简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MONAXA Review: Safety, Regulation & Forex Trading Details

Abstract:MONAXA is currently an unregulated broker with a low WikiFX score of 2.24/10, facing multiple warnings from international regulators and numerous user complaints regarding withdrawal denials and profit deductions.

According to market data, MONAXA is an offshore brokerage firm established in 2022 and headquartered in Anguilla. While it offers modern trading interfaces and high leverage, a deep dive into its operational history reveals significant safety concerns that every Forex trader should consider before depositing funds.

Key Takeaways

- Regulatory Warning:MONAXA is currently not regulated by any recognized financial authority.

- Blacklist Alerts: Both the CySEC (Cyprus) and FSA (Japan) have issued official warnings against this entity.

- Withdrawal Risks: Multiple reports from 2024 and 2025 indicate severe issues with profit withdrawals and account blocking.

- Low Trust Score: WikiFX has assigned a low score of 2.24/10 due to high risk and lack of license.

MONAXA Broker Summary: Safety Score and Key Issues

The MONAXA review reveals a broker that positions itself as a modern choice for Forex enthusiasts but lacks the legal foundation to protect client capital. With a low WikiFX score, the broker is flagged for “Unusual Activities” and “Unverified Status.”

While MONAXA provides access to MT4, MT5, and cTrader, the technical platform cannot compensate for the lack of financial oversight. Traders have frequently reported that while deposits are processed quickly, the exit path for capital is often obstructed by “unexplained rules” or “system audits.”

Regulation: Is the License Real?

A critical part of any MONAXA regulation check is verifying its claims against official databases. Market records show that MONAXA lacks valid licenses to provide investment services. In fact, major global regulators have actively identified the broker as an unauthorized entity.

| Regulator | License Type | Status |

|---|---|---|

| CySEC (Cyprus) | Unregulated Entity | Blacklisted / Warning |

| FSA (Japan) | Financial Instruments Business | Unlicensed / Warning |

| Anguilla | Offshore Registration | No Regulatory Oversight |

In January 2025, the CySEC explicitly listed monaxa.com as a website that does not belong to an authorized entity. Similarly, the Japan FSA issued a warning in December 2024 stating that the firm was conducting business without proper registration. Trading with an unlicensed broker means there is no compensation fund or legal recourse if the broker goes bankrupt or refuses to pay.

MONAXA User Reviews: Login and Withdrawal Complaints

The user feedback for this Forex broker is overwhelmingly negative, particularly regarding the handling of client profits. Market records and user testimonials highlight a pattern of “profit deduction” and “account access” issues.

