Abstract:Is your trading experience at Apex Trader Funding nothing short of a woeful ride? Witnessing account bans and payout blocks? Have you been made to pay for an on-account evaluation? It seems you are with a scam forex broker. Many traders have expressed this concern on broker review platforms. Their growing concerns over a lack of ethical forex trading practices at Apex Trader Funding made us expose it. Read on to know what traders have been saying about this broker.

Is your trading experience at Apex Trader Funding nothing short of a woeful ride? Witnessing account bans and payout blocks? Have you been made to pay for an on-account evaluation? It seems you are with a scam forex broker. Many traders have expressed this concern on broker review platforms. Their growing concerns over a lack of ethical forex trading practices at Apex Trader Funding made us expose it. Read on to know what traders have been saying about this broker.

Examining Complaints Against Apex Trader Funding

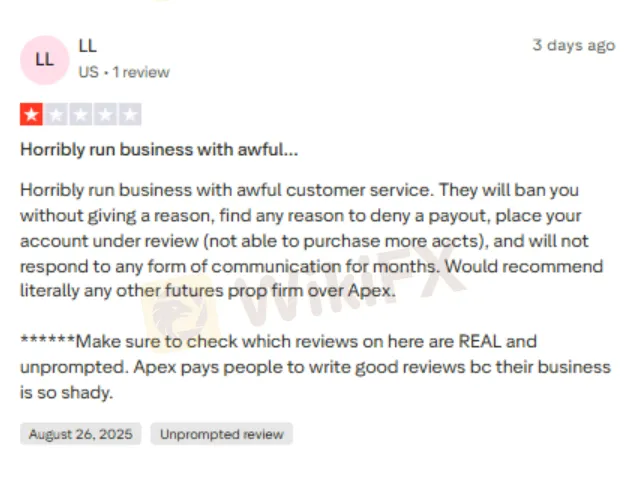

Awful Customer Service Makes it Awful for Traders

Trading issues can arise anywhere. However, as the customer support service helps resolve them, traders feel satisfied. However, nothing of that sort remains at Apex Trader Funding as traders do not find answers to their queries concerning account bans, payout denials, and more. Here is one screenshot wherein a trader has expressed concerns over the lack of effective customer support service.

