Abstract:Do you witness a negative trading account balance on the KKR broker login? Does the broker prevent you from withdrawing your funds after making profits? Do you need to pay an extra margin for withdrawals? These trading issues have become common for traders at KKR. In this KKR broker review article, we have elaborated on the complaints. Take a look!

Do you witness a negative trading account balance on the KKR broker login? Does the broker prevent you from withdrawing your funds after making profits? Do you need to pay an extra margin for withdrawals? These trading issues have become common for traders at KKR. In this KKR broker review article, we have elaborated on the complaints. Take a look!

Top Trading Complaints Against KKR You Must Check

The Negative Trading Account Balance Allegation Against KKR

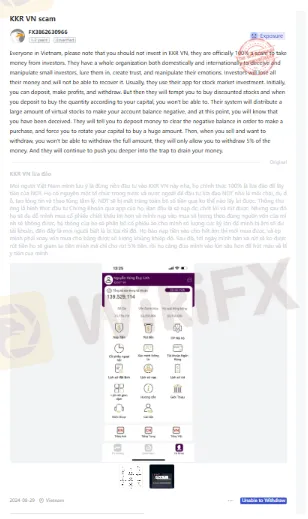

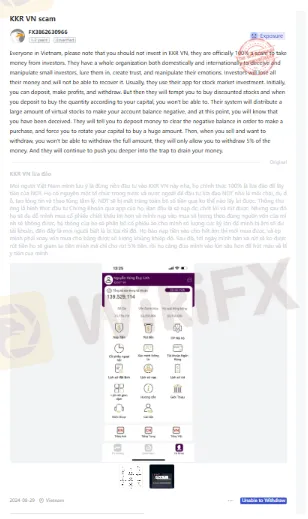

A trader reported that KKR officials let traders deposit funds, make profits and withdraw. Thereafter, these officials will tempt traders to buy discounted stocks. Somehow, you are able to buy the required quantity based on your capital reserve. Knowing this, the officials will distribute a large number of stocks to push your trading account balance into the negative zone. The trader alleged that, at this point, KKR tells traders to deposit to clear the negative balance and make a fresh purchase. Check out the comprehensive KKR review by the trader.

Withdrawal Denials After Making Profits, Say the Trader

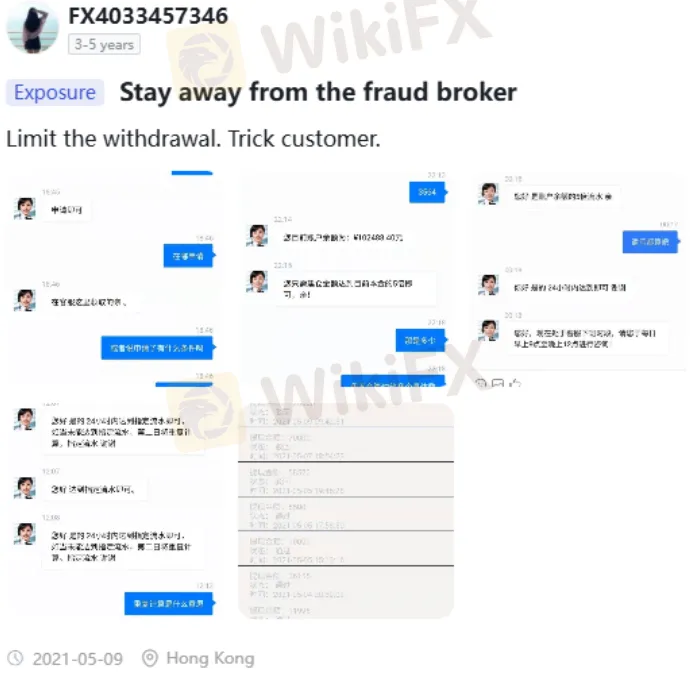

A trader complained that KKR did not allow him to withdraw funds after earning profits. Imagine the numerous strategies and the swift approach the trader had employed to earn those profits. Hearing NO for withdrawals after all these efforts annoyed the trader, who vented out by sharing this complaint on WikiFX, a leading forex broker regulation inquiry app. Check out the complaint below.

