Abstract:JFD review covers pros, cons, and regulation. Learn about CySEC and VFSC licenses, trading platforms, fees, and broker safety for global traders.

JFD Review Overview

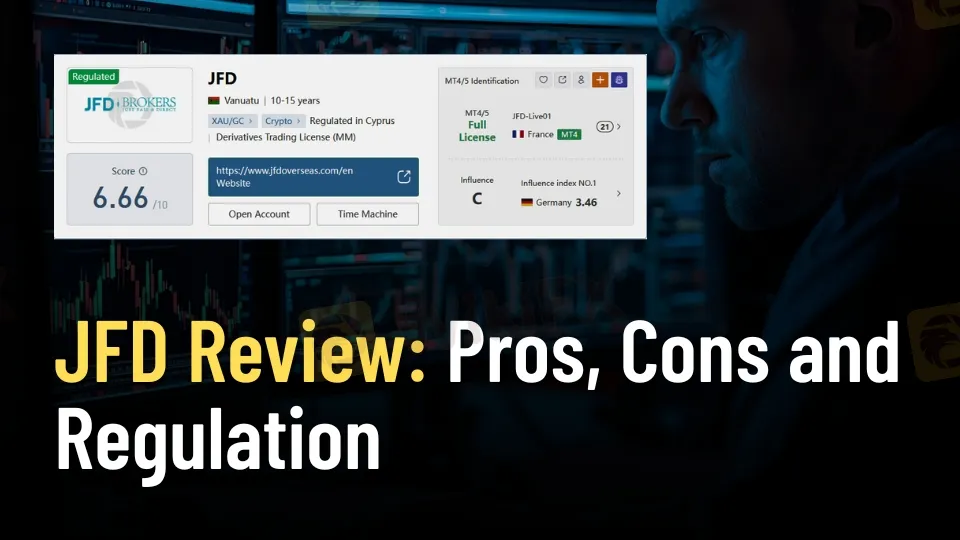

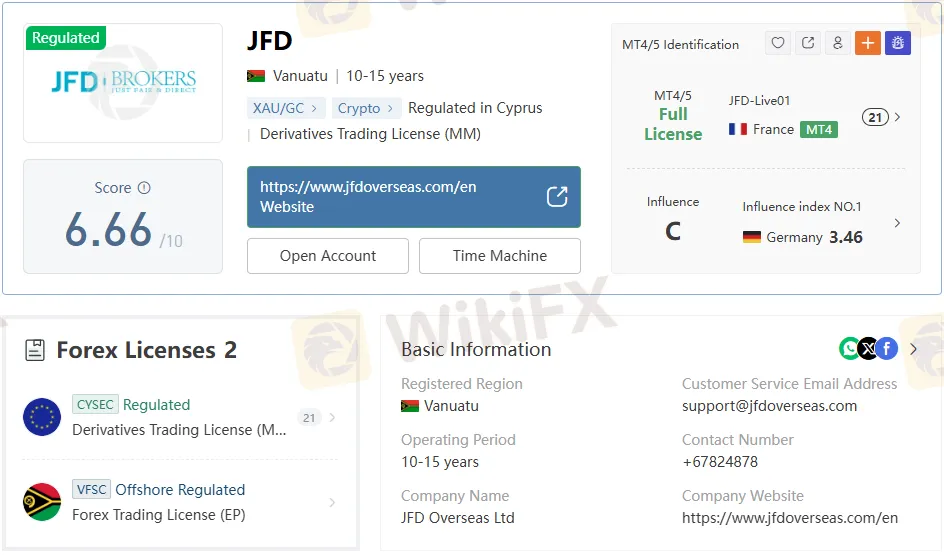

Founded in 2011, JFD Brokers (operating as JFD Group Ltd and JFD Overseas Ltd) positions itself as a multi-asset brokerage with a regulatory footprint in both Europe and offshore jurisdictions. Headquartered in Cyprus, the broker has expanded its services to cover forex, commodities, stocks, indices, cryptocurrencies, and ETFs/ETNs, offering more than 1,500 tradable instruments.

