Profil perusahaan

| FX Broadnet Ringkasan Ulasan | |

| Dibentuk | 1993 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | Tidak Diatur |

| Layanan | Over-the-Counter FX/Click 365/Alat Perdagangan |

| Akun Demo | ✅ |

| Spread | Pada 0,2 sen (spread dolar-yen) |

| Alat Perdagangan | FX BroadNe (Browser/Android/iPhone/Tablet/Mobile) |

| Dukungan Pelanggan | Hotline: 0120-997-867 |

| Email: support@fxbroadnet.com | |

| Media Sosial: Facebook, Twitter | |

Informasi FX Broadnet

FX Broadnet didirikan pada tahun 1993 sebagai perusahaan informasi yang telah menyediakan layanan terkait pasar valuta asing selama lebih dari dua puluh tahun. Perusahaan ini menawarkan " FX Broadnet," layanan online dengan perdagangan spread rendah untuk perdagangan margin valuta asing (FX) over-the-counter berdasarkan teknologi IT terkini, dan menangani "Click 365," layanan perdagangan margin valuta asing yang diperdagangkan di Bursa Keuangan Tokyo. Jelaskan dengan video yang sederhana dan mudah dipahami di YouTube: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

Apakah FX Broadnet Legal?

FX Broadnet diotorisasi dan diatur oleh Otoritas Jasa Keuangan (FSA). Nomor lisensinya adalah 関東財務局長(金商)第244号, yang membuatnya lebih aman daripada broker yang diatur.

Layanan Apa yang Ditawarkan oleh FX Broadnet?

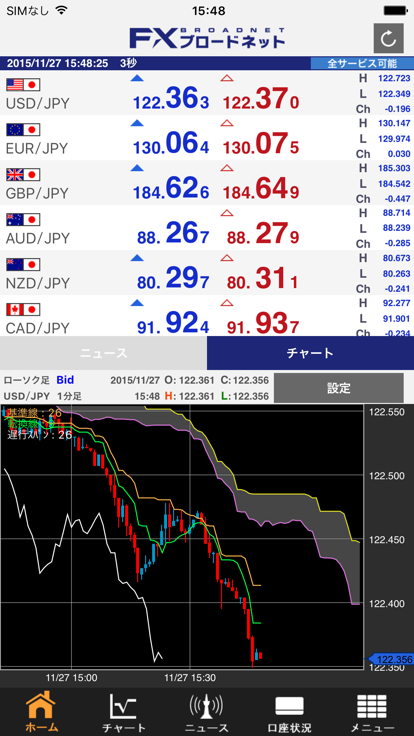

FX Broadnet menyediakan layanan dalam tiga aspek utama: Over-the-Counter FX, Click 365, dan Alat Perdagangan.

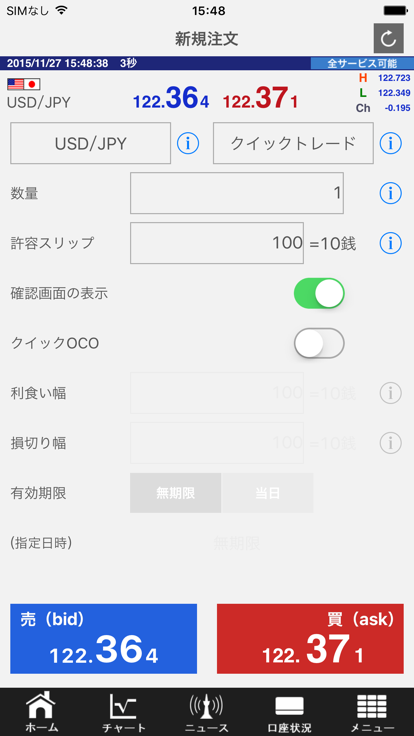

Over-The-Counter FX menyediakan transaksi dengan perbedaan poin rendah. Komputer untuk alat perdagangan khusus valuta asing dari komputer ke smartphone, melacak transaksi, transaksi mulai dari 4.000 yen, memungkinkan transaksi hingga 10.000 jenis Oleh karena itu, cocok untuk pemula dan orang yang ingin mengurangi risiko.

"CLICK 365" adalah perdagangan deposit valuta asing (FX) pertama di Jepang yang memberikan harga preferensial kepada pelanggan melalui mekanisme metode bisnis pasar.

Jenis Akun

Selain akun live untuk perdagangan over-the-counterFX. FX Broadnet juga menyediakan akun demo untuk menjadi akrab dengan platform dan konten terkait pembelajaran.

FX Broadnet Biaya

Kelebihan spread FX Broadnet adalah spread dolar-yen adalah pada 0,2 sen. Semakin rendah spread, semakin cepat likuiditasnya. Click 365 LARGE menggunakan 100.000 unit mata uang, dan Buy Swap turun 0,08. Untuk detailnya, silakan lihat https://www.fxbroadNet.com/click/composition/swap/.

Alat Perdagangan

Pengguna dapat mengunduh beberapa versi FX BroadNet termasuk Browser, Android/iPhone, Tablet, dan Mobile.

| Platform | Didukung | Perangkat yang Tersedia |

| FX BroadNe | ✔ | Browser/Android/iPhone/Tablet/Mobile |

Opsi Dukungan Pelanggan

Para trader dapat mengikuti platform ini di Facebook, Twitter, dan lainnya dan menghubunginya melalui telepon dan email. Jam kerja adalah 9:00 pagi-5:00 sore (kecuali Hari Libur Pasar Antarbank) dari Senin hingga Jumat.

| Opsi Kontak | Detail |

| Hotline | 0120-997-867 |

| support@fxbroadnet.com | |

| Sosial Media | Facebook, Twitter |

| Bahasa yang Didukung | Jepang |

| Bahasa Situs Web | Jepang |

| Alamat Fisik | 〒100-6217 東京都千代田区丸の内1-11-1 |