Abstract:CXMarkets review has attracted increasing attention among Forex traders searching for new trading opportunities. However, when evaluating any broker, regulation, transparency, and risk indicators are far more important than marketing claims.

CXMarkets review has attracted increasing attention among Forex traders searching for new trading opportunities. However, when evaluating any broker, regulation, transparency, and risk indicators are far more important than marketing claims.

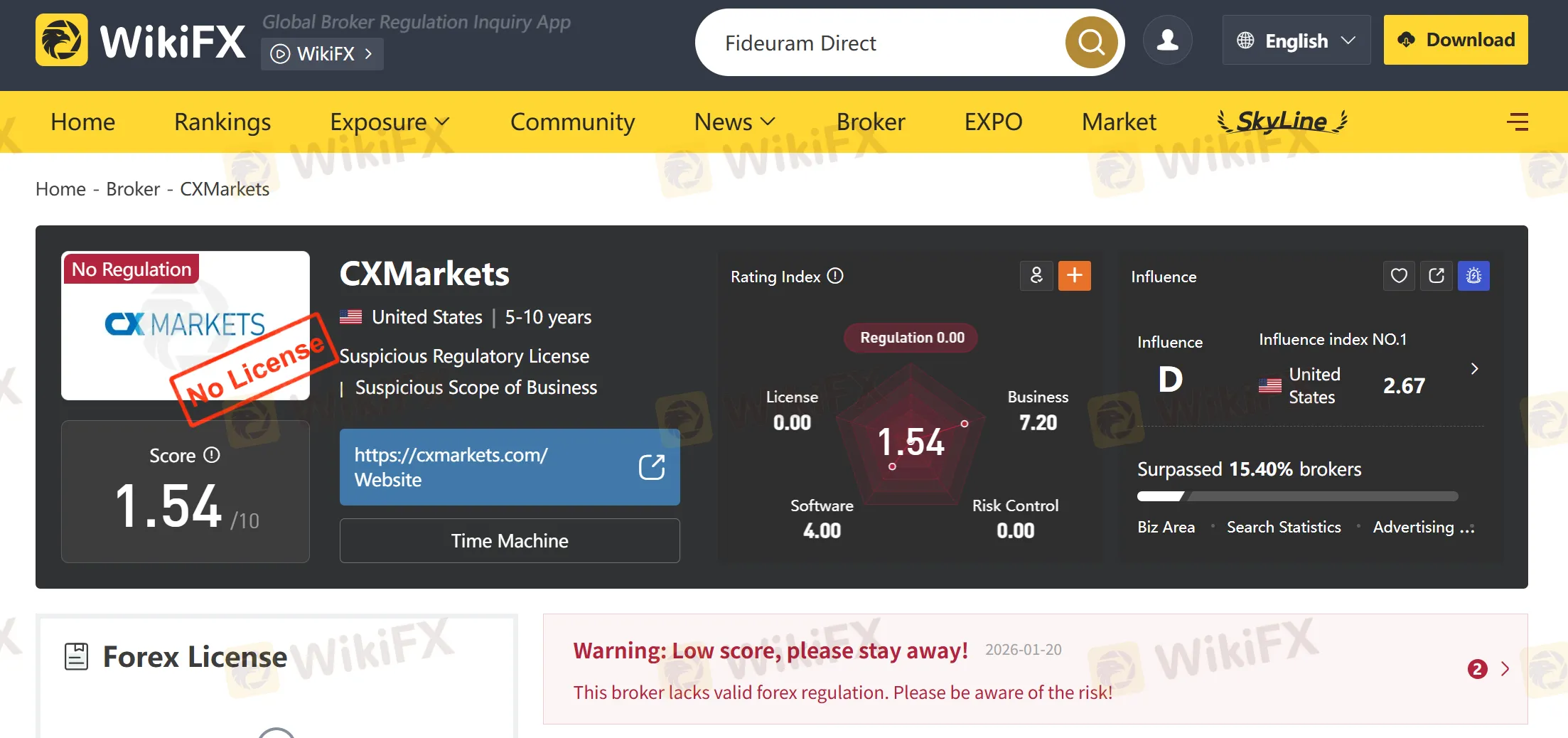

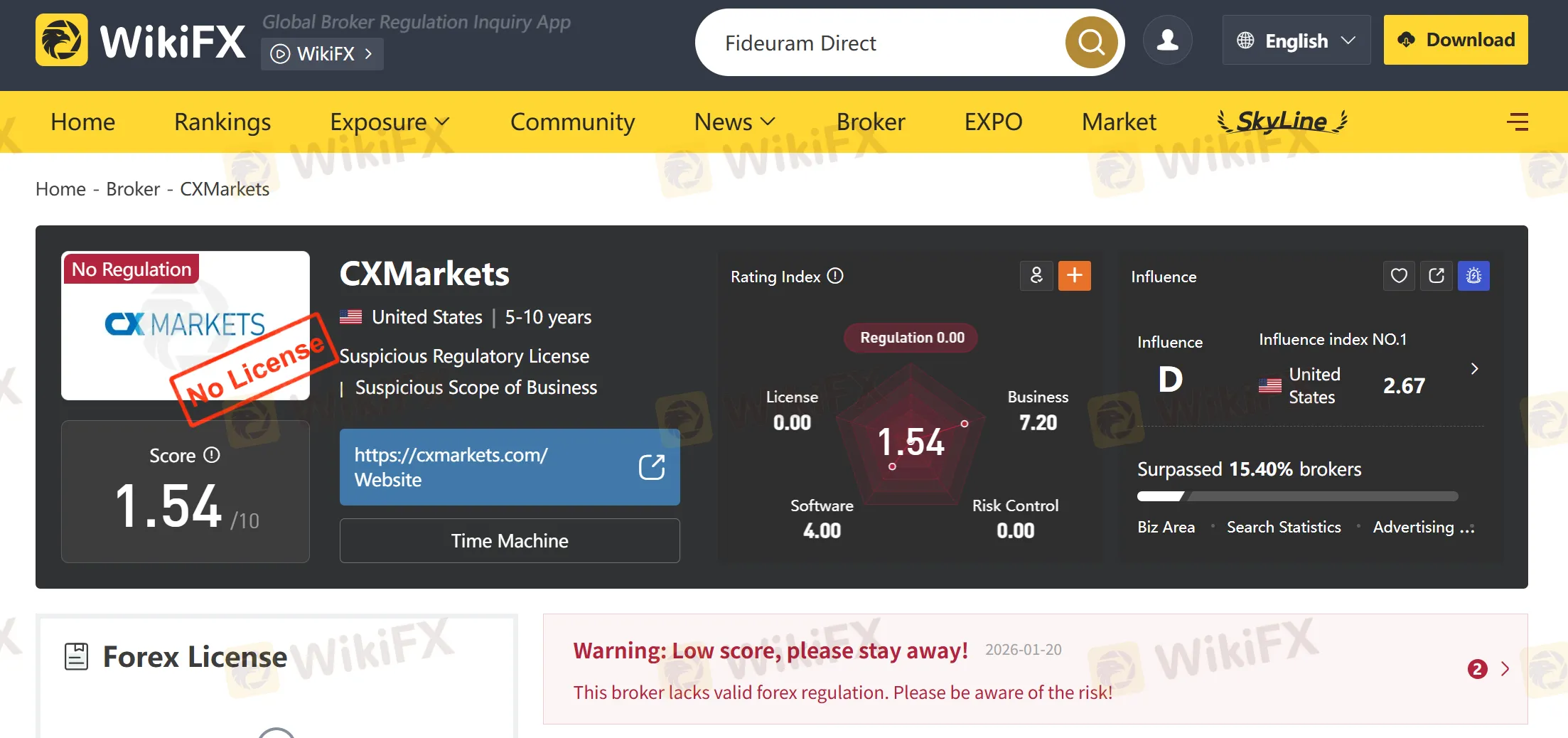

According to WikiFX, CXMarkets has received a low score of 1.54/10, raising serious concerns about its safety and credibility. In this review CXMarkets article, we analyze the brokers background, regulation status, trading offerings, risks, and compare it with better-known regulated Forex brokers.

What Is CXMarkets?

CXMarkets presents itself as an online Forex and CFD broker, offering access to popular financial instruments such as:

- Forex currency pairs

- Indices

- Commodities

- Possibly cryptocurrencies (depending on region)

Despite these offerings, CXMarkets brokers lack sufficient publicly available information regarding corporate ownership, regulatory licenses, and operational transparency—key warning signs for traders.

CXMarkets Regulation: Is CXMarkets Regulated?

One of the most critical questions in any CXMarkets review is regulation.

Regulation Status: High Risk

Based on publicly available data and WikiFX, CXMarkets regulation is either unclear or nonexistent. The broker does not hold a valid license from major financial regulators, such as:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- NFA / CFTC (United States)

Unregulated Forex brokers pose significant risks, including fund misappropriation, withdrawal refusal, and lack of legal protection.

Regulation CXMarkets remains a major red flag for both beginner and experienced traders.

WikiFX Risk Assessment of CXMarkets

According to WikiFX, broker CXMarkets has been assigned a risk score of 1.54/10, which places it firmly in the high-risk broker category.