Withdrawal Denials and Profit Deductions

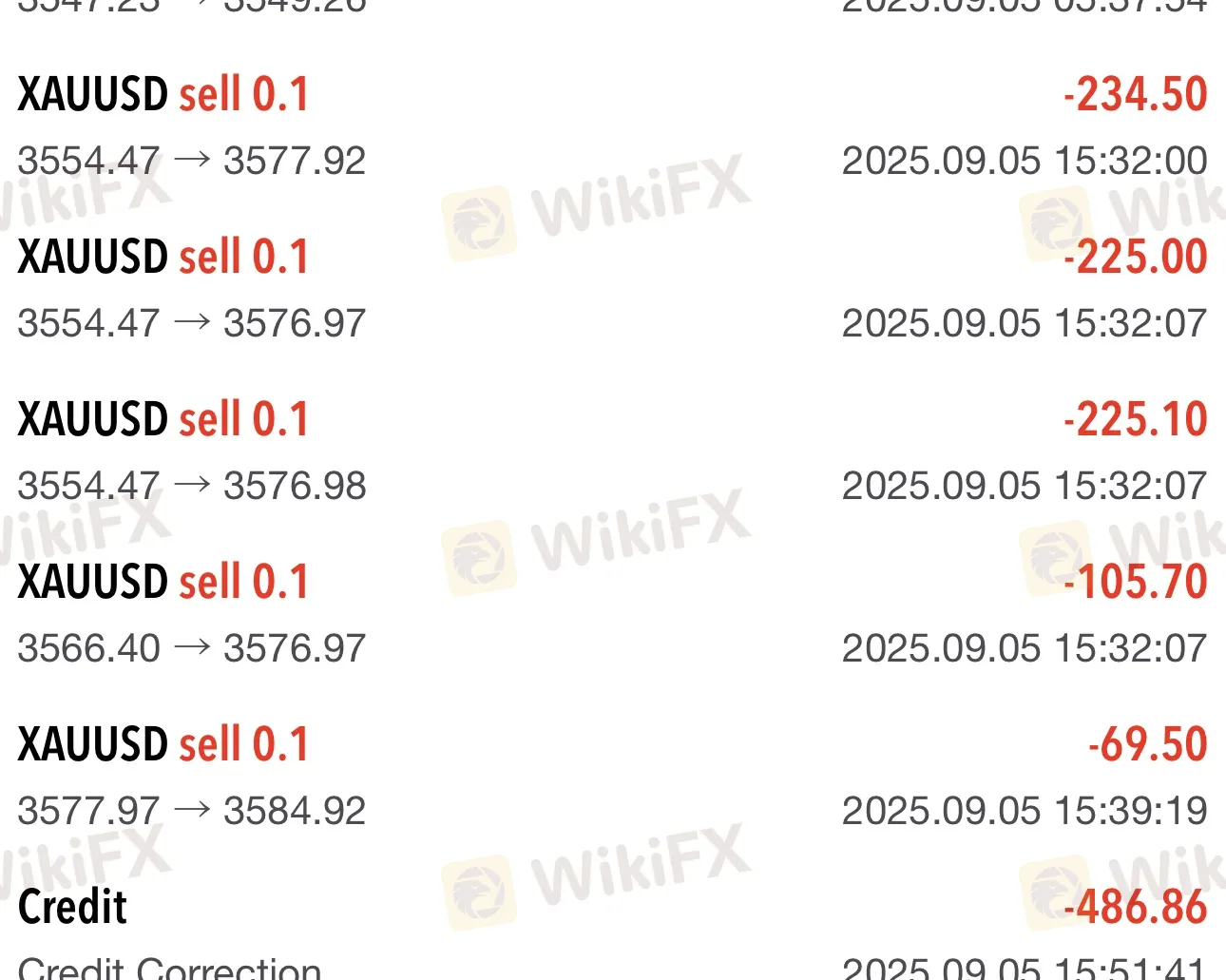

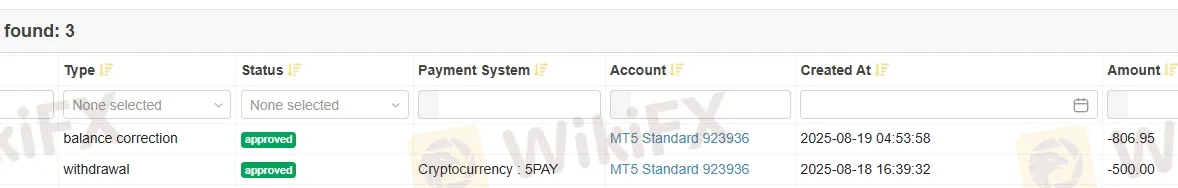

In April 2024, a user reported that MONAXA deducted over $22,000 USD from their account, citing “multiple login” violations from the same VPS. Another trader in 2024 claimed that $15,150 USD was removed from their MT4 platform after a manager allegedly told them they “won too much.”

Problems with Trading and Bonuses

- Price Manipulation: In September 2025, a trader in Malaysia reported extreme price manipulation during news events, claiming their pending orders were triggered 100 pips away from the actual market price.

- The Bonus Trap: Reviews from August 2025 suggest that MONAXA uses “100% bonus” offers to attract deposits. However, when traders attempt to withdraw profits, the broker reportedly demands video verification with ID and subsequently wipes out the earnings, returning only the initial deposit.

- Deposit Issues: Even the deposit process is not flawless, with some users in July 2025 reporting that funds failed to appear in their accounts for days while support tickets were ignored.

Because multiple users have mentioned being accused of “abusive behavior” or having their accounts locked after trying to access their funds, the MONAXA login process and account security are considered high-risk areas.

Trading Conditions and Account Types

For educational purposes, it is worth noting the technical offerings of the broker, though these should be viewed through the lens of the safety risks mentioned above. MONAXA offers four account types: CENT, STANDARD, PRO, and ZERO (ECN).

- Minimum Deposit: Starts at $15.

- Maximum Leverage: Up to 1:2000 (High risk).

- Platforms:MT4, MT5, and cTrader.

- Assets:Forex, Precious Metals, and Commodities.

While a 1:2000 leverage may seem attractive, it is a common tactic used by offshore brokers to induce high-volume trading that often leads to rapid account depletion.

Conclusion: Final MONAXA Review Recommendation

Based on the evidence from WikiFX records and international regulatory warnings, MONAXA is classified as a high-risk broker. The lack of a valid license, combined with consistent reports of profit theft and withdrawal delays in 2024 and 2025, makes it an unsafe choice for traders.

We strongly advise investors to avoid MONAXA and instead choose brokers regulated by Tier-1 authorities such as the FCA, ASIC, or CySEC (authorized CIFs). Protecting your capital starts with choosing a broker that is legally obligated to return it. Always verify a broker's status on WikiFX before making a deposit.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Promised 30% Returns, Lost RM630,000 Instead

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

Pepperstone Review: Regulation, Licences and WikiScore Analysis

Currency Calculator