简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bull Waves Legitimacy Check: A Deep Dive into the Risks & Red Flags

Abstract:When you search for information on a broker like Bullwaves, your main concern is simple: is it a real platform or a potential scam? This worry makes sense, as checking a broker's credibility is the most important step in protecting your money. Let's tackle this directly.

When you search for information on a broker like Bullwaves, your main concern is simple: is it a real platform or a potential scam? This worry makes sense, as checking a broker's credibility is the most important step in protecting your money. Let's tackle this directly.Based on official records, Bullwaves is not completely fake or made-up. It works as a properly registered and regulated company. However, and this is very important, its legitimacy relies on a weak, offshore license that comes with serious risks every potential user must understand. This is not a simple “yes” or “no” answer. The truth is a complicated picture of legal registration overshadowed by serious operational warning signs.

This article will break down the facts, from its company paperwork and regulatory status to real-world user complaints and trading conditions. Our goal is to give you a clear, evidence-based risk assessment, helping you make an informed and safe decision.

Bullwaves' Official Identity

To check legitimacy, we must first look at the verifiable company details. A trustworthy broker is open about its legal structure and licensing. Bullwaves provides this information, which we have verified against public records.

Here are the basic facts about the company behind the brand:

• Parent Company: Equitex Capital Limited

• Company Registration Number: 8434948-1

• Regulating Authority: Seychelles Financial Services Authority (FSA)

• License Number: SD185

• Stated Founding Year: 2023

• Official Registered Address: CT House, office number 9A, Providence, Mahe, Seychelles

It's also important to note a related company, ETX Services Limited, registered in Cyprus (HE455407). According to Bullwaves, this company acts as a service provider and distributor. It is critical to understand that ETX Services Limited is not a licensed EU company, meaning it does not provide the regulatory protections associated with a CySEC-regulated firm. It simply provides services to the offshore parent company.

While a broker's website will list its own credentials, independent verification is the first rule of safe trading. Before proceeding with any broker, it's a critical safety step to cross-reference their license number (in this case, SD185 for Equitex Capital Limited) on a third-party verification platform like WikiFX to see their real-time regulatory status and any warnings.

The Offshore Regulation Red Flag

The single most important point of concern for any trader considering Bullwaves is its regulatory environment. The broker is licensed by the Seychelles Financial Services Authority (FSA). While this provides a surface appearance of legitimacy, it is classified as “offshore regulation,” which is fundamentally different and far less protective than top-tier oversight.

“Offshore regulation” means the broker is registered in a jurisdiction with relaxed financial laws, minimal oversight, and weak enforcement. For forex brokers, this often translates to lower operational costs but also significantly lower standards for client protection. While the Seychelles FSA does have a legal framework, its requirements pale in comparison to those of Tier-1 regulators. Expert review sites like DayTrading.com assign this type of regulation a “Red Level” trust rating, indicating the highest level of risk.

To understand the practical difference, consider the safety nets available to you as a trader.

| Tier-1 Regulators (e.g., FCA - UK, ASIC - Australia) | Offshore Regulators (e.g., Seychelles FSA) |

| Strict, audited financial reporting required | Minimal or no public financial disclosure |

| Mandatory investor compensation funds (e.g., FSCS) | Typically no investor compensation fund available |

| Strong enforcement with heavy fines and license revocation | Weaker enforcement mechanisms and limited recourse for clients |

| Lower leverage limits to protect retail clients | Allows extremely high leverage (e.g., 1:500), increasing risk |

The lack of an investor compensation fund is particularly alarming. With a Tier-1 regulated broker, if the company becomes insolvent, a dedicated fund exists to compensate clients up to a certain limit. With an offshore broker like Bullwaves, if the company fails, your funds are likely gone for good. This regulatory weakness is a foundational risk that cannot be overlooked.

A Look at Trading Costs

Beyond regulation, the practical costs of trading are a key factor. Bullwaves operates on the popular MetaTrader 5 (MT5) platform, which is a strong choice for technical analysis and automated trading. The broker also heavily promotes its social and copy trading features, positioning itself as an accessible option for beginners.

However, a closer look at the account structure and associated fees reveals a mixed picture. The broker offers three main account types, all of which are advertised as “commission-free.”

| Account Type | Minimum Deposit | Spreads (Starting From) | Maximum Leverage |

| Classic | $100 | 1.6 pips | 1:500 |

| VIP | $3,000 | 0.8 pips | 1:500 |

| ECN | $5,000 | 0.1 pips | 1:500 |

The primary cost for traders is the spread. While the VIP and ECN accounts offer competitive spreads, the entry-level Classic account does not. Spreads starting at 1.6 pips are relatively high by modern industry standards. For major pairs like EUR/USD, documented examples show spreads reaching 2.0 pips, which can significantly eat into the profitability of short-term trading strategies.

