Profil perusahaan

| Ringkasan Ulasan Access Bank | |

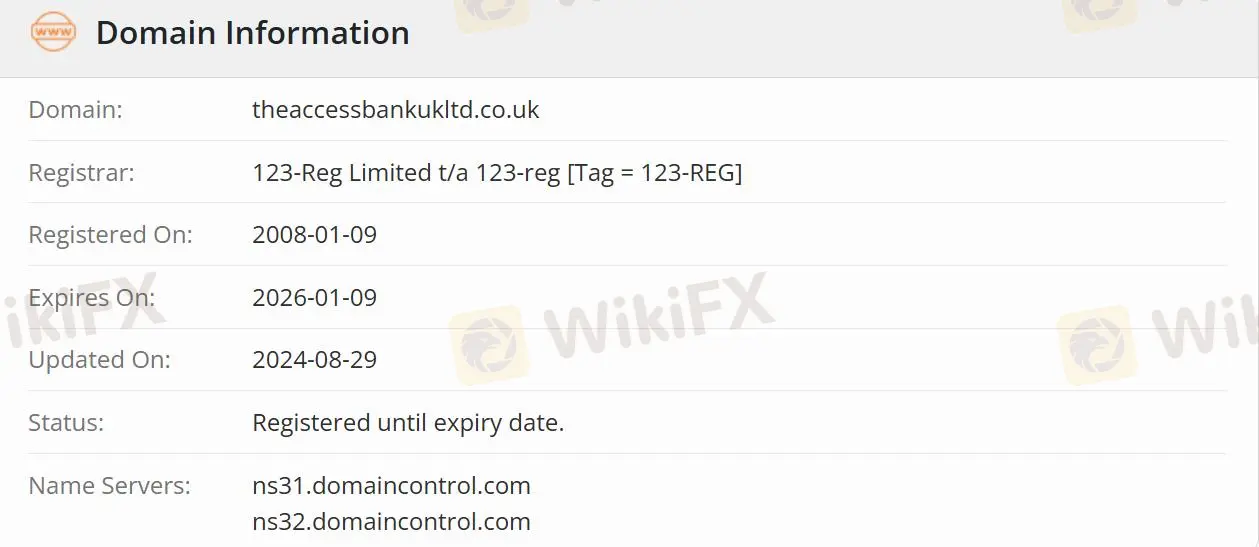

| Dibentuk | 2008-01-19 |

| Negara/Daerah Terdaftar | Inggris Raya |

| Regulasi | Teregulasi |

| Layanan | Perdagangan Keuangan/Perbankan Komersial/Manajemen Aset/Investasi |

| Dukungan Pelanggan | Email: ccontactaaccessprivatebank.com |

| Telepon: 0333 222 4516 (Inggris)/+44 1606 813020 | |

Informasi Access Bank

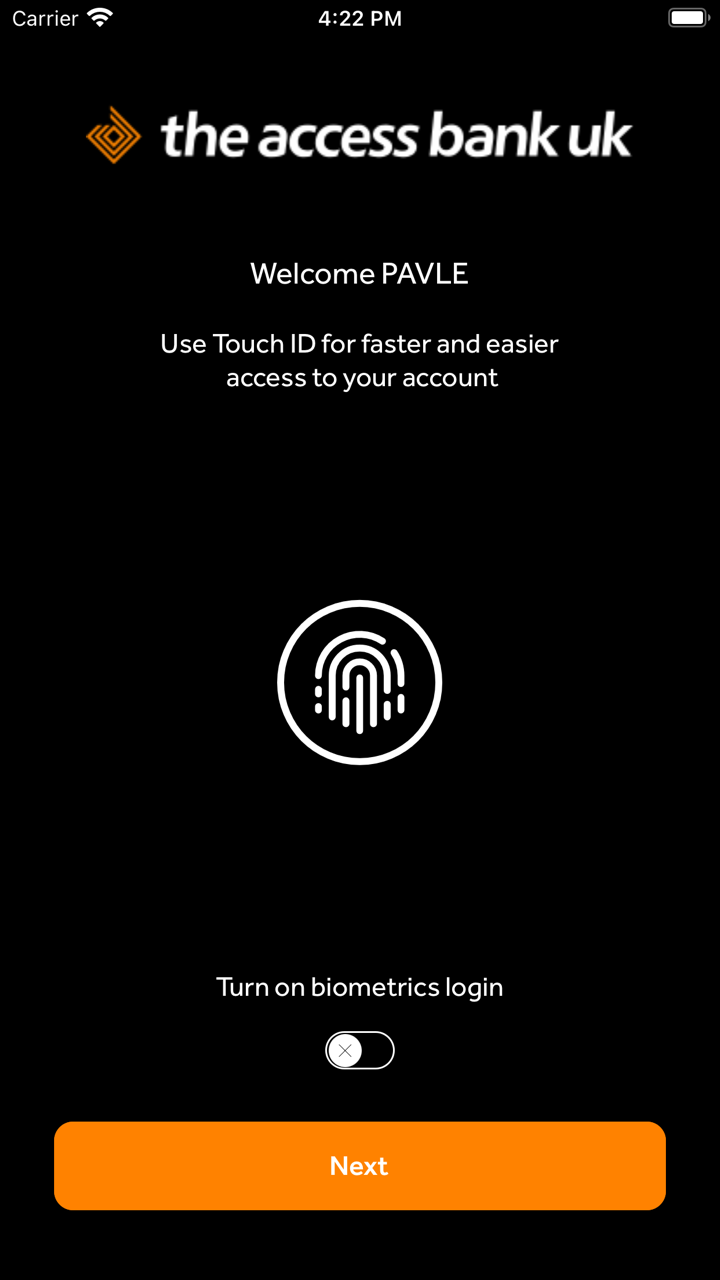

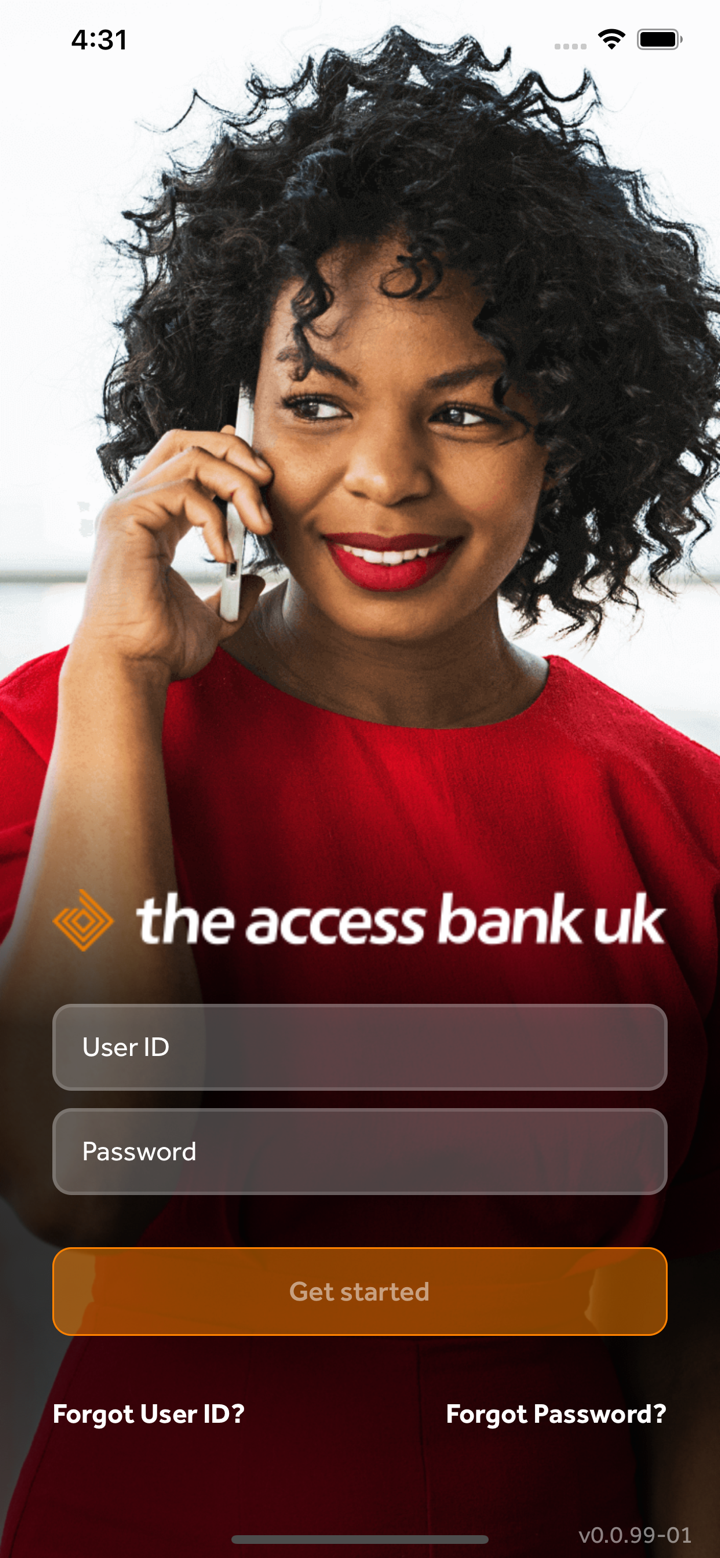

Access Bank yang terdaftar di Inggris Raya menawarkan berbagai produk dan layanan inovatif termasuk perdagangan keuangan, perbankan komersial, dan manajemen aset, serta mendukung aliran investasi ke pasar di Nigeria, Afrika, dan wilayah MENA. Tujuan bank ini adalah untuk mengembangkan bisnis internasional dari Access Bank Group melalui layanan pelanggan dan solusi inovatif dalam Perdagangan Keuangan, Perbankan Komersial, dan Manajemen Aset

Apakah Access Bank Legal?

Access Bank diotorisasi dan diatur oleh Financial Conduct Authority(FCA) dengan nomor lisensi 478415. Perusahaan yang teregulasi lebih aman daripada yang tidak teregulasi.

Layanan apa yang disediakan oleh Access Bank?

