Abstract:It has been a bearish year for the US dollar, but the biggest surprise has been the USD/JPY pair for me in the FX space. By Christmas eve, the Dollar Index (DXY) was down 9.6% year-to-date, trading around 98.00, its weakest level since 2022.

It has been a bearish year for the US dollar, but the biggest surprise has been the USD/JPY pair for me in the FX space. By Christmas eve, the Dollar Index (DXY) was down 9.6% year-to-date, trading around 98.00, its weakest level since 2022. The DXY was primarily driven by the strength in the EUR/USD exchange rate, which was +13.7% YTD, and to a lesser degree the GBP/USD (+7.7% YTD). The likes of the Swedish Krona (+17% YTD) and Swiss franc (+13% YTD) also played a part in the DXY‘s weakness, although these currencies have a combined 7.8% weighting on the DXY, compared to the 57.6% of the euro, 11.9% of the pound and the 9.1% of the Canadian dollar. The only other major currency with a 13.6% weighting on the DXY is the Japanese yen. But the latter was barely holding a gain made earlier this year. The yen’s weakness stood out for me as the most surprising development in the FX space. And it wasnt just against the US dollar.

The yen has had a year to forget

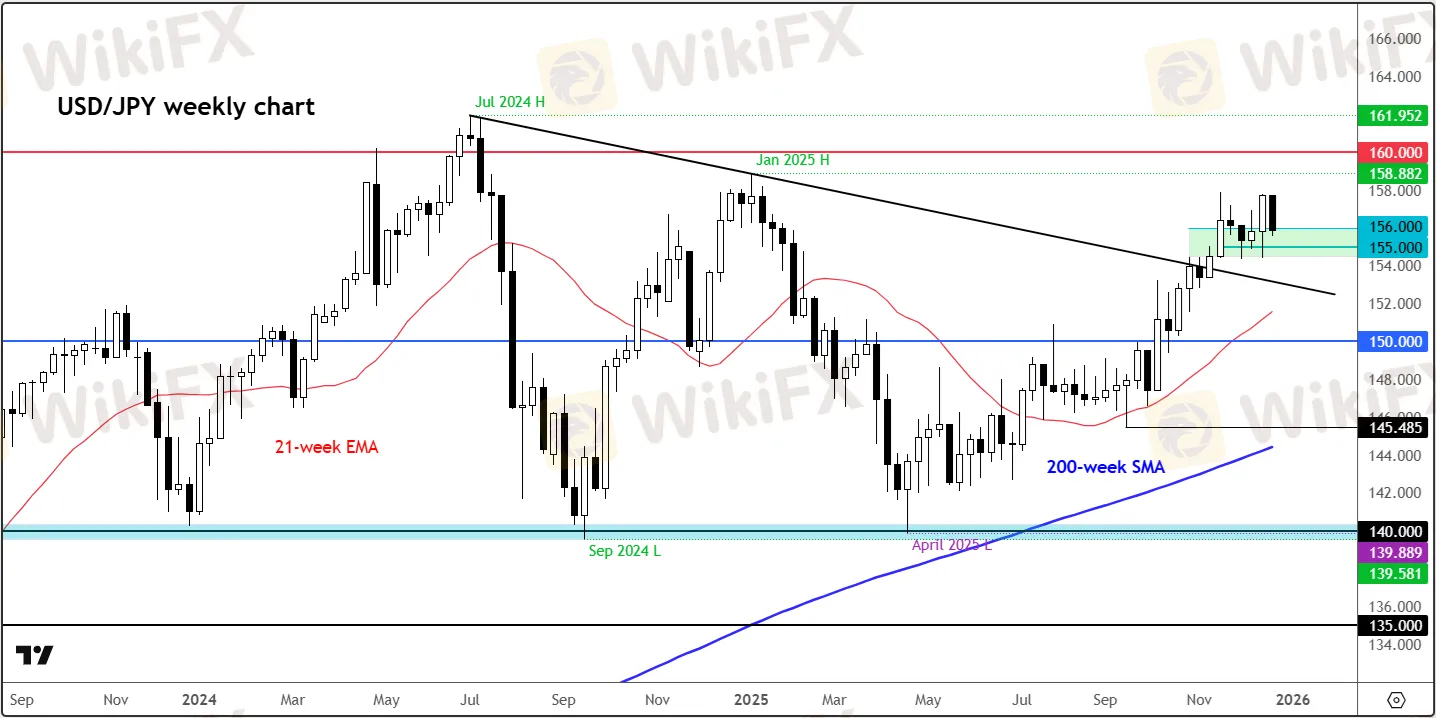

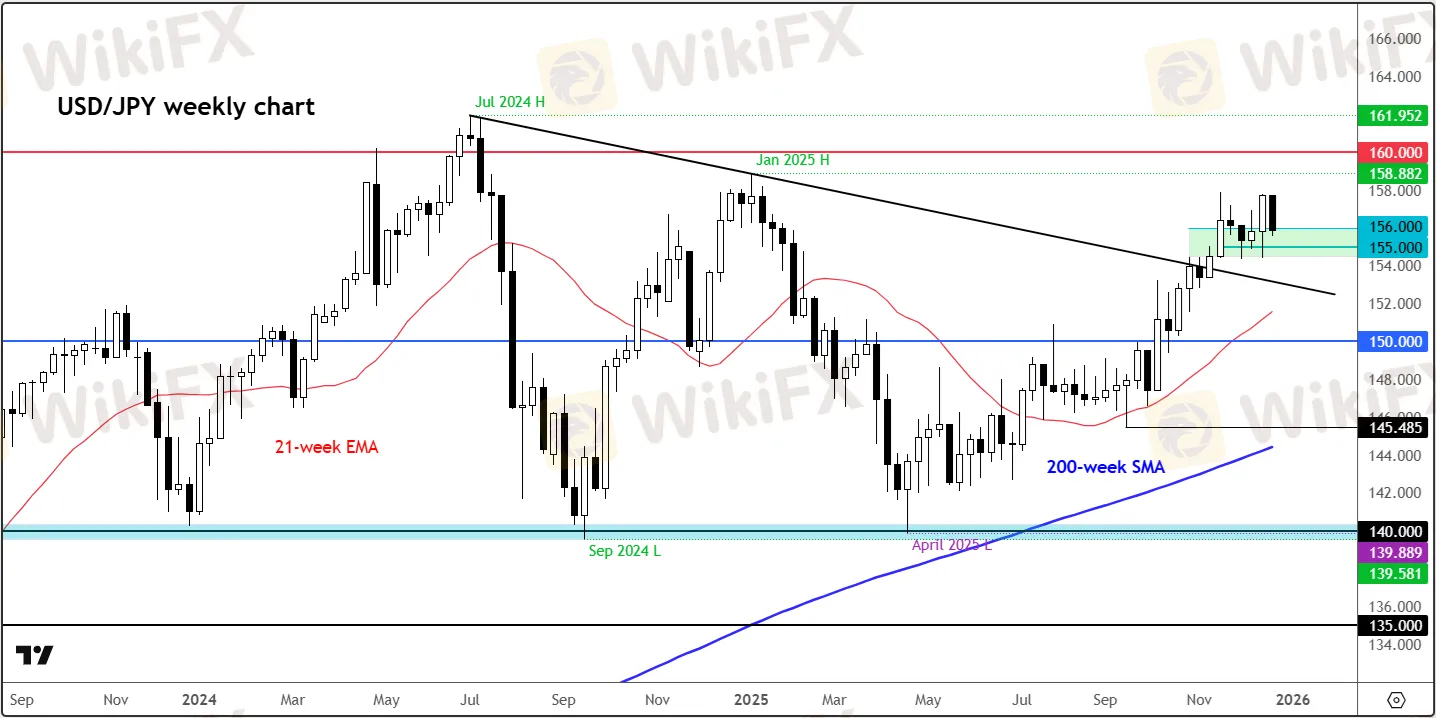

Since bottoming in April, the USD/JPY managed to climb more than 12% just before Christmas, despite the US dollar weakening against all other major currencies during this period. The yen weakened to multi-decade lows and in some cases hit all-time lows against the other major currencies, with the EUR/JPY, for example, surging to near 185.00 handle. The yen sold off despite the Bank of Japan delivering two further rate hikes at the time when other central banks were turning neutral, or in the case of the Fed, dovish. At +0.75%, the benchmark interest rate in Japan was now the highest since September 1995. Bond yields climbed accordingly to multi-decade highs in Japan as JGBs sold off. But that did not translate into any yen strength. So, whats going on?

