Company Summary

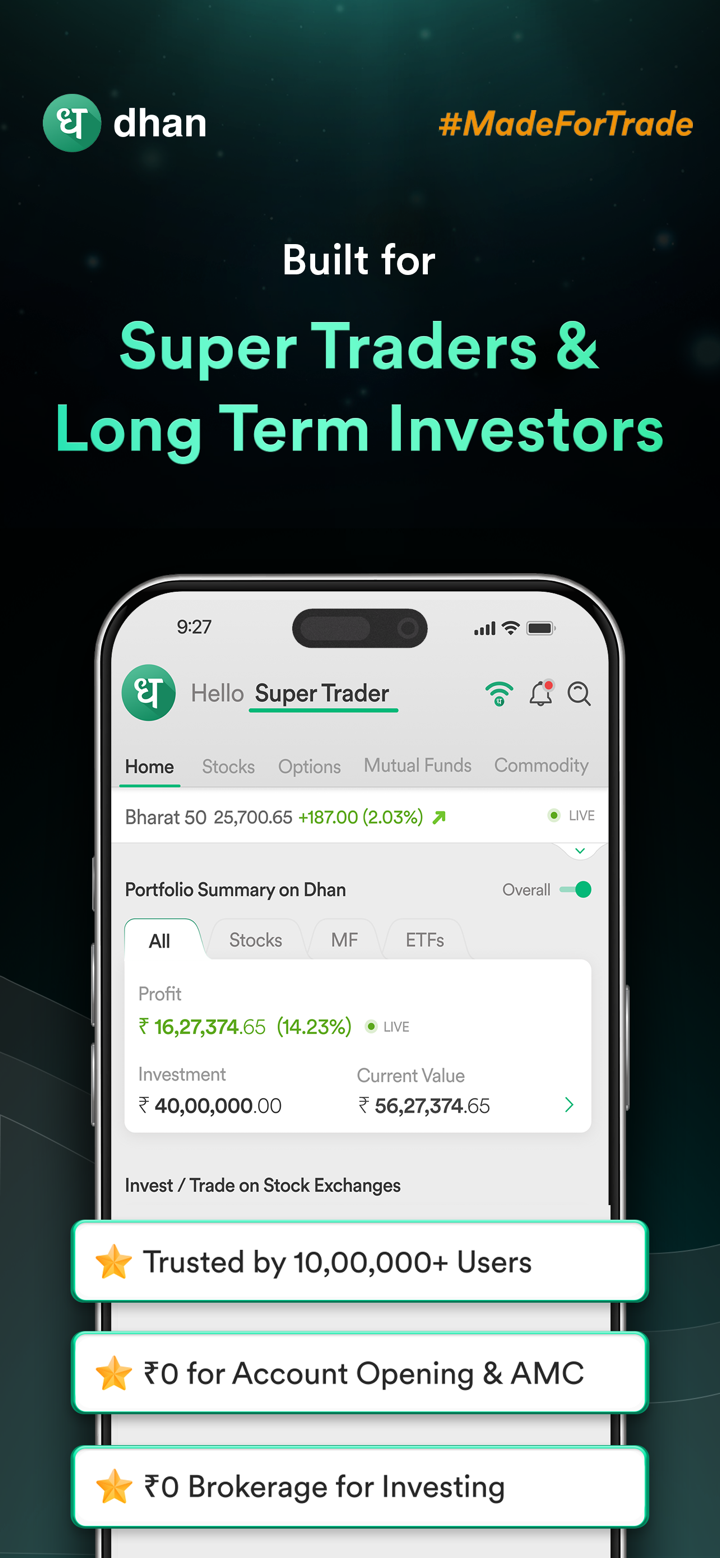

| DhanReview Summary | |

| Founded | 2004 |

| Registered Country/Region | India |

| Regulation | No Regulation |

