Buod ng kumpanya

| GMO CLICK Buod ng Pagsusuri | |

| Itinatag | 2005 |

| Rehistradong Bansa | Hapon |

| Regulasyon | FSA |

| Mga Kasangkapan sa Merkado | Mga Stock, investment trust, forex, CFDs, stock indexes, bonds |

| Demo Account | / |

| Levadura | / |

| Spread | / |

| Platform ng Paggawa ng Kalakalan | 13 platforms (GMO Click FX, Hatchu-kun FX Plus, PLATINUM CHART, at iba pa) |

| Minimum na Deposito | / |

| Suporta sa Customer | Landline: 0120-727-930 |

| Mobile: 03-6221-0190 | |

Impormasyon ng GMO CLICK

Itinatag noong 2005, ang GMO Click Securities ay isang lisensyadong at kontroladong kumpanya ng serbisyong pinansyal sa ilalim ng FSA ng Hapon. Kasama sa maraming pagpipilian sa pamumuhunan nito ang FX, equities, CFDs, at mga tax-advantaged NISA accounts. Pinapatakbo ng kumpanya ang ilang mga sistema ng kalakalan na idinisenyo para sa sinuman mula sa mga baguhan hanggang sa mga may karanasan na mangangalakal.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng Japan FSA | Ang ilang detalye ng platform ay naka-palaman |

| Mababang bayad sa kalakalan, lalo na para sa FX at CFDs | May bayad sa pag-withdraw ng dayuhang pera |

| Libreng pamamahala ng account at walang bayad sa inactivity | |

| Mahabang oras ng operasyon | |

| Iba't ibang mga plataporma ng kalakalan |

Tunay ba ang GMO CLICK?

Oo, ang GMO CLICK ay isang legal, regulated na institusyon sa pinansya. Ito ay awtorisado ng Financial Services Agency (FSA) ng Hapon na may Retail Forex License, sa ilalim ng lisensyang numero 関東財務局長(金商)第77号, na epektibo simula Setyembre 30, 2007.

