Sarikei Online Scams Exposed: Police Trace Bank Account Owners

Police in Sarikei identify four bank account owners linked to online scams, with victims losing over RM475,000 in investment and tender frauds.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Regulatory warnings have exposed the unlicensed platform Eighttoro, which imitated well-known brands. Learn about the risks of fake brokers and how to protect your funds.

Choosing a trading platform can already be difficult for investors. That confusion is exactly what scammers behind a platform called eighttoro appear to have exploited—by deliberately blending the names and visual cues of two well-known brokers into a single, misleading brand.

Despite how it may sound, eighttoro has no connection to either Eightcap or eToro. It is an unauthorised platform that has drawn regulatory attention for attempting to pass itself off as something it is not.

The name “eighttoro” is not accidental. It closely resembles a combination of Eightcap and eToro, both established brokers with global recognition. The platforms branding reportedly echoed elements associated with eToro, increasing the likelihood that unsuspecting users might assume legitimacy based on familiarity alone.

This type of brand imitation is a common tactic in online financial fraud. By borrowing trust built by regulated companies, clone platforms attempt to lower investors guard before any verification takes place.

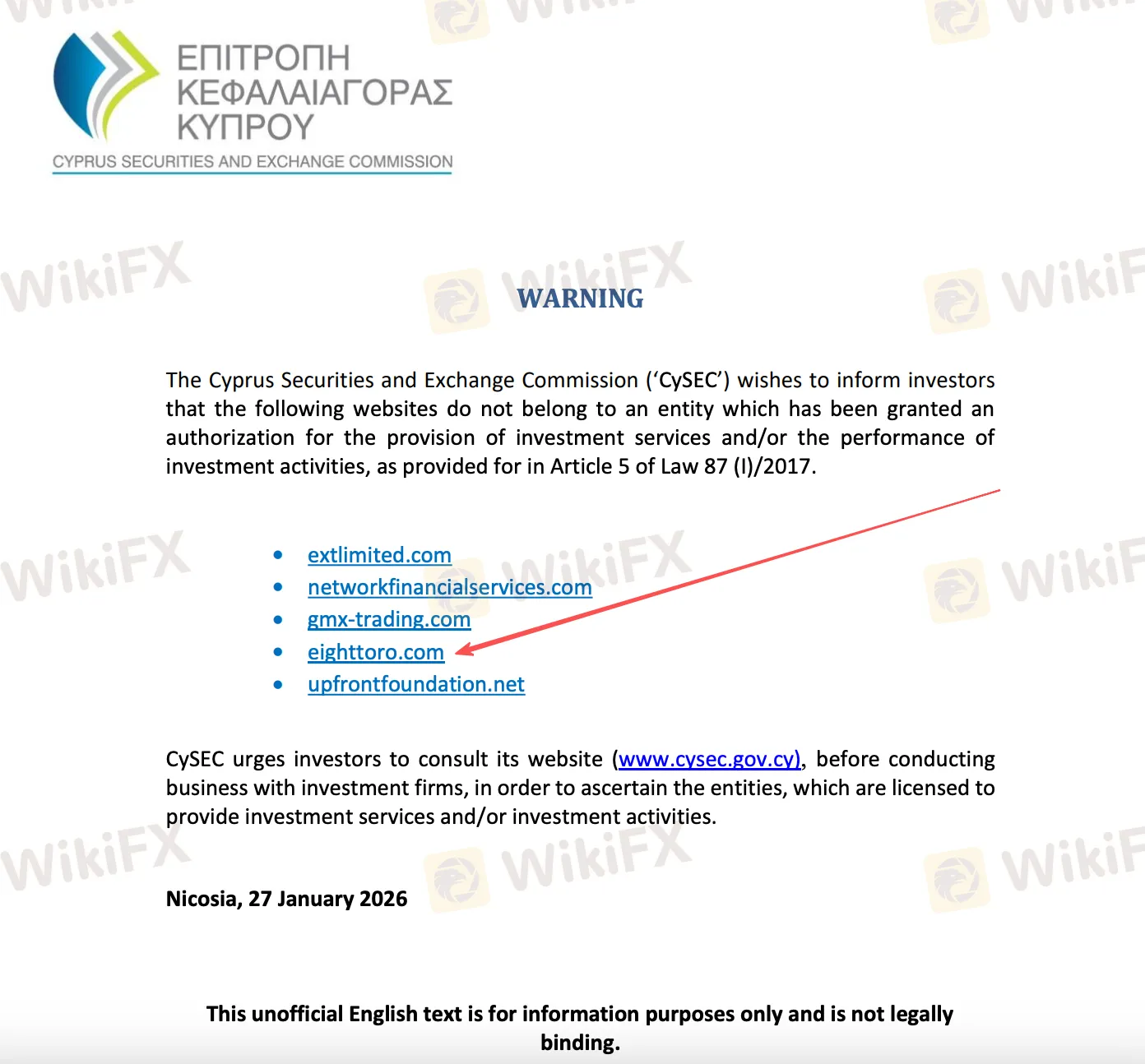

Cyprus financial regulator has issued a public warning against eighttoro, confirming that the platform is not authorised to offer investment services. The warning grouped eighttoro alongside several other unauthorised websites targeting retail traders.

Shortly after regulatory attention, the platforms website became inaccessible. However, archived versions of the site suggest it previously operated in Russian, indicating a targeted approach toward specific language communities rather than a truly global operation.

Before going offline, eighttoro claimed to provide access to thousands of trading instruments across forex, equities, cryptocurrencies, and other asset classes. It also promoted figures such as hundreds of thousands of users worldwide—numbers that would rival or exceed many long-established brokers.

Such exaggerated claims are a recurring pattern among fraudulent platforms. Large user counts and expansive product offerings are often used to create a false sense of scale and credibility, especially when no regulatory filings or independent verification exist.

The case of eighttoro reflects a broader trend rather than an isolated incident. Financial institutions have become the most frequently impersonated sector online, with typosquatted domains and clone websites forming a large share of scam-related internet traffic.

Industry leaders have openly acknowledged that fake websites and impersonation accounts are now being discovered and taken down on a near-daily basis. Regulators, meanwhile, continue to issue warnings about fraudulent use of official names, logos, and even staff identities.

Despite enforcement efforts, regulators themselves admit that scammers adapt quickly. As soon as one domain is blocked, another may appear under a slightly different name or structure.

