Présentation de l'entreprise

| T&DRésumé de l'examen | |

| Fondé | 1980 |

| Pays/Région enregistré | Japon |

| Régulation | FSA |

| Services | AXIA (Value), SOPHIA (Core-Growth) et Stratégie ESG |

| Assistance clientèle | Email: mkt_offshore@tdasset.co.jp |

| Adresse: T&D Asset Management Co., Ltd. Mita Bellju Building, 5-36-7, Shiba, Minato-ku, Tokyo, 108-0014, Japon | |

Fondée en 1980 et enregistrée au Japon, T&D est une société de gestion d'investissement approuvée par la FSA pour fournir divers services de gestion d'investissement, notamment AXIA (Value), SOPHIA (Core-Growth) et Stratégie ESG.

Avantages et inconvénients

| Avantages | Inconvénients |

| De nombreuses années d'expérience dans l'industrie | Assistance uniquement par email |

| Réglementé par la FSA | |

| Divers services de gestion d'investissement |

T&D est-il légitime ?

Oui, T&D est autorisé et réglementé par l'Agence des services financiers (FSA). Le type de licence est Licence de Forex au détail et le numéro de licence est 関東財務局長(金商)第357号.

| Pays réglementé | Régulateur | Statut actuel | Entité réglementée | Type de licence | Numéro de licence |

| Agence des services financiers (FSA) | Réglementé | T&Dアセットマネジメント株式会社 | Licence de Forex au détail | 関東財務局長(金商)第357号 |

Services

T&D propose divers services de gestion d'investissement, notamment AXIA (Value), SOPHIA (Core-Growth) et Stratégie ESG.

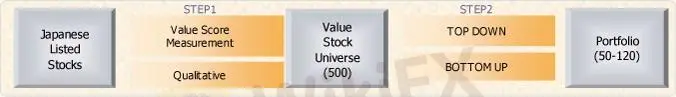

AXIA (Value) : AXIA investit dans des entreprises qui sont encore sous-évaluées, mais qui font des efforts convaincants pour restructurer leurs activités, se développer dans de nouveaux secteurs ou devenir plus rentables.

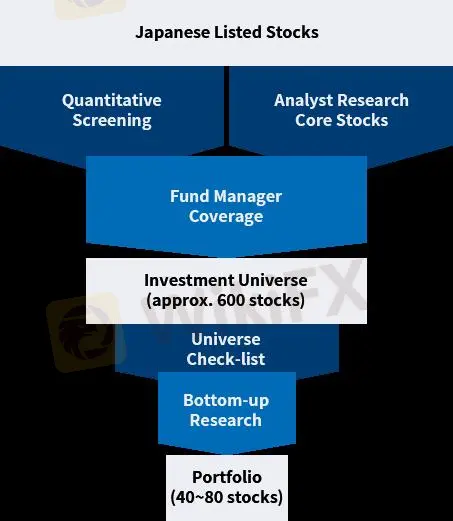

SOPHIA (Core-Growth) : SOPHIA investit dans des entreprises susceptibles d'être réévaluées ou dont la rentabilité s'améliore, identifiées par une croissance positive du ROE. La stratégie vise à capturer l'alpha de la croissance du ROE.

Stratégie ESG : ESG investit dans des entreprises présentant un profil ESG élevé dans une perspective à long terme.