简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Common Questions About Tradeview Markets: Safety, Fees, and Risks (2025)

Abstract:Finding a broker that balances low trading costs with fund security is the ultimate goal for any trader. Tradeview Markets often attracts attention due to its competitive ECN spreads and high leverage options. However, flashy trading conditions mean very little if your capital isn't safe.

Finding a broker that balances low trading costs with fund security is the ultimate goal for any trader. Tradeview Markets often attracts attention due to its competitive ECN spreads and high leverage options. However, flashy trading conditions mean very little if your capital isn't safe.

Based on real-time data and regulatory filings from WikiFX, Tradeview Markets currently holds a confidence score of 3.90 out of 10. This falls significantly below the threshold considered “safe” by industry standards. Before you open an account, it is vital to understand the regulatory gaps and the surge of serious user complaints emerging in 2025.

Is Tradeview Markets actually regulated?

The short answer is: Yes, but with major caveats and warning signs.

Tradeview Markets (TVM Global Limited) holds a license from the Labuan Financial Services Authority (LFSA) in Malaysia. While this designates them as a legal entity, Labuan is considered an offshore regulatory jurisdiction. Unlike Tier-1 regulators (such as the FCA in the UK or ASIC in Australia), offshore regulators often have looser requirements regarding segregated client funds and compensation schemes in the event of broker insolvency.

The “Exceeded” Warning

More concerning is the status of their license with the Cayman Islands Monetary Authority (CIMA). According to the WikiFX database, this license is flagged as “Exceeded.” In regulatory terms, this usually means the broker is operating outside the permitted scope of their license or that the entity handling your money is not the specific entity that holds the license. This creates a legal gray area where—if things go wrong—traders may not have any legal recourse.

Regulatory Blacklists

Perhaps the biggest red flag is a public warning from the National Securities Market Commission (CNMV) of Spain. They have explicitly stated that Tradeview Ltd is not authorized to provide investment services. When a European regulator issues a warning, it typically suggests the broker is soliciting clients illegally without adhering to strict investor protection laws like negative balance protection.

What problems are users reporting?

The user feedback for Tradeview Markets has taken a disturbing turn recently, with 15 serious complaints logged effectively turning the feedback section into a warning zone.

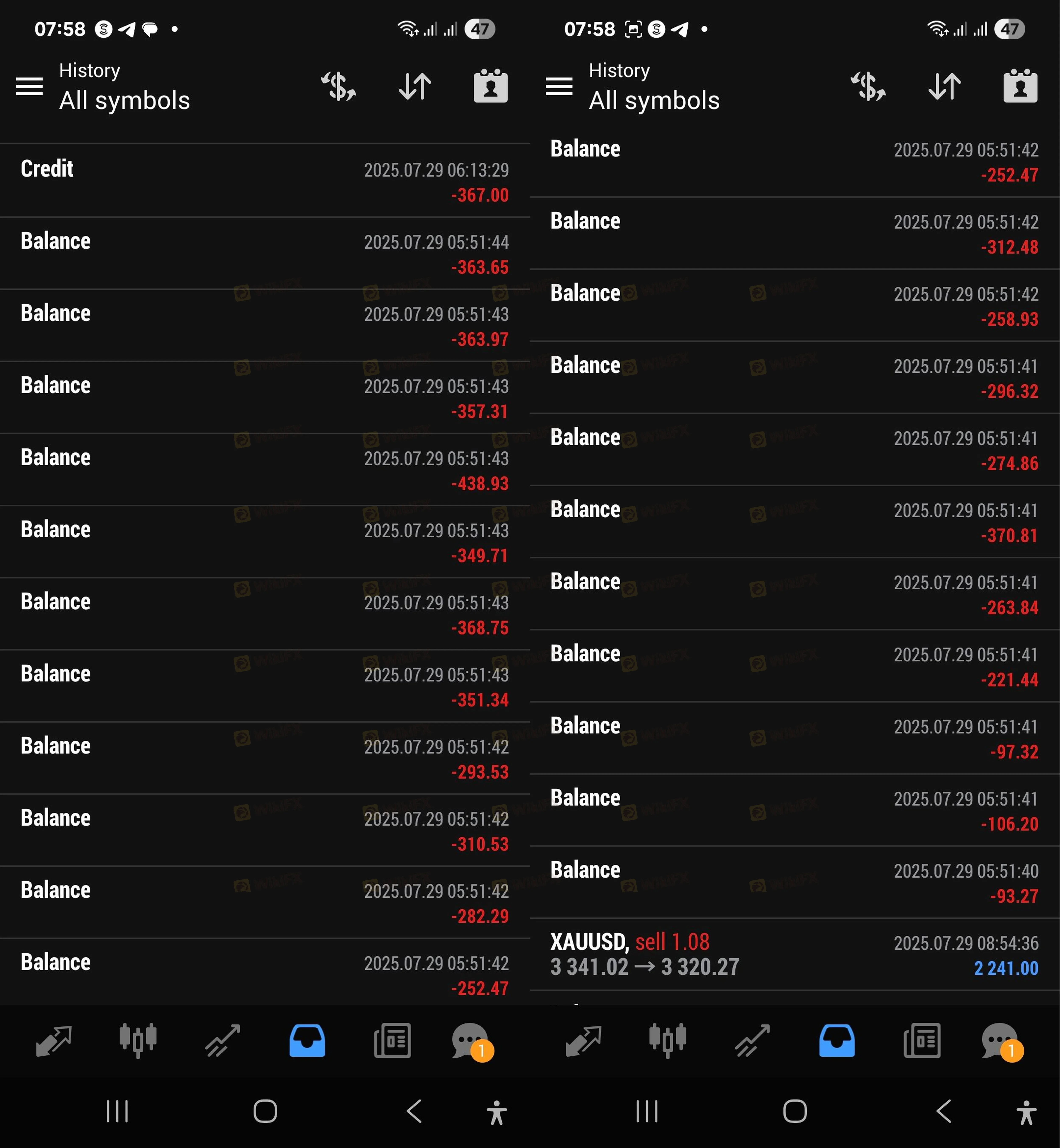

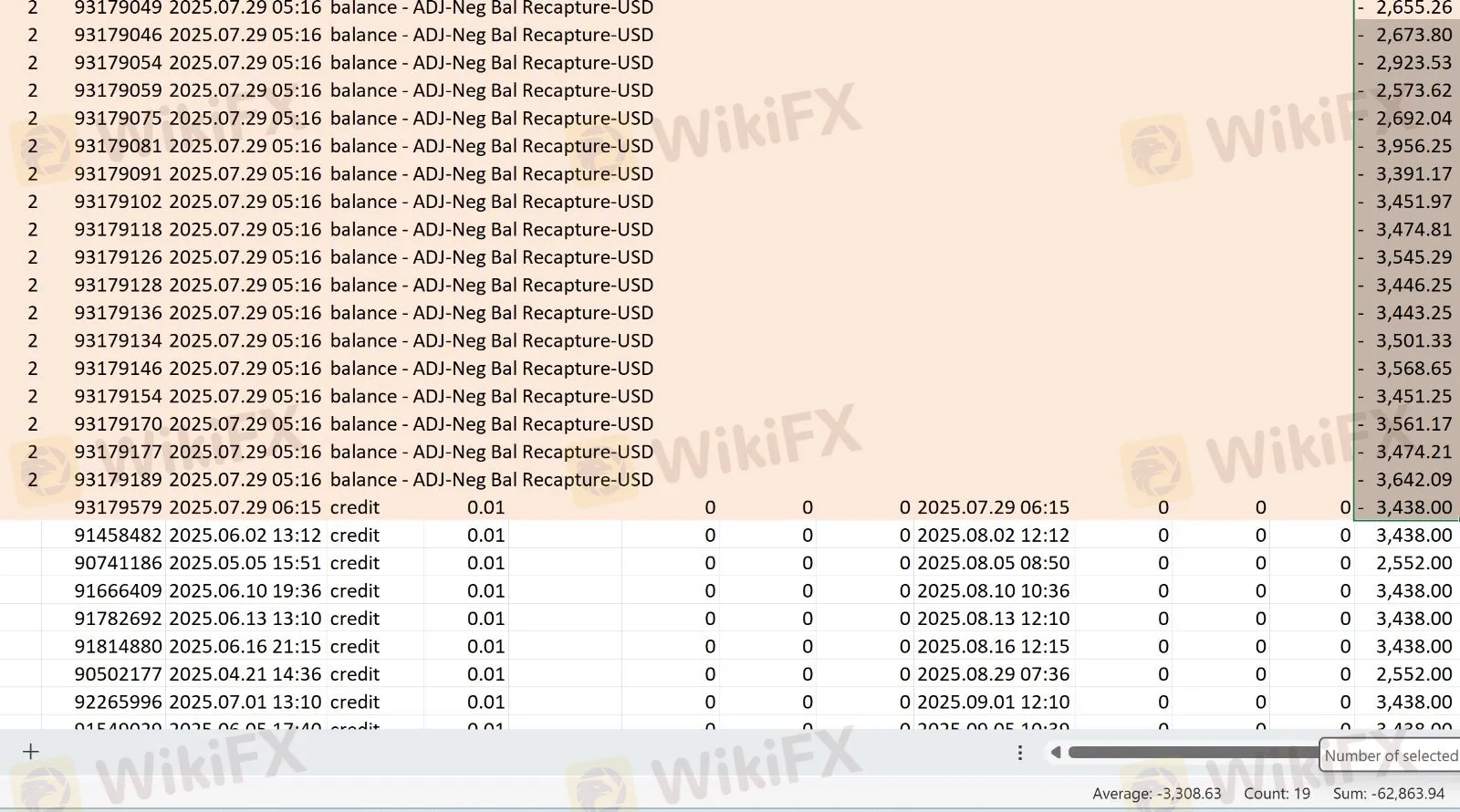

Sudden Fund Deductions and “Negative Balance Recapture”

