NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Trading Pro Review reveals scam alerts, fake offices, and withdrawal issues. Stay cautious with this unregulated broker.

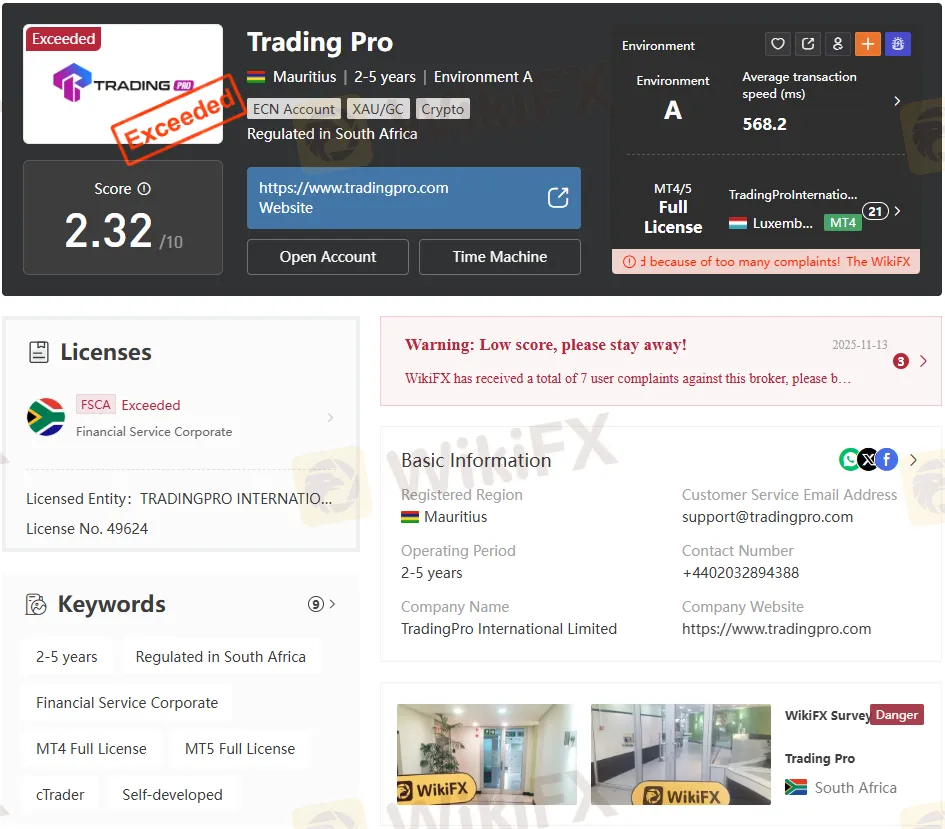

Trading Pro International Limited positions itself as a global forex and CFD broker, but the evidence collected in the attached records paints a troubling picture. The company claims regulation under South Africas Financial Sector Conduct Authority (FSCA), license number 49624, yet the license status is marked “Exceeded”—a designation that signals non‑compliance.

Investigators visiting the listed South African office (Pharos House, Durban) found no physical presence, confirming suspicions that Trading Pro operates without genuine oversight. WikiFX surveys further highlight the absence of verifiable offices and a low trust score of 2.32/10, warning traders to stay away.

Key Regulatory Findings:

This regulatory opacity is the first major red flag in the Trading Pro Review.

The brokers credibility collapses when examining user experiences. One trader reported being lured at the Dubai Forex Expo with a 100% deposit bonus. After making profits, the withdrawal request was denied, citing “account violations.” Both profits and bonuses were removed.

Transaction records from 2025 show repeated issues:

| Transaction ID | Type | Status | Amount (USD) | Account | Date |

| 15252783 | Transfer Out | Approved | -1,525.00 | ScalpX MT5 122157 | 2025-09-23 |

| 14893784 | Credit Expired | Approved | -827.00 | ScalpX MT5 122157 | 2025-08-15 |

| 14030408 | Deposit | Approved | +827.95 | Wallet 193053 (Crypto) | 2025-05-15 |

These records confirm a pattern: deposits are accepted, but withdrawals are systematically obstructed. This aligns with the “Trading Pro Exposed” narrative circulating in trader forums.

Trading Pro advertises multiple account types—ScalpX, Pro, Rookie, and Micro—with leverage up to 1:2000. Minimum deposits vary from $1 to $50, depending on the account tier.

Account Features:

While these conditions appear attractive, they mask deeper risks. High leverage combined with unregulated oversight exposes traders to extreme volatility and broker manipulation.

Trading Pro promotes full licenses for MT4 and MT5, with claims of multiple servers and average execution speeds of 79.82 ms. However, independent testing shows inconsistencies:

The brokers proprietary app boasts over 1,200 downloads, yet reviews highlight poor functionality and frequent login issues.

Platform Snapshot:

These findings reinforce the “Trading Pro Exposed” theme—marketing promises rarely match operational reality.

Pros:

Cons:

This Trading Pro Review demonstrates why traders should exercise extreme caution. Despite offering attractive spreads, leverage, and platform diversity, the brokers regulatory failures, withdrawal obstructions, and fake office listings outweigh any potential benefits.

Verdict: Trading Pro Exposed as a high‑risk, unregulated broker. Traders are advised to avoid engagement and seek regulated alternatives with transparent operations.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr