Profil perusahaan

| Mitoyo Ringkasan Ulasan | |

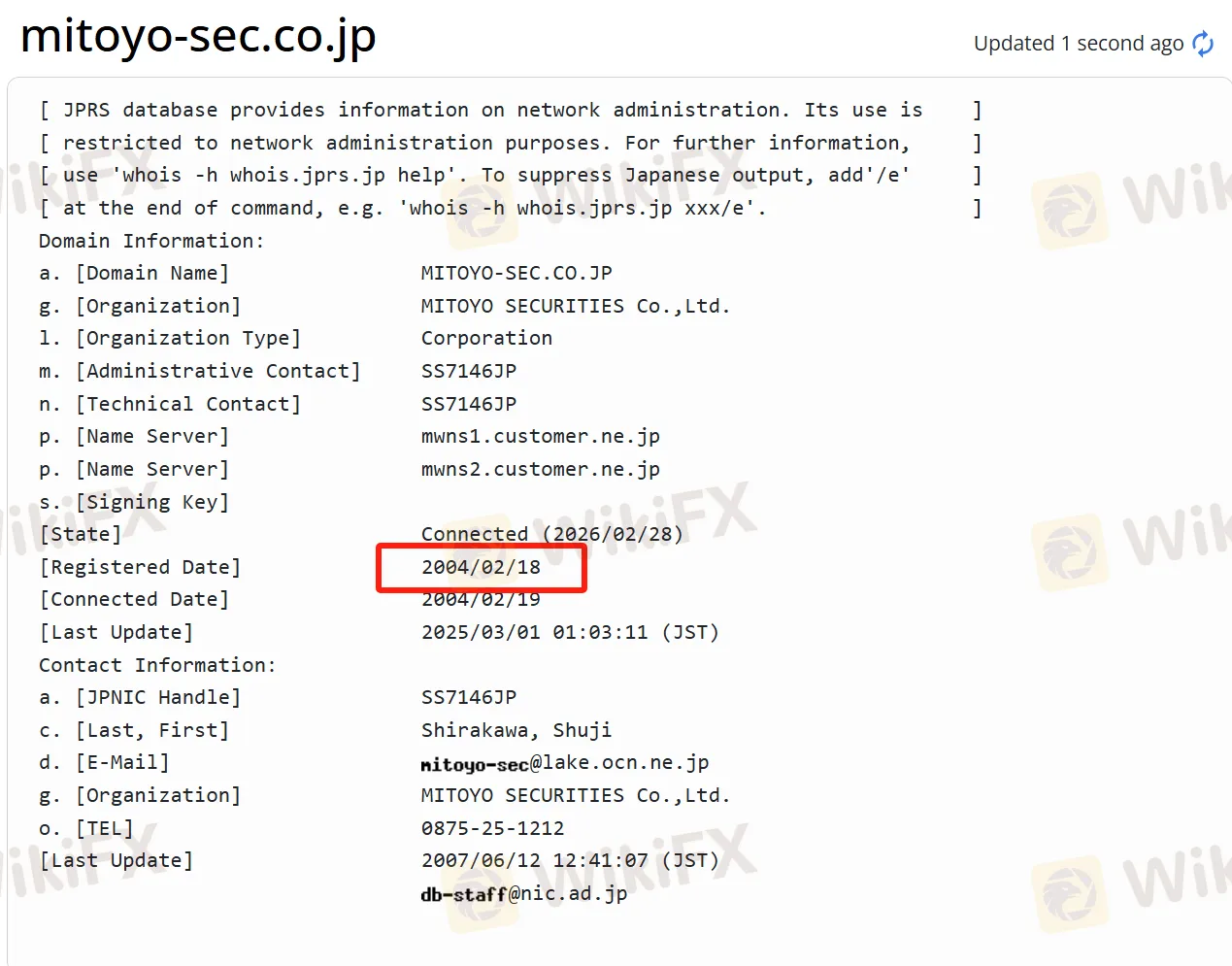

| Dibentuk | 2004 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA (Teregulasi) |

| Instrumen Pasar | Investasi trust, Obligasi, dan Saham |

| Platform Perdagangan | / |

| Dukungan Pelanggan | Tel: 0875-25-1212 |

| Fax: 0875-25-1221 | |

Informasi Mitoyo

Mitoyo Sekuritas adalah perusahaan sekuritas Jepang dengan sejarah panjang. Sejak didirikan, perusahaan ini telah sangat terakar di daerah lokal dan melakukan bisnisnya dengan wilayah Mitoyo sebagai bentengnya. Perusahaan ini menawarkan beragam produk keuangan, mencakup saham yang terdaftar di beberapa bursa domestik, berbagai investasi trust, dan berbagai jenis obligasi. Pada saat yang sama, perusahaan ini menyediakan solusi keuangan yang dipersonalisasi dan berbagai alat perdagangan, yang dapat memenuhi kebutuhan investor yang berbeda. Perusahaan ini memiliki sistem kesejahteraan dan manfaat yang baik, sangat memperhatikan pengembangan lokal, dan aktif berpartisipasi dalam revitalisasi lokal.

Pro dan Kontra

| Pro | Kontra |

| Teregulasi | Bisnis internasional terbatas |

| Berbagai instrumen perdagangan | |

| Sistem kesejahteraan dan manfaat yang baik | |

| Penekanan pada pengembangan lokal | |

| Waktu operasi yang panjang |

Apakah Mitoyo Legal?

Mitoyo adalah perusahaan sekuritas yang sah dan patuh. Otoritas Jasa Keuangan (FSA) mengatur Mitoyo Sekuritas, dan nomor lisensinya adalah Kepala Keuangan Shikoku (Pedagang Keuangan) No. 7.

Survei Lapangan WikiFX

Tim survei lapangan WikiFX mengunjungi alamat Mitoyo di Jepang, dan kami memastikan bahwa perusahaan ini memiliki kantor fisik di lokasi tersebut.

Apa yang Bisa Saya Perdagangkan di Mitoyo?

Mitoyo menyediakan saham domestik yang terdaftar di beberapa bursa, termasuk Bursa Saham Tokyo, Bursa Saham Nagoya, Bursa Saham Sapporo, dan Bursa Saham Fukuoka.

Investasi trust memiliki berbagai jenis, termasuk investasi trust ekuitas, investasi trust tipe obligasi publik (MRF, investasi trust obligasi publik), ETF, J-REIT, dll. Investor dapat mencapai investasi yang terdiversifikasi melalui investasi trust.

Investor juga dapat memilih dari berbagai produk obligasi, seperti obligasi pemerintah yang berorientasi pada individu (termasuk tiga jenis: variabel selama 10 tahun, tetap selama 5 tahun, dan tetap selama 3 tahun), obligasi pemerintah penjualan jendela baru, CB (obligasi korporasi tipe obligasi konversi domestik dengan hak langganan saham baru), obligasi denominasi mata uang asing, dll.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Trust Investasi | ✔ |

| Obligasi | ✔ |

| Saham | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |