WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

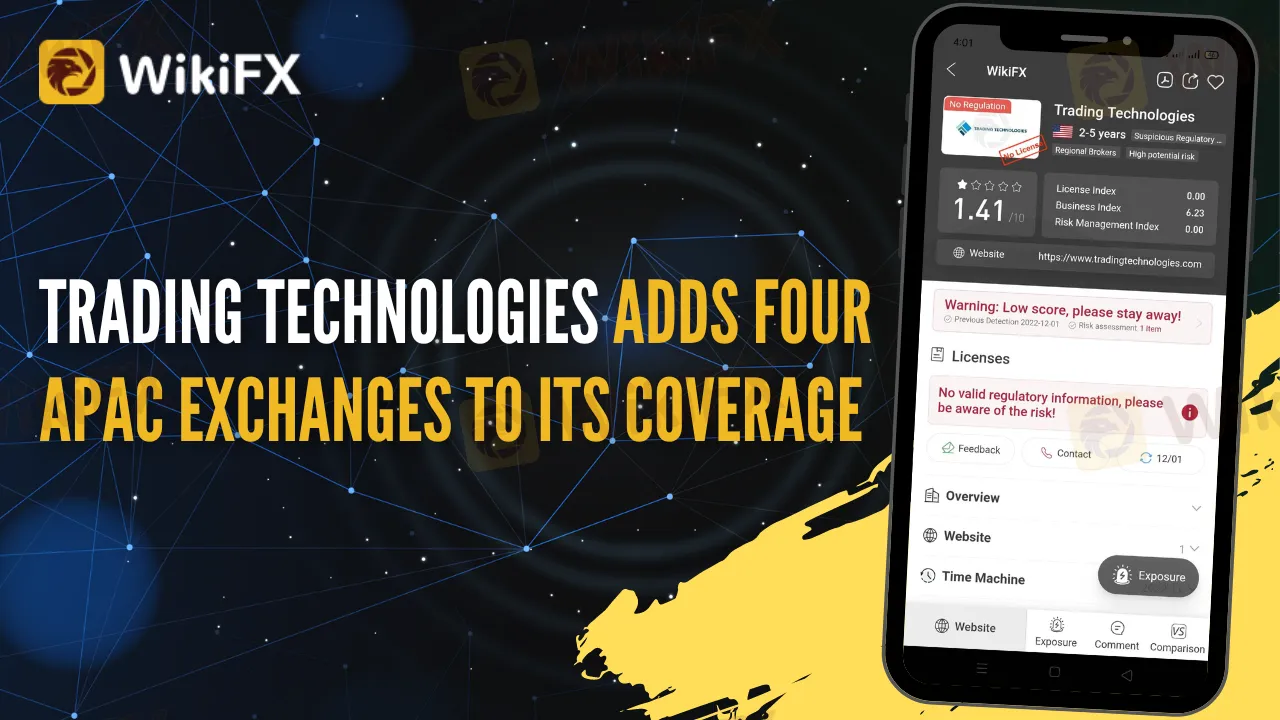

Abstract:Trading Technologies (TT), a supplier of professional trading software, stated on Wednesday that it is expanding its market coverage by adding four prominent Asian exchanges.

According to the press announcement, TT Premium Order Types, the company's new algorithmic execution methods tool coupled with the TT platform, ensures access to Singapore Exchange instruments (SGX Group). Before the end of the year, products from Japan Exchange Group (JPX), Hong Kong Exchanges and Clearing Limited (HKEX), and the Australian Securities Exchange (ASX) will be accessible.

TT is concentrating on increasing its low-latency offerings. With the inclusion of four more markets, the total number now stands at eleven. TT Premium Order Type had formerly supported the Cboe Futures Exchange, Intercontinental Exchange, CME Group, Eurex, Euronext, London Metal Exchange (LME), and Montréal Exchange. Depending on investor demand, other markets are projected to follow.

“We're excited to add these important APAC exchanges to our offering of best-of-breed synthetic order types driven by quantitative modeling, available directly through the TT platform,” said Guy Scott, EVP, and Chief Revenue Officer at Trading Technologies. “Asset managers, hedge funds, trading groups, commodity firms, and others can use these value-added tools to round out their macro portfolios, improve their hedging capabilities, and explore new trading and arbitrage opportunities.”

The product suite is the outcome of TT's purchase of RCM-X, a technology supplier of algorithmic execution methodologies and quantitative trading technologies, in March.

The TT Premium Order Types library, designed for a wide variety of execution use cases, includes:

TT Brisk: targeting arrival price and enhancing physical basis trades

TT Close: for executing intelligently into the settlement or market close

TT POV: in line with market activity to target a rate or in illiquid markets

TT Prowler: for iceberg-style execution with additional anti-gaming and liquidity capture features

TT Scale POV: to execute within a target range dependent on market conditions

TT TWAP+: for time-weighted average price execution evenly across time with intelligent sizing and distribution

TT VWAP+: for volume-weighted average price execution with expected liquidity, such as during settlement windows to mimic Trading at Settlement (TAS)

About Trading Technologies

Trading Technologies (www.tradingtechnologies.com) develops professional trading software, infrastructure, and data solutions for a diverse range of clients, including proprietary traders, brokers, money managers, Commodity Trading Advisors (CTAs), hedge funds, commercial hedgers, and risk managers. TT provides domain-specific technology for cryptocurrency trading as well as machine-learning capabilities for transaction monitoring via its TT® trading platform, in addition to access to the world's leading international exchanges and liquidity venues.

You can find more about Trading Technologies here: https://www.wikifx.com/en/dealer/6421434535.html

Stay tuned for more Forex Broker News.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.