What caused the USD/JPY strength?

One argument why the yen has been a weak spot was to do with the fact that this has been a year where we have seen a big risk rally, keeping demand for the low-yielding JPY downbeat, with traders using the currency as a carry trade. This argument would have made more sense had gold or the likes of Swiss franc also had a weak year, but as we know, it was far from that.

What about interest rate differentials? While the Fed delivered 3 rate cuts, the benchmark US interest rate was still at a relatively-high level of 3.75%, similar to the UK, while rates outside of Switzerland and Japan were all above 2% by the end of 2025. By that logic, youd expect both the USD/JPY and USD/CHF to be among the best performers in the FX space. Yet, the yen was the weakest while the franc was among the strongest. Indeed, the performances of the yen and franc could not be any more contrasting. Despite interest rates being at zero in Switzerland and 0.75% in Japan, the CHF/JPY pair had a rather strong year, and was up for the 7th consecutive month by December, almost reaching the 200.00 level.

So, relative interest rates could not explain the yens weakness either.

Another argument for the surprise strength in the USD/JPY pair was this: shorting the dollar was expensive as the overnight financing costs were significant given that US interest rates have been among the highest in the world. But this didnt stop traders shorting the likes of the USD/CHF, so why would this impact the USD/JPY alone?

The yens weakness was therefore driven almost entirely by domestic factors.

Japans fiscal expansion vs. monetary tightening

