Company Summary

| TISCO Securities Review Summary | |

| Founded | 1975 |

| Registered Country/Region | Thailand |

| Regulation | Not regulated |

| Products and Services | Securities, Derivatives, Foreign Stocks, Mutual Funds, DRx, Research, etc. |

| Demo Account | ❌ |

| Trading Platform | TISCO eTrade |

| Min Deposit | 10,000 THB |

| Customer Support | Phone: 020806000 |

TISCO Securities Information

TISCO Securities was founded in 1975 and is based in Thailand. It offers local and international investment services, including equities, derivatives, mutual funds, and analysis tools. However, it is not regulated by Thai or global financial authorities, and its minimum deposit of 10,000 THB may not suit beginners.

Pros and Cons

| Pros | Cons |

| Wide range of investment products | Not regulated |

| Offers both advisor and online trading | High minimum deposit requirement |

| Competitive fees with Cash Balance account | No demo or Islamic accounts |

| Web-based proprietary platform | Limited trading platform options (no MT4/MT5) |

Is TISCO Securities Legit?

TISCO Securities is not a licensed or regulated broker under Thailand's financial regulatory authorities, such as the Bank of Thailand (BOT) or the Securities and Exchange Commission (SEC) of Thailand. Additionally, it is not regulated by major international bodies such as the UKs Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

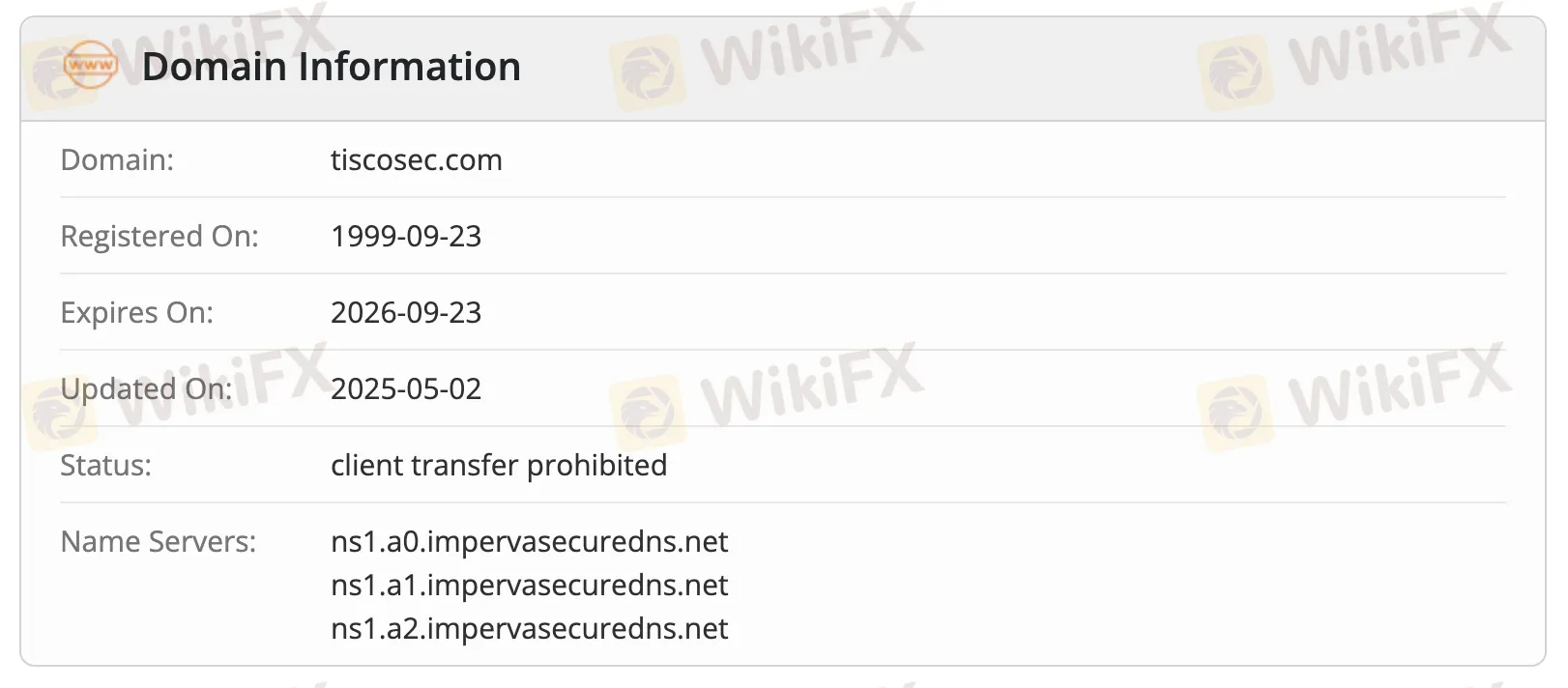

As for the domain information, tiscosec.com was registered on September 23, 1999, and is currently active with its status listed as “client transfer prohibited”, which typically means that the domain is locked to prevent unauthorized transfers. The domain is valid until September 23, 2026, and was most recently updated on May 2, 2025.

Products and Services

Among the many financial products and services TISCO Securities provides are local and international securitiestrading, mutual funds, derivatives, and investmentadvice. To assist investor decisions, the firm also offers international derivative securities, employer-employee investment plans, and market research tools.

| Product/Service | Available |

| Securities | ✅ |

| Derivatives | ✅ |

| Foreign Stocks | ✅ |

| Mutual Funds | ✅ |

| Foreign Derivative Securities (DRx) | ✅ |

| Investment Allocation Plans | ✅ |

| Joint Investment Projects (Employer-Employee) | ✅ |

| Investment Research & Analysis | ✅ |

Account Types

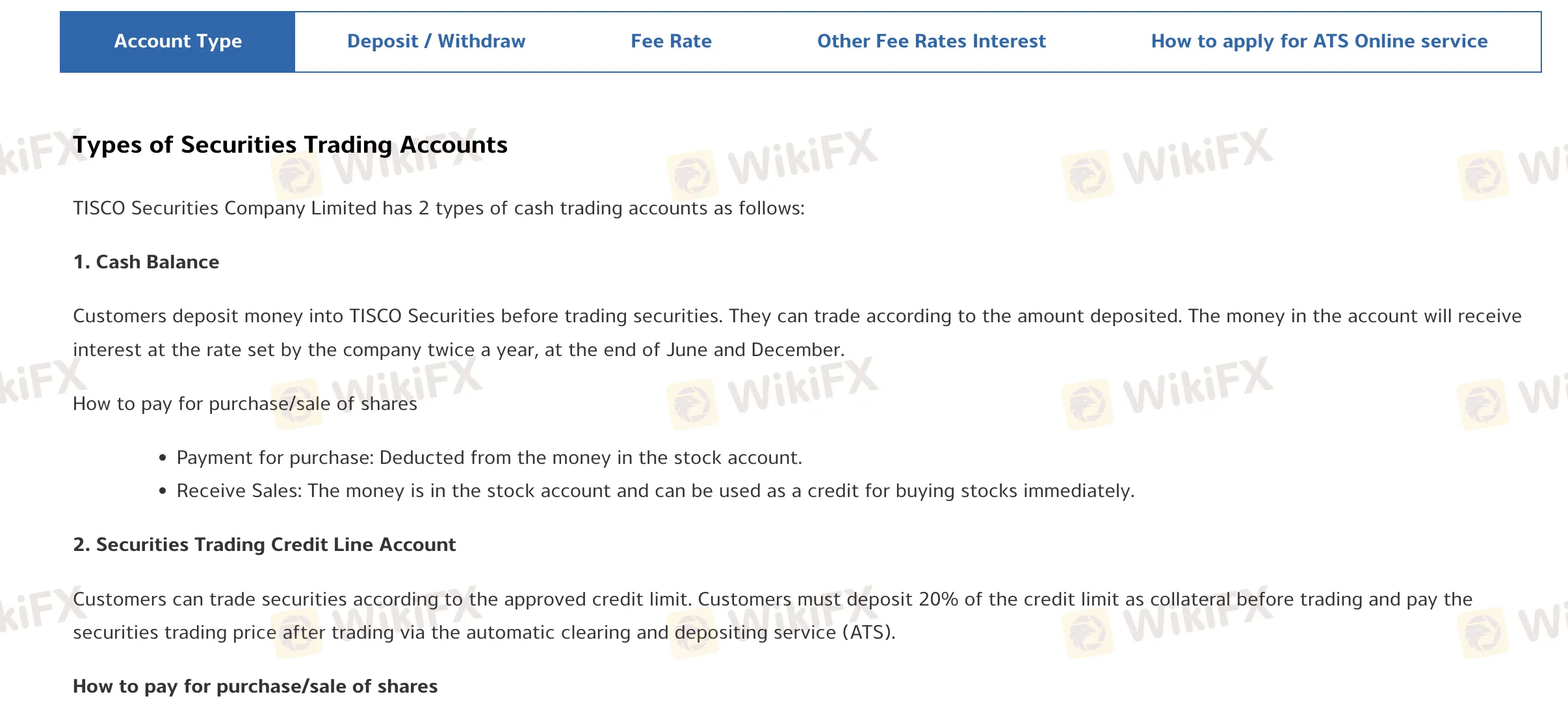

TISCO Securities offers two types of live trading accounts for individual investors: a Cash Balance Account and a Credit Line Account. Both are suitable for Thai stock market trading and can be used either through an advisor or via online self-trading. TISCO does not offer a demo account or Islamic (swap-free) account.

| Account Type | Description | Suitable For |

| Cash Balance Account | Pre-funded account; trade with deposited funds only. Earns interest semi-annually. | Beginner or conservative traders |

| Credit Line Account | Trade on credit up to a limit; 20% margin required upfront; auto-payment via ATS (T+2). | Active or experienced traders |

| Demo Account | ❌ Not available | — |

| Islamic Account | ❌ Not available | — |

TISCO Securities Fees

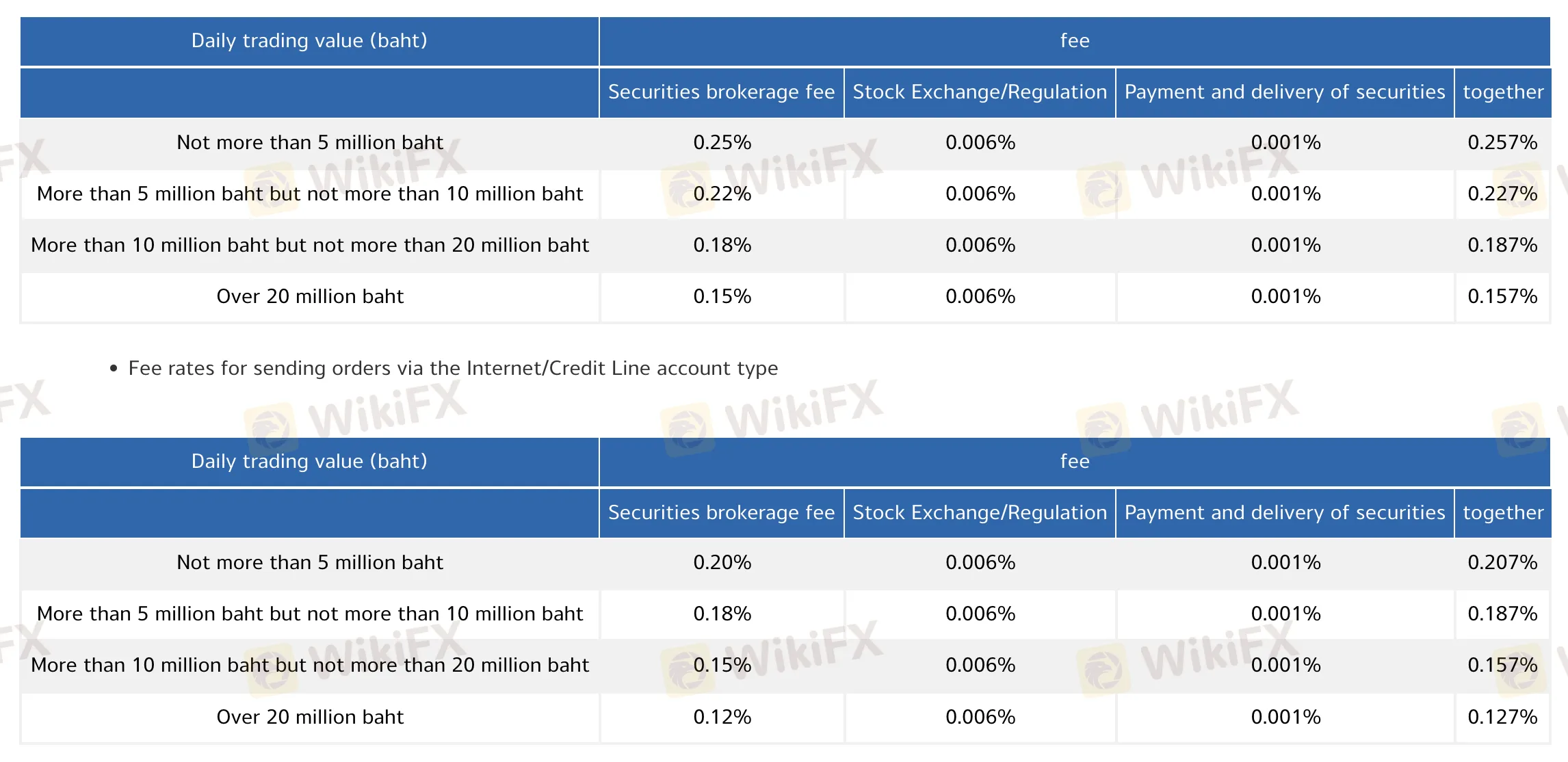

Compared to international online brokers, TISCO Securities charges relatively high trading fees, especially for lower trading volumes and when using investment advisors. However, fees decrease with higher trade volumes and when using online platforms, particularly with a Cash Balance account.

Through Investment Advisors

| Daily Trading Value (Baht) | Brokerage Fee | Exchange Fee | Payment Fee | Total (Excl. VAT) |

| ≤ 5 million | 0.25% | 0.01% | 0.00% | 0.26% |

| > 5M – ≤ 10M | 0.22% | 0.01% | 0.00% | 0.23% |

| > 10M – ≤ 20M | 0.18% | 0.01% | 0.00% | 0.19% |

| > 20M | 0.15% | 0.01% | 0.00% | 0.16% |

Internet / Credit Line Account

| Daily Trading Value (Baht) | Brokerage Fee | Exchange Fee | Payment Fee | Total (Excl. VAT) |

| ≤ 5 million | 0.20% | 0.01% | 0.00% | 0.21% |

| > 5M – ≤ 10M | 0.18% | 0.01% | 0.00% | 0.19% |

| > 10M – ≤ 20M | 0.15% | 0.01% | 0.00% | 0.16% |

| > 20M | 0.12% | 0.01% | 0.00% | 0.13% |

Internet / Cash Balance Account

| Daily Trading Value (Baht) | Brokerage Fee | Exchange Fee | Payment Fee | Total (Excl. VAT) |

| ≤ 5 million | 0.15% | 0.01% | 0.00% | 0.16% |

| > 5M – ≤ 10M | 0.13% | 0.01% | 0.00% | 0.14% |

| > 10M – ≤ 20M | 0.11% | 0.01% | 0.00% | 0.12% |

| > 20M | 0.10% | 0.01% | 0.00% | 0.11% |

Trading Platform

TISCO Securities provides a proprietary web-based platform, TISCO eTrade, suitable for retail investors who prefer managing their portfolios and trading independently online. The platform is accessible via PC and mobile browsers but does not support MetaTrader or third-party terminals.

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| TISCO eTrade | ✔ | Web browser (PC & Mobile) | Retail investors managing portfolios and self-trading |

Deposit and Withdrawal

TISCO Securities does not charge any deposit or withdrawal fees. The minimum deposit required is 10,000 THB.

Deposit Options

| Deposit Method | Min. Deposit | Fees | Processing Time |

| ATS (Real-time: BBL, KBANK, KTB, SCB, TISCO) | 10,000 THB | Free | Same business day if submitted by 16:30 |

| ATS (Cycle: BAY, UOB) | 10,000 THB | Free | Based on notification time, recorded per cycle |

Withdrawal Options

| Withdrawal Method | Min. Withdrawal | Fees | Processing Time |

| To registered bank account (before 10:00 AM) | 5,000 THB | Free | Same day or next day (T+1), by 2:00 PM or 5:00 PM |

| To registered bank account (after 10:00 AM) | 5,000 THB | Free | Next business day (T+1) |

| Transfer to another TISCO trading account (before 16:00) | 5,000 THB | Free | Same business day or T+1 |

| Transfer to another TISCO trading account (after 16:00) | 5,000 THB | Free | Next business day or T+1 |

| For Credit Line accounts (settlement payment) | 5,000 THB | Free | Must notify 1 day before, processed by T+1 |