Abstract:This article is a review of TradersWay. TradersWay remains notable for its unregulated status and high‐risk trading conditions. Below, we provide an impartial overview of TradersWay’s key features, trading conditions, platform offerings, fees, and community feedback.

This article is a review of TradersWay. TradersWay remains notable for its unregulated status and high‐risk trading conditions. Below, we provide an impartial overview of TradersWays key features, trading conditions, platform offerings, fees, and community feedback.

Regulatory Status and Corporate Background

- Unregulated Operation

TradersWay is not overseen by any major financial regulator (FCA, CySEC, ASIC, etc.). This absence of oversight means that standard safeguards—negative balance protection, segregated client funds, formal dispute resolution mechanisms—may not apply. Prospective clients should carefully weigh the lack of regulatory recourse against the brokers trading conditions.

- Company Profile

Headquartered offshore, TradersWay positions itself as a cost‐efficient gateway to global markets. However, public details on the firms ownership structure and financial standing are limited.

Account Types and Leverage

Trading Platforms and Instruments

- Platforms

- MetaTrader 4 & 5 (MT4/MT5): Industry‐standard desktop, web, and mobile clients, offering Expert Advisor (EA) support, technical indicators, and strategy backtesting.

- cTrader: Enables Level II pricing, advanced order types, and algorithmic trading via cAlgo.

- Market Coverage

- Forex: Major, minor, and exotic currency pairs.

- Precious Metals: Gold, silver, platinum.

- Energies: Crude oil, natural gas.

- Cryptocurrencies: BTC, ETH, LTC, and others (as CFDs).

Costs: Spreads, Fees, and Commissions

- Spreads

- From 0 pips: On major forex pairs, under the brokers RAW pricing model. Average spreads tend to widen during volatile sessions.

- Commissions

- Withdrawal Fee: A flat 1.5% fee applies to certain withdrawal methods (e.g., credit/debit card transfers). Wire transfers and some e‐wallet withdrawals may be exempt or charged differently—clients should verify at the time of request.

- Overnight Swaps & Inactivity

- Standard interbank swap rates apply for positions held past the daily rollover.

- Inactivity fees may be imposed after 90 days without a trade.

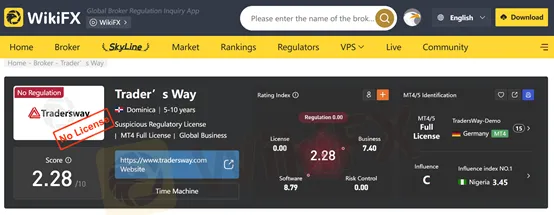

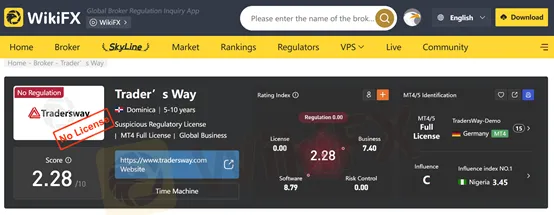

WikiFX Rating

WikiFX assigns TradersWay a rating of 2.28 / 10, reflecting its unregulated status, limited transparency, and mixed client feedback. This score places it in the lower tier of global CFD brokers.

Community Feedback and User Experiences

TradersWays high‐leverage offering appeals to certain high‐risk traders, while the 0-pip spreads and multiple platform choices are often cited as positives in online discussions. Conversely, the 1.5% withdrawal fee and lack of regulatory protections draw consistent criticism.

Conclusion

TradersWay caters to a niche segment of traders seeking aggressive leverage and a variety of trading platforms. However, its unregulated status and certain fees warrant careful due diligence. Prospective clients should balance the brokers low spreads and high leverage against the potential risks of trading with an entity outside the purview of recognized financial authorities. If you have traded with TradersWay, please share your experiences on WikiFX. Your reviews help fellow traders make more informed decisions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.