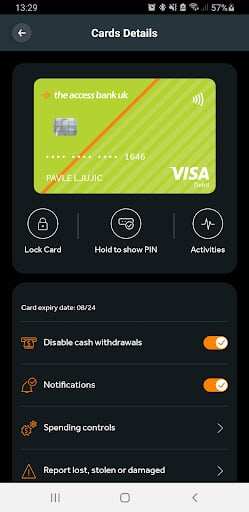

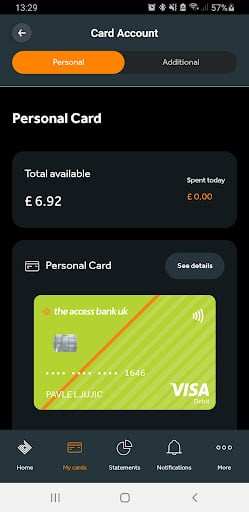

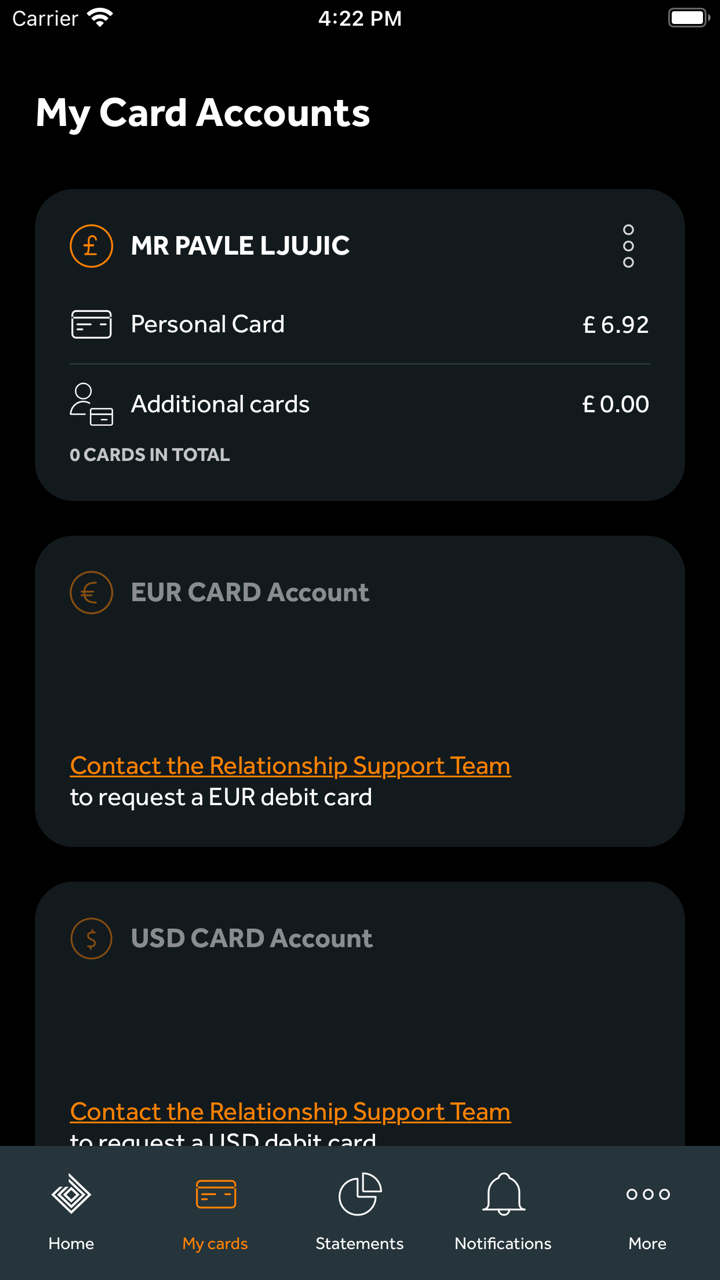

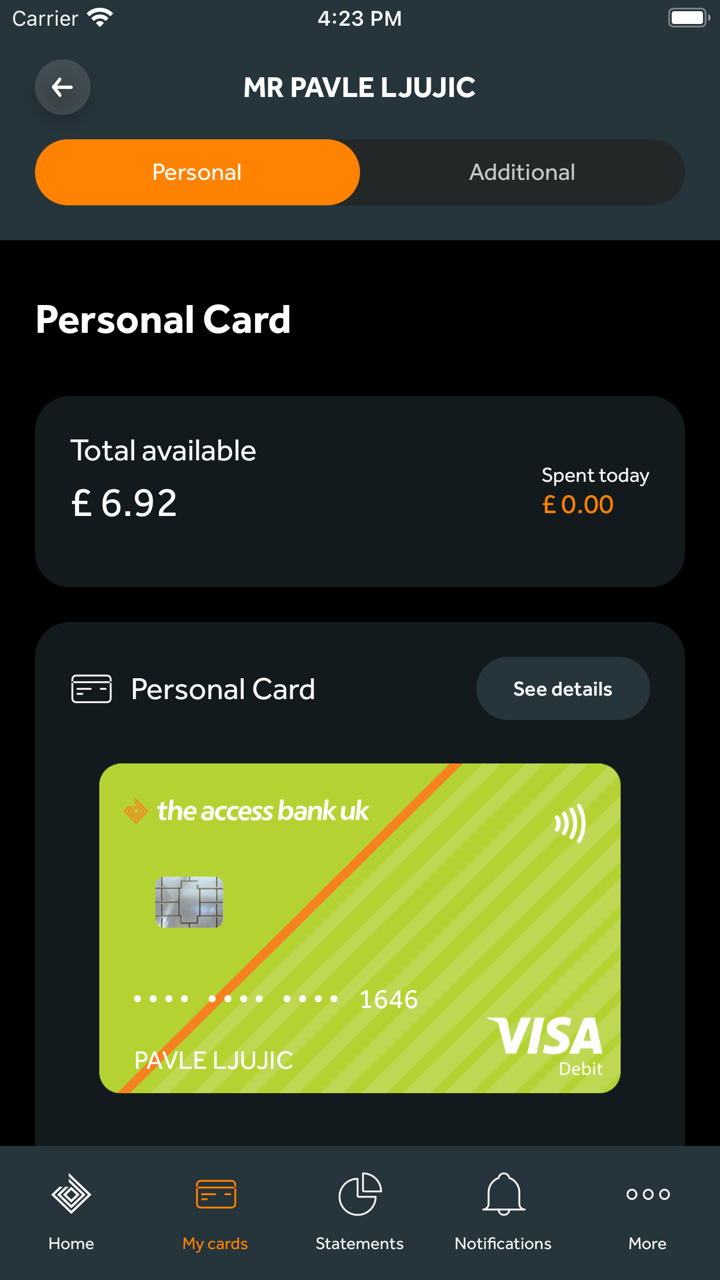

