Abstract:Stake.com faces a security breach with over $40M in digital assets stolen. Amid user concerns, the platform assures the safety of funds. Stay updated with WikiFX

Leading cryptocurrency betting platform, Stake.com, faced a severe security breach, resulting in unauthorized transactions from its Ethereum and Binance Smartchain hot wallets. Reports suggest that the platform lost over $40 million in digital assets in this audacious cyber-attack.

Chronology of the Attack

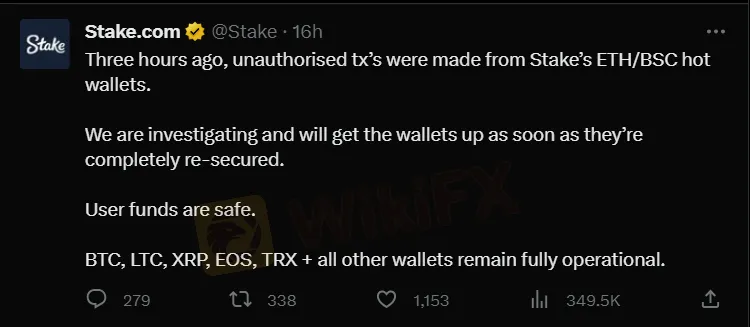

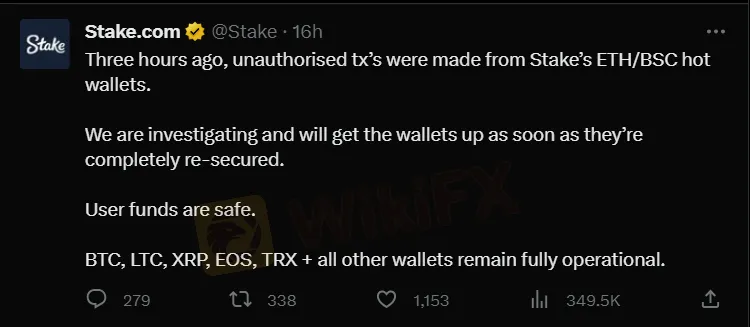

On Sept. 4, Stake.com confirmed that it had detected irregular activity, with unauthorized transactions being made from its ETH and BSC hot wallets. This shocking revelation came after speculations swirled on X (previously known as Twitter) when multiple users raised alarms about possible unauthorized withdrawals.

Zachxbt, a notable online investigator, shared on X that Stake.com could have lost assets up to a staggering amount of $41 million. He further analyzed that hackers initially made away with around $16 million and subsequently siphoned off another batch worth over $25 million.

Stake.com's Response to the Breach

Despite the turmoil, Stake.com was quick to assure its vast user base about the safety of its funds. “We want to assure our customers that their assets and funds are secure,” read a statement from the company on X. The platform went on to clarify that all other wallets, including BTC, LTC, XRP, EOS, and TRX, remain unaffected and are fully operational.

Canadian celebrity, Drake, who endorses Stake.com, has not commented on the incident.

In a conversation with the media, Ed Craven, Stake.com's co-founder, emphasized the platform's precautionary measures. “We always keep a minimal amount in our hot wallets due to such security risks. We are working tirelessly to ensure that the affected wallets are back online soon.”

Curiously, both Craven and Stake.com have refrained from revealing the exact value of the stolen digital assets, raising eyebrows in the crypto community.

The Road Ahead

The hacking incident has once again highlighted the vulnerabilities associated with crypto platforms and the immense importance of stringent security measures. Stake.com announced that a thorough investigation is already in progress, and steps are being taken to further bolster its security infrastructure.

As the world watches closely, the incident serves as a stark reminder for other crypto platforms about the unpredictability and challenges that lie ahead.

Stay informed on this developing story and more with the WikiFX App. For the latest updates, download here: https://www.wikifx.com/en/download.html.