A more significant point of caution is the inactivity fee. Bullwaves charges a $10 fee after just 30 days of no trading activity. This is an unusually aggressive policy. Many reputable brokers have inactivity periods of six months to a year, or charge no such fee at all. This 30-day policy can unfairly penalize long-term investors, swing traders who hold positions for weeks, or casual traders who may not log in frequently. It creates pressure to trade, which can lead to poor decision-making.

The Voice of the Trader

A company's official claims are one thing; the real-world experiences of its clients are another. Analyzing user reviews provides powerful insight, but with Bullwaves, the picture is dangerously inconsistent.

At first glance, the Trustpilot profile for `bullwaves.com` appears positive, with a “Great” rating of 4.1 out of 5 from over 680 reviews as of early 2025. Many users praise the platform, with comments like, “Bullwaves has been outstanding from brilliant customer service to fast withdrawals,” and “Customer service and fast withdrawals I cannot fault.” These positive reviews suggest that for some users, the experience has been satisfactory.

Beneath the Surface: A Pattern of Serious Complaints

However, digging deeper reveals a disturbing pattern of severe complaints that directly contradict the positive narrative. These are not minor issues but fundamental problems that question the broker's integrity.

• Sudden Account Closure and Profit Confiscation: One of the most serious allegations involves a user whose account was abruptly closed. The user stated, “They are a fraud company who closed my account and confiscated my profits without giving any valid reason. They accused me of 'market abuse' but provided absolutely no proof to back that claim.” This type of action, where a broker unilaterally seizes profits, is a massive red flag.

• Severe Withdrawal Difficulties: Multiple users report significant problems when trying to access their funds. One trader explained a month-long ordeal: “I filled in the wrong bank details and could not withdraw... When I consulted the platform for a solution, they gave me a very perfunctory answer... it took me over a month to finally withdraw to a crypto wallet.” Another complaint from as recently as early 2025 details a withdrawal request of over $33,000 stuck in “pending” status for weeks, with support repeatedly giving vague answers.

• Allegations of Fake Bonuses: A user reported a devastating experience with a promotional bonus, warning, “They give fake credit bonuses which will get deducted in the middle of a trade and wipe your entire funds... I lost £1000 in a matter of minutes.” This suggests that bonuses may come with predatory terms designed to cause client losses.

Critically, there is a major point of confusion and a significant red flag in the company's online presence. There are two distinct Trustpilot profiles: `bullwaves.com` with its high rating, and `www.bullwaves.global` with an extremely poor rating of 2.2 out of 5. The latter is filled with severe complaints about scams and withdrawal issues. This discrepancy is a common tactic used by less reputable operations to manage their online reputation and can easily mislead prospective clients.

When faced with such conflicting user reports, a single source is not enough. To get a more complete picture of user-submitted issues, it's wise to consult platforms like WikiFX, which aggregate user complaints and reviews from a global audience, helping you spot recurring problems that a single review site might miss.

Is Your Money Truly Safe?

Ultimately, the most important question is about the safety of your capital. To answer this, we need to evaluate the protective measures Bullwaves has in place against the critical safety nets that are missing.

What Protections Does Bullwaves Offer?

The broker does implement two standard industry safety features:

• ✅ Segregated Accounts: This is a fundamental requirement where client funds are held in bank accounts separate from the company's own operational funds. This prevents the broker from using client money for its business expenses and offers a basic layer of protection against misuse.

• ✅ Negative Balance Protection: This is a crucial feature, especially with high leverage. It ensures that a trader cannot lose more money than their account balance. If a market move causes your account to go into a negative value, the broker is obligated to reset it to zero.

What Critical Safety Nets Are Missing?

While the protections above are necessary, they are insufficient on their own. The most important safety features, which are standard with top-tier brokers, are absent.

• ⚠️ No Investor Compensation Fund: This is the most critical omission. As mentioned, because Bullwaves is regulated in Seychelles, there is no government-backed or industry-sponsored insurance scheme. If the broker becomes insolvent or engages in fraud, there is no formal mechanism to recover your deposited funds.

• ⚠️ Weak Regulatory Recourse: If you have a dispute with Bullwaves regarding a trade, a withdrawal, or your account closure, your only recourse is to complain to the Seychelles FSA. This process is notoriously difficult and often yields little to no result for the individual client compared to filing a complaint with a Tier-1 regulator like the FCA or ASIC.

• ⚠️ Lack of Financial Transparency: As a privately held company registered offshore, Bullwaves is not required to publish its financial statements. Its financial health, profitability, and capital reserves are completely unknown. You are trading with a company without knowing if it is financially stable.