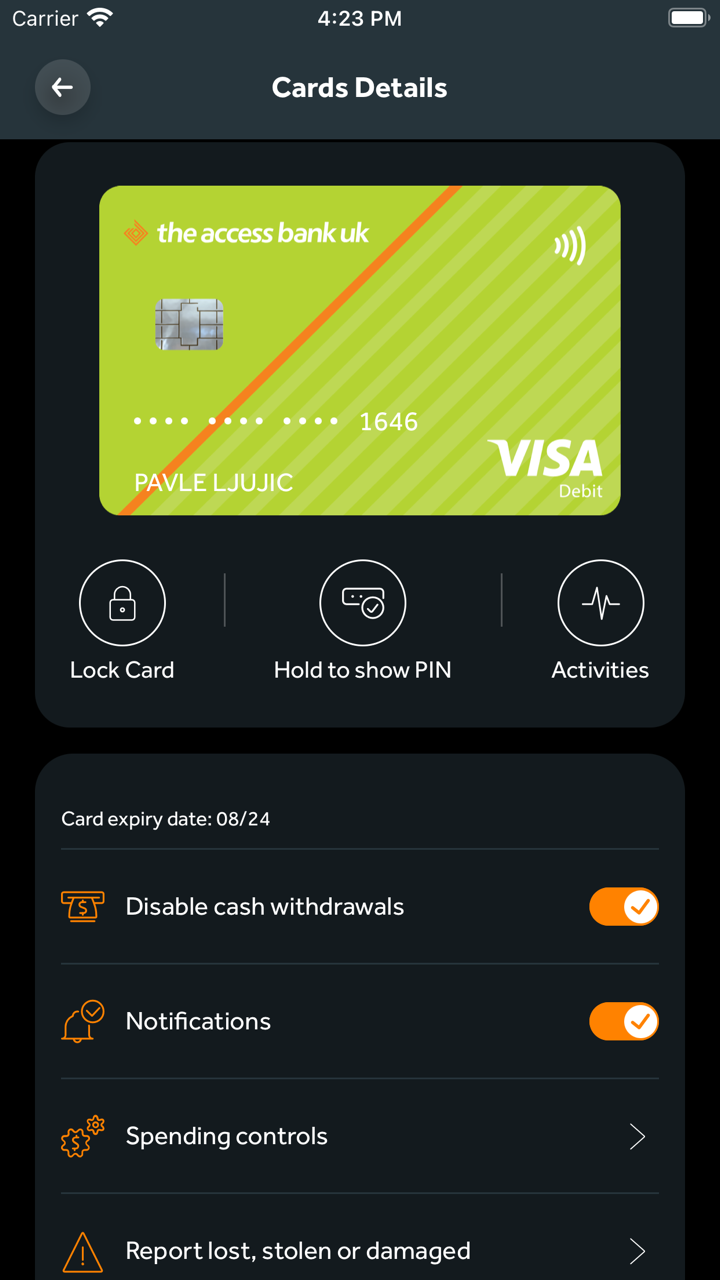

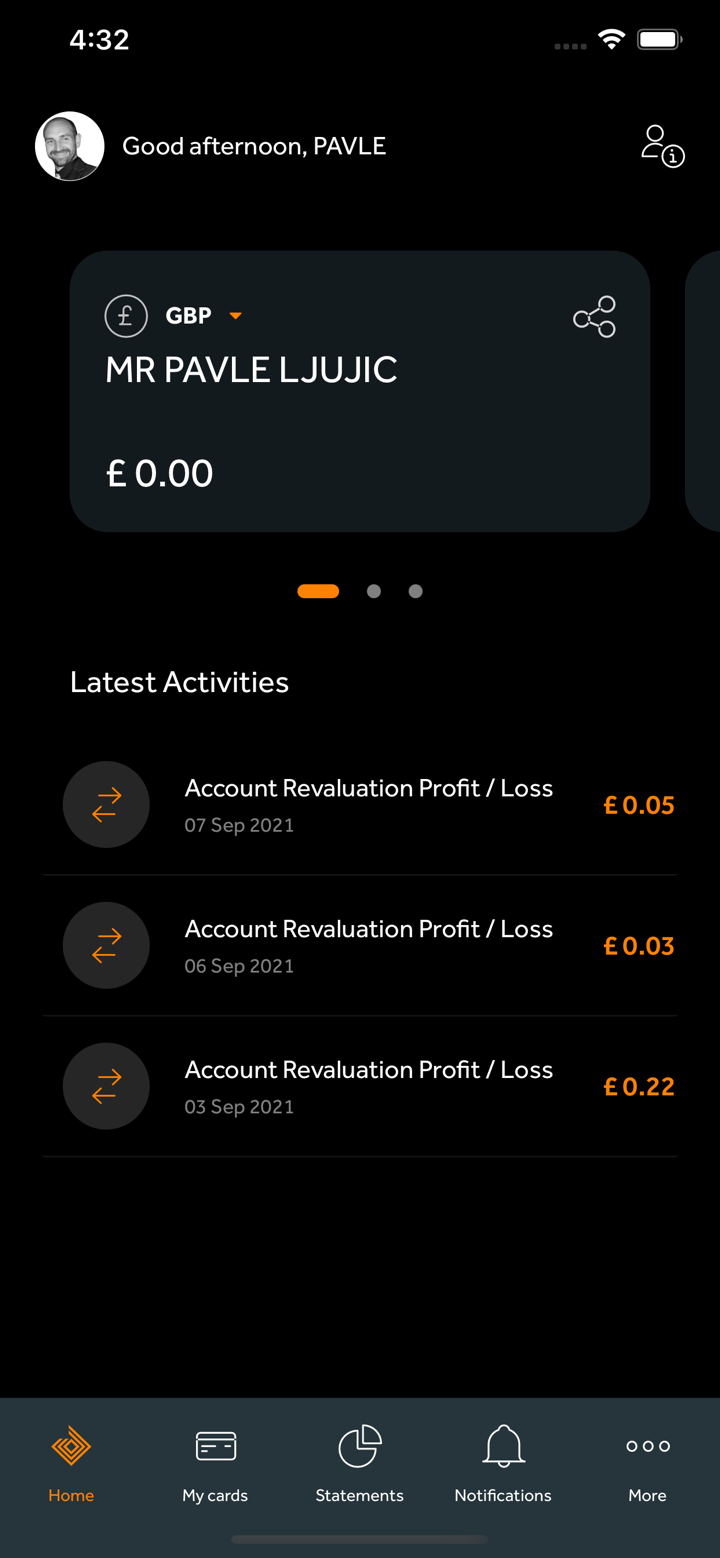

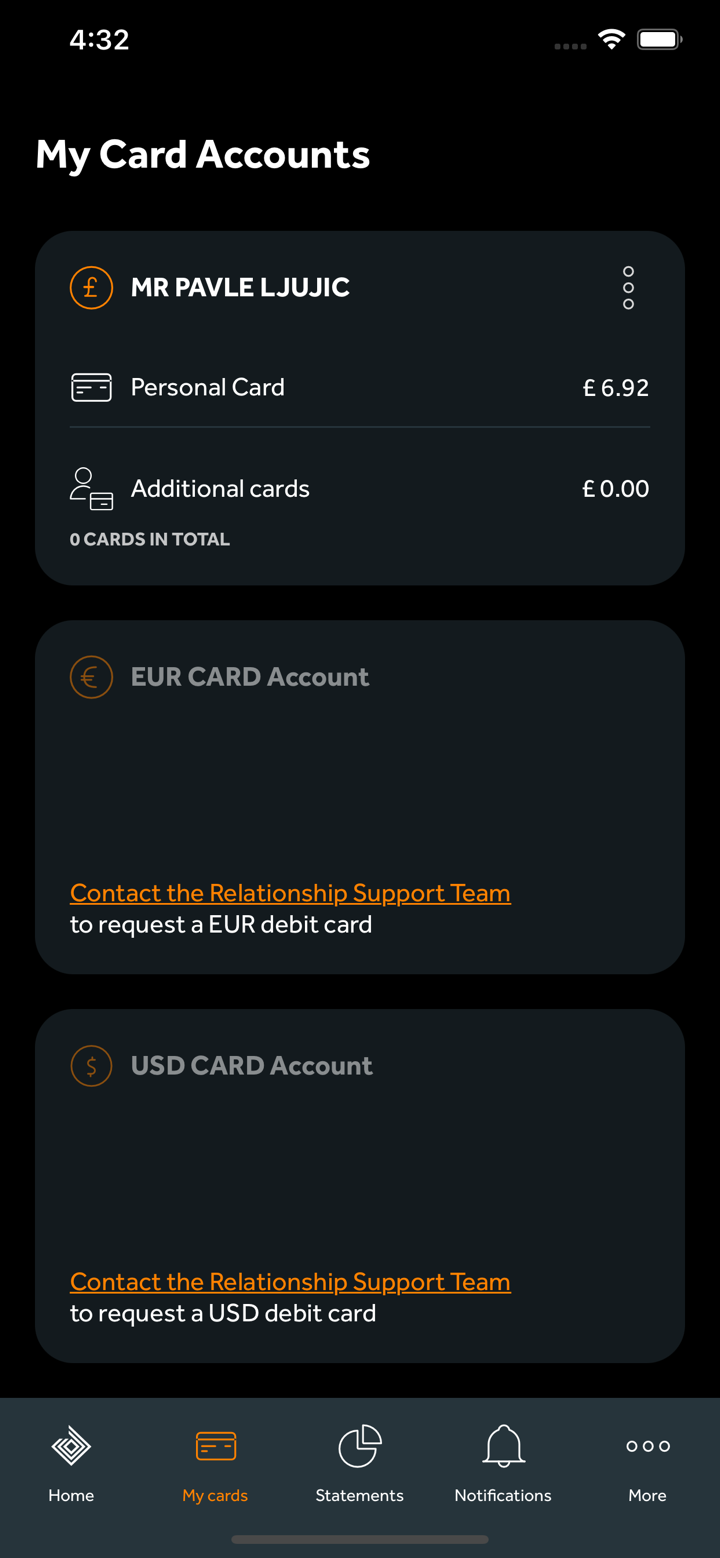

