Basic Information

Montenegro

MontenegroScore

Montenegro

|

5-10 years

|

Montenegro

|

5-10 years

| https://www.limitprime.com/

Website

Rating Index

MT4/5

Full License

LimitPrimeSecurities-Demo

Influence

C

Influence index NO.1

United States 3.14

United States 3.14

MT4/5 Identification

Full License

France

FranceInfluence

C

Influence index NO.1

United States 3.14

United States 3.14 Licenses

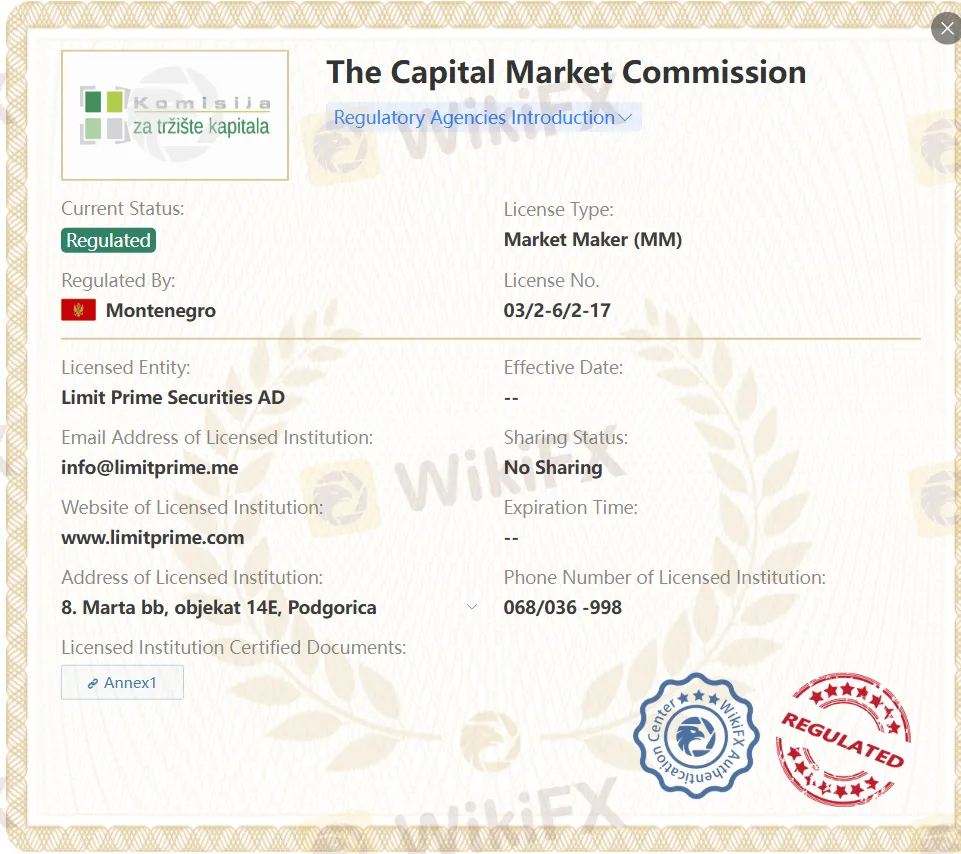

LicensesLicensed Entity:Limit Prime Securities AD

License No. 03/2-6/2-17

Montenegro

Montenegro

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

limitprime.com

limitprime.com Germany

Germany

| LIMIT PRIME Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Montenegro |

| Regulation | SCMN |

| Market Instruments | Forex, Commodities, Indices, Stocks, Metals |

| Demo Account | ✅ |

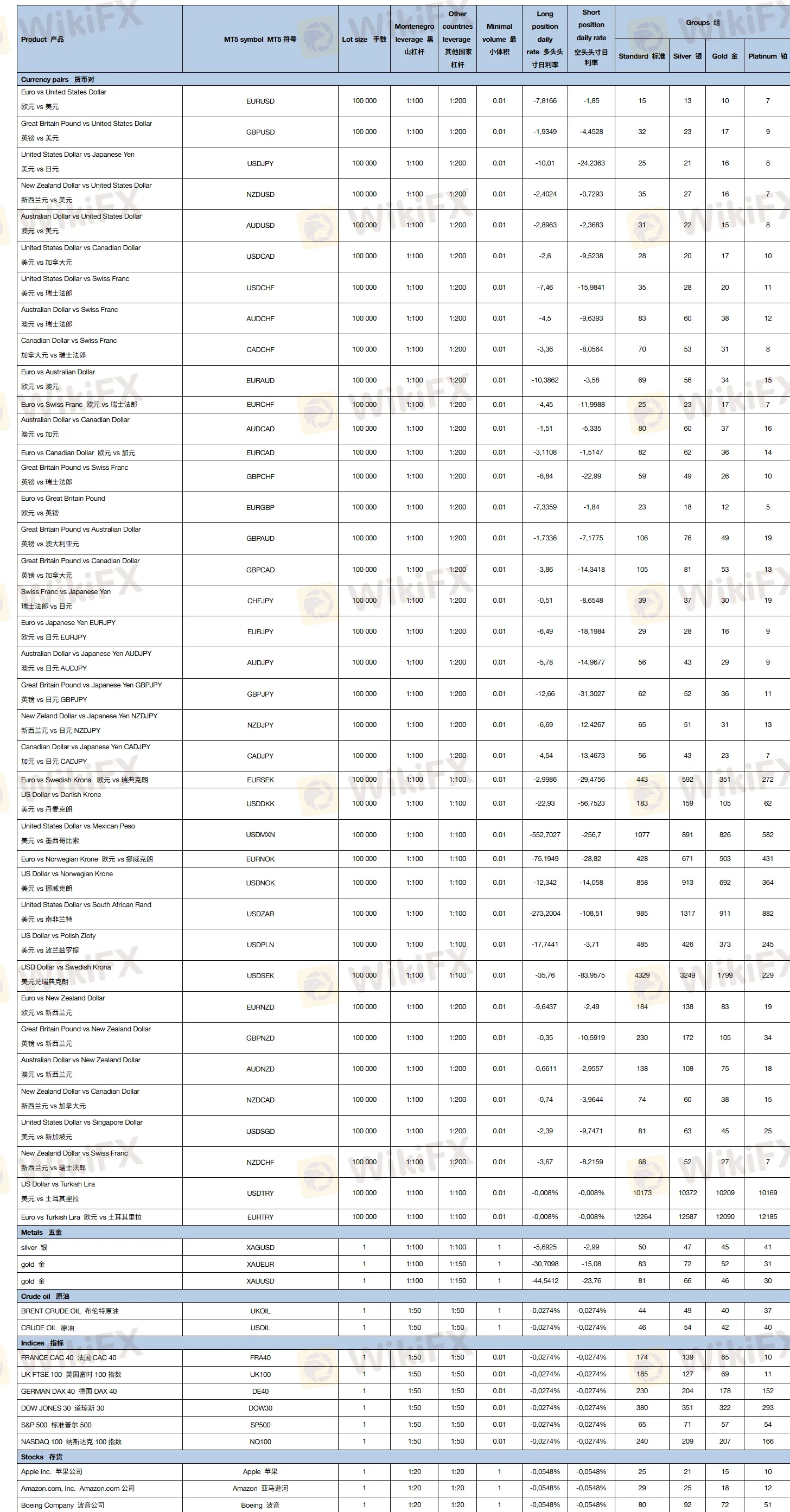

| Leverage | Up to 1:100 |

| Spread | Variable |

| Trading Platform | MT5 |

| Minimum Deposit | €100 |

| Customer Support | Phone: +382 68 036 998 |

| E-mail: info@limitprime.com | |

| Address: Ulica 8 marta bb, objekat 14E, Podgorica | |

| Social Media: Facebook, Instagram, LinkedIn, YouTube | |

LIMIT PRIME is a regulated brokerage firm that offers a variety of trading tools and flexible payment options, suitable for experienced traders. Its advantages include high security and transparent fees; however, the potential drawbacks may be inactive account fees and a lack of a beginner-friendly platform.

| Pros | Cons |

| Regulated well | Limited types of accounts |

| Commission free | |

| Separated accounts | |

| Negative balance protection | |

| Demo accounts available | |

| MT5 available | |

| Various payment methods | |

| Various trading instruments |

LIMIT PRIME is a regulated brokerage firm. Limit Prime Securities is regulated under the MIFID II regulation, ESMA, licensed and controlled by the Capital Markets Authority of Montenegro.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Capital Market Commission (SCMN) | Regulated | Limit Prime Securities AD | Market Maker (MM) | 03/2-6/2-17 |

These are the instruments that can be traded on LIMIT PRIME: 40 forex, commodities, indices, stocks, and metals.

| Trading Asset | Available |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| Funds | ❌ |

| ETFs | ❌ |

LIMIT PRIME offers a demo account, which allows traders to test out this platform without risking real money.

LIMIT PRIME offers a type of live account: Standard accounts. When the customer begins trading, they must make a minimum payment of 100 euros, which will automatically classify them into the standard trading group.

The leverage of this platform is up to 1:100. Leverage refers to the act of borrowing funds for investment to magnify investment returns. It allows investors to achieve a larger investment scale with a smaller amount of their own funds, thus enabling them to realize greater returns when the investment yield is high.

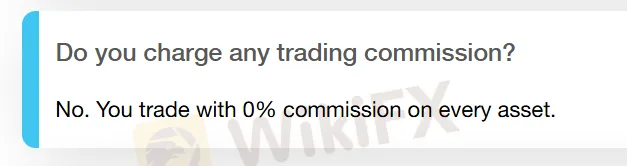

Direct costs: The company does not chargeany trading commissions to its clients.

Whenever there is an open position during the night, the swap is deducted from the client's account.

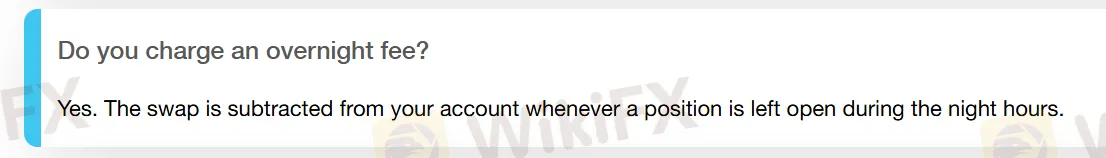

Indirect costs: All clients who have not conducted any transactions and those who have not made at least one transaction within three months from the date of account approval are considered inactive accounts. A commission of $20 will be charged on each withdrawal for inactive accounts.

LIMIT PRIME is a regulated company, and its clients enjoy negative balance protection. This means that the client's account will not be withdrawn with more funds than you actually have.

MT5 is one of the most popular trading platforms all around the world. It's an advanced platform that supports the trading of multiple financial products, providing an automated trading system, technical tools, and copy trading functions.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | / | Beginners |

LIMIT PRIME offers the following payment methods: Bank Transfer, Mastercard, Skrill, Neteller, Visa, and American Express.

In my experience with Limit Prime Securities, the highest leverage offered on major forex pairs is up to 1:100. As a trader, this level of leverage is standard for many regulated brokers, particularly in regions outside of the strictest ESMA boundaries. The ability to utilize 1:100 can enhance trading flexibility, but it's important to remember that leveraged trading carries increased risk, especially in volatile markets. When I compared leverage across Limit Prime’s other asset classes, I found that the same maximum leverage—up to 1:100—applies not only to forex but also to commodities, indices, stocks, and metals. This uniformity is somewhat unusual, as many brokers typically offer lower maximum leverage on stocks and metals due to their different risk profiles and margin requirements. For me, this means I need to be extra vigilant with my position sizing and risk management, particularly when dealing with more volatile or less liquid instruments. Although high leverage can be appealing for experienced traders seeking larger exposure, I personally approach it with caution. Given that Limit Prime Securities is regulated in Montenegro and provides negative balance protection, I feel somewhat reassured, but I always remind myself that responsible use of leverage is critical to preserving capital and long-term trading sustainability.

Based on my research and personal scrutiny as a trader, I can confirm that Limit Prime Securities offers the MetaTrader 5 (MT5) platform. In my experience, MT5 fully supports the use of Expert Advisors (EAs) for automated trading. This is an important consideration for me since the ability to automate strategies is crucial for testing, executing trades with discipline, and managing multiple markets efficiently. MT5’s technical infrastructure, as provided by Limit Prime Securities, appears to be up to industry standards, and the platform is accessible on desktop, mobile, and web devices. However, I always approach automated trading with caution. While using EAs can enhance efficiency, it also introduces specific risks, such as over-optimization or connectivity disruptions. For me, the key aspect is the broker’s regulatory status and platform stability. Limit Prime Securities is regulated in Montenegro, and clients benefit from negative balance protection, which gives added confidence when deploying automated systems. Still, I make a habit of extensively backtesting any EA in a demo environment—which Limit Prime does provide—before risking real capital. In summary, from my professional standpoint, Limit Prime Securities enables EA use via MT5, but, as with any broker, diligent testing and ongoing monitoring are essential for sustainable results.

As an experienced trader, I pay very close attention to a broker’s regulatory status before deciding to commit any real funds. In my review of Limit Prime Securities, I found their regulation by the Capital Market Commission (SCMN) in Montenegro to be a reassuring factor, especially given the financial safeguards in place. For me, the most important protection comes from their adherence to negative balance protection, meaning my account cannot fall below zero due to trading losses. This reduces the risk of incurring debts to the broker during periods of high volatility. Additionally, regulatory oversight typically requires that client funds be held in segregated accounts, separate from the broker’s own operating funds. This separation is crucial; it can help ensure my capital remains protected in the event of broker insolvency. Limit Prime’s licensing under MIFID II and ESMA-aligned standards further supports an environment with transparent business practices and risk controls, both vital for peace of mind as a trader. However, regulation in Montenegro does not guarantee the same investor protection as top-tier jurisdictions. While I feel more secure trading with a regulated entity like Limit Prime Securities compared to an unlicensed broker, I remain mindful of regional regulatory differences. For me, this means I only deposit what I can afford to risk, and monitor my accounts actively, regardless of regulation.

From my direct experience researching and evaluating Limit Prime Securities, I found that they offer access to several of the major asset classes that suit a wide variety of trading strategies. Specifically, I was able to trade forex, commodities, indices, stocks, and metals on their platform. However, I noted that Limit Prime does not provide access to cryptocurrencies, bonds, options, funds, or ETFs. This limitation can be important for traders who value exposure to digital assets or broader diversification across additional markets. The ability to trade multiple asset types—forex being a cornerstone, but also commodities and global indices—was an essential consideration for me in judging their flexibility. I believe their coverage is solid for someone focused on traditional markets or who prefers the depth of offerings in classic instruments. One of the benefits I appreciated is their provision of these instruments through the well-regarded MT5 trading platform, which gave me confidence in the technical backbone of their services. That said, if your trading plan involves cryptocurrency or niche financial products, you may need to look elsewhere. In my cautious approach, understanding exactly which instruments are supported—and which are not—is vital for long-term planning and portfolio management.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now