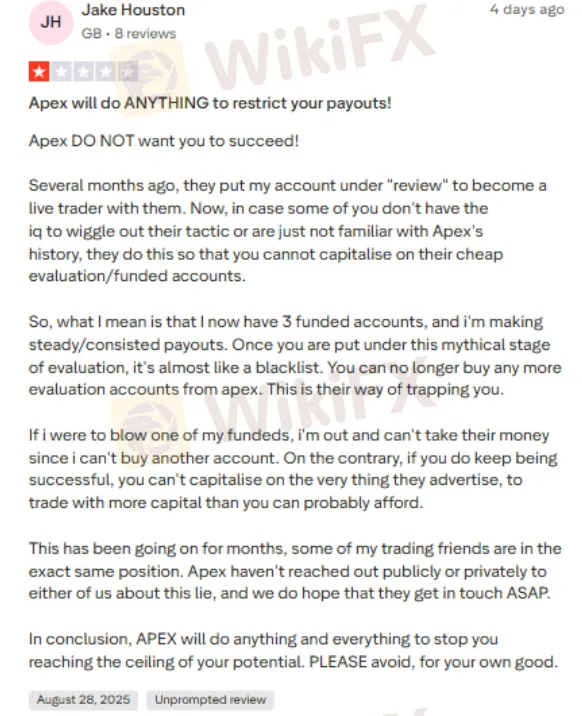

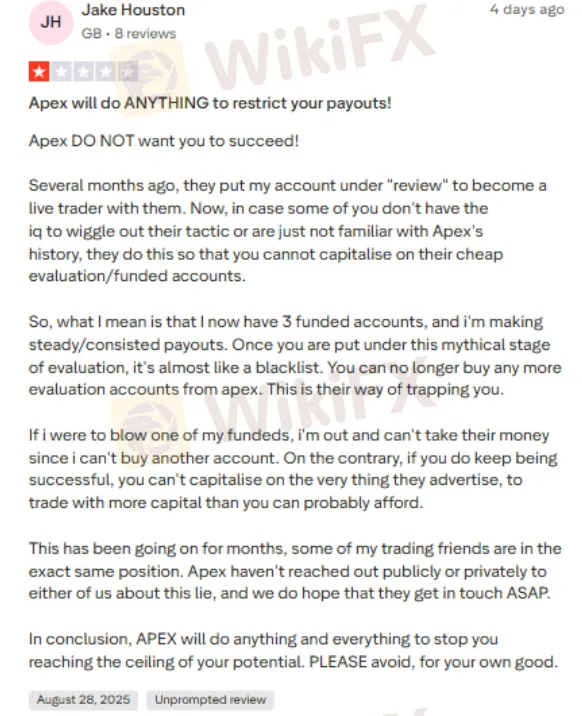

Too Many Hassles in the Account Evaluation

Traders constantly witness a myriad of issues concerning account evaluation. According to traders, it is one of the many scamming tactics the broker employs to defraud traders. It is like preventing traders from purchasing more evaluation accounts from Apex Trader Funding.

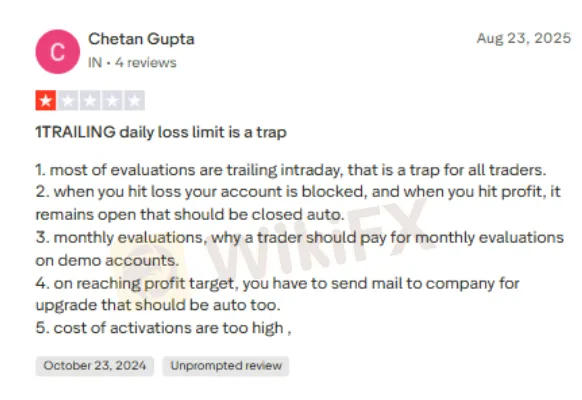

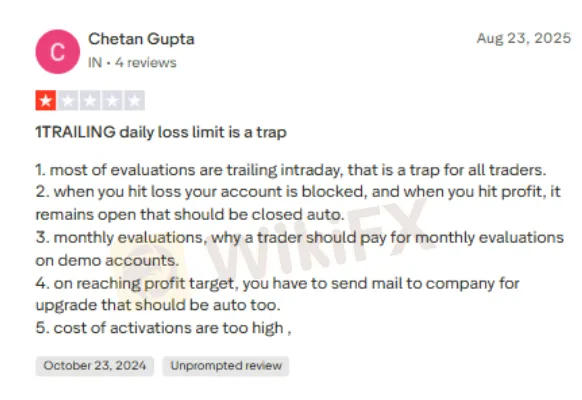

Monthly Evaluation Charges Debited from Traders

Apex Trader Funding constantly evaluates trading accounts, which may not be a bad thing. However, traders have to pay the evaluation charges. According to traders, if the account hits a loss, it gets blocked. Contrary to when profits happen, the account remains, which should be closed automatically. The activation pay remains high, which does not make traders any happier. Take a close look at this screenshot.

The WikiFX Review of Apex Trader Funding

The red flag stems from the fact that it is an unlicensed forex broker, which allows it to stay free from the obligations of making trading practices transparent with traders. The US-based forex broker, which, despite being in this business for over two years, has failed to gain the regulatory nod. Therefore, the scam tactics mentioned by traders above are not a surprise. Considering the imminent trading risks, the WikiFX team has given Apex Trader Funding a score of 1.30 out of 10.

Want to Stay Updated About Latest Forex Scams & Other Financial Updates? Join WikiFX Masterminds

Here is how you can join it.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congrats, you have become a community member.