Abstract:A 49-year-old woman from Malaysia (Johor Bahru) has reported losing RM2.6 million to a fraudulent online investment scheme. The woman, who worked as a clerk at a goldsmith, fell victim to the scam after being lured by promises of high returns.

A 49-year-old woman from Johor Bahru has reported losing RM2.6 million to a fraudulent online investment scheme. The woman, who worked as a clerk at a goldsmith, fell victim to the scam after being lured by promises of high returns.

Johor police chief Datuk M. Kumar explained that the victim first encountered the scheme in August 2024 through an online advertisement. The ad promised a 9% return on investments. Convinced by the offer, the woman decided to test the waters with an initial investment of RM100,000 in mid-October. She soon received RM12,100 in profits. This early return gave her confidence in the schemes legitimacy and potential profitability.

Eager for greater returns, the woman made additional transfers between October and late November. She sent a total of RM2,656,600 from her bank account to those controlled by the scammers and their associates. However, after the initial payout, she received no further returns. Instead, the perpetrators demanded additional payments, claiming these were necessary to release her promised profits and original capital.

Suspicious of the scheme's demands, the victim realised she had been duped. On 30 November, she lodged a police report at the Batu Pahat police station.

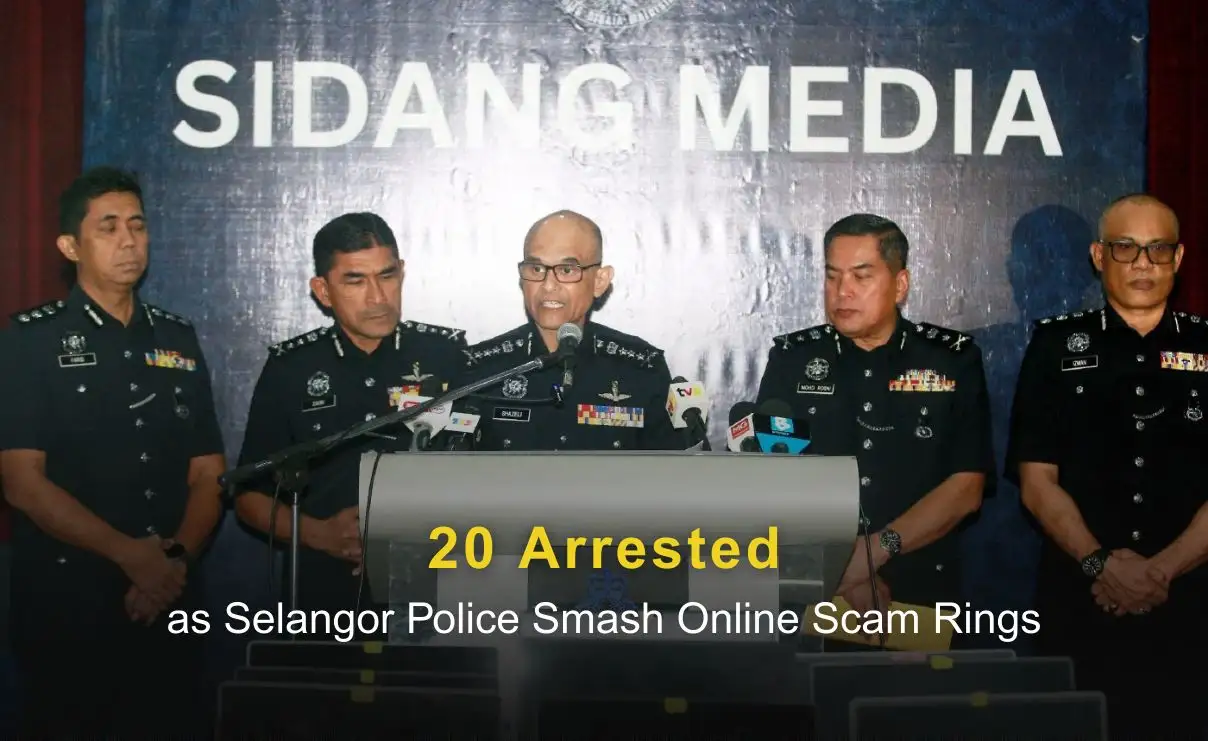

The case is now under investigation and has been classified under Section 420 of the Penal Code, which deals with cheating. If convicted, offenders could face imprisonment for up to ten years, whipping, and a fine. Kumar stated that the authorities are working to identify the culprits and recover the stolen funds.

He also warned the public to be cautious of online investment schemes offering high returns. Many of these schemes are designed to defraud unsuspecting investors.

To help individuals avoid falling prey to such scams, tools like WikiFX can be invaluable. WikiFX provides comprehensive information about brokers, including their regulatory status, customer reviews, and safety ratings. These insights allow users to verify the legitimacy of investment platforms before committing funds. With features like risk alerts and in-depth analysis, WikiFX empowers potential investors to make informed decisions and steer clear of unlicensed or fraudulent schemes.