Abstract:Trust between traders and brokers is paramount. However, for Rachelle, a 29-year-old from the Philippines, her trust in the broker Ventezo has been shattered. In the back of the article we arranged a few small questions, each answer to the chance to win a bonus.

Trust between traders and brokers is paramount. However, for Rachelle, a 29-year-old from the Philippines, her trust in the broker Ventezo has been shattered. In the back of the article we arranged a few small questions, each answer to the chance to win a bonus.

Rachelles experience with Ventezo has been anything but smooth. Despite making a successful withdrawal request, her funds have yet to be returned. This has left her and her friend in a state of frustration and disbelief. Her case isn't isolated; it echoes the experience her mother faced with another broker, TIFIA, where a similar situation occurred. The common thread in these distressing tales? The involvement of a country manager named Elenita A. Canoy, who, despite personal connections, has failed to ensure the proper return of funds.

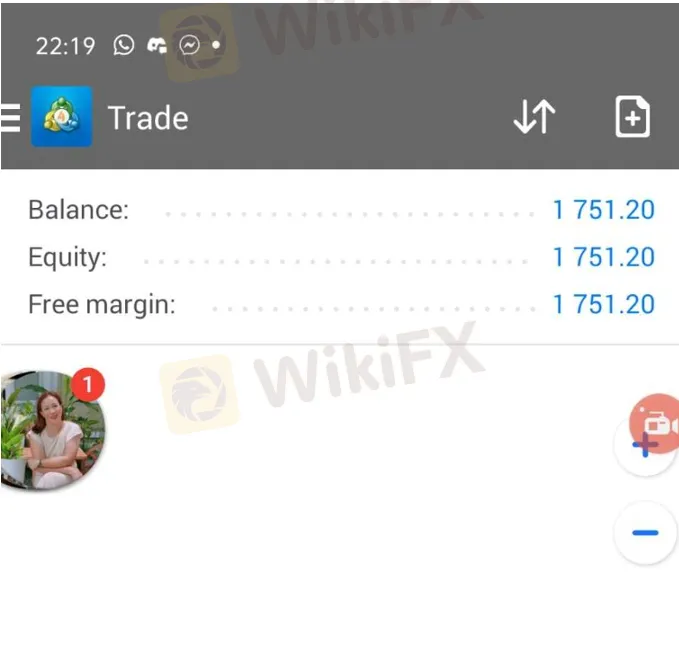

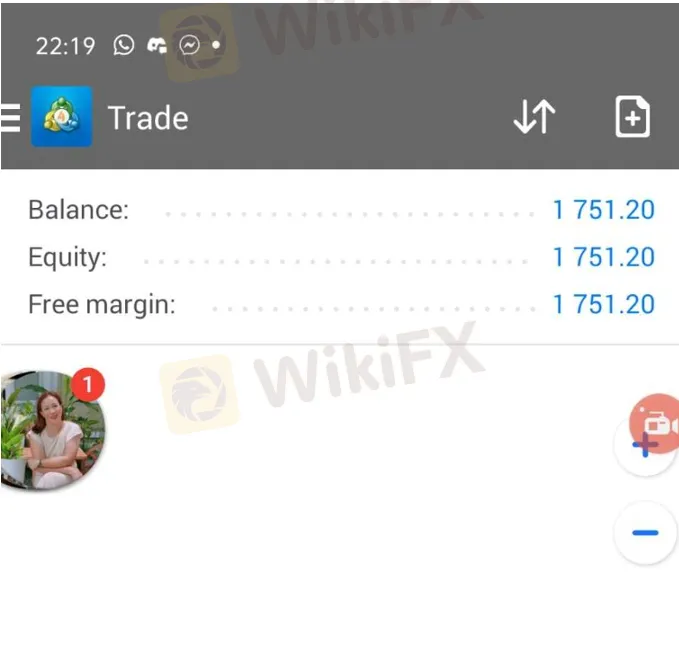

Rachelle and her mother were drawn to Ventezo by Canoy‘s assurances, believing that their close relationship would safeguard their investments. This trust led them to follow Canoy to Ventezo after their previous broker, TIFIA, closed. Unfortunately, their confidence in Ventezo has been misplaced. The broker has shown little regard for its clients, with Rachelle’s withdrawal request being blocked despite assurances of a successful transaction.

WikiFX has given Ventezo a concerningly low score of 1.42/10. This score is a glaring red flag for potential traders, signaling severe issues within the broker's operations. For Rachelle, this rating is more than just a number; it's a reflection of the distress and financial hardship shes currently enduring.

Ventezo's actions, or lack thereof, in processing Rachelle's withdrawal request highlight the broker's apparent disregard for its clients' financial well-being. The situation serves as a stark warning to others who might be considering trading with Ventezo. The promises of high returns and successful withdrawals mean little when a broker fails to honor them.

In an industry where reputation is everything, Ventezos inability to return funds to its clients not only tarnishes its own image but also underscores the importance of thoroughly vetting brokers before investing. The red flag raised by WikiFX should serve as a critical warning to all traders: tread carefully, and don't let the allure of quick profits blind you to the potential risks.

As Rachelle's case continues to unfold, it remains to be seen whether Ventezo will take responsibility and return her funds. Until then, her story serves as a cautionary tale of trust misplaced and the dangers of dealing with brokers that operate with little transparency and accountability.

Questions

Do you know how many exposures WikiFX has received in the last three months about Ventezo?

Do you know how many risk alerts WikiFX gave to Ventezo?

Addition

Please scan the QR code to join our private group, which has a lucky draw every day, Participate in the group and have a chance to win a cash prize of $10!