Abstract:Are you having trouble withdrawing funds from your IEXS account or facing delays getting your funds? Not being able to access your own capital is one of the most stressful situations any trader can face. It breaks down your basic trust with a broker. This isn't just annoying - it's a serious problem that can mess up your financial plans and cause a lot of worry.

This guide goes beyond basic advice. We'll look at real user experiences and official regulatory information to give you clear answers. Our goal is to help you understand why IEXS withdrawal problems happen and show you practical steps you can take. We understand your concerns and want to give you the information you need to handle this tough situation.

Understanding Your Frustration

Are you having trouble withdrawing funds from your IEXS account or facing delays getting your funds? Not being able to access your own capital is one of the most stressful situations any trader can face. It breaks down your basic trust with a broker. This isn't just annoying - it's a serious problem that can mess up your financial plans and cause a lot of worry.

This guide goes beyond basic advice. We'll look at real user experiences and official regulatory information to give you clear answers. Our goal is to help you understand why IEXS withdrawal problems happen and show you practical steps you can take. We understand your concerns and want to give you the information you need to handle this tough situation.

How Big Is This Problem?

When we look at what users are saying online, we see a worrying pattern of complaints about IEXS. WikiFX, a website that collects user reviews and regulatory information about brokers, has posted a warning that says: “WikiFX has received a total of 12 user complaints against this broker, please be aware of the risks...” These aren't just one-off problems - they show a clear pattern of serious issues. Let's break down what users are experiencing:

· Complete Withdrawal Failures: Several real users report they can't get their funds out at all. A user in Thailand (FX3683206741) called the experience a “nightmare,” saying their capital never arrives despite asking multiple times. Another Thai user (FX2078363630) felt the same way, saying their capital was “trapped” and “blocked without clear explanations.” A third report from Thailand (FX4003422530) explains how every withdrawal attempt faced “delays, vague responses, or no resolution at all.” This problem isn't just with bank transfers - a user in India (fapp) reported waiting five days for a crypto withdrawal that was never processed.

· Very Long Withdrawal Delays: Beyond complete failures, traders report having to wait way too long. An Indian user (FX3027693162) said that after experiencing huge slippage, getting their remaining 80,000 rupees took five days to process, which they said was “even slower” than expected.

· Frozen Accounts: In one of the worst cases, a user from India (FX3731280539) reported their account with 600,000 rupees was frozen. The only reason customer service gave was a “compliance review,” with no other explanation or timeline. This lack of clear information leaves the trader not knowing what will happen or when.

· Platform Problems: The withdrawal issues seem to be part of bigger problems with how the platform works. Many complaints mention severe slippage, system freezes, and stop-loss orders that don't work. One user (FX3027693162) reported “200 points of slippage” during an important economic news release, while another (FX2913372850) experienced 32 pips of slippage overnight. These problems suggest a platform that struggles with basic trading functions, making it difficult to trust that it can handle fund transfers properly.

These are just summaries of what users experienced. To make your own decision, it's important to read the full details of these complaints. You can find a complete record of all user reviews and problem reports on the official IEXS page on WikiFX.

Understanding Why This Happens

Just listing complaints isn't enough. When we analyze the available information, we can see several warning signs that might explain why IEXS withdrawal delays and platform problems happen. These factors, taken from the broker's public information, show potential operational and regulatory risks.

Regulatory Warnings

A broker's regulatory status is the foundation of whether you can trust them. The information about IEXS raises serious questions. The broker has an Appointed Representative (AR) license with the Australian Securities and Investments Commission (ASIC). An AR license means the company works as an agent for another, fully licensed company, which is a less direct form of regulation.

More worrying is its Investment Advisory License with the UK's Financial Conduct Authority (FCA), which is marked as “Exceeded.” This means the broker might be offering services or operating beyond what they're allowed to do. Operating outside of regulatory permissions is a major red flag.

The most serious warning is a notice from ASIC dated 2025-08-13, putting “IEXS Global (iexs.com)” on its investor alert list. Being officially flagged by a top regulator like ASIC is one of the strongest signs of potential risks for traders.

A Pattern of Problems

The IEXS withdrawal problems don't happen alone. They're part of a larger pattern of platform unreliability that many traders have documented. The complaints are specific and technical, pointing to system-wide failures.

Users report extreme slippage, such as a stop-loss order on USD/JPY slipping by 130 points (FX3731280539) or a EUR/USD spread becoming nine times wider during a news release (FX1139931510). Others describe system freezes lasting seconds or even minutes during volatile periods, preventing them from closing positions (FX3866386214, FX3505597072).

From a business perspective, a platform that struggles with basic tasks, such as executing orders, providing price feeds, and running stop-loss orders properly, may also struggle with the back-office processes needed for smooth, timely withdrawals. These technical failures suggest a lack of strong infrastructure, which can directly impact all client services, including processing funds.