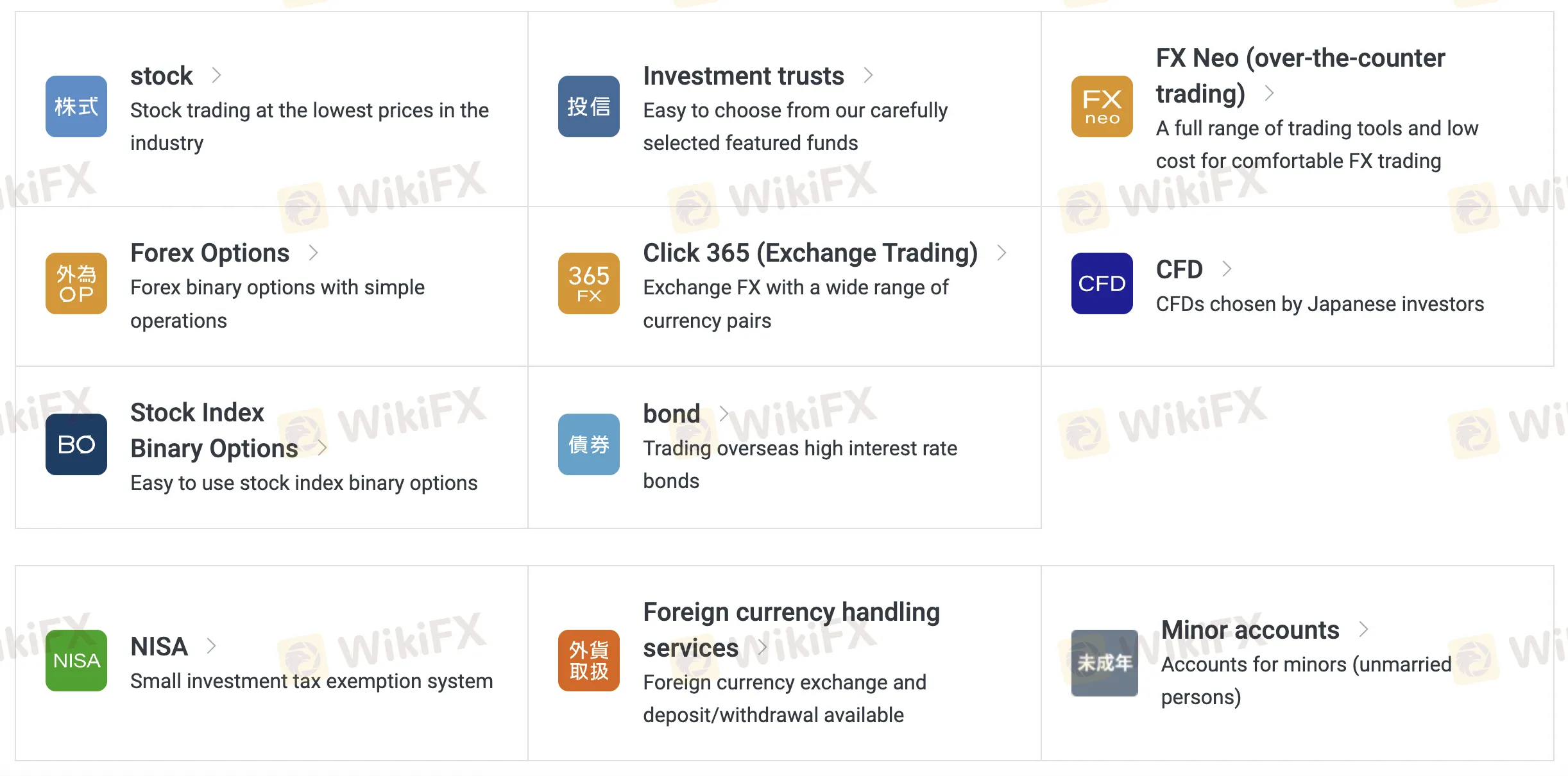

Ano ang Maaari Kong Kalakalan sa GMO CLICK?

Kasama sa maraming kagamitan sa pamumuhunan at kalakalan nito, nagbibigay ang GMO Click Securities ng mga stocks, FX, options, CFDs, bonds, at iba pa. Ang mga produkto nito ay angkop sa karaniwang mga mamumuhunan pati na rin sa mga naghahanap ng mababang account na may mga benepisyo sa buwis.

| Mga Kasangkapan sa Kalakalan | Supported |

| Stocks | ✔ |

| Investment Trusts | ✔ |

| Forex | ✔ |

| CFDs | ✔ |

| Stock Indexes | ✔ |

| Bonds | ✔ |

| Options | ❌ |

| ETFs | ❌ |

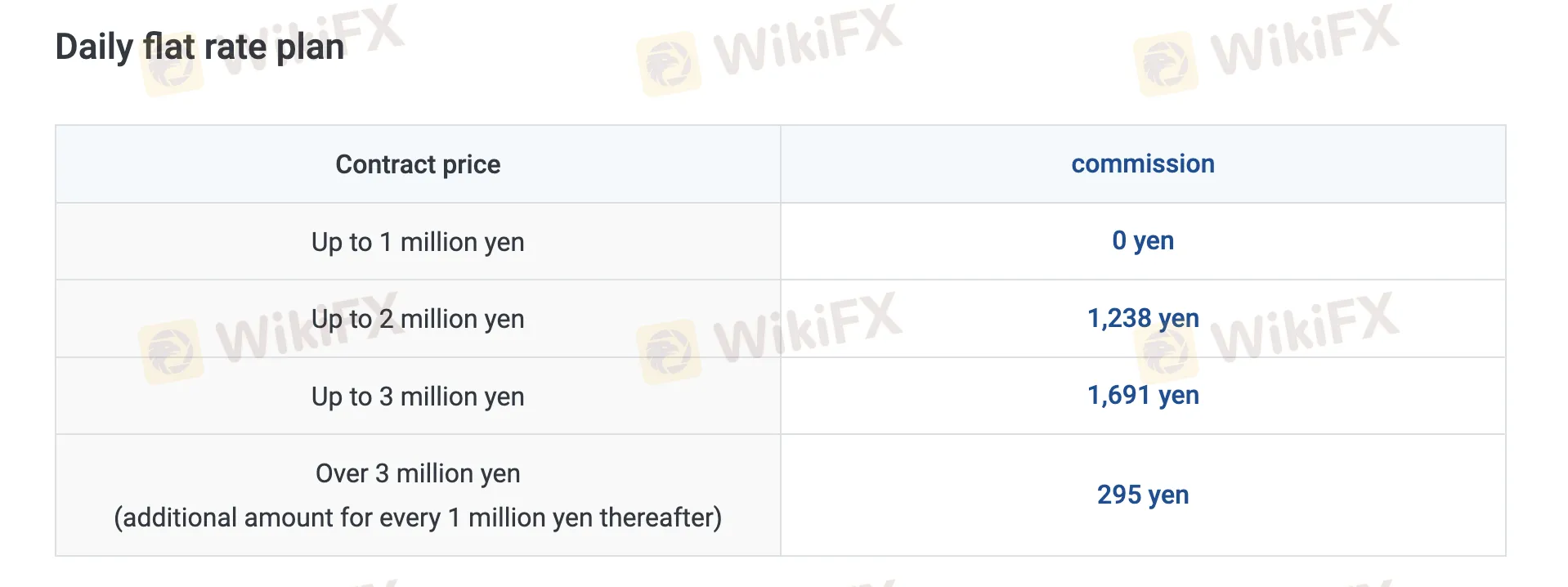

GMO CLICK Mga Bayad

Ang GMO Click ay kilala sa pagbibigay ng ilang sa pinakamababang bayad sa industriya, lalo na para sa FX, CFD, at stock trading, na may walang komisyon sa maraming produkto at maigting na spreads.