In Japan, Sanae Takaichi become the new prime minister in October, making her the first woman to hold the office. Under Takaichis governance, a fiscal dove, traders have been betting on aggressive fiscal expansion. The hope from Takaichi was to boost economic growth significantly, arguing that by sustaining a higher level of longer-term growth would more than offset increased short-term increases in the debt-to-GDP ratio. In theory, that sounds like a decent plan, if enough growth is generated and sustained. In practice, growth may not materialise as much as expected, especially when your central bank is trying to normalise monetary policy after decades of extraordinary-low rates and numerous stimulus packages.

Investors worried that the fiscal expansion would not lead to sustainable GDP growth, while elevated inflation was increasing the pressure on the Bank of Japan to respond by tightening policy faster. Japan was pressing the accelerator and brake at the same time. That sort of a policy is usually not sustainable, and this was reflected in bond yields climbing steadily while the yen was weakening throughout the year. Investors were demanding better fiscal discipline from the government, but all they got was some lousy verbal warnings.

How much of an impact will Japans intervention have on USD/JPY?

With all major risk events of the year behind us, could the Japanese government use the thin holiday period to intervene in the FX markets? They have been warning against “one-sided and sharp” currency moves. That signals Japans readiness to intervene in the FX markets by buying the yen and selling US dollar reserves. But this alone will not be enough to turn the tide in the yen selling, although it will most definitely have a short-term impact.

Source: TradingView.com

Japanese policymakers will be watching the yen closely, and history shows theyre not shy about intervening. Should USD/JPY surge towards the 160.00 region, Tokyo could step in to support the yen once more. Until then, the USD/JPY trend is likely to stay bullish amid existing macro factors supporting it.