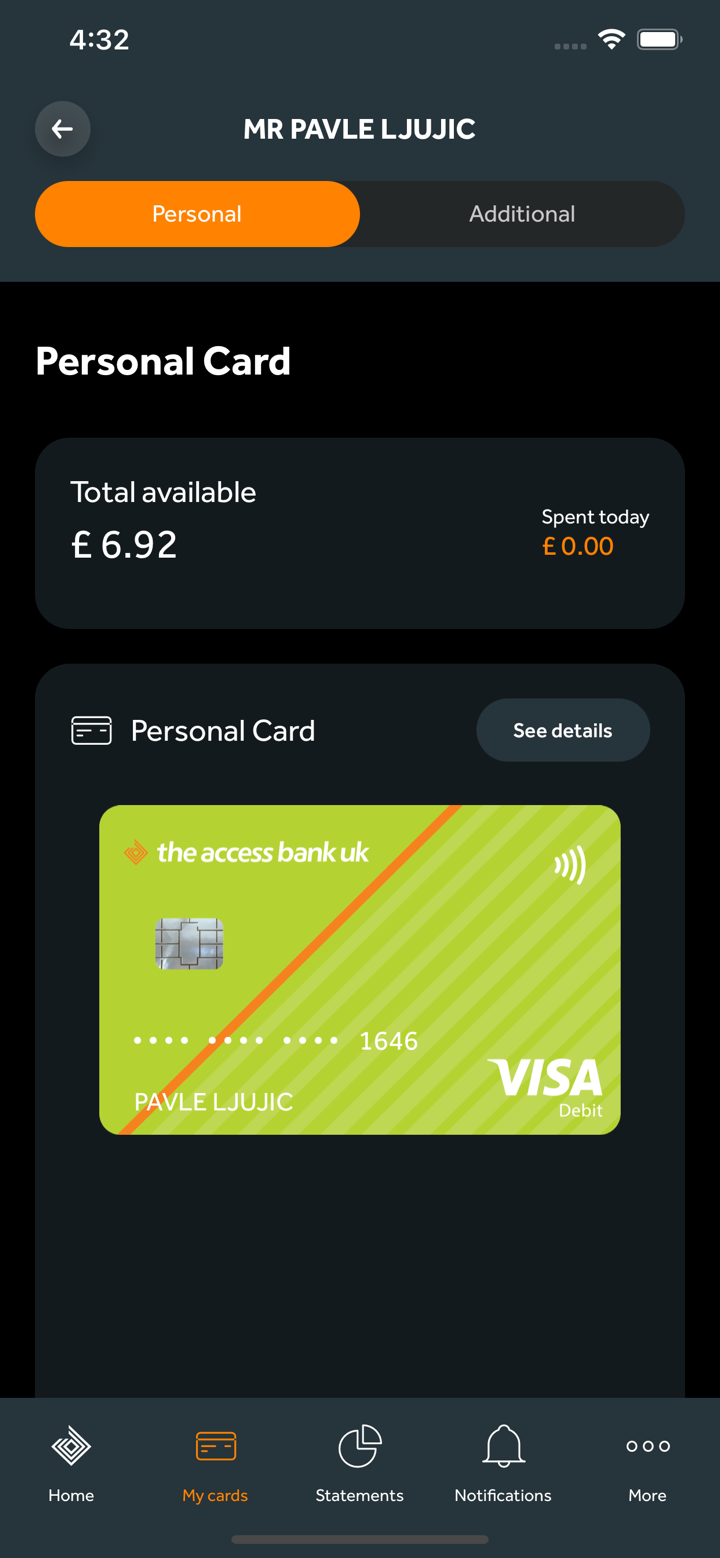

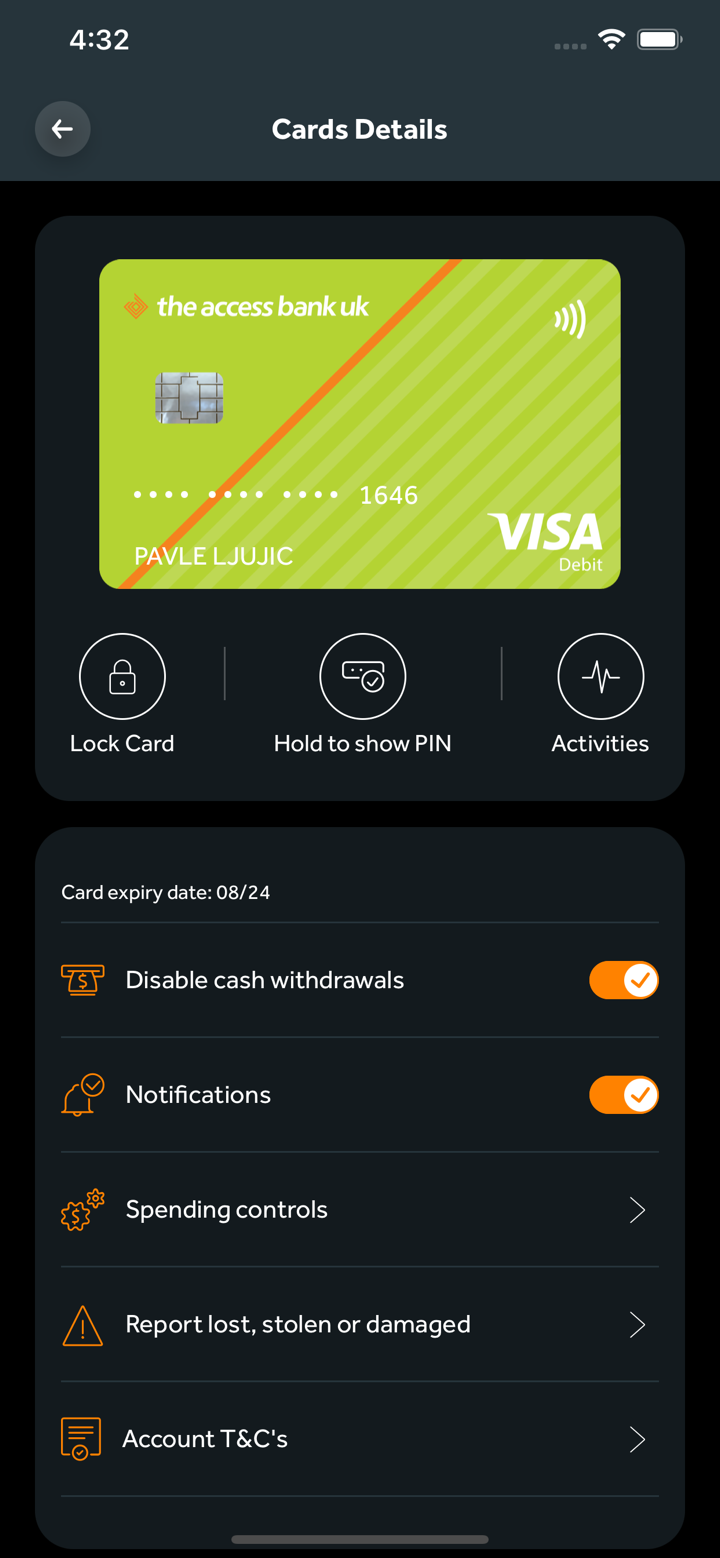

Access Bank menyediakan berbagai layanan keuangan kepada individu, bisnis, dan individu pribadi di Inggris. Pengguna internasional lainnya dapat menikmati layanan seperti perbankan komersial dan pembiayaan perdagangan.

