简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pepperstone Review: Regulation, Licences and WikiScore Analysis

Abstract:This Pepperstone review provides a factual assessment of the regulatory framework, licensing structure and WikiScore of the Pepperstone broker, based on information available on the WikiFX platform

Overview of Pepperstone on WikiFX

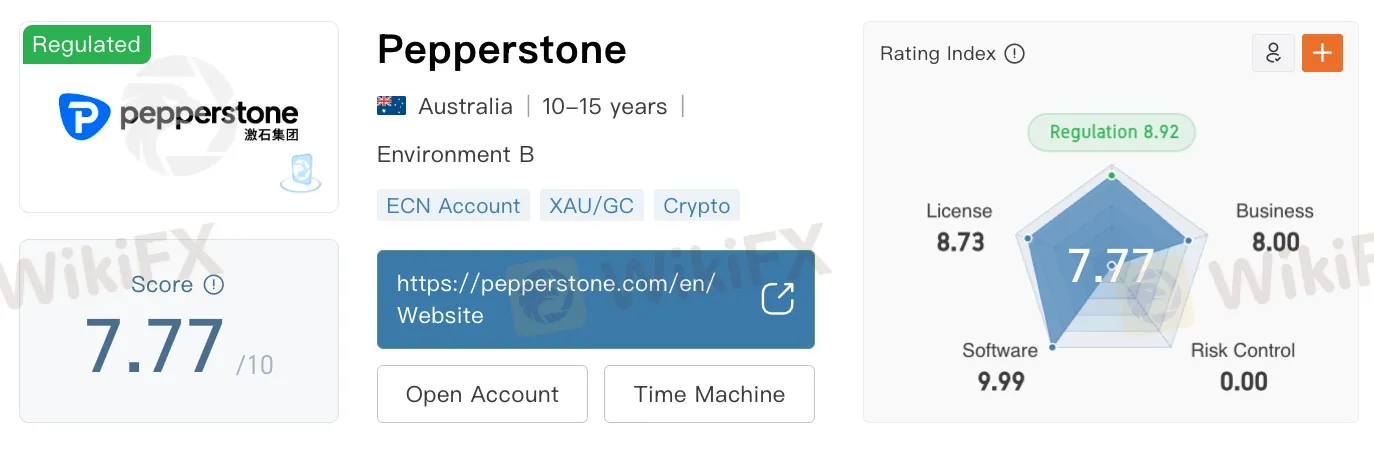

According to WikiFX, Pepperstone holds a WikiScore of 7.77 out of 10. This score places the broker within a moderately high ranking compared with other global brokers listed on the platform. The WikiScore is calculated using a combination of criteria, including regulatory licensing, licence quality, operational history, business scale, platform performance, and exposure indicators.

View WikiFXs full review on Pepperstone here: https://www.wikifx.com/en/dealer/0361453884.html

A score in this range generally reflects a broker with established regulatory coverage and a relatively stable operational profile. Within the context of this Pepperstone review, the score is largely supported by the brokers authorisation from multiple recognised financial regulators in major financial jurisdictions.

The WikiScore is intended as a comparative reference tool for traders evaluating brokers based on objective criteria. It does not function as an endorsement or guarantee, but rather as an informational benchmark that highlights a brokers regulatory standing.

Pepperstone Regulation Overview

Pepperstone regulation is based on licences issued by financial authorities in Australia, the United Kingdom, Cyprus and The Bahamas. Each licence permits the broker to provide trading services within specific jurisdictions and carries varying levels of supervisory oversight and investor protection requirements.

Australia Securities and Investments Commission

Pepperstone is authorised by the Australia Securities and Investments Commission under a Market Making Licence with licence number 414530. ASIC serves as the corporate and financial services regulator in Australia and is responsible for overseeing financial markets, investment firms and derivatives providers.

ASIC-regulated firms are required to meet capital adequacy standards, maintain client fund segregation and comply with strict reporting obligations. They must also implement internal compliance systems designed to manage operational risk and ensure transparency in client dealings.

Within the Pepperstone brokers regulatory structure, the ASIC licence represents a significant element of its oversight in the Asia Pacific region and reflects compliance with Australian financial legislation.

Financial Conduct Authority of the United Kingdom

Pepperstone is also authorised by the Financial Conduct Authority of the United Kingdom under a Forex Execution Licence with licence number 684312. The FCA is widely regarded as one of the most established financial regulators globally.

The FCA supervises financial services firms operating in the United Kingdom and enforces rules concerning capital reserves, conduct of business and the safeguarding of client funds. FCA authorised brokers are required to keep client funds separate from company funds and are subject to ongoing regulatory monitoring and reporting.

In terms of Pepperstone regulation, FCA authorisation provides oversight within one of the world‘s most developed financial markets and contributes to the broker’s compliance with recognised regulatory standards.

Cyprus Securities and Exchange Commission

Pepperstone holds a Market Making Licence issued by the Cyprus Securities and Exchange Commission under licence number 388/20. CySEC is the national financial regulator of Cyprus and operates under the broader regulatory framework of the European Union.

Firms authorised by CySEC must comply with European financial directives relating to investor protection, transparency and capital requirements. CySEC-regulated brokers are also required to implement procedures for client fund protection and to participate in compensation mechanisms, subject to eligibility conditions.

This licence extends Pepperstone's regulation within the European Economic Area and allows the broker to provide services in compliance with regional financial laws.

Securities Commission of The Bahamas

In addition to its licences in Australia, the United Kingdom and Cyprus, Pepperstone is authorised by the Securities Commission of The Bahamas under a Derivatives Trading Licence with licence number SIA F217.

The Securities Commission of The Bahamas regulates financial services entities incorporated within its jurisdiction. Offshore regulators generally apply different supervisory frameworks compared with major onshore regulators, and investor protection measures may vary in scope.

For the Pepperstone broker, this licence allows the provision of derivatives trading services to international clients in jurisdictions where local regulatory authorisation may not be available.

Regulatory Scope and WikiScore Context

The presence of licences from ASIC, the FCA and CySEC demonstrates that Pepperstone regulation includes oversight from recognised financial authorities in major financial centres. These regulators are known for enforcing structured compliance frameworks and operational standards for licensed brokers.

The additional authorisation from the Securities Commission of The Bahamas provides further operational flexibility for international business activities, although offshore supervision may differ from that of onshore regulators in terms of enforcement and investor protection mechanisms.

Pepperstones WikiScore of 7.77 reflects the combined influence of these regulatory licences, along with operational data and risk indicators assessed by WikiFX. Brokers with multi-jurisdictional regulatory coverage typically benefit from higher credibility scores due to the broader scope of oversight.

Conclusion

Pepperstone regulation spans both onshore and offshore financial authorities, each of which applies its own supervisory standards and compliance requirements. The brokers WikiScore of 7.77 places it within a moderately high ranking among global brokers listed on WikiFX.

As with any broker assessment, regulatory credentials should be considered alongside other operational factors such as trading conditions, platform reliability and individual risk tolerance. WikiFX provides regulatory and scoring information as a reference to support informed decision-making rather than as an endorsement.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Currency Calculator