简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FBS Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:FBS holds reputable licenses from ASIC and CySEC, earning a solid WikiFX score of 7.58, yet it faces a critical volume of over 170 recent complaints regarding profit cancellations and withdrawal denials. While technically regulated, the disconnection between its compliance on paper and heavy user reports of "Balance Fixed" deductions urges extreme caution.

Executive Summary: FBS poses a complex dilemma; while it holds top-tier licenses from ASIC and CySEC earning it a high trust score, it currently faces over 170 recent complaints involving rejected withdrawals and retroactively cancelled profits. Traders must weigh the safety of its regulatory status against a flood of reports describing aggressive “profit wiping” tactics.

Before you find a Forex broker to trust with your hard-earned capital, you need to look beyond the surface-level marketing. In this FBS review, we dig deep into why a broker with a respectable 7.58 WikiFX Score is causing panic among so many of its active users. Is your money actually safe, or is the regulatory shield just a facade?

Question 1: FBS Regulation & Safety: Is my money safe?

Safety in trading starts with one word: regulation.

According to the latest database records, FBS is regulated by two major authorities:

1. Cyprus Securities and Exchange Commission (CySEC) under license number 331/17.

2. Australia Securities & Investment Commission (ASIC) under license number 426359.

On paper, this is a strong FBS regulation status. ASIC is a “Tier-1” regulator, known as one of the strictest police forces in the financial world.

Why does this matter?

When a broker is regulated by a Tier-1 agency like ASIC, they are typically required to keep client money in Segregated Accounts. Imagine a piggy bank that belongs to you, which the broker can see but cannot smash open to pay for their own office rent or marketing. If the broker goes bankrupt, your money should theoretically still be sitting in that piggy bank, safe and sound.

However, there is a catch.

While FBS has these established licenses, their summary also mentions a headquarters in Belize and a negative disclosure from the Malaysia Securities Commission (SCM), which placed them on an investor alert list. Many brokers legally operate an “offshore” branch (like Belize) to offer higher leverage or easier sign-ups. If you register under the offshore branch, the strict protections of ASIC or CySEC do not apply to you. You essentially step out of the “safe zone” and into a jurisdiction with fewer safety nets.

Question 2: Are the trading fees and leverage fair?

FBS offers a maximum leverage of 1:30 for its standard accounts in this dataset. In the world of Forex broker features, leverage is often marketed as a tool to “get rich quick,” but you should think of it as a “double-edged sword.”

How does leverage work?

Imagine you have $100. With 1:30 leverage, the broker lets you trade as if you have $3,000.

- The Good: If the price goes up 1%, you gain 30% on your actual money.

- The Bad: If the price drops just 3.3%, your entire $100 is wiped out instantly.

FBS offers accounts like “Standard” (Spreads from 0.7) and “Ultra” (Spreads from 0).

Educational Context: The “Spread” is the cost you pay to open a trade. It's the difference between the Buy and Sell price. A 0.7 spread is relatively competitive. However, low costs mean nothing if the broker manipulates the price execution, a concern we will address next.

Question 3: What are real traders complaining about?

This is where the FBS review takes a dark turn. Despite the good score, the WikiFX database has flagged 170 complaints in just the last 3 months. Analyzing the specific `casesText`, a terrifying pattern emerges.