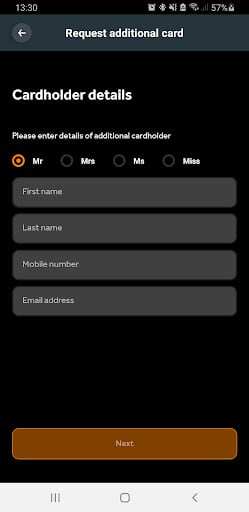

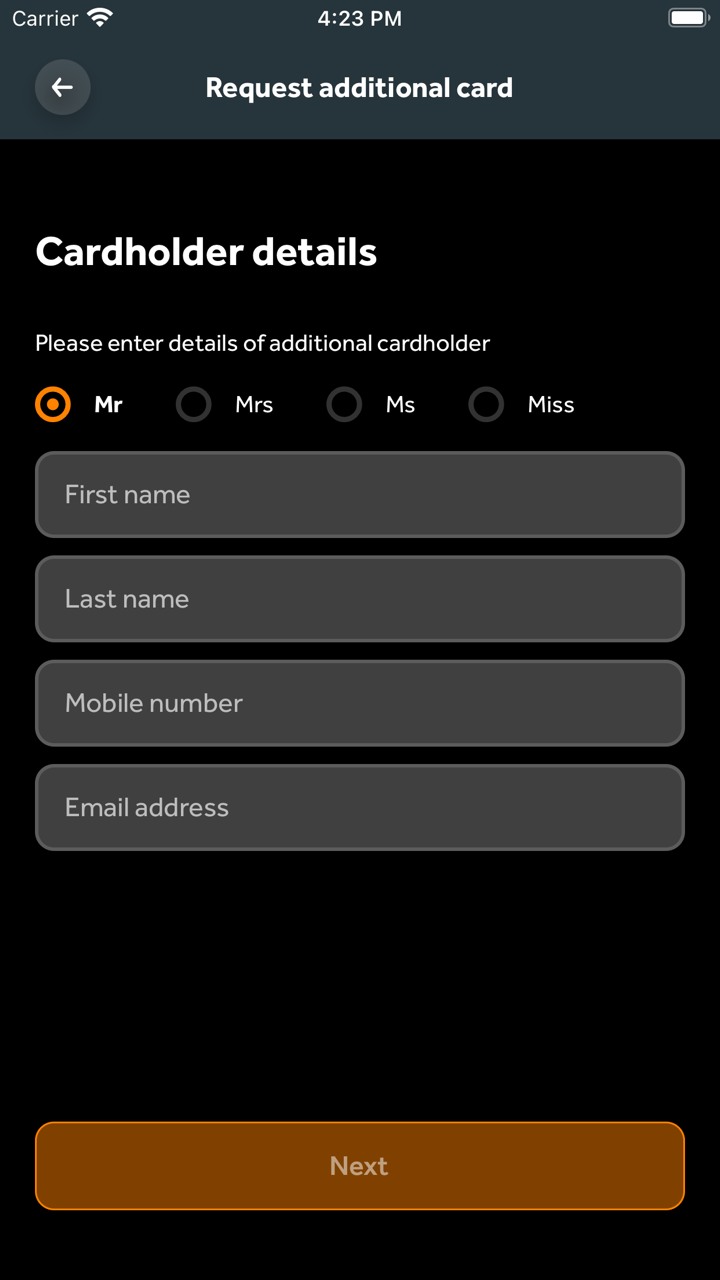

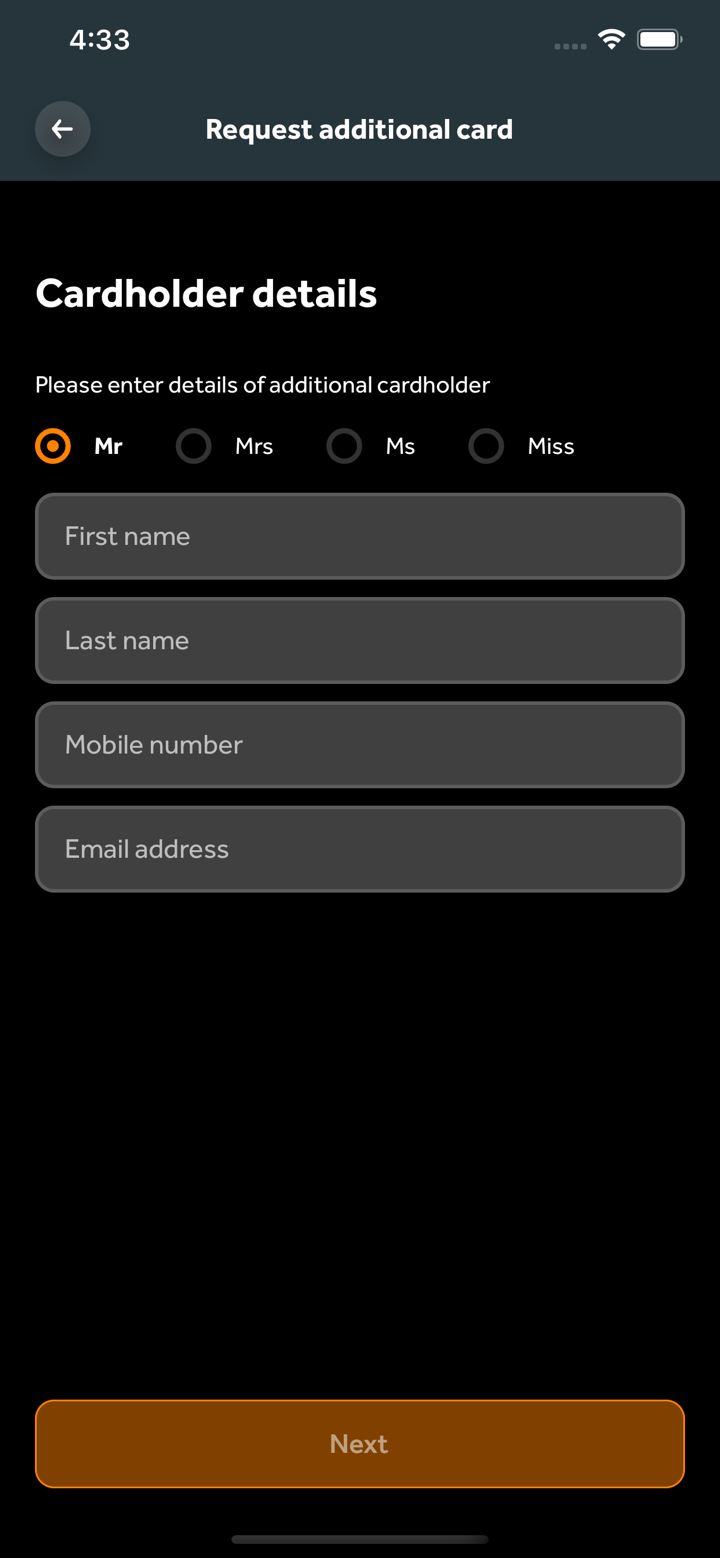

Pelanggan pribadi di Inggris dapat memilih perbankan pribadi, rekening saat ini, pinjaman properti, layanan pertukaran valuta asing, pembayaran lebih cepat, pertanyaan yang sering diajukan, dan rekening deposito pemberitahuan.

Bank ini menyediakan pelanggan bisnis di Inggris dengan perbankan bisnis, rekening bisnis, perdagangan keuangan, pinjaman