FCA Flags Multiple Unauthorised Platforms Offering Financial Services Without Approval

Unlicensed platforms operating across multiple domains and using identical website interfaces to offer financial services.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:New FCA alert: multiple forex/CFD brands share the same “n3” signup page. We list examples and show fast ways to confirm a broker’s licence.

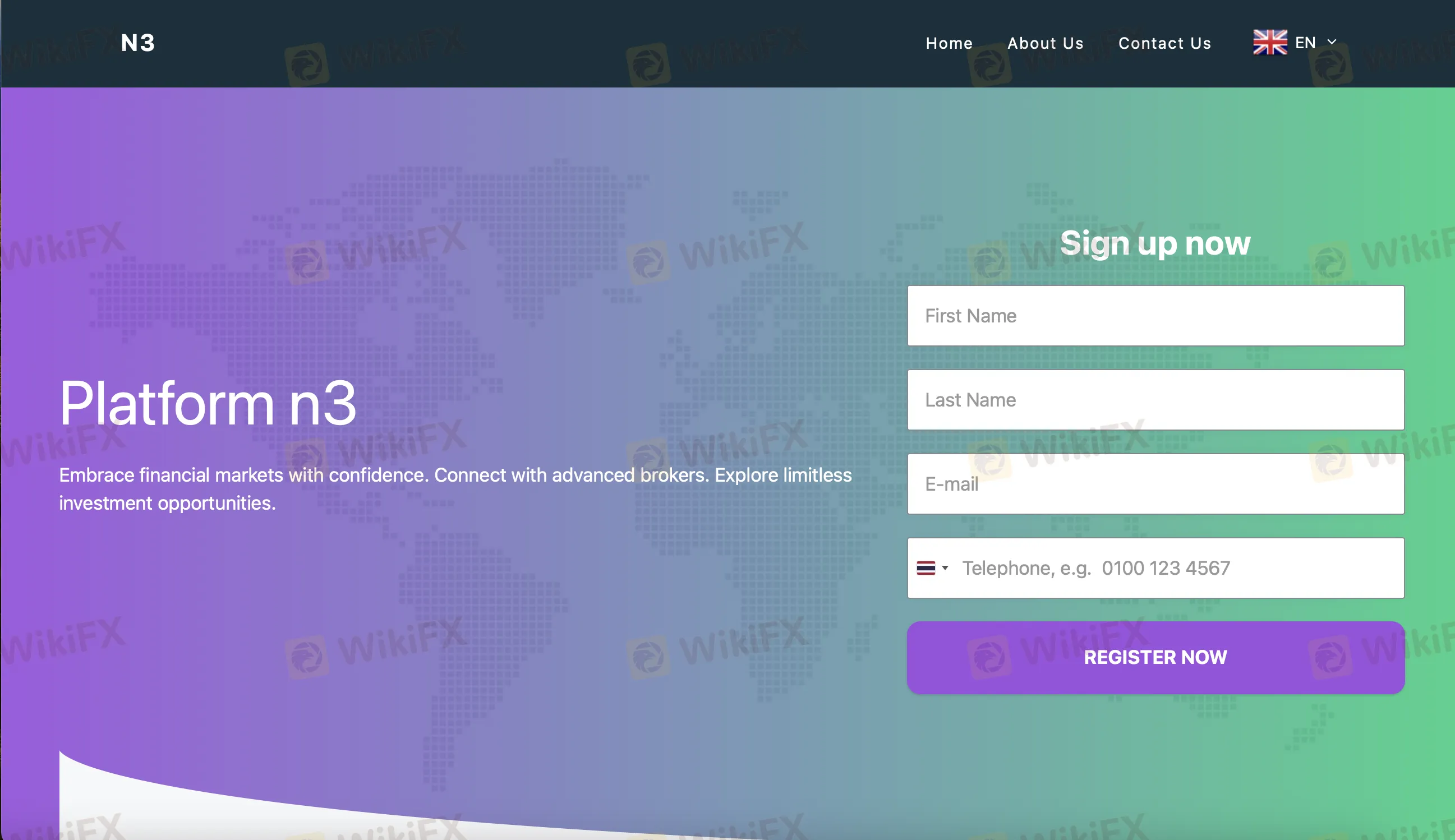

The UK‘s Financial Conduct Authority (FCA) has issued another reminder to retail traders: a cluster of unauthorised brokers is circulating online using the same landing-page template. The pages look almost identical — a large headline reading “Platform n3,” a short marketing blurb, and a right-hand “Sign Up Now” form with three or four fields — with only the logo and brand name swapped. The regulator’s message is simple: do not deposit or share documents with firms that arent authorised.

Below are examples of domains that present an almost carbon-copy “n3” registration page. Treat similar look-alikes as high risk and verify authorization before taking any action:

These represent a pattern, not an exhaustive list. If you see the same layout under a different brand, assume high risk until proven otherwise.

WikiFX has documented the “single template, multiple brands” tactic in earlier coverage, showing how the same landing page is recycled across fresh domains while authorization claims stay vague or unverifiable:

Round-up of identical landing pages and the risks of funding unlicensed entities:

https://www.wikifx.com/en/newsdetail/202509198354302169.html

Follow-up analysis of the “close site → change domain → relaunch” cycle once exposure increases:

https://www.wikifx.com/en/newsdetail/202509056484552112.html

Together with the FCAs latest alert, these reports point to a rinse-and-repeat web operation designed to harvest leads quickly before moving on.

Bottom Line: When different “brokers” share the exact same n3 registration page, that‘s your cue to stop and verify. Check a regulator’s public register or a trusted database before you share documents or send money. If the entity, license, and domain dont match — walk away and keep evidence.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Unlicensed platforms operating across multiple domains and using identical website interfaces to offer financial services.

FCA warnings reveal four unauthorised investment platforms using the same website design, differing only in their logos.

The UK’s Financial Conduct Authority is scrapping its old complaints reporting system. From 2027, brokers face bi-annual filings, the removal of the "Other" category, and strict new mandates on tracking vulnerable traders.

The Financial Conduct Authority (FCA) in the UK has published the FCA Warning List Firms to Avoid:- November 2025, alerting forex traders and investors about unauthorized brokers. These firms are operating without the necessary FCA approval. To safeguard your funds and avoid scams, be sure to check the full warning list below.