le parole.

Esposizione

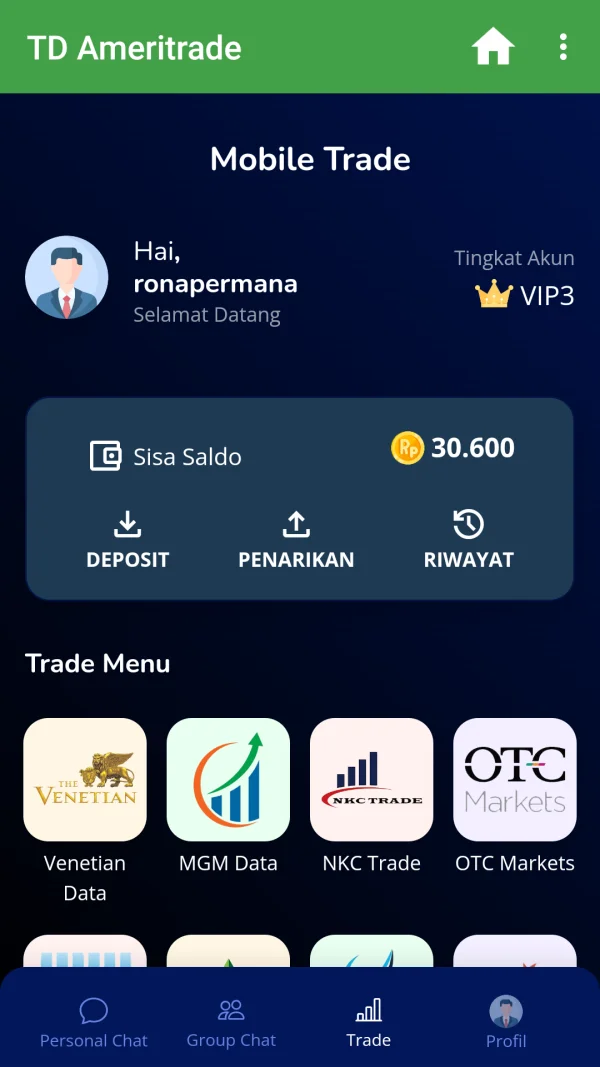

Đỗ Văn Ngọc

Australia

Il sito Web di TD Ameritrade sembra molto professionale, ma ho cercato in tutto il sito Web e non ho trovato informazioni sulle licenze regolamentari. Se un'azienda è strettamente regolamentata, dovrebbe dirlo ad alta voce per ottenere la fiducia dei clienti, giusto?

Positivo

♔

Hong Kong

Costa $25.000 aprire un conto con TD Ameritrade... Ad essere onesti, la soglia è un po' alta per me! Quindi non prendo in considerazione l'idea di fare trading con esso per il momento. Si dà il caso che io possa aspettare e vedere di nuovo per vedere come sta andando questa azienda.

Neutro

墨香

Argentina

In effetti, mi piace l'esperienza di trading con TD A. Faccio trading sul forex da quasi due anni, ma non in modo continuo o intenso, perché non posso dire di avere molta esperienza, ma le condizioni e i servizi di TDA sono stati soddisfacente per me. Non capisco perché qui wikifx dice che non è regolamentato, perché posso ancora prelevare normalmente.

Positivo