Your Action Plan

If you're currently facing an IEXS withdrawal delay or a frozen account, feeling helpless is understandable. However, there are structured steps you can follow to address the issue and create a formal record of your attempts to solve it.

1. Create a Complete Record

Before taking any other steps, document everything. Take clear screenshots of your account dashboard showing the balance, your withdrawal request history, any error messages you've received, and your complete chat logs or email exchanges with IEXS customer support. Date and time-stamp all act as evidence. This documentation is extremely valuable for any future escalation.

2. Use Official Communication Channels

Start or continue formal contact with the broker using its official channels. Based on its public profile, these are:

· Email: `support@iexs.com`

· Phone: `+4008424229`

In your communication, be professional, clear, and direct. State your account number, the exact amount and date of your withdrawal request, and provide a clear timeline of the events and your attempts to resolve the issue. Ask for a specific reason for the delay and a firm timeline for resolution.

3. Review the Broker's Terms

Carefully read the withdrawal policy in the broker's terms and conditions or client agreement. Look for any stated processing times, required verification documents, or specific conditions that you may have accidentally missed. Understanding their official policy will strengthen your position if they're failing to follow their own rules.

4. Share Your Experience Publicly

If official channels fail to provide a satisfactory solution, sharing your experience publicly is a step many traders take to apply pressure and warn others. Platforms like WikiFX have dedicated “Exposure” sections where users can detail their issues with supporting evidence. Submitting a detailed, evidence-backed complaint on the IEXS WikiFX page can alert other traders and the platform itself.

5. Consider Contacting Regulators

As a final step, you can consider contacting the regulators listed. Given the “Appointed Representative (AR)” status with ASIC and the “Exceeded” status with the FCA, the path for regulatory help may be more complex than with a fully licensed broker. However, it's still a valid option. You can file a report with both ASIC and the FCA, providing the complete record you created in step one. This is particularly relevant given that ASIC has already placed the broker on its investor alert list.

A Balanced View

To make an informed decision, it's essential to consider all available information, including both the negative reports and any positive points. While we've focused on problems, a fair analysis requires acknowledging the full picture presented publicly.

The Case for Caution (The Red Flags):

· Many Verified Complaints: There are over a dozen verified complaints on WikiFX, with many focused on withdrawal failures, frozen accounts, and severe platform problems like massive slippage.

· Regulatory Warnings: The broker is operating under an “Exceeded” FCA license and, most importantly, was added to ASIC's investor alert list on August 13, 2025.

· Low WikiFX Score & Tags: The broker has a low overall score and is flagged with risk tags like “Suspicious Overrun” and “High potential risk,” showing that third-party analysis has identified significant concerns.

The Counterarguments (The Positive/Neutral Points):

· Successful Withdrawals: Some users have reported positive experiences. A user from Vietnam (nanababy) said withdrawals have always been timely. An Indian user (FX1128270969) reported that USDT withdrawals were “quite fast,” processed in 45 minutes, though they noted large amounts require proof of profile.

· Claims of a “Smear Campaign”: An unverified review from a user named 'Amy_Yo' defends the broker, claiming “compliant operations and positive client feedback” and suggesting recent negative claims are “malicious attacks.”

· Long Operating History: The broker is listed as having been in operation for “5-10 years,” a duration that some traders may view as a sign of market presence and legitimacy.

The conflicting reports make personal research essential. The only way to make a fully informed decision is to review all the evidence yourself. The complete IEXS profile on WikiFX, including its regulatory details, server performance, and all 28 user reviews, provides the data you need to draw your own conclusions.

Conclusion: Moving Forward Carefully

While IEXS is a broker with an established operating history, the significant number of verified user complaints about IEXS withdrawal problems, frozen accounts, and severe platform problems is a serious concern. These aren't minor complaints - they are fundamental failures that affect a trader's security.

When these user-reported issues are combined with major regulatory red flags - specifically, an “Exceeded” license status and a formal warning on ASIC's investor alert list - they show a high-risk trading environment. The ability to deposit and, more importantly, withdraw funds reliably and without unnecessary delay is the most basic requirement of any trader. We strongly encourage traders to choose brokers with a clean, top-tier regulatory record and a consistent, long-term history of positive user feedback on fund processing and platform stability.

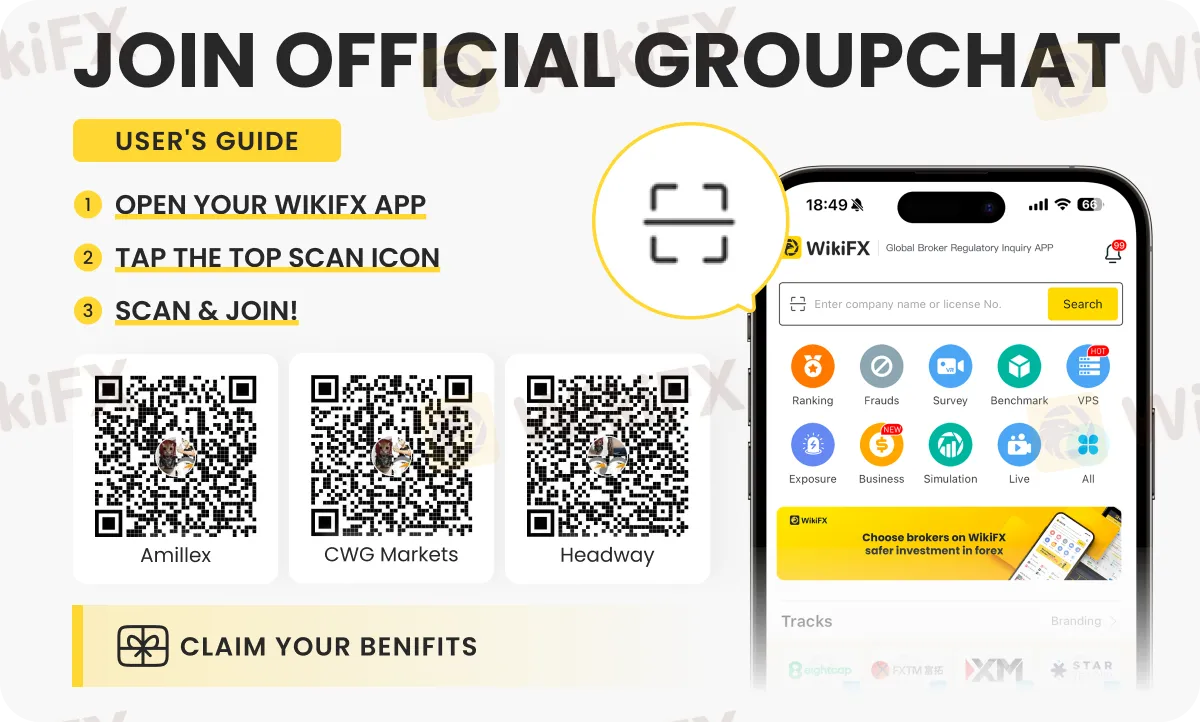

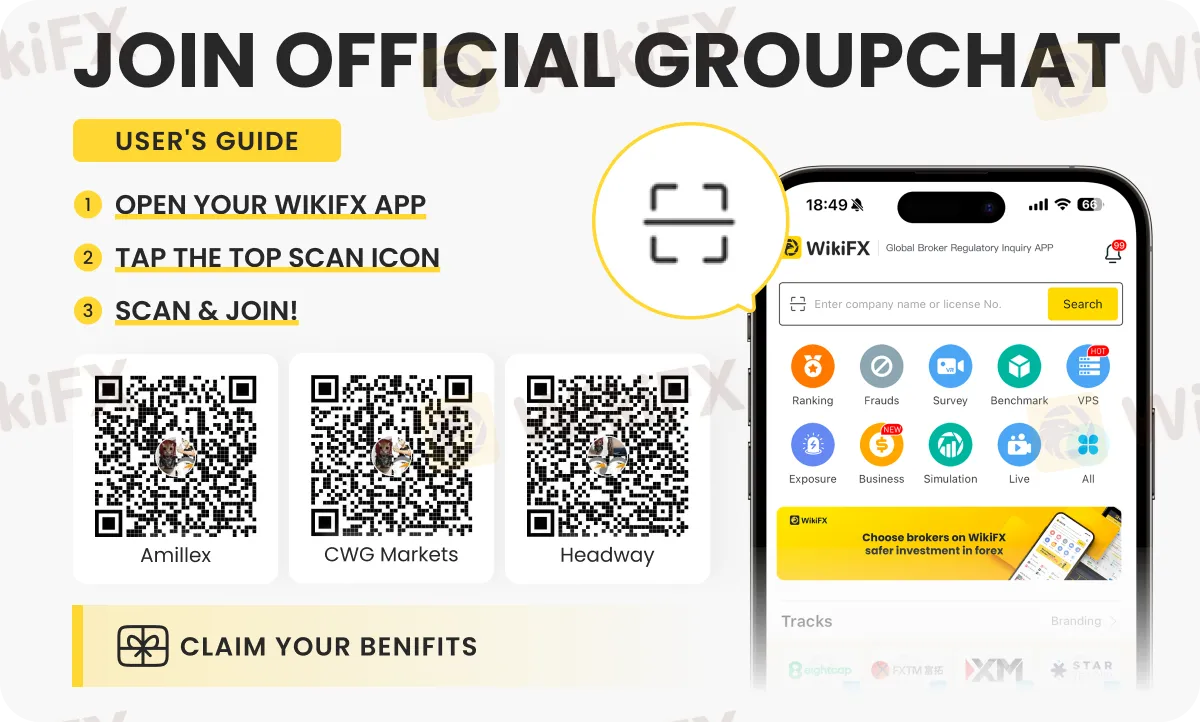

For extensive forex market updates, connect with us on special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the simple instructions shown below.