Abstract:Mention the word forex in Malaysia, and you will often hear immediate reactions: “It is a scam”, “It is like a money game”, or “Everyone loses”. Is forex trading a scam, or do people actually make money from it?!

Mention the word forex in Malaysia, and you will often hear immediate reactions: “It is a scam”, “It is like a money game”, or “Everyone loses”. The common association between foreign exchange trading and illegal pyramid schemes has become deeply rooted, largely due to a history of syndicates misusing the term forex to disguise fraudulent operations. Yet this perception is far from the truth. The foreign exchange market is one of the most legitimate, essential and heavily traded financial markets in the world.

The Global Forex Market: A Legitimate Cornerstone of Modern Finance

Forex, short for foreign exchange, is simply the trading of one currency for another. The market operates 24 hours a day across major financial centres such as London, New York, Tokyo and Sydney. It is regulated, vast and indispensable to global commerce. Corporations rely on currency transactions to pay overseas suppliers, protect foreign income or manage their exposure to currency fluctuations. Governments also participate actively to stabilise their economies, maintain reserves and guide monetary policy. Whether Malaysians realise it or not, forex affects them every day, from the strength of the ringgit against the United States dollar to the prices paid for imported goods, travel and international services.

To call the forex market a scam would be equivalent to calling global trade a scam. What has been problematic is not the market, but the way certain individuals and fraudulent groups misuse its name to lure unsuspecting Malaysians into illegal schemes.

Where the Real Scams Come From

Many scam operations in Malaysia hide behind phrases such as “forex investment programme”, “guaranteed monthly returns” or “trade for you with zero risk”. These are clear red flags. They are not forex trading. They are unlicensed fund raising schemes or outright Ponzi operations. The misconception grows because victims, after losing money, understandably associate their experience with the word forex.

In reality, genuine forex trading never guarantees returns. It involves risk, strategy, discipline and ongoing market analysis. Any organisation promising effortless profits is not offering a trading opportunity. It is offering a scam.

Why So Many Traders Still Lose Money

Even in legitimate trading environments, many individuals fail to consistently generate profits. Yet the reasons are rarely due to the market itself. The real roots of failure often lie in human psychology and behavioural patterns that have existed long before forex became accessible to the public.

- Fear of missing out

Many people see others making profits and enter the market without proper knowledge or planning.

- Greed

After a few early successes, traders often increase their trading size recklessly, ignoring risk management principles.

- Fear and panic

A temporary loss can lead to impulsive actions, such as closing trades too early or abandoning strategies on an emotional basis.

- Lack of discipline and patience

Successful trading requires consistency. Impatient traders overtrade or constantly shift strategies in pursuit of quick rewards.

- Poor risk management

Many beginner traders risk far too much on single trades, ignoring professional practices such as limiting risk to a small percentage of total capital.

These issues are universal and not unique to Malaysia. However, in a country where financial literacy is still developing, these emotional and behavioural pitfalls often lead people to blame the market rather than addressing the root causes.

Do People Make Money in Forex? Yes, but Not Without Skill

Professional traders, fund managers and institutional investors participate in forex every day, and yes, they make money. They do so through structured strategies, risk controls and disciplined execution. Their success is based on training, patience and the understanding that losses are part of the profession.

Retail traders can also succeed, but only when they treat trading as a craft and not as a shortcut to quick riches. When approached responsibly, forex becomes a skill-based endeavour, not the gambling activity many assume it to be.

A Shift Needed in the Malaysian Mindset

For Malaysia to advance in financial literacy, it is essential to differentiate between the forex market and forex themed scams. Blaming the entire global currency market for the misconduct of local syndicates is like blaming the entire stock market due to the actions of one fraudulent share investment group.

Forex is not the problem. The real challenges lie in lack of education, lack of emotional discipline and the tendency to trust promises of unrealistic returns.

Markets Do Not Scam People, People Scam People

The foreign exchange market is a legitimate and vital foundation of the global economy. People do make money from forex, but they do so through skill, discipline and realistic expectations. When Malaysians learn to distinguish real trading from scams, and when traders learn to master their own emotions, the narrative surrounding forex will change.

