Abstract:The Pakistan rupee slid further against the U.S. dollar on Wednesday, as the local foreign exchange association warned that panic was spreading through the currency market following the sharp declines this week.

The rupee fell 2% on Monday, and 3% on Tuesday, despite last weeks staff level agreement reached with the International Monetary Fund (IMF) that would pave the way for a disbursement of $1.17 billion under resumed payments of a bailout package.

On Wednesday morning the rupee was trading at 225 per dollar, having ended Tuesday at 221.99 after Fitch ratings agency revised its outlook for Pakistan sovereign debt from stable to negative – though it affirmed Long-Term Foreign-Currency and Issuer Default Rating at “B-”.

“There is panic in the market, I fear it (the rupee)will go down further,” Zafar Paracha, Secretary General of a foreign exchange association, the Exchange Companies of Pakistan, told Reuters.

Paracha said he did not see any reason for the depreciation in the rupee other than a possible IMF pre-conditions. Neither the government or the IMF have said anything about the need for any further depreciation of the currency, though Pakistan recently adopted a market-based exchange rate under advice from the IMF under the economic reforms agenda.

“The recent movement in the rupee is a feature of a market-determined exchange rate system,” the State Bank of Pakistan said in a series of Twitter posts late Tuesday night, adding that rupees depreciation against dollar is in large part a global phenomenon.

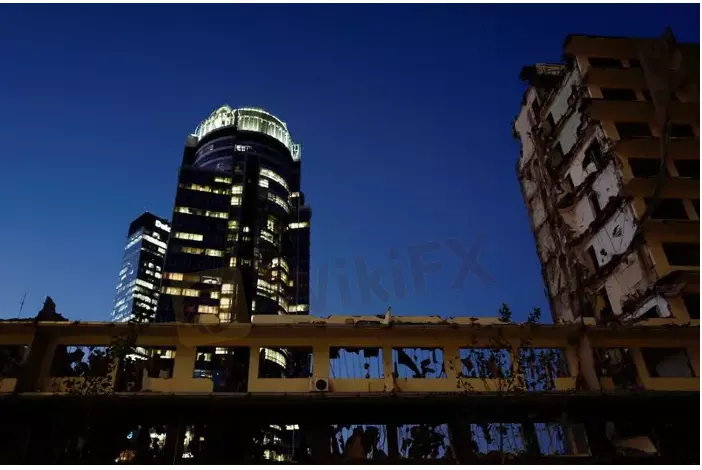

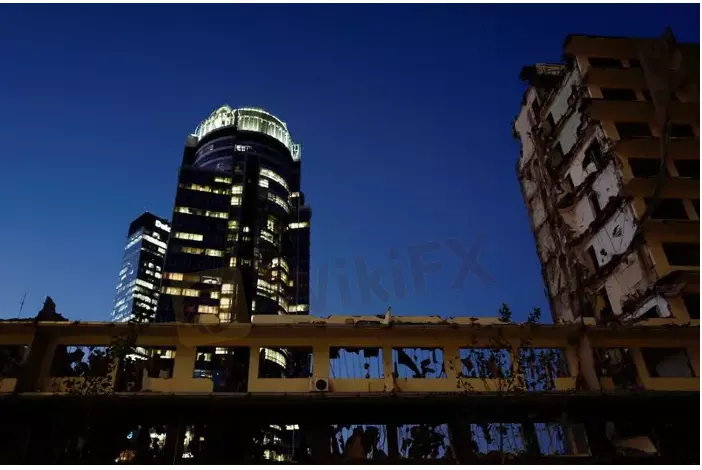

Pakistan faces economic turmoil, with fast depleting foreign reserves, a declining currency and widening fiscal and current account deficits, and the rupee has lost 18% of its value since Dec. 21.

Reserves have fallen to as low as $9.8 billion, hardly enough to pay for 45 days of imports.

Pakistan has also passed through another bout of political instability, with the government of Prime Minister Shehbaz Sharif taking over from ousted premier Imran Khan in April.

On Tuesday, sovereign dollar bonds issued by Pakistan suffered sharp losses to record lows after Fitch‘s move, while the Pakistan Stock Exchange’s KSE100 Index .KSE fell 2.36%.