Perfil de la compañía

| GMCU Resumen de la revisión | |

| Establecido | 1985 |

| País/Región Registrada | Australia |

| Regulación | ASIC (Excedido) |

| Servicios | Préstamos, cuentas bancarias, depósitos a plazo, seguros |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Aplicación Móvil de Banca |

| Soporte al Cliente | Teléfono: 1800 694 628 |

| Correo Electrónico: info@gmcu.com.au | |

| Dirección Postal: PO Box 860, Shepparton, VIC 3632 | |

Información de GMCU

GMCU (Goulburn Murray Credit Union Co-Operative Ltd) fue fundado en 1985 y está regulado por ASIC con la licencia No. 241364, aunque el estado se indica como "Excedido". La institución ofrece servicios financieros estándar como préstamos hipotecarios, cuentas bancarias personales y productos de seguros, pero no ofrece otros servicios de trading o cuentas demo.

Pros y Contras

| Pros | Contras |

| Varios canales de contacto | Licencia ASIC excedida |

| Amplia gama de servicios bancarios tradicionales | |

| Múltiples opciones de cuentas | |

| Largo tiempo de operación |

¿Es GMCU Legítimo?

Sí, Goulburn Murray Credit Union Co-Operative Ltd (GMCU) está regulado. Posee una Licencia de Asesoramiento de Inversiones emitida por la Comisión Australiana de Valores e Inversiones (ASIC) bajo el número de licencia 241364. Sin embargo, su estado regulatorio se marca como Excedido, lo que puede indicar que la licencia ya no es válida o ha superado su alcance previsto.

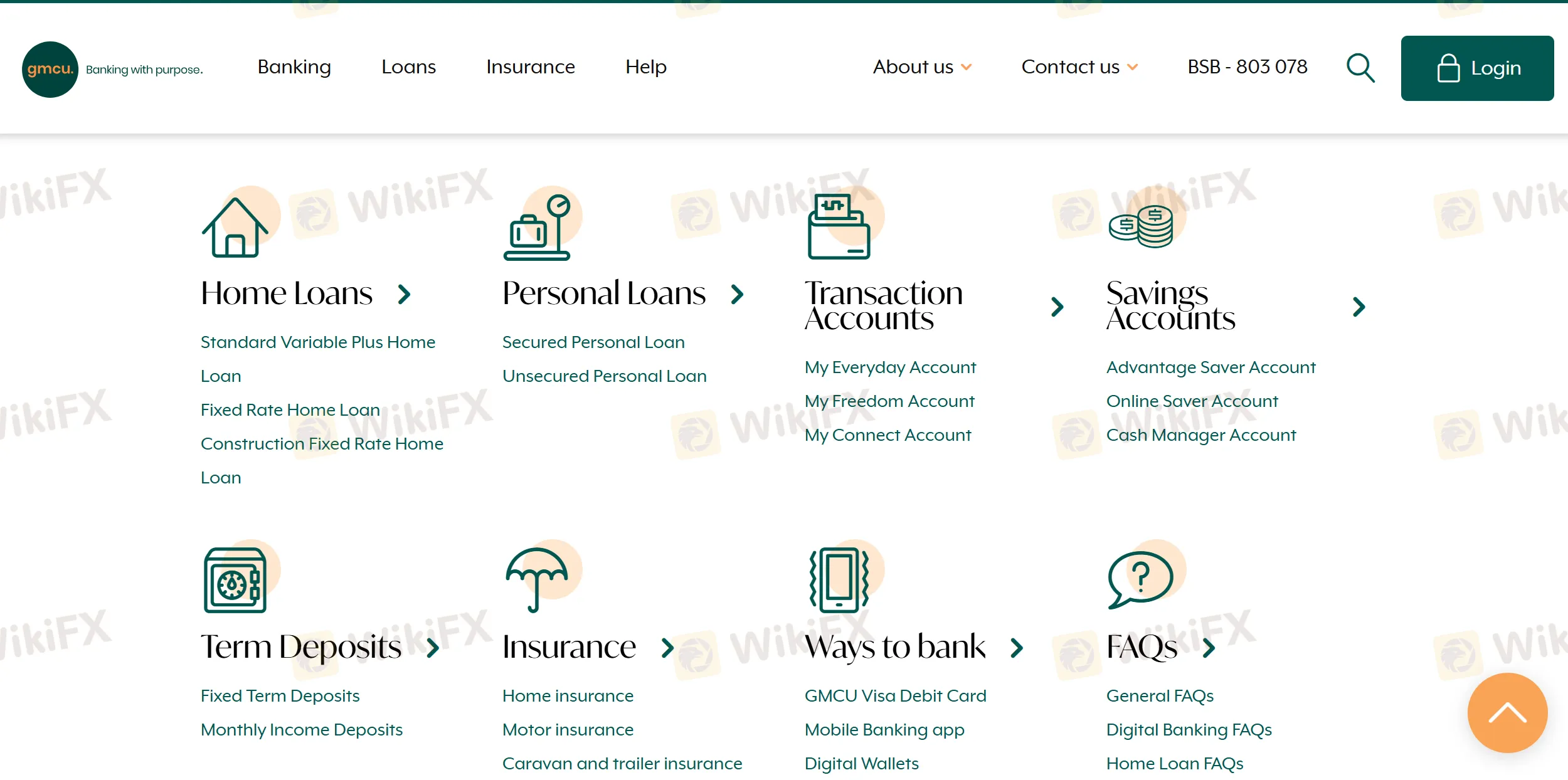

Servicios de GMCU

GMCU ofrece una amplia gama de servicios bancarios minoristas que incluyen préstamos hipotecarios y personales, varios tipos de cuentas, depósitos a plazo y opciones de seguros.

| Categoría | Servicios |

| Préstamos Hipotecarios | Variable Estándar Plus, Tasa Fija, Tasa Fija de Construcción |

| Préstamos Personales | Préstamo Personal Garantizado, Préstamo Personal No Garantizado |

| Cuentas de Transacción | Mi Cuenta Diaria, Mi Cuenta Libertad, Mi Cuenta Conexión |

| Cuentas de Ahorro | Advantage Saver, Online Saver, Cuenta de Gestión de Efectivo |

| Depósitos a Plazo | Depósitos a Plazo Fijo, Depósitos de Ingresos Mensuales |

| Seguros | Hogar, Automóvil, Caravana y Remolque, Seguro de Propietario |

Tipo de Cuenta

GMCU ofrece varios tipos de cuentas reales adaptadas a las necesidades bancarias diarias, incluidas cuentas de transacciones personales y de ahorro.

| Tipo de Cuenta | Adecuado para |

| Mi Cuenta de Todos los Días | Personas que necesitan una cuenta de transacciones general |

| Mi Cuenta Libertad | Estudiantes o titulares de tarjetas de descuento que buscan exenciones de tarifas |

| Mi Cuenta Conexión | Personas que prefieren la banca digital sin acceso a sucursales |

| Cuenta de Ahorro Ventaja | Ahorradores regulares que desean intereses adicionales |

| Cuenta de Ahorro en Línea | Ahorradores enfocados en línea |

| Cuenta de Gestor de Efectivo | Miembros que gestionan flujos de efectivo más grandes |