The “Balance Fixed” Nightmare

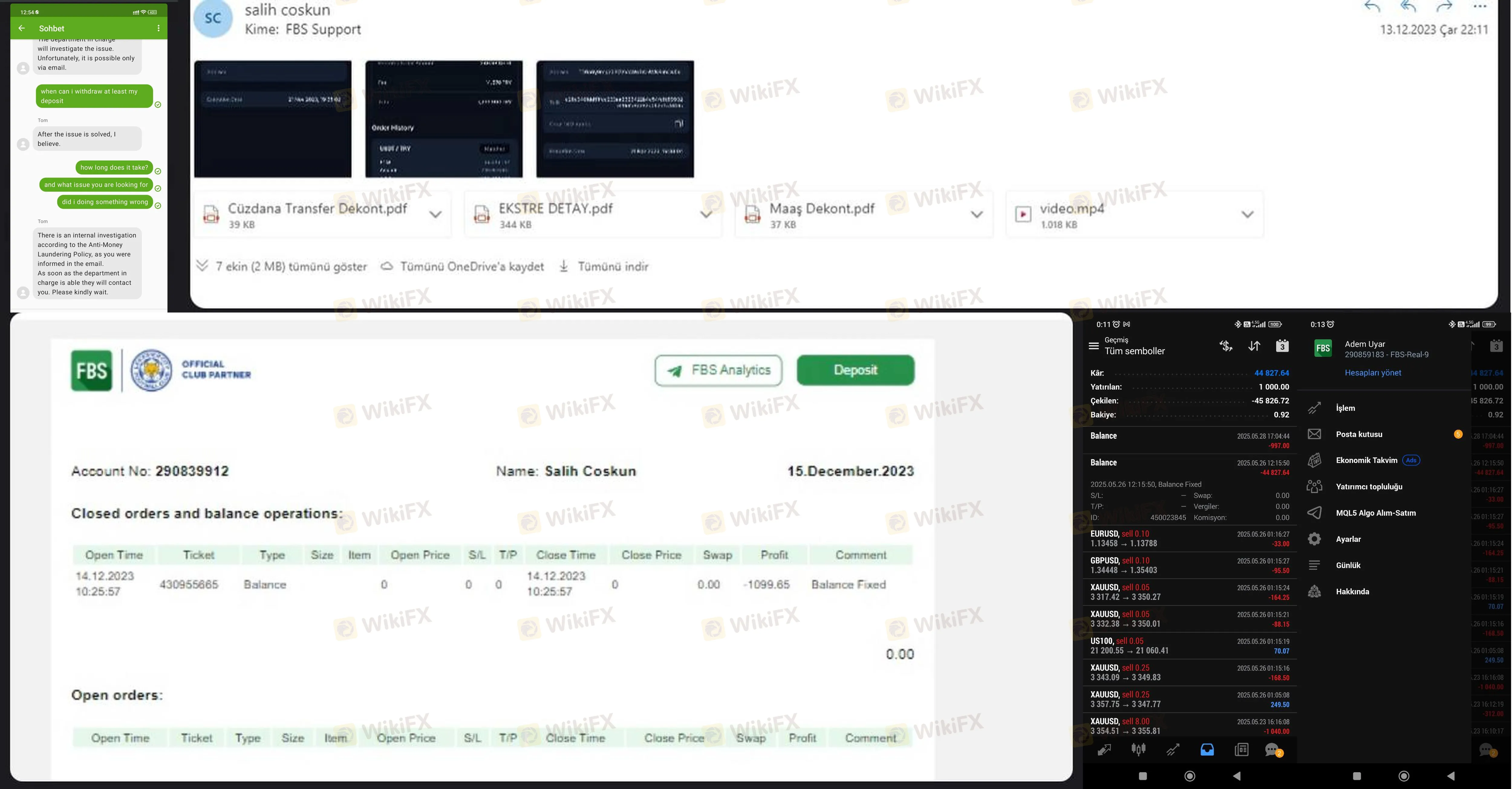

Multiple traders (Case 14, 18, 40) report making profits, only to have the money disappear from their accounts under a transaction labeled “Balance Fixed.”

- Real Story: One trader deposited $248, grew it to over $1,000, and then FBS removed purely the profits, citing “Anti-Money Laundering” checks.

- The Verdict: Legitimate brokers do not arbitrarily confiscate profits. They may freeze accounts for investigation, but simply deleting money is a major red flag often called “churning.”

Price Manipulation

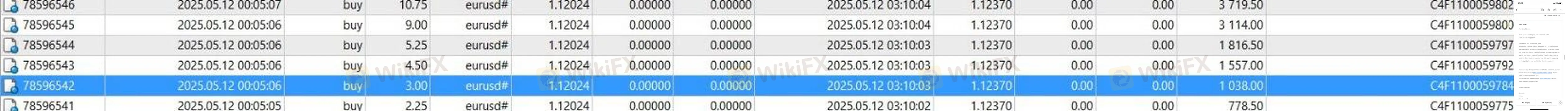

Case 1 describes a trader with a massive account who saw their pending orders filled at a price 40 points worse than the market price shown at other brokers. This is called Slippage.

- Educational Context: Slippage happens when the market moves faster than your order can be filled. However, when it happens only on one broker and not others (as seen in Case 20 with Silver prices), it suggests the broker might be feeding you “bad data” to trigger your stop-loss and absorb your funds.

