Company Summary

| UCTrader Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Italy |

| Regulation | Unregulated |

| Market Instruments | Forex:spot, forwards, swaps (even and uneven), blocks, and flexi forwards; commodities: base metals, carbon, energy bullet and Asian swaps |

| Trading Platforms | Web-based UCTrader |

| Customer Support | Phone, email, address, FAQ |

What is UCTrader?

UCTrader, UniCredit's FX trading platform, caters to global Corporate and Investment Bank customers, including those of UniCredit Bank GmbH, UniCredit SpA, and others within Europe. Traders can access various FX products like spot, forwards, swaps (even and uneven), blocks, and flexi forwards. Additionally, it offers trading options for commodities including base metals, carbon, and energy bullet and Asian swaps.

However, it's paramount to acknowledge that UCTrader currently operates without valid regulations from recognized financial bodies, necessitating caution and careful consideration from investors.

In the upcoming article, we will comprehensively analyze this broker's attributes from various angles, delivering clear and well-organized information. If you find this topic intriguing, we encourage you to continue reading. At the conclusion of the article, we will provide a concise summary to offer you a quick grasp of the broker's key features.

Pros & Cons

| Pros | Cons |

| Wide range of trading instruments | Lack of regulation |

| Customizable desktop | No MT4/MT5 platforms |

| Wide presence in Europe |

Pros:

Wide Range of Trading Instruments: UCTrader offers a diverse selection of trading instruments for forex and commodities, catering to various trading preferences and strategies.

Customizable Desktop: Traders can personalize their desktop layout according to their preferences from UCTrader's web-based platform, enhancing efficiency and usability.

Wide Presence in Europe: UCTrader has a significant presence in Europe, providing access to European markets and resources.

Cons:

Lack of Regulation: UCTrader operates without regulation from recognized authorities, raising concerns about investor protection and financial transparency.

No MT4/MT5 Platforms: The absence of support for popular trading platforms like MetaTrader 4/5 inconveniences traders accustomed to these platforms' features and functionalities.

Is UCTrader Legit or a Scam?

When considering the safety of a brokerage like UCTrader or any other platform, it's important to conduct thorough research and consider various factors.

Regulatory sight: The absence of valid regulations under which the broker operates signifies potential risks, as it lacks the guarantee of comprehensive protection for traders engaging on its platform.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: UCTrader prioritizes security with robust measures. User accounts employ two-factor authentication, requiring both a password and a one-time passcode for access. Additionally, accounts are automatically locked after three unsuccessful login attempts. Encryption ensures confidentiality for all data transmitted between web browsers and UCTrader, enhancing overall protection.

Ultimately, the choice to trade with UCTrader is a personal decision. It is important to thoroughly assess the risks and benefits before arriving at a conclusion.

Market Instruments

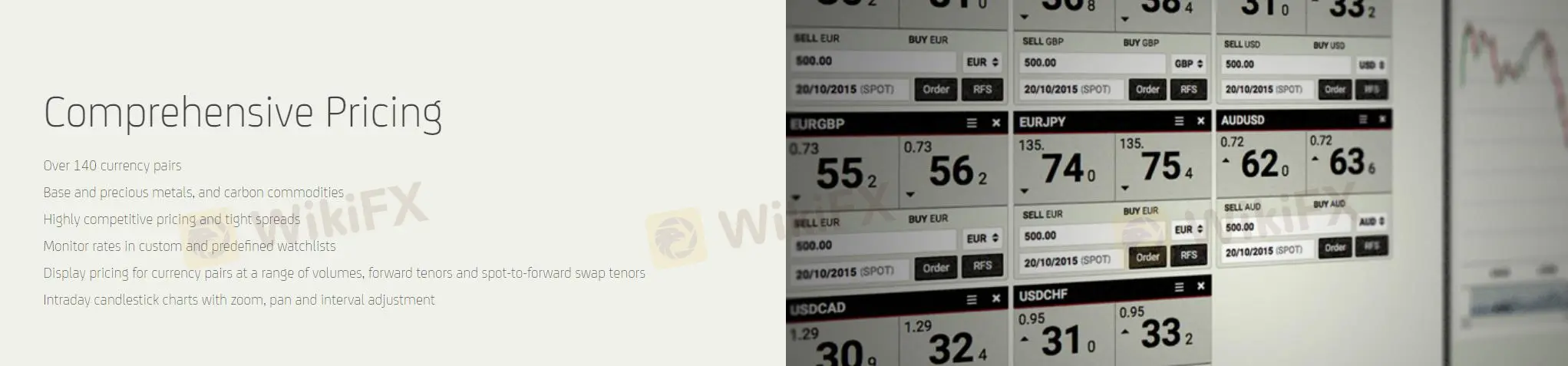

UCTrader, UniCredit's FX trading platform, presents an extensive array of market instruments designed to meet the diverse needs of its global clientele.

Within the FX products category, traders can access various instruments such as spot, forwards, swaps (including even and uneven), blocks, and flexi forwards with more than 140 currency pairs. These instruments provide traders with the flexibility to engage in speculative trading, hedging against currency risks, and executing arbitrage strategies in the dynamic foreign exchange markets.

Furthermore, UCTrader facilitates trading in commodities, including base metals, carbon, and energy bullet and Asian swaps. These commodities hold significant importance in industrial and manufacturing sectors, making them attractive assets for traders seeking portfolio diversification and exposure to tangible goods.

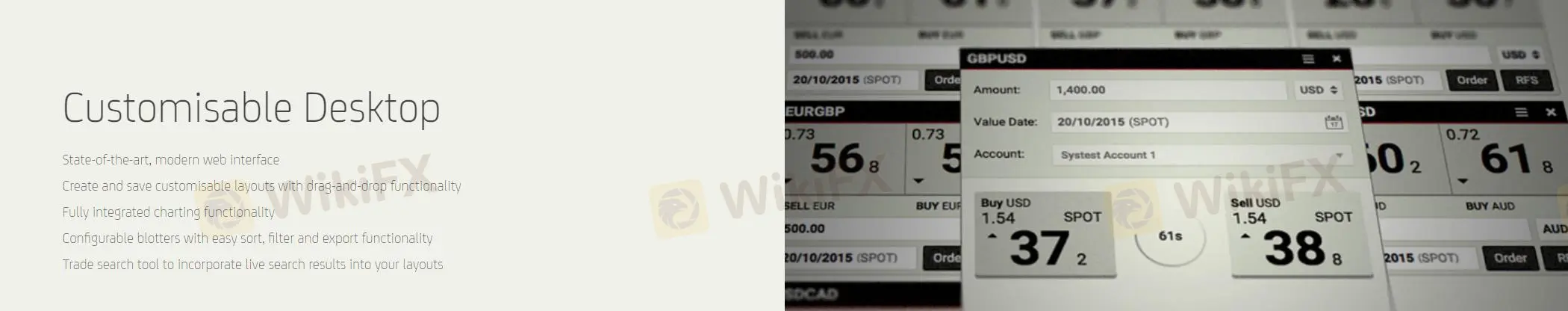

Trading Platform

UCTrader boasts a sophisticated and customizable desktop interface, providing traders with state-of-the-art tools for efficient trading. Its modern web interface offers flexibility and ease of use, allowing users to create and save personalized layouts using drag-and-drop functionality.

The platform's fully integrated charting functionality enables traders to analyze market trends and make informed decisions. Configurable blotters with sorting, filtering, and export capabilities streamline trade management.

Additionally, UCTrader features a trade search tool that seamlessly incorporates live search results into user layouts, enhancing accessibility and efficiency.

As a web-based application, UCTrader ensures accessibility from any device with internet access, provided it meets the minimum system requirements and uses a supported web browser such as Mozilla Firefox, Google Chrome, or Microsoft Edge. Traders can rely on UCTrader for a user-friendly and intuitive trading experience, backed by UniCredit's commitment to customer satisfaction.

Customer Service

UCTrader offers comprehensive customer service through various channels including phone for direct communication, email for detailed inquiries, physical address for in-person visits and an FAQ section for general inquiries' answers.

Address: UniCredit Bank GmbH, Piazza Gae Aulenti, 4 20154 - Milan.

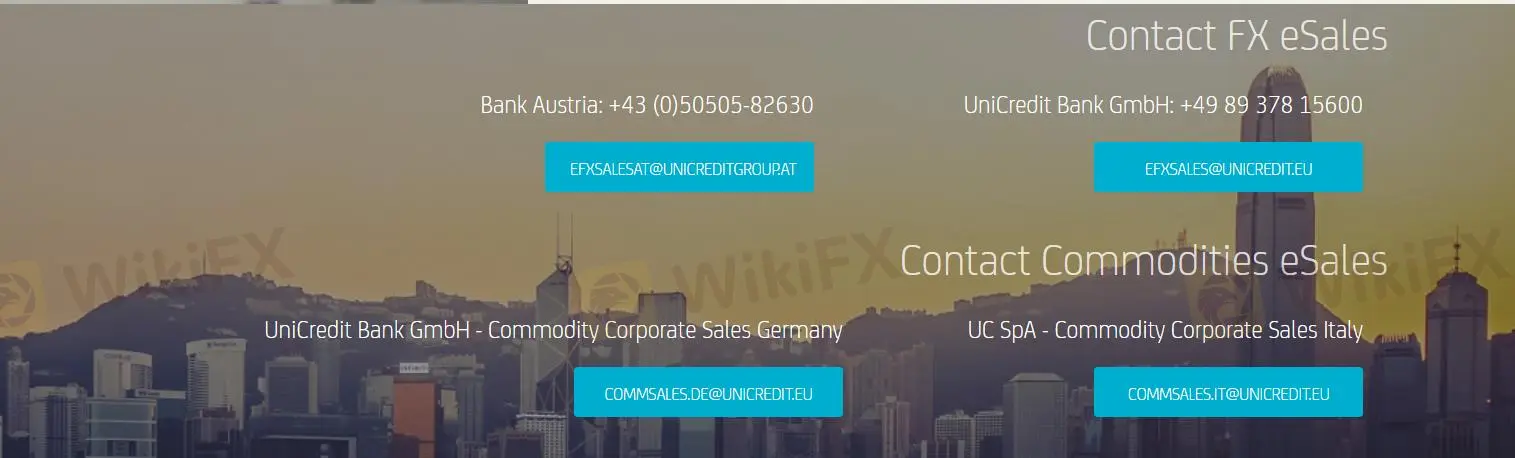

Contact FX eSales:

Bank Austria: +43 (0)50505-82630.

EFXSALESAT@UNICREDITGROUP.AT

UniCredit Bank GmbH: +49 89 378 15600.

EFXSALES@UNICREDIT.EU

Contact Commodities eSales

UniCredit Bank GmbH - Commodity Corporate Sales Germany

COMMSALES.DE@UNICREDIT.EU.

UC SpA - Commodity Corporate Sales Italy

COMMSALES.IT@UNICREDIT.EU.

Conclusion

In conclusion, UCTrader offers traders a comprehensive range of trading instruments, including FX products like spot, forwards, swaps, blocks, and flexi forwards, as well as commodities such as base metals, carbon, and energy bullet and Asian swaps. However, the absence of regulation from recognized authorities should prompt concerns for investors.

Therefore, individuals considering UCTrader as their broker should be cautious, undertake full research, and explore alternative, regulated brokers that prioritize transparency, security, and client protection.

Frequently Asked Questions (FAQs)

| Question 1: | Is UCTrader regulated? |

| Answer 1: | No. It has been verified that this broker is currently under no valid regulation. |

| Question 2: | Is UCTrader a good broker for beginners? |

| Answer 2: | No. It is not a good choice for beginners because it is unregulated by any recognized financial authorities. |

| Question 3: | Does UCTrader offer the industry leading MT4 & MT5? |

| Answer 3: | No, it offers its own web-based platform. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.