Key Risk Factors Highlighted by WikiFX:

- No valid regulatory license

- Limited transparency about company ownership

- Potential operational risks

- Insufficient investor protection

A score this low strongly suggests traders should proceed with extreme caution—or avoid the broker entirely.

Trading Products and Services (CXMarkets Forex)

Available Instruments (Claimed):

- Forex trading (major & minor pairs)

- CFDs on indices and commodities

However, CXMarkets Forex lacks clear disclosures regarding:

- Leverage limits

- Spread types (fixed or floating)

- Execution model (STP, ECN, or Market Maker)

This lack of clarity further increases trading risk.

CXMarkets Pros and Cons

Potential Advantages

- Access to Forex and CFD markets

- Simple onboarding process

Major Disadvantages

- No credible regulation

- Very low WikiFX score (1.54/10)

- Lack of transparency

- Unclear trading conditions

- Weak investor protection

CXMarkets vs Regulated Forex Brokers (Comparison Table)

Is CXMarkets Legit or a Scam?

While CXMarkets markets itself as a Forex broker, the absence of valid regulation and its extremely low WikiFX score make it a high-risk trading platform.

This CXMarkets review does not classify the broker as outright illegal, but it clearly falls into the unsafe and unverified broker category, especially when compared to regulated alternatives.

Who Should Avoid CXMarkets?

You should avoid CXMarkets brokers if you:

- Are a beginner trader

- Require strong regulatory protection

- Value transparent trading conditions

- Want reliable withdrawals and dispute resolution

Final Verdict: Should You Trade With CXMarkets?

Final Rating: High Risk – Not Recommended

Based on WikiFX data, regulation gaps, and transparency issues, Forex CXMarkets does not meet the basic safety standards expected of a trustworthy broker.

Traders are strongly advised to choose fully regulated Forex brokers with proven track records, strong oversight, and higher WikiFX ratings.