简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MONAXA Review: Safety, Regulation & Forex Trading Details

Abstract:MONAXA currently holds a very low safety score on WikiFX due to a lack of valid regulation and multiple warnings from authorities like CySEC and the FSA. Recent user data highlights severe risks, including repeated complaints regarding profit deductions and withdrawal denials.

Key Takeaways

- Regulatory Warning:MONAXA is unregulated and has appeared on warning lists by CySEC (Cyprus) and the FSA (Japan).

- High Risk Score: With a WikiFX score of 2.24, this broker falls into a dangerous category for investors.

- User Complaints: Multiple reports cite unfair profit deductions, withdrawal refusals, and strict rules regarding account login methods.

- Trading Conditions: While it offers MT4 and MT5, the trading environment is rated as “Poor” with Grade D execution speeds.

MONAXA Broker Summary: Safety Score and Key Issues

Conducting a thorough MONAXA review reveals significant safety concerns for potential investors. Established in 2022 and headquartered in Anguilla, this broker has quickly garnered negative attention in the Forex market.

The WikiFX system assigns MONAXA a low score of 2.24 out of 10. This score reflects the broker's lack of recognized licensing and the high volume of investor complaints. While the broker claims specific regional influence in Malaysia and Indonesia, the underlying safety metrics suggest a high-risk environment. Investors often search for a reliable MONAXA broker experience, but the data indicates potential instability in fund security and operational transparency.

MONAXA Regulation: Is the License Real?

For any MONAXA Forex trader, regulation is the primary safety net. According to WikiFX records, MONAXA does not hold a valid license from a Tier-1 regulator. Instead, it operates out of Anguilla, a jurisdiction with looser financial oversight compared to hubs like the UK or Australia.

More critically, regulatory bodies have issued specific warnings against this entity.

- CySEC (Cyprus): Issued warnings in 2025 identifying domains associated with MONAXA as unauthorized.

- FSA (Japan): Issued a warning in December 2024 regarding the operator not being registered to conduct financial business.

Regulatory Status Table

| Regulator | License Type | Status |

|---|---|---|

| Anguilla Registry | Corporate Registration | No Forex License |

| CySEC (Cyprus) | Regulatory Disclosure | Warning / Unauthorized |

| FSA (Japan) | Regulatory Disclosure | Warning / Unregistered |

Because MONAXA lacks valid supervision, client funds may not be protected by segregation laws or compensation schemes.

User Reviews: Withdrawal Limits & Login Complaints

A critical part of this MONAXA review involves analyzing user feedback. Data from 2024 and 2025 indicates a pattern of disputes centered on financial withdrawals and the application of trading rules.

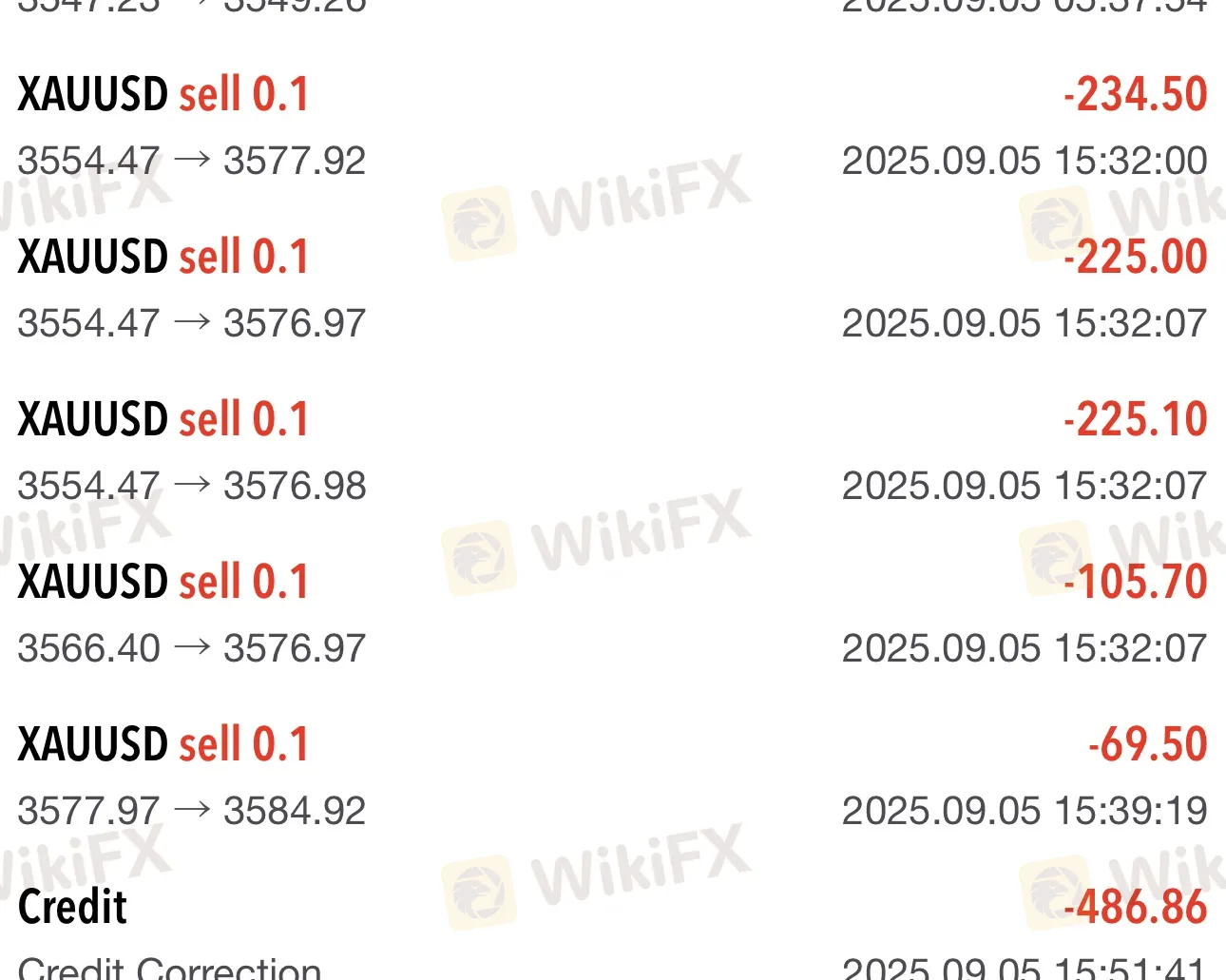

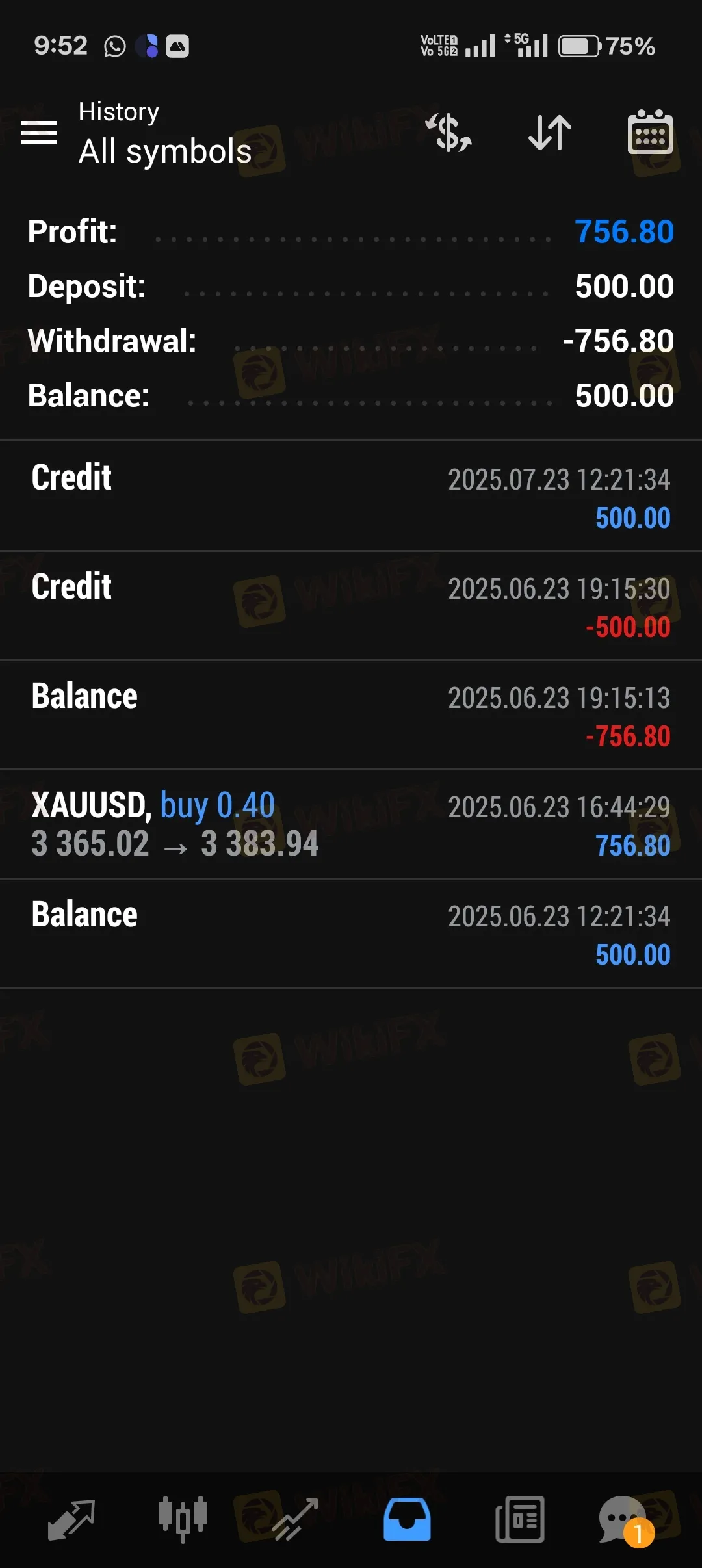

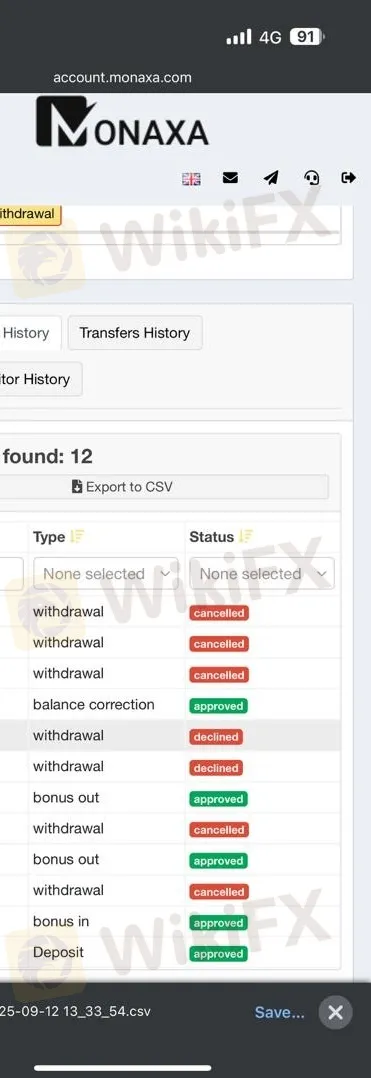

Profit Deductions and Withdrawal Issues

The most frequent complaint involves the removal of profits.

- Case Evidence (September 2025): A user from Malaysia reported that after claiming a bonus, the broker “deducted all profit” and accused the user of abuse without clear evidence.

- Case Evidence (April 2024): Another trader reported a deduction of approximately $15,000 from their account, with the broker claiming they “won too much.”

- Withdrawal Delays: Users from India and Singapore noted that while deposits are instant (under 24 hours), withdrawals often face indefinite delays or are completely ignored by support tickets.

Login Rules and Account Blocking

Several detailed reports mention issues related to login methods and Virtual Private Servers (VPS).

- VPS & Login Restrictions: One user reported a loss of $22,000 USD because MONAXA accused them of breaking rules by having “multiple login with same VPS.” This suggests the broker may enforce strict, non-standard rules regarding how traders access their accounts to deny profits.

- Account Access: Investors have reported being blocked after requesting withdrawals, effectively losing access to their capital.

Trading Environment & Software

MONAXA provides access to industry-standard platforms, including MT4, MT5, and cTrader.

- Leverage: Offers up to 1:1000 leverage, which is extremely high and significantly increases the risk of rapid capital loss.

- Spreads: Standard accounts see spreads starting from 1.8 pips, which is not competitive compared to industry leaders.

- Execution Quality: WikiFX benchmark data rates the transaction speed and slip grade as Poor (D), specifically noting slow execution speeds on the downside.

Conclusion: Final MONAXA Review Recommendation

Based on the available data, MONAXA presents a high-risk profile for Forex traders. The combination of absent regulation, official warnings from CySEC and FSA, and a pattern of user complaints regarding profit deductions and login policy violations makes this broker unsafe for substantial investment.

Recommendation: Investors should prioritize brokers with Tier-1 regulation (such as FCA, ASIC, or NFA) where dispute resolution channels are legally mandated. Avoiding unregulated entities like MONAXA is the safest strategy to protect your capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Currency Calculator