Abstract:CMC Markets allegations explained—slippage, fees, and regulation—plus how to assess execution integrity and safety in Singapore and globally.

Introduction

CMC Markets faces recurring allegations centered on slippage, order execution integrity, and fee transparency, alongside questions about its regulatory status in multiple jurisdictions, including Singapore, the UK, New Zealand, Canada, Germany, and France. While user exposures describe severe slippage during volatility and perceived hidden charges such as inactivity fees, the broker simultaneously holds prominent licenses (e.g., FCA, MAS, FMA, CIRO) and operates long-standing entities with market‑maker permissions, creating a mixed risk‑reward profile that demands careful, evidence‑based evaluation. This article examines the allegations, contextualizes them against regulation and platform structure, and outlines a due‑diligence framework tailored to retail traders, with a focus on Singapore.

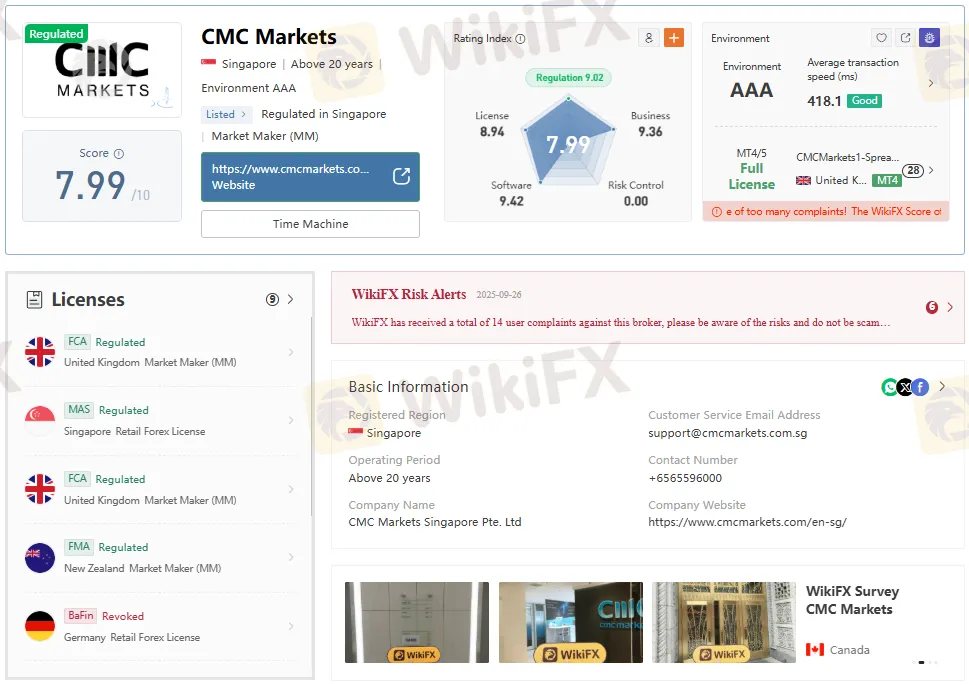

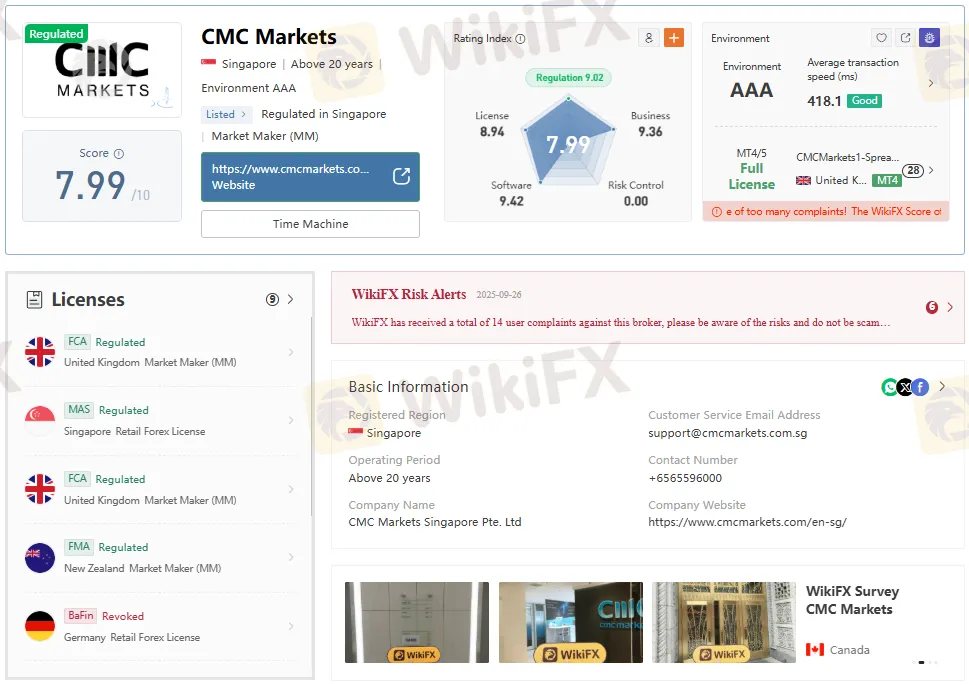

Regulation and licenses

CMC Markets operates as a market maker with long‑standing oversight under the UK FCA (CMC Markets UK plc, Firm Ref 173730, Market Maker license type, effective since 2001) and holds a current “Regulated” status in that jurisdiction. In Singapore, CMC Markets Singapore Pte. Ltd. is listed under MAS with a “Regulated” status and a public business address at Central Boulevard, aligning with local rules for retail FX; on‑site survey artifacts also confirm office presence. The group shows current authorizations in New Zealand (FMA; license 41187), Canada (CIRO; regulated), and Australia (ASIC license 238054 for the Asia Pacific entity), while historical retail FX permissions are recorded as revoked in Germany and France for the UK plc—separate from a newer German entity with a “Common Financial Service License” showing as “Exceeded.”

