Company Summary

| EGM Securities Review Summary | |

| Founded | 2018 |

| Registered Country/Region | Kenya |

| Regulation | No regulation |

| Market Instruments | Currencies, Commodities, Shares, Indices, ETFs |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 0.0 pips |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | / |

| Customer Support | 24/6 support |

| WhatsApp: +254-730-676-002 | |

| Phone (Toll-Free Kenya): 0800-211-185 | |

| Phone (International): +254-730-676-002 | |

| Email: support@egmsecurities.com | |

| Address: 12th Floor, Tower 2, Delta Corner Towers, Waiyaki Way, Westlands, Nairobi, Kenya | |

| Bonus | Welcome bonus of 30% extra on the first deposit |

EGM Securities Information

Founded in 2018, EGM Securities is an unregulated broker registered in Kenya. The tradable instruments with a maximum leverage of 1:400 include currencies, commodities, shares, indices, and ETFs. The broker supports both MT4 and MT5 platforms.

Pros and Cons

| Pros | Cons |

| 24/6 customer support | No regulation |

| MT4 and MT5 platforms available | Unknown minimum deposit |

| Demo accounts available | |

| Various tradable instruments | |

| Bonus offered | |

| Popular payment options |

Is EGM Securities Legit?

EGM Securities is not regulated, even though it claims to be licensed and regulated by Kenyas Capital Markets Authority. An unregulated broker is not as safe as a regulated one.

What Can I Trade on EGM Securities?

EGM Securities offers a wide range of market instruments, including currencies, commodities, shares, indices, and ETFs.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Shares | ✔ |

| Indices | ✔ |

| ETFs | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

Leverage

The maximum leverage is 1:400, meaning that profits and losses are magnified 400 times. Note that higher leverage can improve profit potential while also increasing risk, therefore appropriate risk management is crucial.

EGM Securities Fees

The spread is from 0.0 pips, and the commission is $0. The lower the spread, the faster the liquidity.

Trading Platform

EGM Securities cooperates with the authoritative MT4 and MT5 trading platforms available in mobile, desktop, and tablet to trade. Junior traders prefer MT4 over MT5. Traders with rich experience are more suitable for using MT5. MT4 and MT5 not only provide various trading strategies but also implement EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Mobile/Desktop/Tablet | Beginners |

| MT5 | ✔ | Mobile/Desktop/Tablet | Experienced traders |

Deposit and Withdrawal

EGM Securities accepts credit cards, bank transfers, eWallets, crypto wallets, mobile money like M-Pesa, and more for deposit and withdrawal. However, transfer processing times and associated fees are unknown.

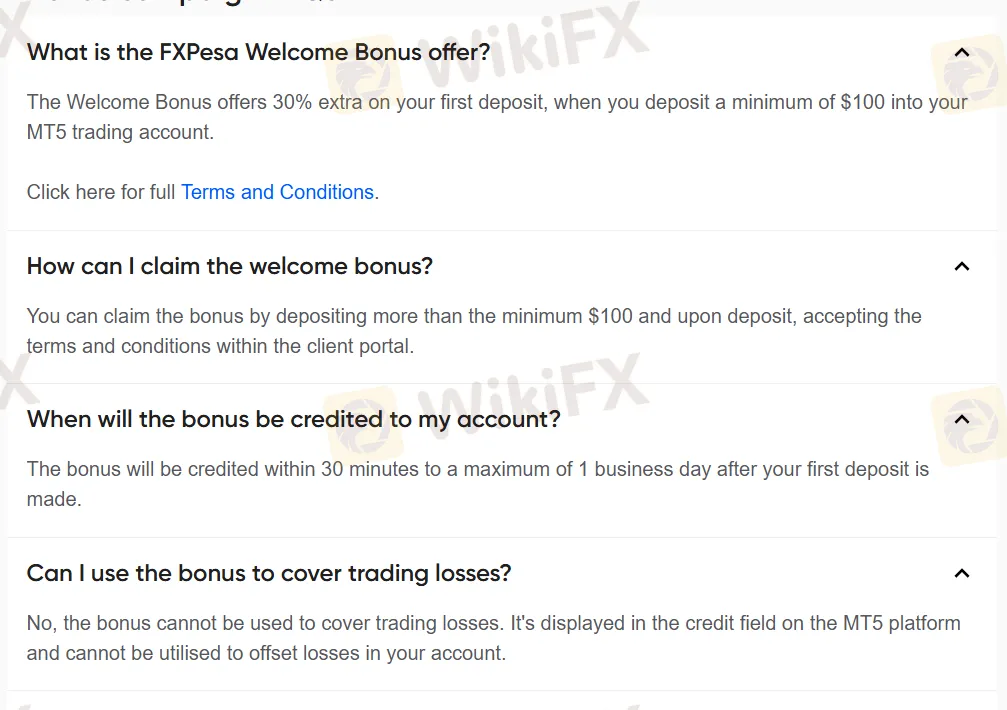

Bonus

Traders can receive a welcome bonus of 30% extra on the first deposit. The bonus will be credited within 30 minutes to a maximum of 1 business day after the first deposit.