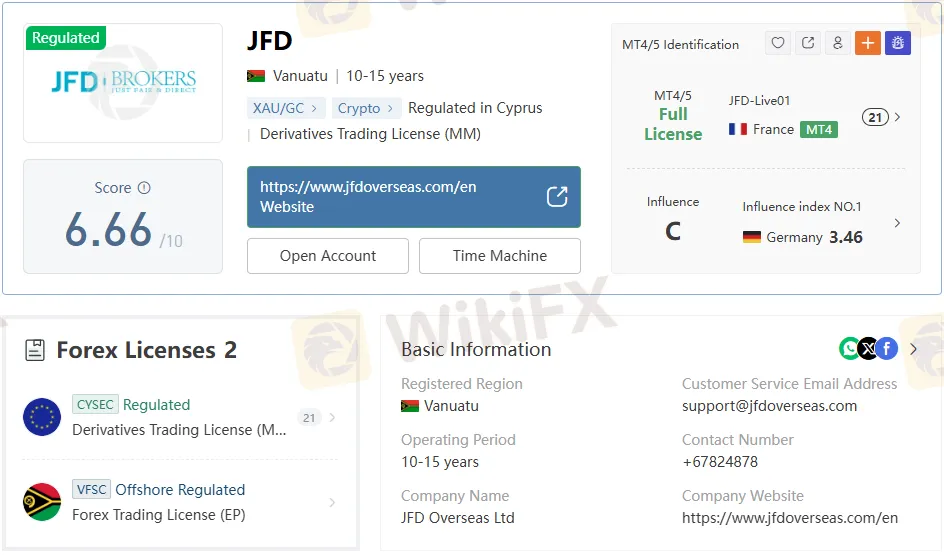

This JFD review examines the brokers regulatory standing, trading platforms, fees, and overall safety profile. With CySEC oversight in Cyprus and a VFSC license in Vanuatu, JFD operates under a dual framework that blends EU regulatory standards with offshore flexibility.

JFD Regulation and Safety

CySEC License

JFD Group Ltd holds a Cyprus Securities and Exchange Commission (CySEC) license (No. 150/11), effective since August 2011. This license authorizes activities including derivatives trading, investment consulting, asset management, and securities trading. Importantly, CySEC regulation allows JFD to passport services across 20 EU member states, reinforcing its legitimacy within Europe.

VFSC License

JFD Overseas Ltd also holds a Vanuatu Financial Services Commission (VFSC) license (No. 17933), issued in January 2023. While this provides authorization for forex, futures, securities, bonds, and options trading, it is categorized as offshore regulation. Offshore licenses typically operate under lighter frameworks, which may raise questions about investor protection compared to EU standards.

Transparency and Domain Registration

The brokers primary domain, jfdbrokers.com, was registered in September 2011 and is set to expire in September 2025. Domain records confirm active status with restrictions on transfer and renewal, signaling operational continuity.

Trading Platforms and Technology

JFD supports MetaTrader 4+ (MT4+) and MetaTrader 5+ (MT5+), alongside Stock3, a German social trading platform.

- MT4: Enhanced with exclusive JFD add-ons, suitable for beginners.

- MT5: Advanced features for experienced traders, supporting desktop, web, and mobile.

- Stock3: Web-based, designed for traders seeking community-driven insights.

Execution speed averages 187 milliseconds, with multiple servers in Cyprus ensuring stability. Leverage options extend up to 1:400 for professional clients, while retail accounts are capped at lower levels under EU rules.

Instruments Available

JFD offers access to nine asset classes:

- Forex

- Commodities

- Stocks

- Cryptocurrencies

- Precious metals

- Indices

- ETFs/ETNs

- Bonds

- Mutual funds

This breadth of instruments places JFD in line with larger competitors, though some brokers may offer broader derivatives coverage.

Account Types and Features

JFD operates a single account system with the following conditions:

- Minimum deposit: 500 EUR/USD/GBP/CHF

- Margin call level: 100%

- Stop-out level: 50%

- Negative balance protection: Available for EU accounts, not for offshore accounts

- Segregated funds: Client money held in top-tier institutions

A demo account is available for testing strategies and platform functionality.

JFD Fees and Costs

Trading Commissions

- CFDs, FX & Metals: Commission-based structure

- US stocks: $0.05 per share, minimum $3

- EU stocks: 0.15% of order volume, minimum €3

- Spanish stocks: 0.20% of order volume, minimum €6

Financing and Swaps

Overnight financing applies to CFDs on stocks and cash indices, calculated at 3.25% plus the benchmark rate.

Deposit and Withdrawal Fees

- Bank transfer (Sofort): 1.8% + fixed fee

- Online payments (Skrill, Neteller): 0.25 EUR + 1.7–3.25%

- Credit cards: 1.95–2.95%

- Withdrawals: Credit card refunds incur €0.25 authorization + €2 refund fee; Skrill/Neteller withdrawals cost 1–2% (capped at $30).

Inactivity Fee

Accounts inactive for three months incur a €20 monthly fee.

Compared to competitors, JFDs fees are higher than discount brokers but remain competitive against mid-tier European firms.

JFD Pros and Cons

Competitor Context

Compared to brokers like Pepperstone or IC Markets, JFDs regulatory standing in Cyprus provides credibility, but its reliance on VFSC for offshore operations may deter risk-averse traders. Fee structures are heavier than low-cost competitors, though JFD compensates with platform enhancements and broader asset coverage.

Bottom Line

This JFD review highlights a broker that blends European regulation with offshore flexibility, offering a wide range of instruments and established trading platforms. While fees are relatively high and offshore licensing may concern cautious investors, CySEC oversight and segregated client funds provide a measure of safety.

For traders seeking access to multiple asset classes under a regulated EU framework, JFD presents a legitimate option. However, cost-sensitive traders may find better value with competitors offering lower commissions and fees.