Execution model and slippage context

CMC Markets identifies as a market maker (MM), not an ECN—an important structure distinction because internalization of flow, spread setting, and last‑look logic can affect apparent fills and slippage versus direct market access. Reported average transaction speed of roughly 418 ms is tagged “Good,” yet even sub‑second execution can experience adverse price movement in fast markets, particularly on gold and news events, which magnify gap‑risk and requotes. Allegations that spread widen into stops reflect a common trader concern; however, proving intent demands synchronized broker price ladders, independent quote feeds, and timestamped audit trails, not just outcome‑based screenshots.

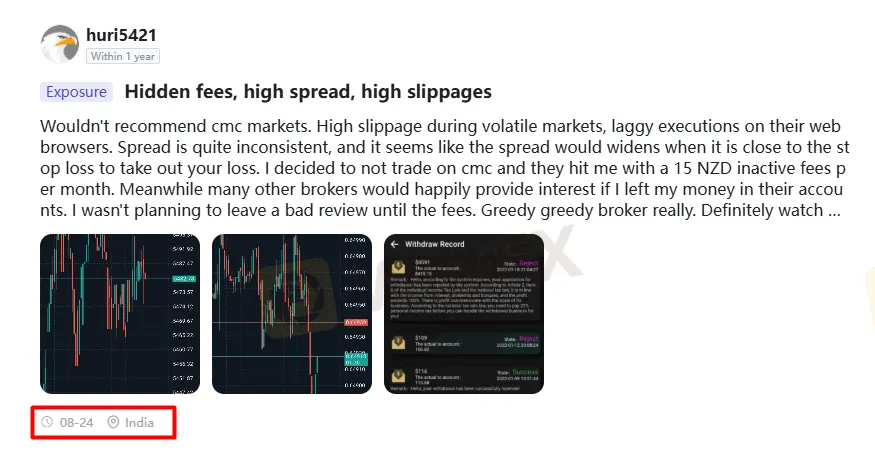

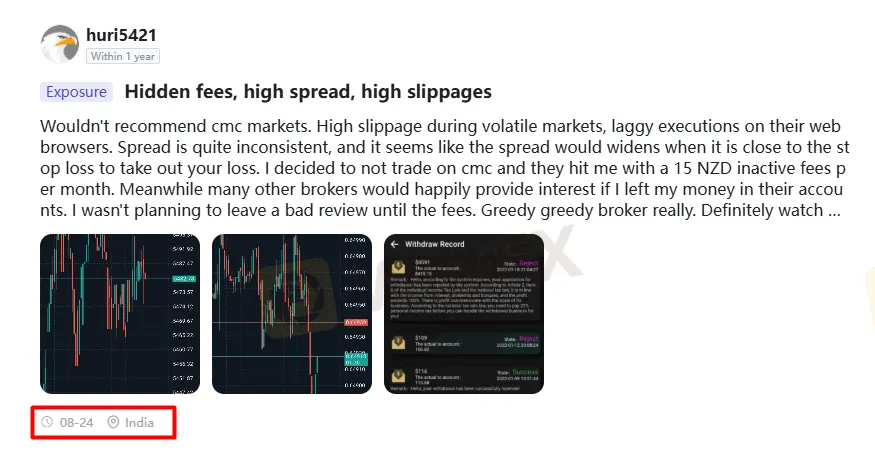

Fees, spreads, and inactivity policy

The broker advertises two principal account types: Standard with FX spreads “from 0.6 pips” and FX Active with “from 0.0 pips” plus a 0.0025% commission, which can improve headline spreads but shift total cost into commission for active FX. Share CFD commissions vary by market, with minimum charges (e.g., US$10 minimum on US shares), so cost realism depends on ticket size and venue, not the lowest possible percentage. Dormant accounts—no trades or open positions for one year—incur a monthly inactivity fee of about 15 AUD (or equivalent), a policy that aligns with the “hidden fees” criticism when traders are unaware of the dormancy clock.

