Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The only true way to protect your hard-earned money in the forex market is by staying informed and alert. With the growing number of fraudulent brokers, this dynamic and tempting market has become increasingly risky. Awareness is your best defense. This article serves as another important scam alert, to help you stay safe and avoid losing your money.

The only true way to protect your hard-earned money in the forex market is by staying informed and alert. With the growing number of fraudulent brokers, this dynamic and tempting market has become increasingly risky. Awareness is your best defense. This article serves as another important scam alert, to help you stay safe and avoid losing your money.

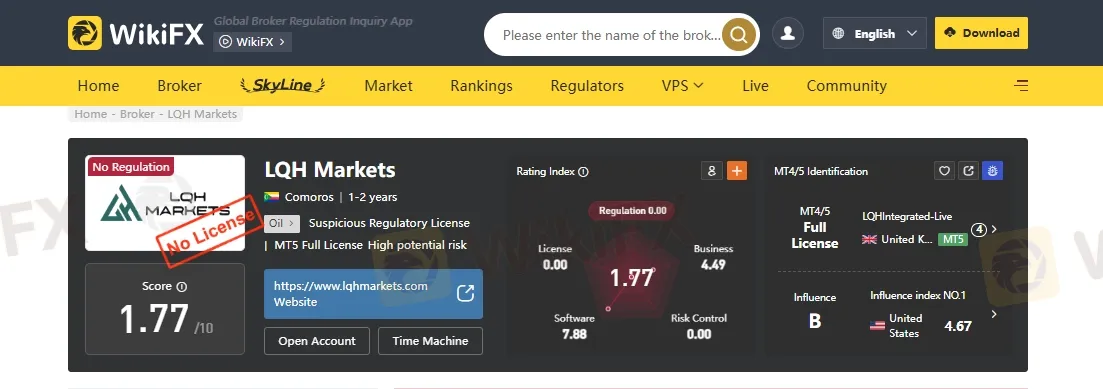

1. Relatively New Broker- LQH Markets is a relatively new broker, operating since 2023. Choosing to trade with a newly established company can be risky, as such brokers often lack a solid track record, industry recognition, and sufficient client reviews to verify their trustworthiness. Additionally, new brokers may not yet have the experience or infrastructure needed to effectively handle customer support issues or respond to market volatility.

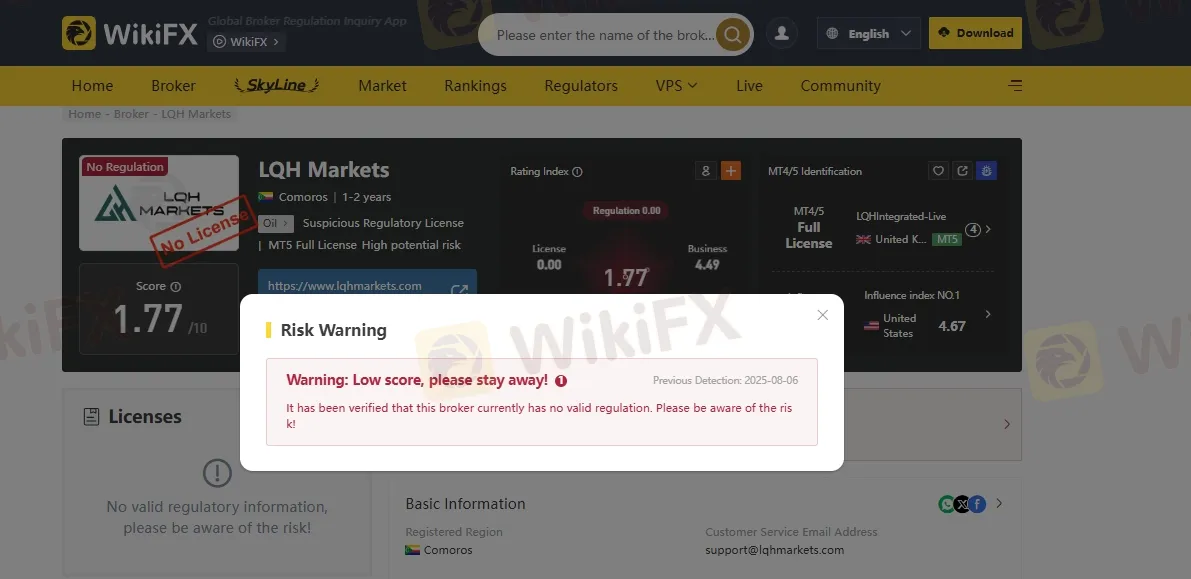

2. WiKiFX Warning - According to WikiFX , this broker is a scam broker and having low score. WikiFX has issued a clear and direct alert urging users to avoid LQH Markets. They highlight the brokers low rating and confirm it lacks valid regulatory approval—stating: “Warning: Low score, please stay away!... No valid regulation… be aware of the risk.”

3. Lack of Proper Regulation- Regulation is one of the most crucial factors to consider when choosing a forex broker. A properly regulated broker is supervised by reputable financial authorities that enforce strict rules to protect traders and ensure fair, transparent business practices. In contrast, an unregulated or loosely regulated broker operates without accountability, putting your funds at significant risk.LQH Integrated Ltd, claims to hold an International Brokerage and Clearing House License in Comoros . A jurisdiction known for its weak regulatory standards. This type of license offers little to no real protection for investors and is generally considered unsafe and unreliable by industry standards.

4. Low Trust Score- LQH has a very low score of 1.77 out of 10 on WikiFX. This low rating is a big warning sign and raises serious doubts about the brokers trustworthiness. A score this poor often means there are problems with customer service, transparency, or overall reliability. It's one of the red flags we've found. You must not ignore it.

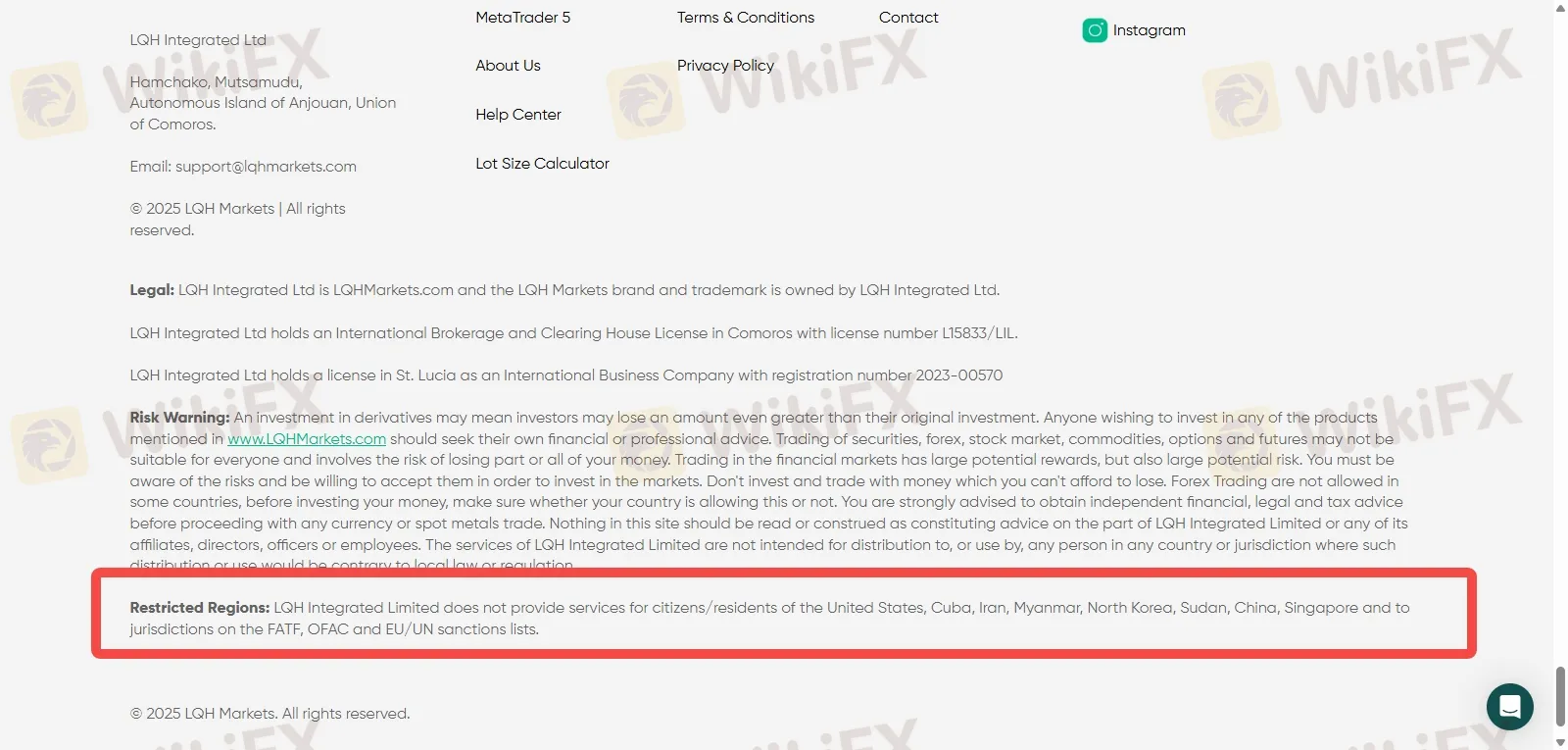

5. Regional Restrictions- A major red flag is that LQH does not offer its services in key financial markets, including Restricted Regions: LQH Integrated Limited does not provide services for citizens/residents of the United States, Cuba, Iran, Myanmar, North Korea, Sudan, China, Singapore and to jurisdictions on the FATF, OFAC and EU/UN sanctions lists.

6. Withdrawal Delays- Numerous traders have expressed concerns about the way LQH Markets operates, pointing to issues like slow withdrawals, surprise fees, and inefficient customer support. One of the most commonly reported problems is the delay in processing withdrawal requests, which can be particularly frustrating for traders who need timely access to their funds.

READ THESE IMPORTANT ARTICLES- www.wikifx.com/en/newsdetail/202508067254974846.html

www.wikifx.com/en/newsdetail/202508065794423793.html

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.