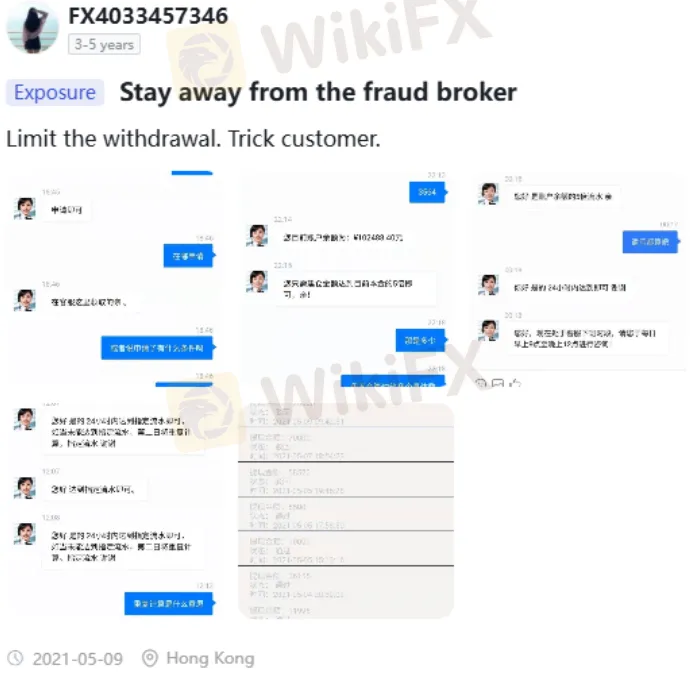

The Limited Withdrawal Access Claim

In another revelation, a trader alleged that KKR tricks many traders into investing on its platform. To make it complicated, the broker limits the withdrawal access. Meted out an experience of this kind, the trader shared the KKR broker review online. Lets check it out!

KKR Broker‘s Dubious Stance on Regulatory Supervision

The KKR broker is alleged to have a dubious stance on the company’s regulatory status. According to a trader, its officials sometimes claim that the FCA regulates it. Other times, the officials say that it is regulated by the CBRC, the trader said. However, the trader acknowledged that Wiki Global has detailed its regulatory status. You can know about this right below.

KKR Broker Review: Check Score & Regulatory Status

The complaints against the KKR broker point to a serious operational glitch that stems from a lack of regulatory oversight. The investigation by the WikiFX team found no license for KKR despite its operational presence spanning more than five years. As a result, the team gave the KKR broker a score of 1.54 out of 10.

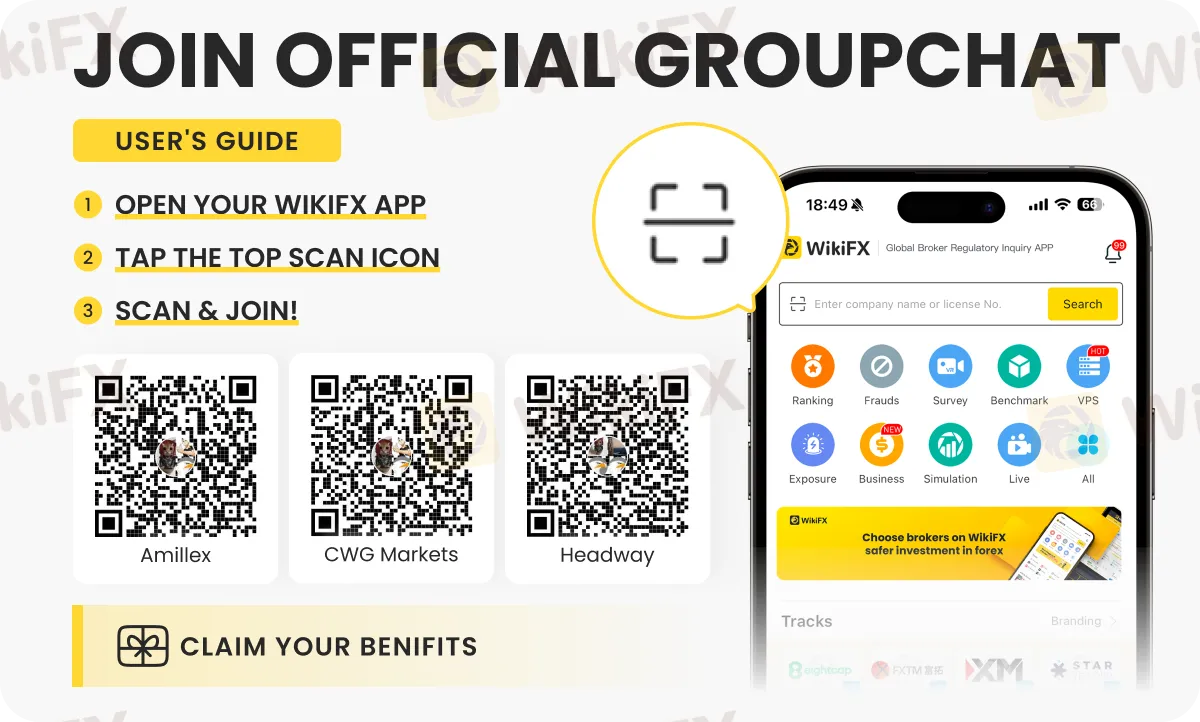

Want to stay updated about the latest forex trends and news? Join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) today.