properti, rekening deposito pemberitahuan, pinjaman langsung, pembayaran lebih cepat, dan pertanyaan yang sering diajukan.

Pelanggan pribadi di Inggris mendapatkan perbankan pribadi eksklusif, portofolio diskresioner, portofolio hanya eksekusi, pinjaman properti, rekening deposito pemberitahuan, pembayaran lebih cepat, dan pinjaman dengan jaminan portofolio.

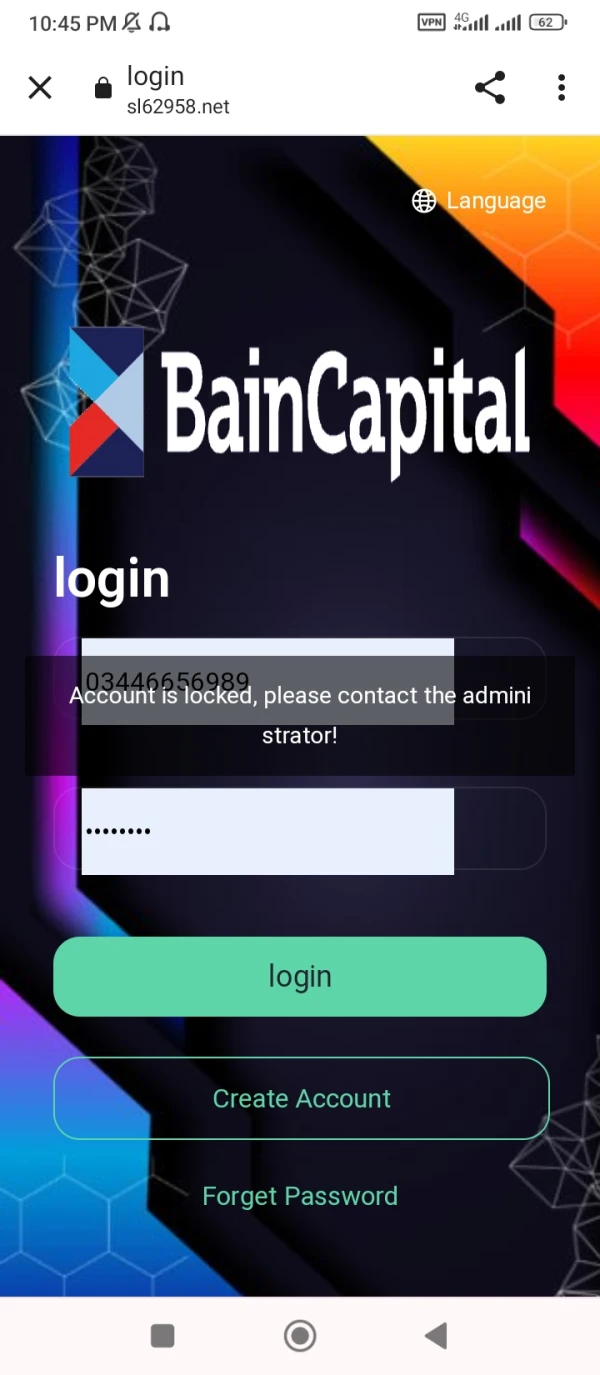

Ghazi6612

Pakistan

Sekarang akun saya juga terkunci.

Paparan

sunny91

Turki

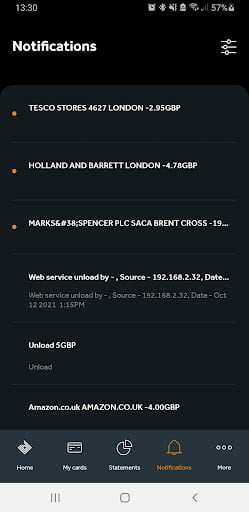

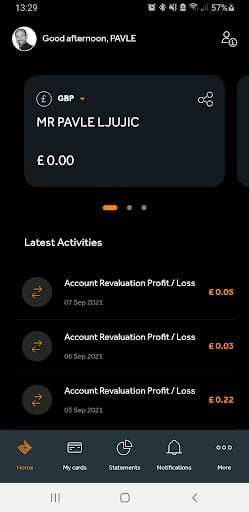

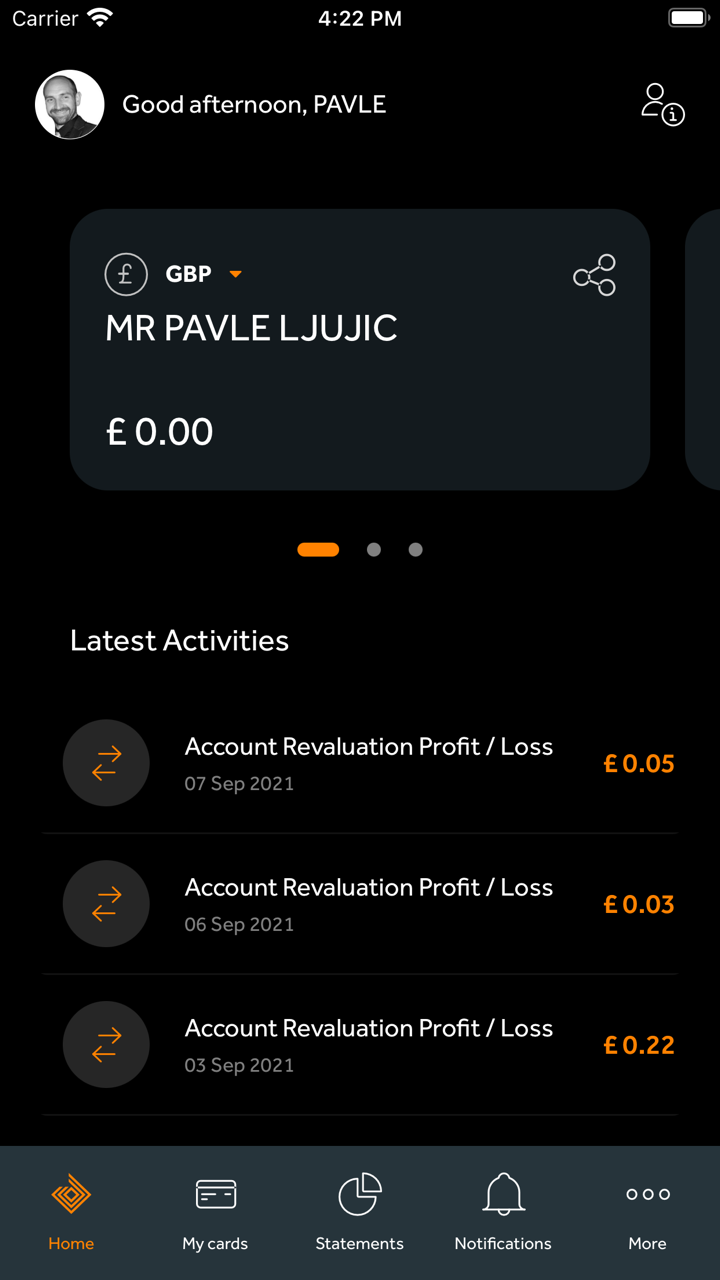

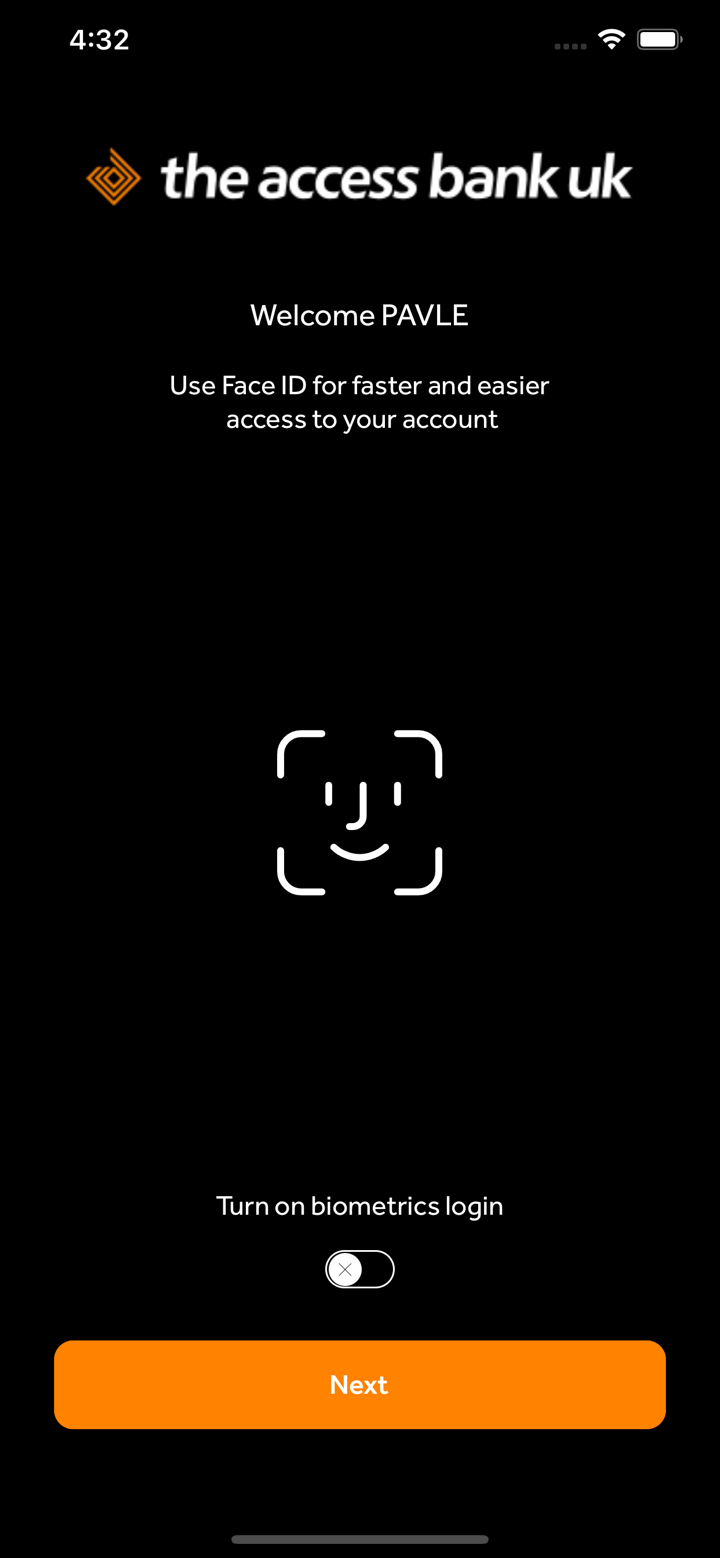

Banking dengan Access Bank UK terasa sangat pribadi. Mereka benar-benar mengutamakan pemahaman dan memenuhi kebutuhan saya. Layanan perbankan online mereka sederhana dan efisien.

Baik

拳

Singapura

Terpercaya dan dapat diandalkan! Layanan perbankan terbaik!

Baik

KASLAS

Nigeria

masalah utama broker adalah jaringan yang buruk tetapi broker Access Bank sangat bagus dalam jaringan sederhana untuk perdagangan dan membuat proses penarikan keuntungan berhasil

Baik

程安 -陶

Argentina

Layanan pelanggan perusahaan ini sangat baik. Saya menerima tanggapan dalam waktu satu jam setelah mengirim email, dan layanan pelanggan dengan sabar dan cermat membantu saya menyelesaikan masalah tersebut.

Baik

Rith Rith

Hong Kong

Saya sudah mencoba banyak hal semacam ini, dalam arti tertentu, saya ingin mencobanya, tetapi dalam alam bawah sadar saya berpikir, ya, ya, saya ingin mencoba!! Adakah yang bisa memberi tahu saya bahwa itu berhasil.

Baik