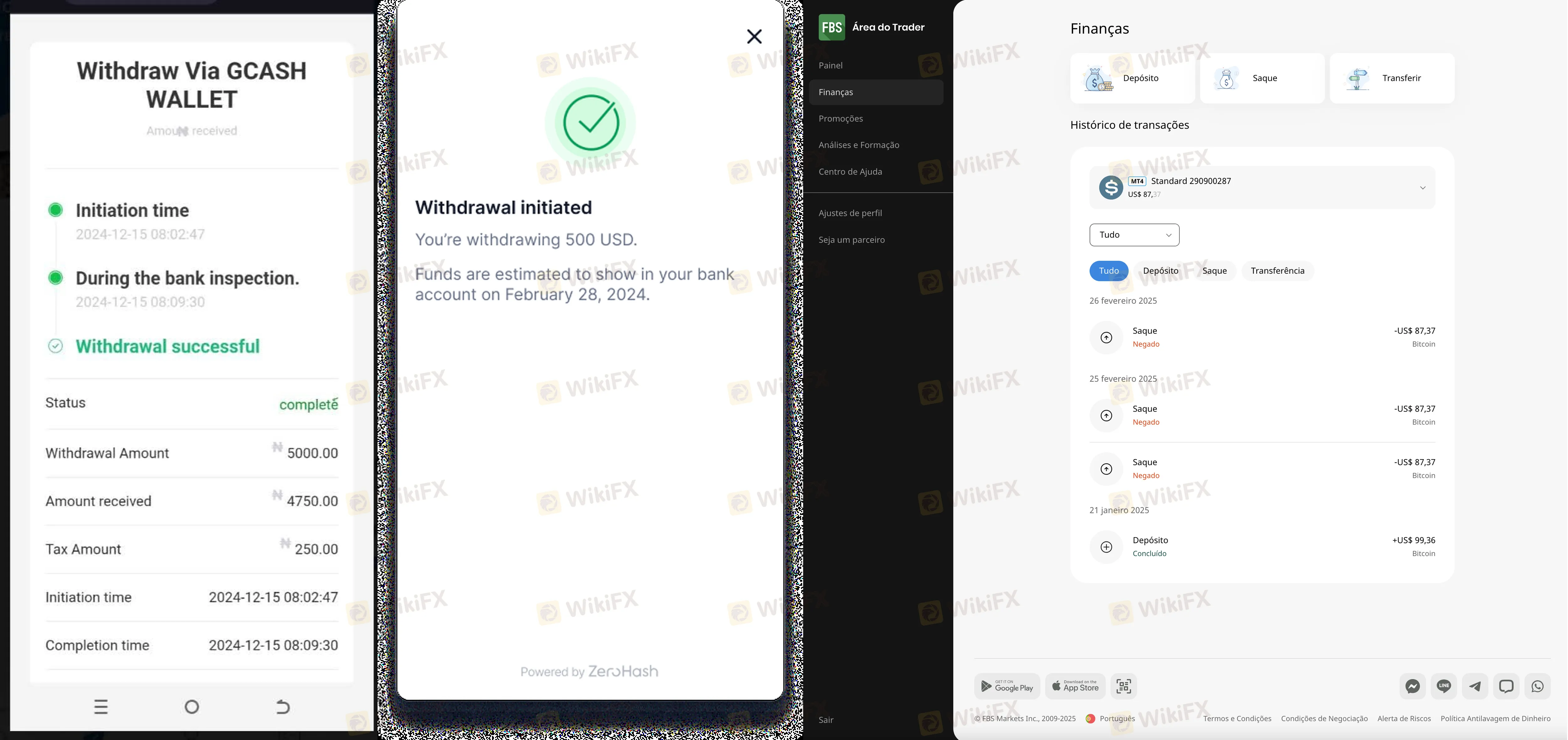

Withdrawal Roadblocks

Dozens of cases (Case 31, 32, 47, 50) report that withdrawals are marked as “Successful” on the dashboard but never reach the bank. Support reportedly asks for endless “video selfies” or claims the deposit method doesn't match the withdrawal method, even when it does.

Pro Tip: If a broker asks for a “deposit” or “tax fee” to release your withdrawal (as seen in Case 58), stop immediately. This is a classic scam tactic. No legitimate broker charges you more money to give you your money.

Question 4: What software will I use?

FBS provides access to the industry-standard MT4 and MT5, as well as their own proprietary mobile app.

Security Warning: The FBS Login Process

When using these platforms, especially proprietary apps, security is paramount. Always ensure you are on the official URL before entering your FBS login details to avoid phishing sites.

However, the bigger risk here isn't hackers—it's the backend. In Case 54 and 66, traders noticed the price charts on the FBS app were different from global charts (like TradingView).

- Why this matters: If you use a broker's own app, they control the data feed. If they want to hunt your Stop Loss, they can momentarily dip the price on their app (and only their app) to close your trade. Using neutral platforms like MT4 can sometimes be safer, but only if the broker feeds legitimate market data into it, which serves as the core complaint from many FBS users.

Final Verdict: Should I open an account?

The data presents a conflicting picture. FBS has the regulatory licenses (ASIC/CySEC) that usually guarantee safety, earning it a solid WikiFX Score of 7.58. However, the operational reality reported by hundreds of traders—specifically regarding “Balance Fixed” profit removals and withdrawal refusals—is alarming.

The Bottom Line:

A license is a shield, but it seems there are cracks in the armor, likely involving the offshore entity where many international clients are registered. If you are a high-volume or profitable trader, the risk of having your profits cancelled appears statistically high based on recent data.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and investor alerts.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Currency Calculator