Abstract:There is no one perfect strategy for trading forex. There is no elixir that will grant you grant you trading powers and guarantee success every single time. However there are strategies out there with a better success rate that will help you gain confidence quicker in the market, or at least there is a bit of information that when your ad with your own trading strategy you will be able to gain a better edge. Today I want to discuss one of the best trading pieces of knowledge that if you were to incorporate it into your trading strategy you would surely see favorable results.

If you intend on using some of this information to trade it is best that you find a broker with very small spreads to give yourself the best chances of winning in the market. To find such a broker I recommend you do your research using WikiFX. This all-in one helps you find the best regulated and verified brokers world wide. They also show you which brokers are known scammers, so you can avoid these people before you lose your money. For any broker query you may have, I recommend you use WikiFX.

Why are the highs and lows of the day crucial?

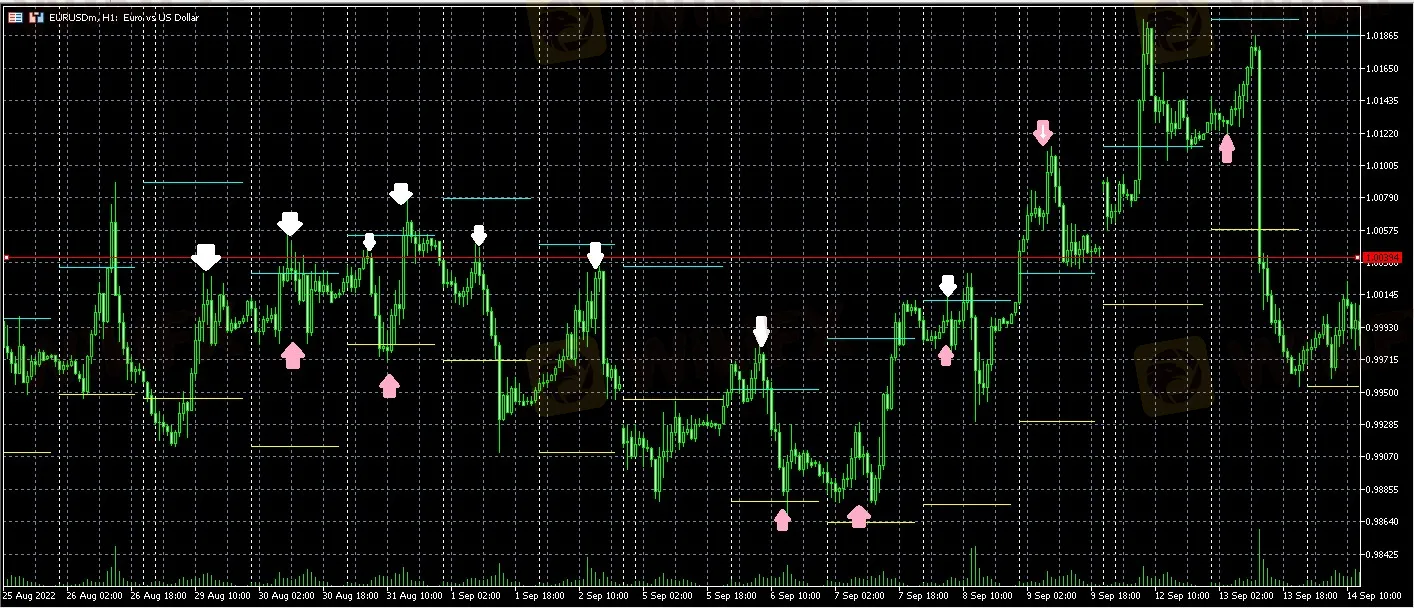

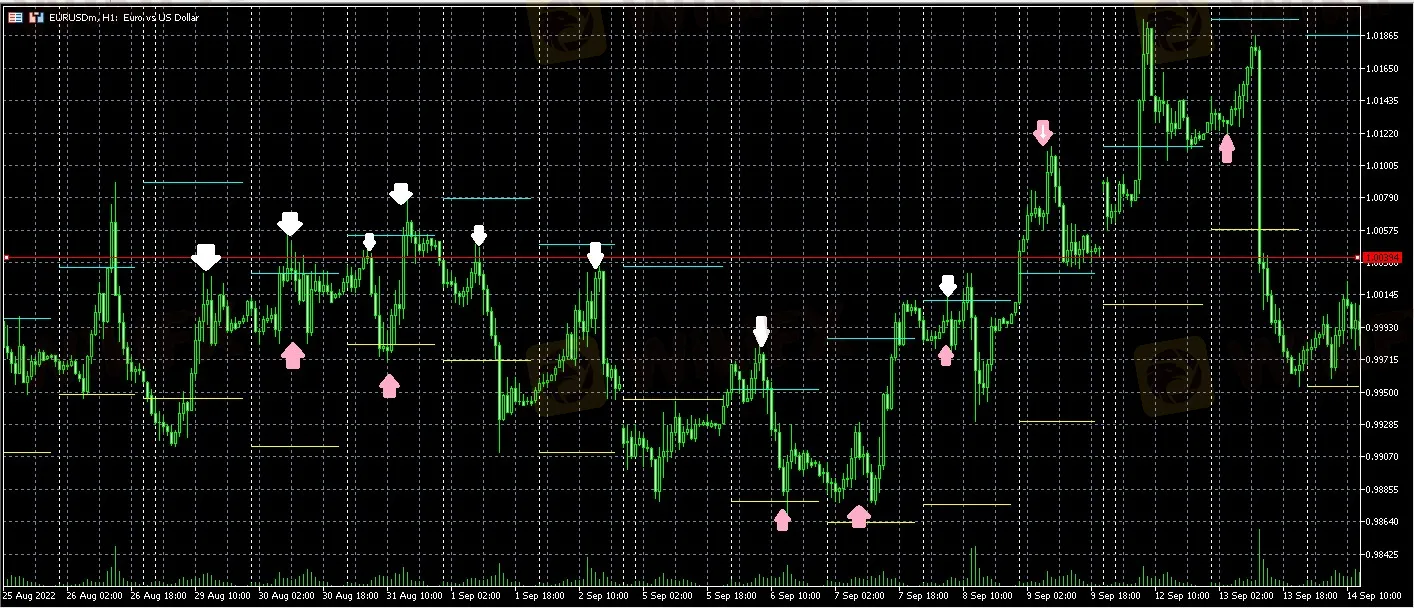

Before I carry on look at this chart

Here I have marked out all of the possible trades just using the high and the low of the current and previous days. It is quite easy to see that be it may that some days where the trades do not succeed, a majority of the time prices reject right around these points.

Why does this happen

I am sure we are all knowledgeable about support and resistance. No trading strategy does not use some kind of version of support and resistance as they help us determine at which point of the chart will price bounce off or return. They aid us with entries and exits, but some support and resistance are built differently and carry more weight.

At any given time frame there are a number of supports and resistances, however, it is more common for these areas to be broken and last for short periods of time. On a bigger time frame, we get stronger rejection areas, and hence we are using the high and low of the day as rejection zones

When big banks and big money steer the market they usually have to leave some losing positions open when they are done manipulating the markets. They have to close these positions at break even so they have to steer the market back to these areas. The high and the low of the day are usually above everyone's stop loss of the day so they usually want to breach the high of the day to stop out traders. This is when we enter when we see this manipulation going on.

This information is useful when you paid it along with the current trend. The aim is not to try to take advantage of every single trade. It is to find one or two good trades a day that you maximize on and leave the charts. You can add this tool to your trading arsenal and begin seeing a better success rate.