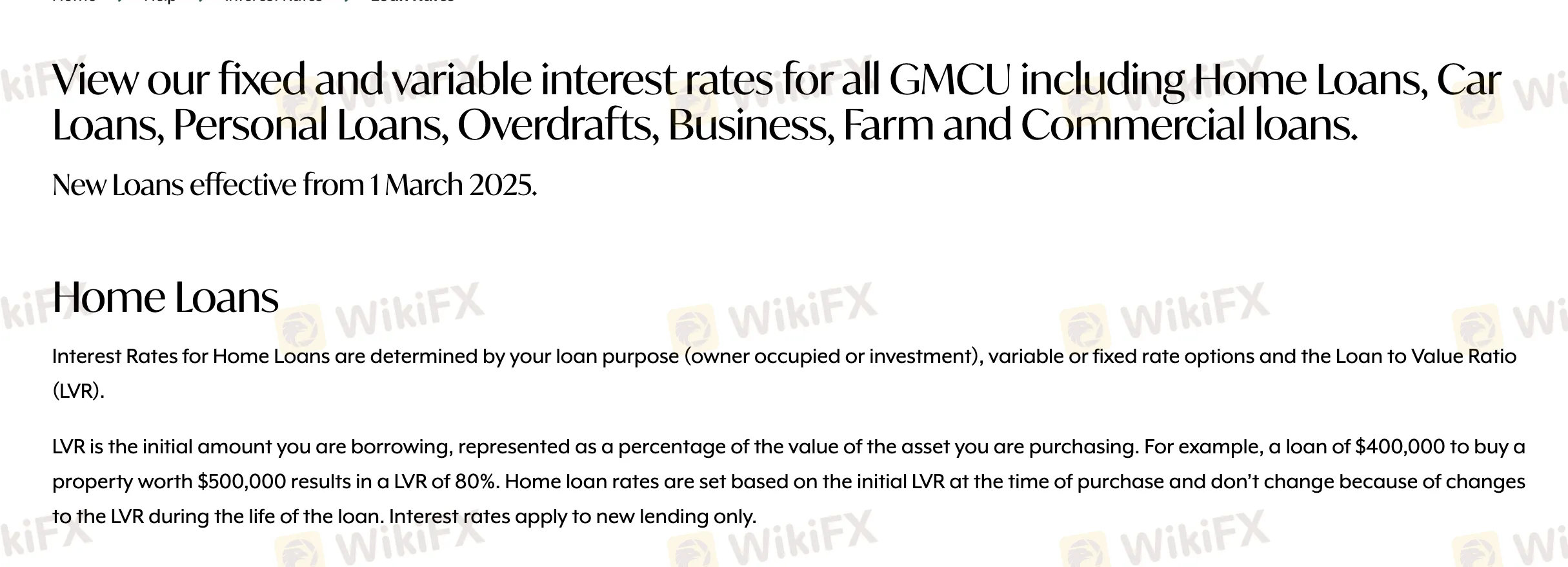

Tarifas de GMCU

Las tarifas de GMCU son moderadas a altas en comparación con los estándares de la industria, especialmente para productos de préstamos no garantizados como préstamos personales y sobregiros.

| Tipo de Préstamo | Tasa de Interés (anual) |

| Préstamo Hipotecario (Ocupante Propietario, LTV <80%) | 5.94% - 5.79% |

| Préstamo Hipotecario (Ocupante Propietario, LTV >80%-95%) | 6.34% - 5.79% |

| Préstamo Hipotecario (Inversión, LTV <80%) | 6.14% - 6.09% |

| Préstamo Hipotecario (Inversión, LTV >80%-95%) | 6.54% - 6.09% |

| Préstamo Personal (Garantizado) | 7.79% |

| Préstamo Personal (No Garantizado) | 14.95% |

| Sobregiro (Garantizado) | 9.99% - 10.60% |

| Sobregiro (No Garantizado) | 17.69% |

| Préstamo Comercial/Agrícola (Garantizado) | 10.54% - 12.00% |

| Préstamo Comercial/Agrícola (No Garantizado) | 18.75% |

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| Aplicación de Banca Móvil | ✔ | iOS, Android |

Depósito y Retiro

GMCU no menciona explícitamente el cobro de tarifas por depósitos o retiros.

| Método de Pago | Tarifas | Tiempo de Procesamiento |

| Crédito de Entrada Directa | / | Normalmente el mismo día |

| Débito de Entrada Directa | Pueden aplicarse tarifas de devolución si hay fondos insuficientes | Según el horario del proveedor |

| Pagos Periódicos | / | Según lo programado |

| Banca por Internet/Móvil | / | Instantáneo o el mismo día |

| Depósito en Sucursal | / | Instantáneo o al final del día |