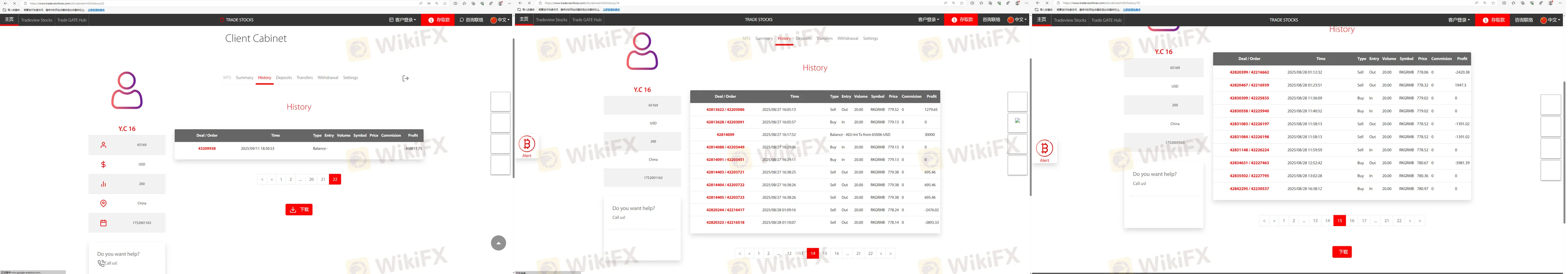

A recurring and alarming theme in the 2025 complaints is the sudden disappearance of funds. Multiple users report that funds—ranging from $8,000 to over $160,000—were wiped from their accounts overnight. The broker allegedly justifies this as “negative balance recapture” or historical adjustments, often without prior notice or transparent calculation.

One particularly detailed case from August 2025 describes a user who had $8,635 removed, leaving a negative balance. Another user claimed the broker removed $62,000 citing an “old credit balance” that had supposedly been settled years ago.

Coercion and NDAs

What makes these complaints unique—and particularly dangerous—is the alleged aftermath. Several traders report that after their funds were deducted, Tradeview Markets effectively held the remaining balance hostage. Users claim they were forced to sign legal agreements under duress, promising not to post negative reviews or sue the company, just to be allowed to withdraw whatever small amount was left in their accounts.

Case Evidence: A user reported getting blocked on WhatsApp after questioning a $62,000 deduction and being forced to sign a silence agreement to access remaining capital.

The “Pig Butchering” Pattern

Other complaints coming from Malaysia and Hong Kong describe behavior matching “pig butchering” scams. Users are invited into WhatsApp groups, encouraged to deposit, and allowed to trade normally for a while. However, once they attempt to withdraw significant profits or principal (in one case over 300,000 USDT), the account is reportedly deleted, trading records are wiped, and communication lines are cut.

What trading conditions does Tradeview Markets offer?

If you look past the safety concerns, the technical trading environment at Tradeview is designed to appeal to high-volume/high-risk traders.

Leverage Rules

Tradeview offers maximum leverage of up to 1:400.

- The Implication: While high leverage allows you to control large positions with a small deposit (e.g., controlling $40,000 with just $100), it implies high risk. In regulated zones like Europe, leverage is capped at 1:30 to protect traders. A 1:400 ratio means a market move of just 0.25% against you could wipe out your entire account instantly.

Spreads & Costs

The broker offers three main account types: Standard, ECN, and cTrader.

- ECN/cTrader: These accounts feature raw spreads starting from 0.0 pips. This is ideal for scalpers and algorithmic traders who need tight pricing. However, 0.0 spreads almost always come with a commission fee per lot traded.

- Asset Classes: Interestingly, the data indicates that Cryptocurrency trading is NOT allowed. This is a significant limitation for modern traders looking to diversify into Bitcoin or Ethereum within the same platform.

Software

Tradeview provides the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, along with cTrader. These platforms are robust, supporting Expert Advisors (EAs) and automated trading strategies. However, excellent software cannot compensate for the risk of fund withdrawal denials.

Bottom Line: Should you trust Tradeview Markets?

Despite offering competitive spreads and professional platforms like cTrader and MT5, Tradeview Markets cannot be recommended at this time.

The combination of a low 3.90 WikiFX Score, an “Exceeded” regulatory status in the Cayman Islands, and a specific warning from Spanish authorities creates a high-risk profile. More importantly, the volume and nature of recent complaints—specifically regarding the unauthorized removal of client funds and forcing users to sign silence agreements—suggests a breakdown in ethical business practices.

When a broker is accused of retroactively deducting “negative balances” from years prior or deleting accounts upon withdrawal requests, the safety of your deposit is compromised regardless of how low the spreads are.

Safe trading starts with verification. Markets change fast, and regulations are constantly updated. To verify the current license status of this broker or to find safer, higher-rated alternatives, search for “Tradeview Markets” on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

US Trade Deficit Collapses In October: Structural Shifts In Global Trade Revealed

Big Boss Review 2025: Safety Warning and Regulatory Analysis

EURUSD Fails to Make New Highs

Situation In Venezuela Adds To Dollar Uncertainty

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

Dollar on Edge: Supreme Court Tariff Ruling and Deficit Warnings Collide

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Top Forex Brokers Offering Free Demo Accounts

Dollar Reigns Supreme: Economic Resilience Eclipses Political Noise Ahead of

Currency Calculator