Abstract:TradeUltra Limited is a broker that could potentially be an investment scam if you’re not careful. Why are we saying this? You'll understand after reading this TradeUltra review. This article exposes the warning signs of the broker and aims to protect you.

???? Read the full article below.

TradeUltra Limited is a broker that could potentially be an investment scam if youre not careful. Why are we saying this? You'll understand after reading this TradeUltra review. This article exposes the warning signs of the broker and aims to protect you. Read the full article below.

Red Flags of TradeUltra

1. Lack of Reputed Regulation

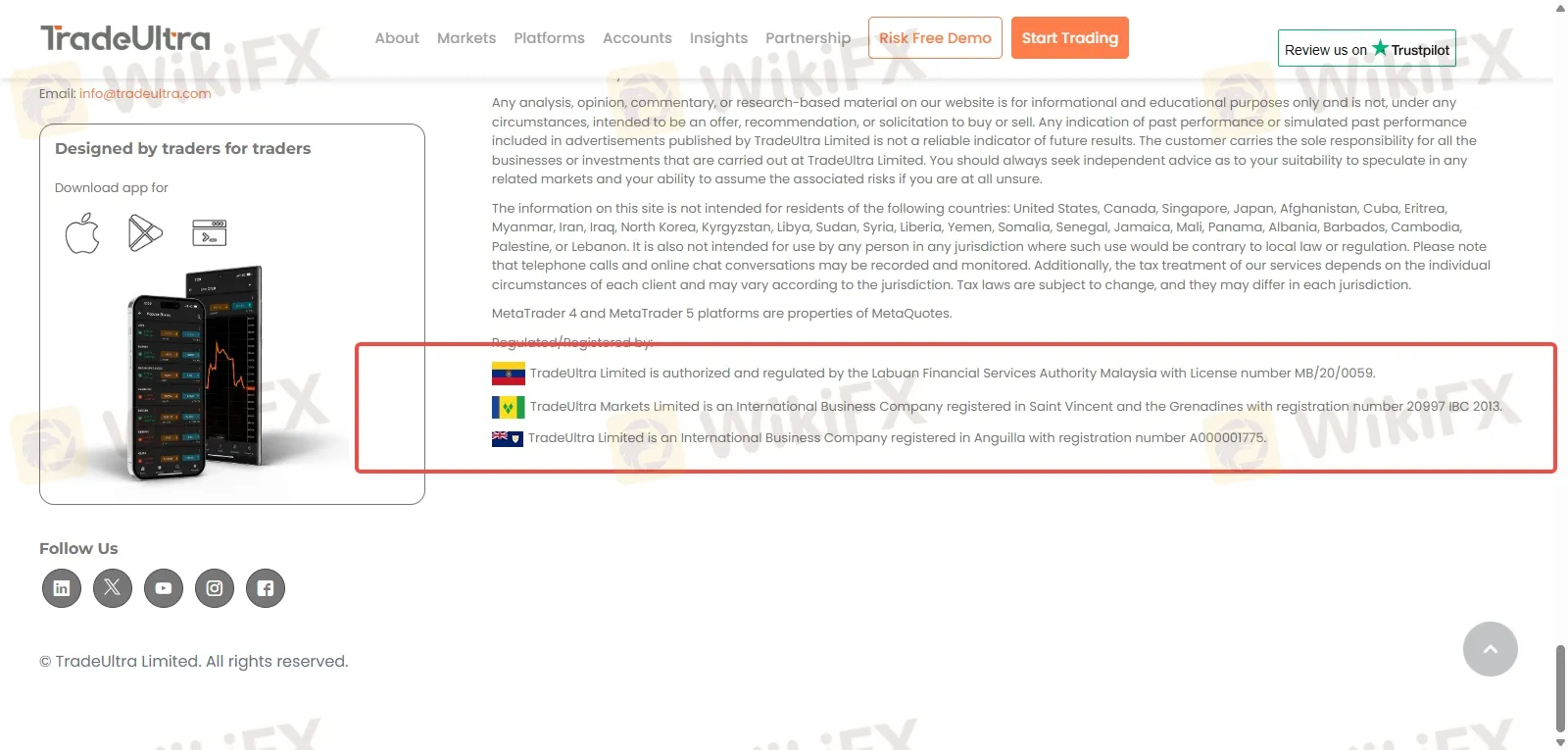

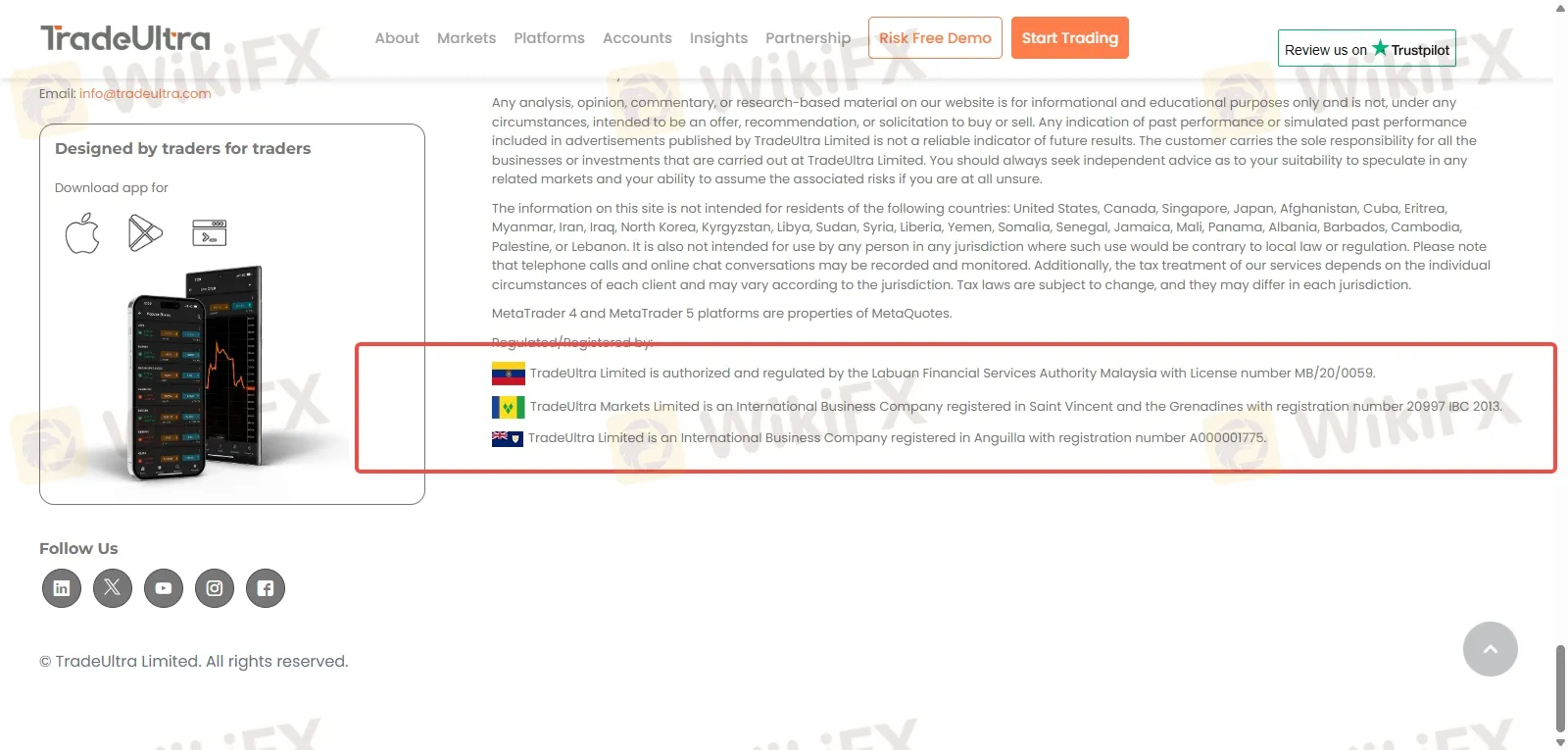

According to the broker, TradeUltra Limited claims to be authorized and regulated by the Labuan Financial Services Authority (LFSA) in Malaysia, under license number MB/20/0059. However, it's important to note that LFSA is not considered a top-tier regulatory body in the financial world. TradeUltra Markets Limited is registered as an International Business Company (IBC) in Saint Vincent and the Grenadines, with registration number 20997 IBC 2013—a jurisdiction widely known for its light regulatory oversight.

Furthermore, TradeUltra Limited is also registered in Anguilla as an IBC with registration number A000001775. The presence of multiple offshore registrations raises concerns about the broker's regulatory transparency and accountability.

2. TradeUltra offers CFD-only trading

TradeUltra Limited positions itself as a multi-asset Straight Through Processing (STP) broker, established in 2013 and headquartered in Malaysia. However, despite calling itself a multi-asset platform, the broker offers only CFD (Contract for Difference) trading, which can be highly speculative and risky—especially for inexperienced traders. The lack of access to real assets or a broader range of financial instruments is another point of concern.

3. Regional Restrictions On TradeUltra

The broker imposes restrictions on clients from several regions. According to its own disclosure, the services and information provided on the TradeUltra website are not intended for residents of the following countries:

United States, Canada, Singapore, Japan, Afghanistan, Cuba, Eritrea, Myanmar, Iran, Iraq, North Korea, Kyrgyzstan, Libya, Sudan, Syria, Liberia, Yemen, Somalia, Senegal, Jamaica, Mali, Panama, Albania, Barbados, Cambodia, Palestine, or Lebanon.

This long list of restricted countries further narrows the brokers client base and suggests a lack of global credibility and acceptance.

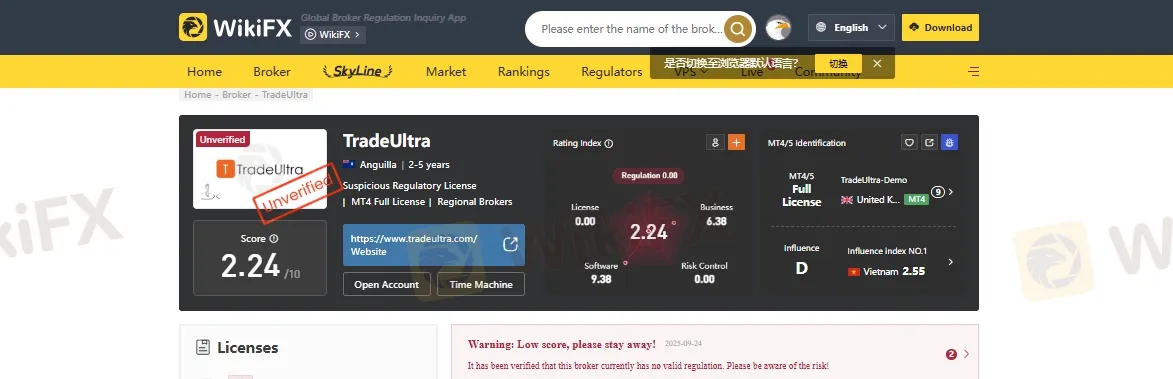

What WikiFX reveals about TradeUltra?

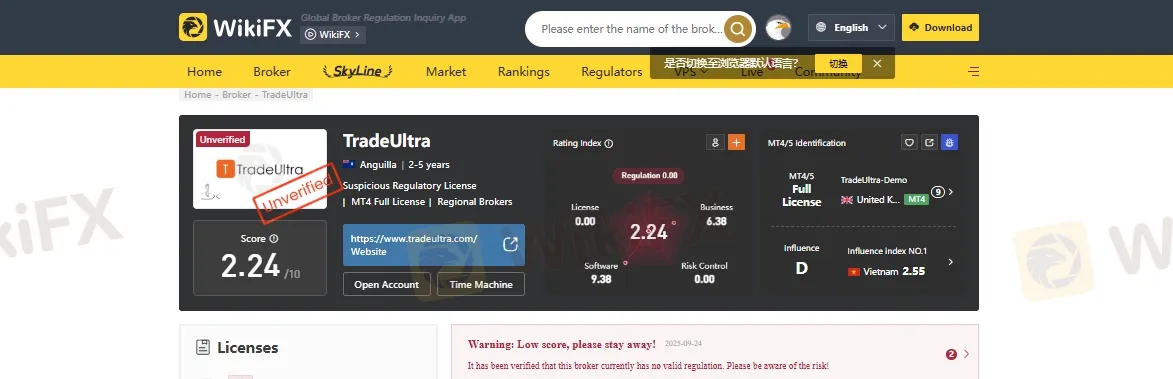

In our TradeUltra review, we found that WikiFX gave the broker an extremely low score — just 2.24 out of 10. This rating is a major red flag for anyone considering investing or trading with this platform. Also, WikiFX issued an alert, strongly advising users not to engage with the broker. The platform clearly stated a warning:

“LOW SCORE – PLEASE STAY AWAY.”

This kind of public alert from a monitoring site like WikiFX should not be taken lightly. It suggests that TradeUltra may not meet the basic standards of trust, transparency, or regulatory compliance expected from a reliable broker.

Join WikiFX Community

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!