Cases like eighttoro underline an important reality: a familiar or well-designed brand name does not guarantee legitimacy. Before engaging with any trading platform, investors should take the time to verify regulatory status, corporate background, and operational history through reliable, independent sources.

Using broker information platforms such as WikiFX can help investors quickly check licensing records, risk warnings, and exposure reports linked to a platform. In an environment where fraudulent websites increasingly imitate legitimate firms with high precision, conducting basic verification in advance remains one of the most effective ways to reduce unnecessary risk.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Police in Sarikei identify four bank account owners linked to online scams, with victims losing over RM475,000 in investment and tender frauds.

Did SolisMarkets fail to restore your forex trading account balance despite repeated follow-ups with the broker? Does the forex broker contact you only for deposits but run away as you request fund withdrawals? Have you failed to receive adequate support from the broker on trading guidance? In this SolisMarkets review article, we have investigated many trader complaints. Take a look!

As of 2026, the main question about XeOne regulation has a clear answer based on facts: this broker works without a real financial license from any trusted, top-level regulatory authority. Our research into public records and watchdog websites shows serious concerns that potential traders need to understand before working with this company. While the company, XeOne Prime Ltd, does have a business registration in Mauritius, this is an important difference that should not be confused with financial regulation. A business registration lets a company legally exist, but it does not give it permission to offer financial services, and it does not put it under the strict oversight needed to protect client capital. This article gives a detailed, fact-based analysis of XeOne's operating status. We will break down its business standing, look at the serious complaints from users, and examine its product offerings to show the risks involved. The goal is to give you the facts needed to make a smart

If you're asking 'Is XeOne legit?' or have heard talk about a 'XeOne scam,' you are doing important research. Your capital's safety depends on finding the right answers. In the complicated world of online trading, telling the difference between a trustworthy company and a dangerous one is the most important skill any trader can learn. This review aims to give you a clear, fact-based answer to your questions. We will examine how XeOne works, what regulations it follows, and what users say about it to give you a final answer. To be honest, our research shows that XeOne presents serious risks to traders and works without proper government oversight. This entire review is based on checkable facts gathered by WikiFX, a worldwide platform for checking broker regulations, making sure our findings are clear and based on real information. We will explain exactly why we reached this conclusion and what it means for anyone thinking about investing in this company.