| Produktong Pangkalakalan | Mga Bayad |

| Spot Stock | Araw-araw na Flat Plan: ¥0 (hanggang sa ¥1M/day), pagkatapos scaled |

| Bawat Trade Plan: Mula sa ¥50 | |

| Margin Stock | Flat Plan: ¥0 (hanggang sa ¥1M), pagkatapos scaled |

| Bawat Trade Plan: Mula sa ¥97 | |

| FX Neo | 0, may mga spreads |

| Forex Options | 0 |

| Click365 | 0 para sa standard na kontrata; ¥770–990/ticket para sa Click365 Large |

| CFD | 0 |

| Stock Index Binary Options | 0 |

| Bonds | 0 |

Mga Swap Rate

| Uri | Taunang Rate |

| Interes ng Kustomer (Pangkalahatan) | 2.00% |

| Interes ng Nagbebenta | 0.00% |

| Bayad sa Pagsasanla ng Stock (Pangkalahatang Kredito - Maikling Panahon) | 3.85% |

| Plano ng VIP (Institusyonal na Kustomer) | 1.80% |

Mga Singil na Hindi Kaugnay sa Paghahalal

| Uri ng Singil | Halaga |

| Singil sa Deposito | 0 (Mga instant deposito); May singil ang ATM/bangko |

| Singil sa Pag-Atas | 0 (JPY) ¥1,500 para sa pag-atas ng dayuhang pera sa FX |

| Singil sa Hindi Paggalaw | 0 |

| Singil sa Order sa Call Center | 0.11% ng halaga ng kalakalan (min ¥3,520, max ¥220,000) |

| Mga Benta ng Bahagyang Bahagi | 2.2% ng presyo ng kontrata |

| Singil sa Pagbili ng Odd Lot | ¥1,100/bilang |

| Mga Singil sa Pamamahala ng Account | 0 |

| Singil sa Paglabas ng Dokumento | ¥1,100 (mga ulat, personal na datos, atbp.) |

Platform ng Paghahalal

| Platform/App | Sinusugan | Magagamit na mga Dispositibo | Nararapat para sa |

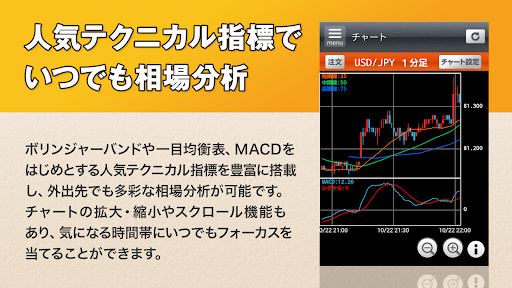

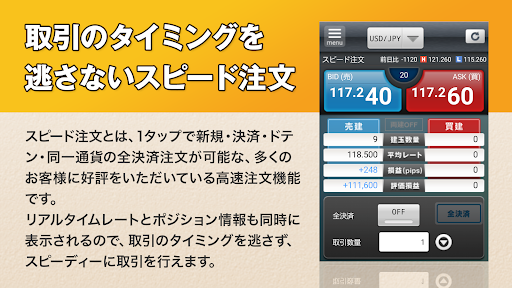

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | Mga mangangalakal sa FX (lahat ng antas) |

| Hatchu-kun FX Plus | ✔ | Windows | Mga mangangalakal sa FX na nangangailangan ng mga advanced na function |

| PLATINUM CHART | ✔ | Windows / Mac | Mga gumagamit ng teknikal na tsart sa FX & CFD |

| FX Watch! | ✔ | Wear OS | Mga alerto sa FX sa mga smartwatch |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | Mga mangangalakal sa CFD |

| Hatchu-kun CFD | ✔ | Windows / Mac | Mga mangangalakal sa CFD na nangangailangan ng mga tool sa PC |

| GMO Click Stock | ✔ | iPhone / Android | Mga mangangalakal ng stocks (mobile access) |

| GMO Click Stocks para sa iPad | ✔ | iPad / Mac | Mga mangangalakal ng stocks na mas gusto ang mga tablet |

| Super Hatchu-kun | ✔ | Windows | Mga mangangalakal ng stocks na nangangailangan ng desktop trading |

| iClick Forex | ✔ | iPhone / Android | Mga nagsisimula sa FX o mga mangangalakal na palaging nasa paggalaw |

| GMO Click Stock BO | ✔ | iPhone / Android | Mga mangangalakal ng Stock Binary Options |

| iClickFX365 | ✔ | iPhone | Mga mangangalakal ng FX365 (mobile) |

| FXroid365 | ✔ | Android | Mga mangangalakal ng FX365 (mobile) |