For Singapore residents, the MAS regulation is in force for the local entity, with public address verification through field surveys, but traders should still validate license scope and permitted products before funding. Leverage for retail accounts is listed up to 1:200, but MAS product‑specific caps and risk disclosures still apply, and slippage risk remains instrument‑dependent regardless of jurisdiction. Platform availability includes CMCs NextGen, plus MT4/5 connectivity under certain servers, supporting familiar workflows but not removing market‑structure risks particular to a market‑maker model.

Due‑diligence checklist

- Compare live vs. independent quotes: Capture time‑synced Level 1 tick data around stop‑outs to evaluate spread behavior and true best‑bid‑offer during volatility.

- Export order audit logs: Obtain exact timestamps, requested vs. executed price, and platform latency to separate platform delay from market gap.

- Test both account types: Run simultaneous micro‑lot tests on Standard and FX Active to quantify effective spread plus commission under identical conditions.

- Monitor dormancy: Set calendar reminders within 10–11 months of inactivity to avoid the AUD 15 equivalent monthly charge.RO entries for the specific entity being used, and note historical revocations in Germany/France versus current German licensing under a different corporate unit.

Experience and expert perspective

Firsthand user exposures consistently point to slippage as the most salient pain point, with stop‑loss proximity and volatile‑hour trading cited as triggers for outsized fills. From an expert operations standpoint, MM venues can deliver competitive day‑to‑day pricing but concentrate execution control, increasing the need for independent price verification and slippage monitoring. Traders evaluating Singapore access should prioritize a staged funding plan, latency testing during scheduled news, and documented comparisons to alternate venues to build a personal evidence base rather than relying solely on anecdotes.

Pricing reality: spreads vs. total cost

The Standard “from 0.6 pips” quote is indicative and varies by volatility; live spreads can expand rapidly around data releases or thin liquidity, impacting fill quality. FX Actives “from 0.0 pips” plus 0.0025% commission can sharpen quotes for scalpers, but total round‑trip costs hinge on fill variance and any positive/negative slippage, not just published minimums. Share CFD minimum commission floors (e.g., US$10) can render small tickets disproportionately expensive, so position sizing should take fee floors into account.

Complaints, surveys, and reputational signals

The file notes a stream of recent complaints, consistent with the slippage and fee narratives circulating in public reviews. Field surveys document office confirmations in Singapore, Australia, and Canada, while a 2021 UK visit reported no office found at a time—an operational detail worth reconciling against the current London headquarters address. The composite “score” and sub‑scores (e.g., regulation ~9.02, average transaction speed labeled “Good”) present a mixed picture: adequate formal oversight with persistent customer‑experience friction during stress.

Market maker vs. ECN: what it means

Market makers internalize order flow and set their own dealing quotes, which can allow tight spreads in stable conditions but may widen materially in spikes, affecting stop execution. ECN or STP models route to external liquidity, potentially offering depth and variable spreads, but can still slip during gaps and may levy higher commissions without guaranteeing better fills. The key practical step is comparative, timestamped trade‑copier tests across venues in identical conditions to measure realized slippage empirically.

Bottom‑of‑funnel: Is it safe and regulated in Singapore?

CMC Markets Singapore Pte. Ltd. shows MAS “Regulated” status and public office verification, indicating authorization to serve local retail clients under Singapore rules. Safety in practice depends on entity selection, adherence to MAS requirements, and personal validation of execution and cost behavior on the chosen account type. For traders sensitive to slippage on high‑volatility assets, empirical testing under the local server environment remains the most decisive safety check beyond formal regulatory status.

Final assessment

CMC Markets presents a dual narrative: established, multi‑jurisdiction regulation with market‑maker permissions and broad product access, set against concentrated user complaints about slippage, execution lag, and fee transparency. Singapore access under MAS and FCA coverage in the UK are positives, but they do not eliminate event‑driven slippage or the need for disciplined, data‑driven testing. Traders should approach with structured verification of fills, vigilant fee management, and incremental funding—rewarding venues that demonstrate stable execution quality under their specific strategy and market hours.