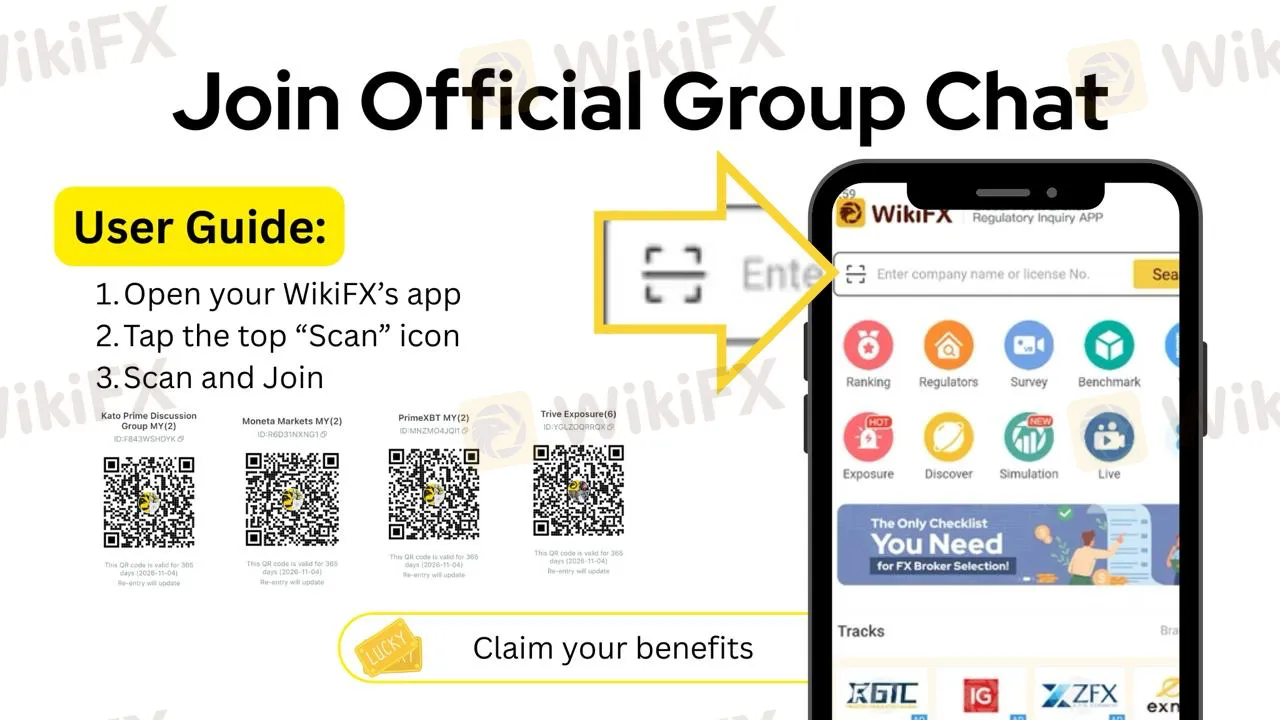

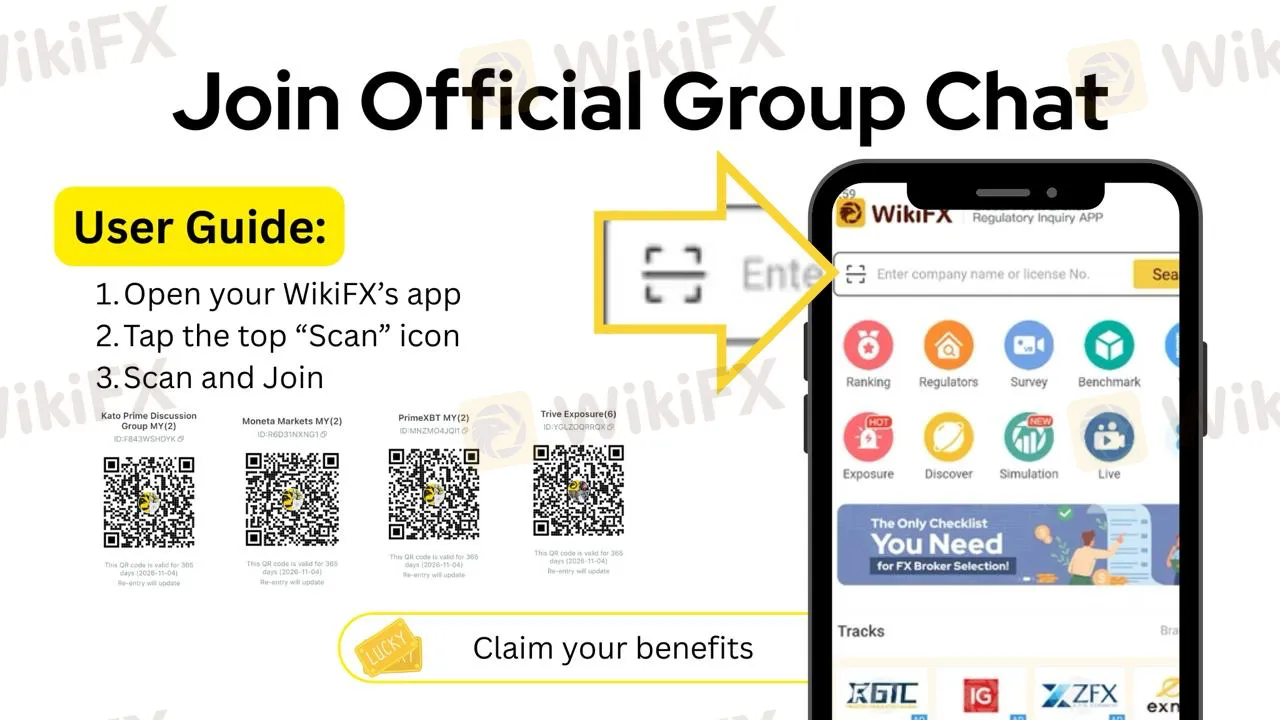

WikiFX provides a range of practical tools that support traders in making informed decisions. Its pip calculator allows users to estimate potential profits and losses with accuracy, while the economic calendar offers real-time updates on global financial events that may influence currency movements. The platform also delivers timely market news and comprehensive broker reviews, helping traders stay aware of industry developments and the credibility of various service providers. As a reminder, choosing a regulated broker is crucial for safety and transparency, and WikiFX simplifies this due diligence process by verifying licences, regulatory status and company backgrounds. The application is free to download, making it an accessible resource for Malaysian traders seeking guidance and clarity in the forex market.