• ⚠️ Very Short Operating History: The company was founded in 2023. As of 2025, it has a very short track record of less than two years. It has not proven its stability or reliability through various market cycles or economic downturns. New brokers are inherently riskier than those with a decade or more of proven operational history.

Final Verdict and Advice

After a thorough analysis of its regulation, trading conditions, and user feedback, our verdict on Bullwaves is clear. It is a broker that presents an unacceptably high level of risk for the average retail trader.

Let's summarize the key findings:

• Legitimacy: Bullwaves is a legally registered and regulated broker, not an outright “fake” one. Its operations are authorized under a license in Seychelles.

• Primary Risk: Its legitimacy is anchored to a weak, offshore license that offers minimal client protection, no compensation fund, and weak legal recourse in case of disputes.

• Warning Signs: A very short operational history, high-risk trading conditions (like 1:500 leverage), an aggressive inactivity fee, and a documented pattern of severe user complaints regarding withdrawals and sudden account closures are significant red flags.

• High-Risk Disclosure: The broker's own risk disclosure states that 75.2% of its retail investor accounts lose money when trading CFDs, highlighting the inherent risk of its products.

Given the combination of weak offshore regulation, a very short track record, and severe user complaints, we categorize Bullwaves as a high-risk broker. It is not a suitable choice for beginners or any trader who prioritizes the safety and security of their funds. The potential benefits do not outweigh the substantial risks.

Your most powerful tool in avoiding potential scams and high-risk brokers is independent due diligence. Before you deposit a single dollar with *any* broker, make it a non-negotiable habit to perform a full background check. Visit a comprehensive verification platform like WikiFX to review its regulatory details, user reviews, and any official warnings. This simple step can save you from significant financial loss and stress.

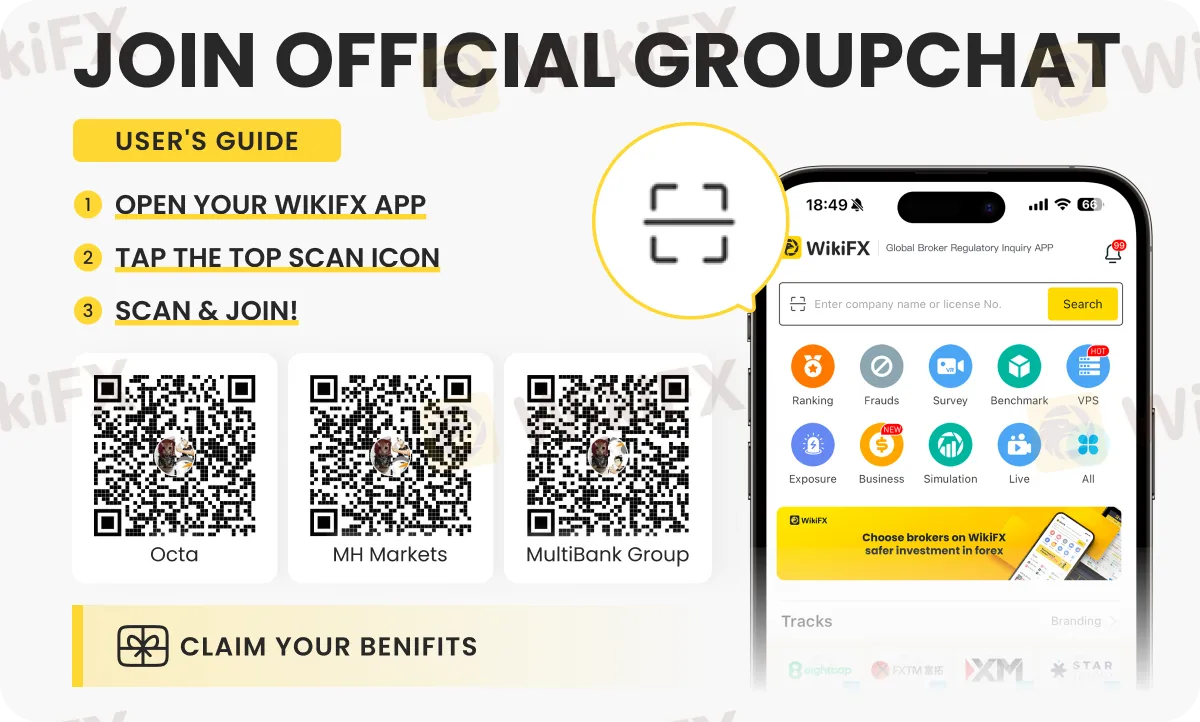

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator