Abstract:When you search for a broker like ZFX, the main question you want answered is simple: "Is ZFX legit?" You've probably found mixed information—some people praise their services, while others warn about possible scams. This analysis aims to cut through the confusion and give you a clear, fact-based answer. The truth isn't simple. ZFX works under a parent company called Zeal Group, which has an important license from a top regulator. However, the protection you get as a trader isn't the same for everyone. It depends completely on where you live and which legal company you sign up with. This important difference between strong regulation versus offshore flexibility is the main issue you need to understand. This article takes a deep look at this complexity, helps you tell real facts from dangerous lies, and gives you the power to make a safe, smart decision for yourself.

When you search for a broker like ZFX, the main question you want answered is simple: “Is ZFX legit?” You've probably found mixed information—some people praise their services, while others warn about possible scams. This analysis aims to cut through the confusion and give you a clear, fact-based answer. The truth isn't simple. ZFX works under a parent company called Zeal Group, which has an important license from a top regulator. However, the protection you get as a trader isn't the same for everyone. It depends completely on where you live and which legal company you sign up with. This important difference between strong regulation versus offshore flexibility is the main issue you need to understand. This article takes a deep look at this complexity, helps you tell real facts from dangerous lies, and gives you the power to make a safe, smart decision for yourself.

Understanding ZFX's Regulation

Whether any broker is legitimate starts and ends with its regulatory status. This isn't just paperwork; it's the legal framework that controls how your capital is handled, how trades happen, and what you can do if things go wrong. For ZFX, the regulatory picture involves two different companies, which is the main source of both its credibility and the concerns around it. Understanding this dual structure is the most important step in figuring out your personal risk.

The UK's FCA Regulation

The strongest part of ZFX's credibility is its UK-based company, Zeal Capital Market (UK) Limited. This company is authorized and regulated by one of the world's most respected financial watchdogs: the Financial Conduct Authority (FCA). Working under FCA license number 768451 is a significant achievement.

This regulation isn't just for show. It requires strict operational standards and, most importantly, provides real protections to clients. A key benefit for traders under this company is their inclusion in the Financial Services Compensation Scheme (FSCS). This scheme acts as a safety net, protecting client funds up to £85,000 if the broker becomes unable to pay its debts. Furthermore, the FCA requires strict separation of client funds, meaning the broker must keep your capital in separate accounts from its own business money, typically with top banks.

The Offshore FSA Reality

While the FCA license provides strong legitimacy, the reality for most international clients, especially those in Asia and other non-UK regions, is different. These traders typically sign up through a separate company: Zeal Capital Market (Seychelles) Limited.

This company is regulated by the Financial Services Authority (FSA) of Seychelles under license number SD027. It's important to understand that the FSA is an offshore regulator. While it provides a formal regulatory framework and issues a valid securities dealer license, the level of oversight and protection it offers is much lower than the FCA. Specifically, there is no investor compensation scheme like the UK's FSCS. If the Seychelles-based company were to fail, there is no guaranteed government-backed fund to pay back clients. Brokers use this location to offer more flexible trading conditions, such as much higher leverage, which are restricted under stricter systems such as the FCA.

Regulatory Arbitrage Explained

This dual structure is a common industry practice called “regulatory arbitrage.” A global brokerage group uses different legal companies in various locations to optimize its operations and serve different client needs. For the trader, this creates a direct trade-off that you must consciously accept or reject.

The main benefit of signing up under the Seychelles company is access to highly flexible trading conditions. This includes much higher leverage, which can be up to 1:2000, and potentially lower minimum deposit requirements. These features are attractive to retail traders looking to maximize their market exposure with smaller amounts.

The clear risk is losing top-tier investor protection. By trading with the offshore company, you are stepping outside the protective umbrella of schemes like the FSCS. Your funds are protected by the broker's internal policy of separation, but not by a government-backed compensation guarantee.

To make this very clear, here is a direct comparison:

Addressing “ZFX Scam” Claims

A search for ZFX will definitely bring up claims or warnings of a “ZFX scam.” It's important to analyze these reports carefully to understand where they come from. Our investigation shows these claims fall into two main categories: scams done by imposters using the ZFX name, and real complaints about the actual broker's operational characteristics.

The Imposter Problem

A large number of the most damaging “scam” reports are not related to the official ZFX broker at all. They are the result of a widespread and dangerous imposter problem. Fraudulent people create fake websites, misleading social media profiles, and harmful mobile apps that convincingly copy the look and feel of the real ZFX.

These scams often follow a “pig butchering” script. You might be contacted on a messaging app or social media platform by someone pretending to have a personal connection. Over time, they build trust and then introduce a “guaranteed” investment opportunity, directing you to a fake ZFX platform. After depositing funds, you may see impressive but fake profits. When looking to withdraw, you will face endless excuses, demands for more deposits in the form of “taxes” or “fees,” and eventually, the scammer will disappear with your funds. It's essential to recognize that these fraudulent operations are completely separate from the regulated broker operating at the official zfx.com domain.

Common Complaints About ZFX

Even when dealing with the real broker, traders have reported issues that, while frustrating, are not typically signs of an outright scam but rather known risks of the trading environment.

One common complaint is slippage. This happens when your order is executed at a price different from the requested price. During periods of high market volatility, such as a major news release, liquidity can dry up, causing wider spreads and slippage on both entry and stop-loss orders. This is a characteristic of STP/ECN execution models, where trades are passed to liquidity providers, and is not unique to ZFX.

Another point of disagreement is sudden leverage changes. ZFX uses a policy of reducing leverage before weekends or major, high-risk news events to reduce its own risk exposure. For a trader who doesn't know about this policy and is holding large positions, this can greatly increase their margin requirements and potentially trigger a margin call or stop-out. This is a risk management policy that traders must understand and factor into their strategy.

Your First Line of Defense

Given how common sophisticated imposters are, your primary defense is careful verification. The only official global domain for the broker is www.zfx.com. Do not trust any other variation or link sent to you by an unverified source.

To avoid falling for a convincing fake, it's absolutely essential to verify any broker's details independently. We strongly recommend using a third-party verification platform, such as WikiFX, to check the broker's official website, regulatory status, and license details before opening an account. This simple check can be the difference between a legitimate trading experience and falling victim to fraud.

Inside the Trading Engine

Assuming you have verified the real broker, the next question is suitability. Is ZFX's trading environment a good fit for your style, strategy, and budget? This requires a close look at its account structures, costs, and the tools it provides.

Account Types Overview

ZFX structures its offerings around three primary account types, serving different levels of trading experience and money.

· Mini Account:

· Minimum Deposit: $50

· Spreads: From 1.5 pips

· Commissions: None

· Best For: Beginners looking to test the platform with minimal money or experiment with strategies.

· Standard STP Account:

· Minimum Deposit: $200

· Spreads: From 1.3 pips

· Commissions: None

· Best For: The average retail trader who prefers an all-in cost structure with no separate commissions.

· ECN Account:

· Minimum Deposit: $1,000

· Spreads: From 0.2 pips

· Commissions: They may apply

· Best For: Advanced traders, scalpers, or those with larger volume who prioritize the tightest possible spreads and are comfortable with a commission-based cost structure.

The Real Cost of Trading

The cost of trading at ZFX depends on your chosen account. The Micro and Standard accounts bundle the broker's fee into the spread, which is the difference between the bid and ask price. This is straightforward but can be more expensive for active traders. The ECN account offers raw, near-zero spreads from liquidity providers but adds a fixed commission. For frequent or high-volume traders, the ECN account is almost always more cost-effective.

A critical warning relates to the advertised high leverage. The 1:2000 leverage is “dynamic,” meaning it is not fixed. This can act as a trap for the unaware. Imagine a trader opens an account with $200 and enjoys the full 1:2000 leverage. After a few profitable trades or a new deposit brings their account equity to over $1,000, the leverage might automatically be reduced to 1:500 or less. If the trader is holding positions based on the previous high leverage, this sudden change can cause the margin usage to spike, potentially leading to an immediate margin call or liquidation of their positions.

Platforms and Tools

The foundation of ZFX's platform offering is the globally recognized MetaTrader 4 (MT4). It is available for PC, web, and mobile, providing a familiar and strong environment for most traders. In some regions, MetaTrader 5 (MT5) is also being rolled out. For those interested in social trading, the broker also offers a ZFX Copy Trading feature, allowing users to automatically copy the trades of more experienced strategy providers within the ZFX community.

Fund Trail and Safety

A trader's relationship with a broker is built on trust, especially when it comes to capital. The security of your funds and the efficiency of deposits and withdrawals are extremely important.

Where Your Capital is Held

ZFX states that it follows the practice of using separated accounts for client funds. This means your capital is held in accounts at reputable banks, such as Barclays, separate from the company's own operational funds. This is a critical security measure. It ensures that if the broker becomes unable to pay its debts, client funds are protected and cannot be used by creditors to pay off the company's debts. While this provides a significant layer of protection, it's important to remember that for clients under the FSA (Seychelles) company, this separation is an internal policy, not a guarantee backed by a government compensation scheme.

The Process of Funding

Moving money in and out of your ZFX account is a relatively straightforward process with several options, reflecting good adaptation for international clients.

· Deposit Methods: Deposits are generally free of charge. Common methods include bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. In certain regions, USDT (Tether) is also supported as a deposit option.

· Withdrawal Process: As a standard anti-money laundering practice, withdrawals are typically processed back to the original source of the deposit.

· Important Warning: Traders must be aware of a specific clause in the terms. If you deposit funds and then request a withdrawal without having done any trading activity, the broker may charge an administrative fee of around 3% to 5%. This policy is in place to prevent the platform from being used for money cycling and covers payment processing costs.

Final Verdict and Considerations

After a thorough analysis of its regulatory structure, user feedback, trading conditions, and operational policies, we can draw a final conclusion on ZFX's legitimacy.

ZFX is not a fake broker; it is a legitimate trading brand operated by Zeal Group, a company with a strong regulatory footprint via its FCA-licensed UK company. However, its legitimacy for you as an individual trader comes with critical considerations that you must weigh carefully. The practice of signing up international clients to an offshore company is a deliberate business model that presents a clear trade-off: you gain access to high leverage and flexible terms at the cost of top-tier regulatory protection.

Summary of Findings

To summarize our analysis, here is a balanced view of the pros and cons as of early 2026.

· Pros:

· Backed by a group holding a strong FCA (UK) license, which enhances overall brand credibility.

· Low entry barrier with a $50 minimum deposit for a Mini account.

· Flexible account types suit a range of traders, from beginners to professionals.

· Good adaptation for Asian markets, including customer service and payment methods.

· Cons & Risks:

· The use of regulatory arbitrage means most retail clients fall under the weaker FSA (Seychelles) regulation, which lacks a financial compensation scheme.

· The dynamic leverage system poses a significant risk of sudden margin calls for traders who are unprepared for automatic reductions as their equity grows.

· The brand name is heavily targeted by fraudulent individuals, requiring extreme vigilance from users to avoid imposter scams.

· Standard market risks, such as slippage during high volatility, are present as with any STP/ECN broker.

Your Final Safety Check

Our analysis provides a framework, but it cannot replace your own careful research. The online trading world is filled with risks, and the most significant are often the ones you do not see coming. While the core ZFX company is legitimate, the risks associated with its dual-regulatory model and the high number of imposters cannot be overstated.

Before you proceed with any broker, including ZFX, we insist that you take one final, non-negotiable step: visit a trusted, independent verification service like WikiFX. There, you can confirm the broker's up-to-date regulatory information, check the official and correct website domain, and review recent, unfiltered user feedback. This is the single most important action you can take to protect yourself and ensure you are partnering with a genuinely safe and suitable broker.

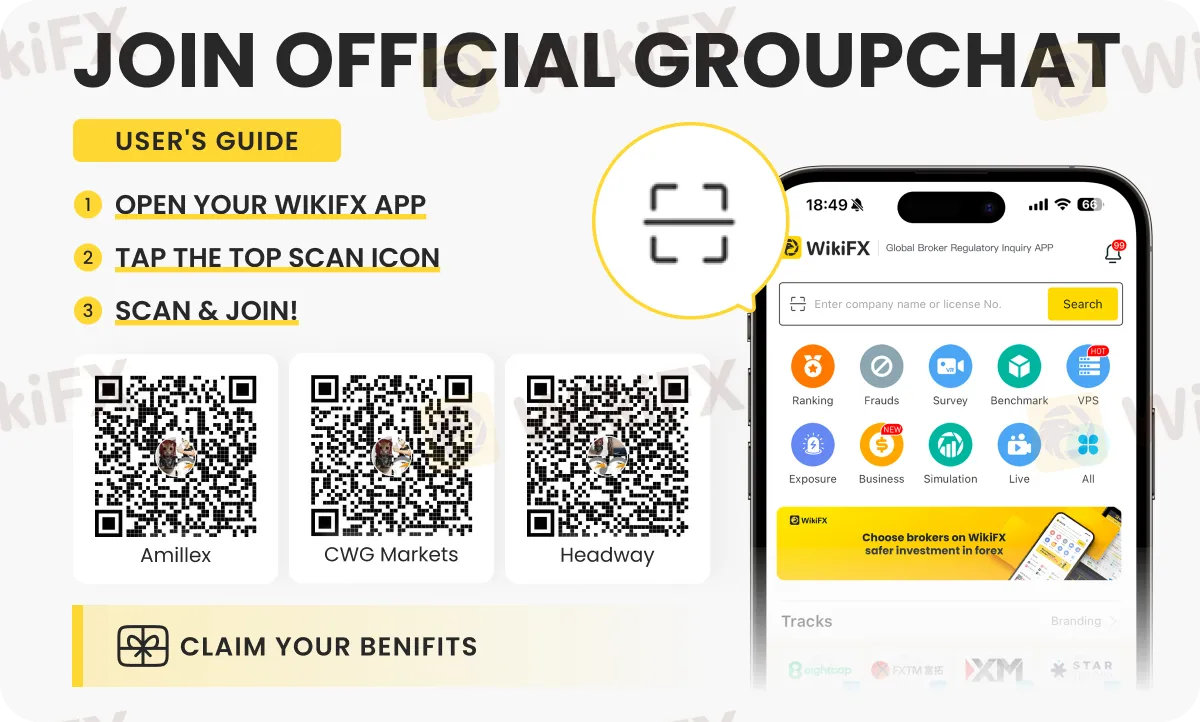

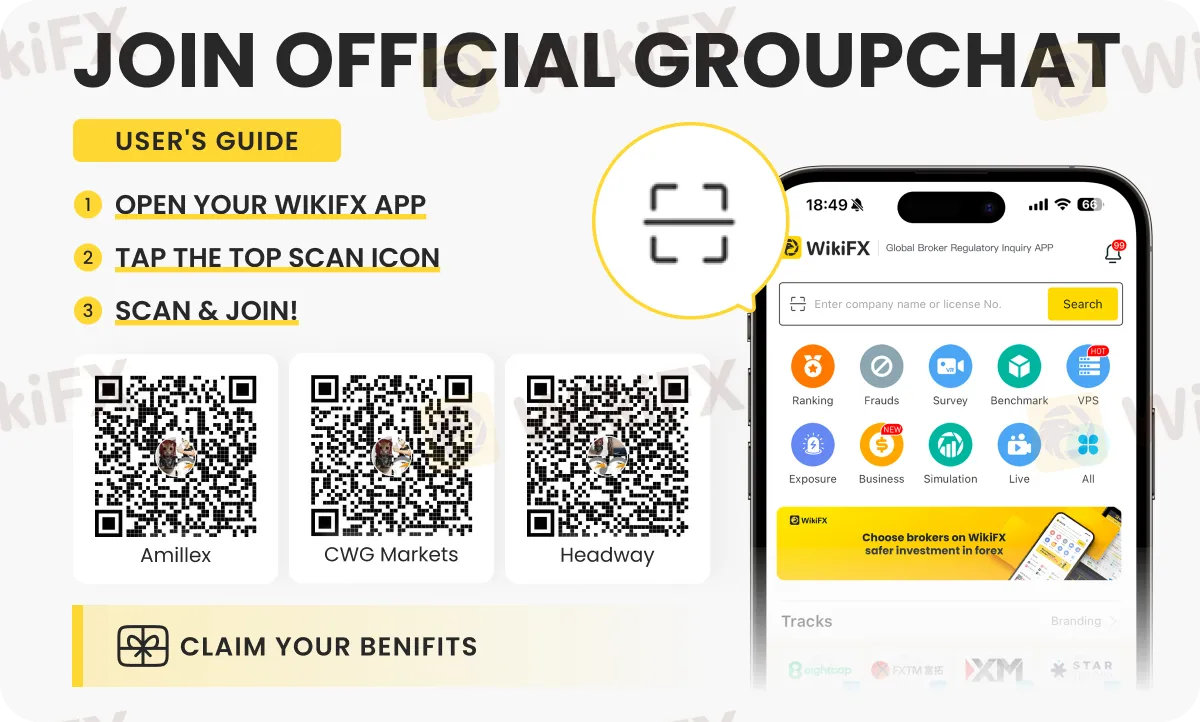

Want to make the most of the global forex trading market? Listen to our experts as they share game-changing insights on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join these groups by following the instructions shown below.