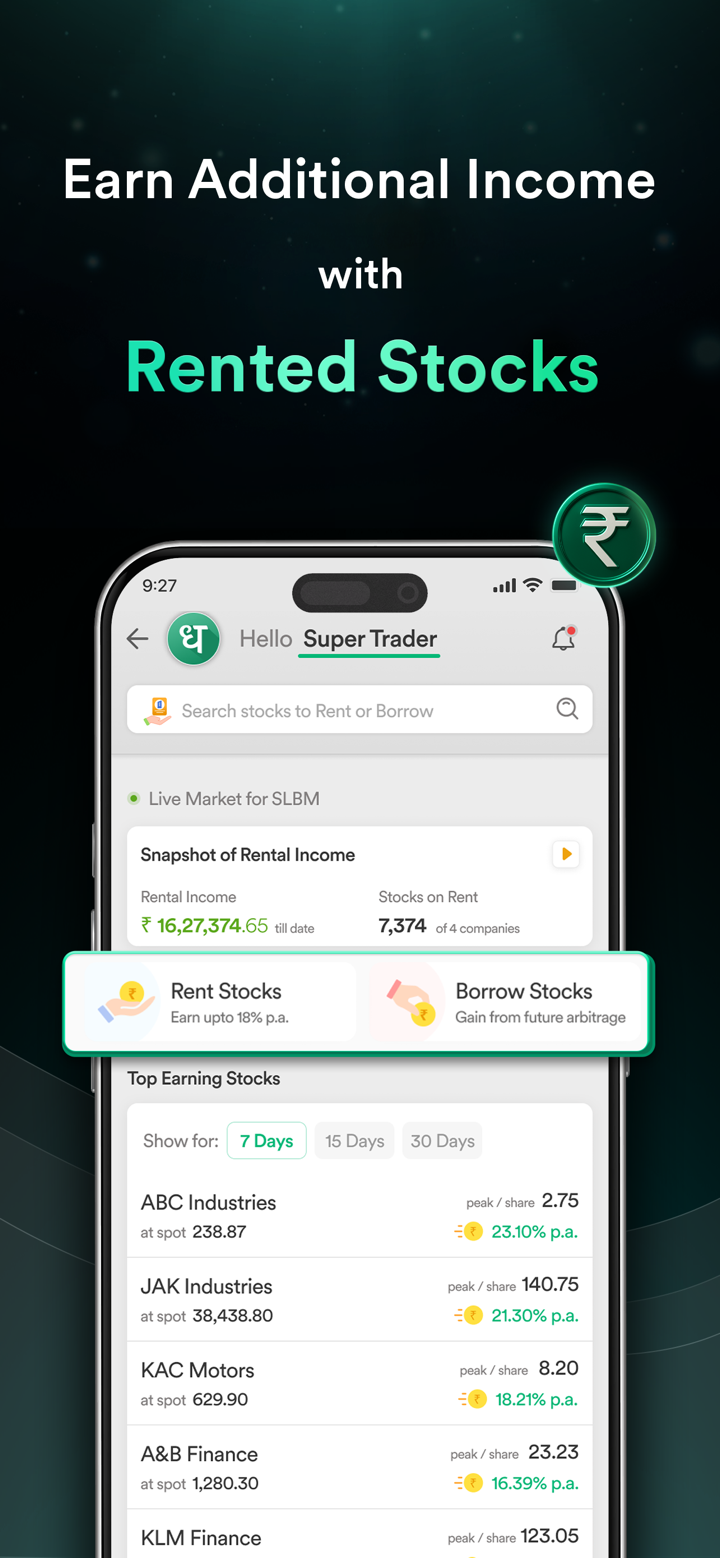

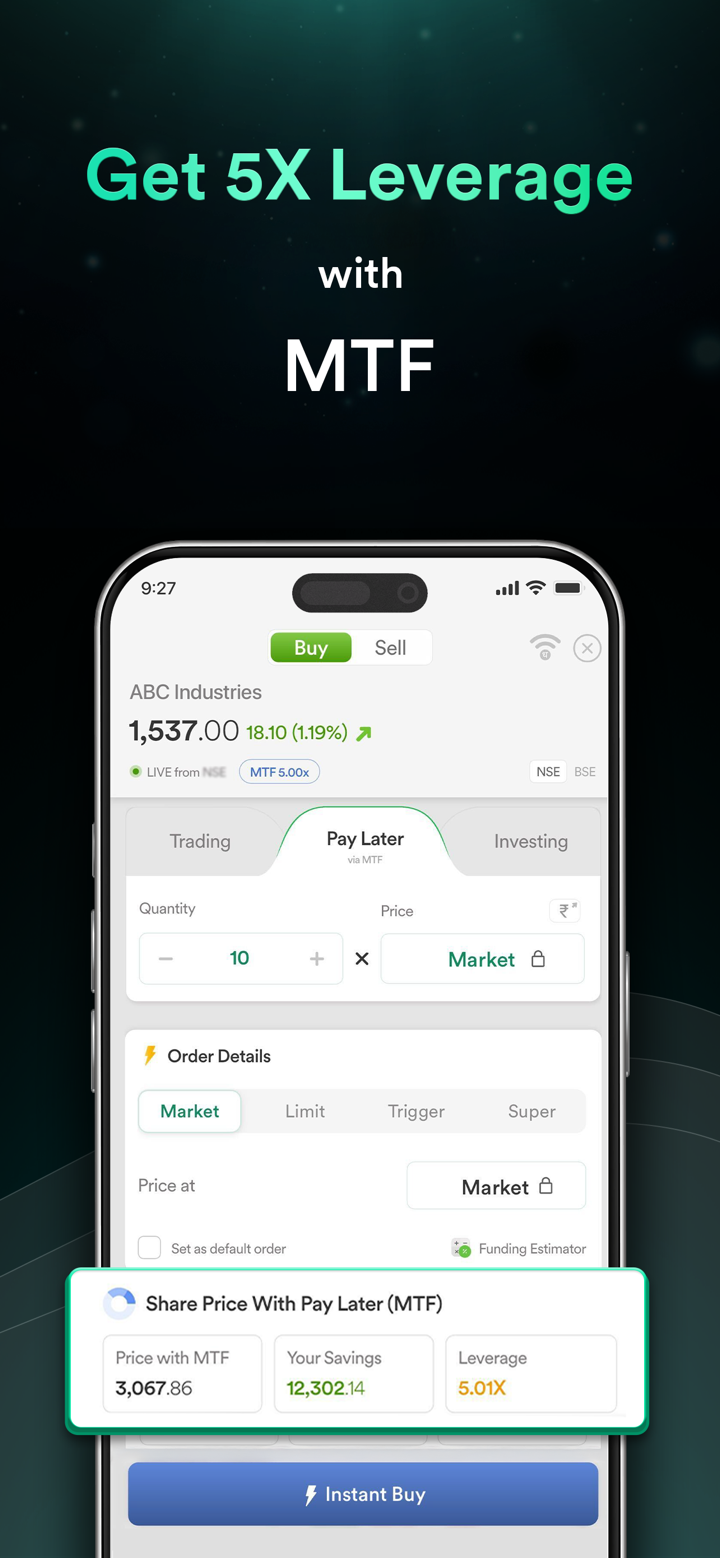

| Market Instruments | Stocks, Options, Futures, Commodity, Currency, ETFS, Mutual Funds, |

| Demo Account | ❌ |

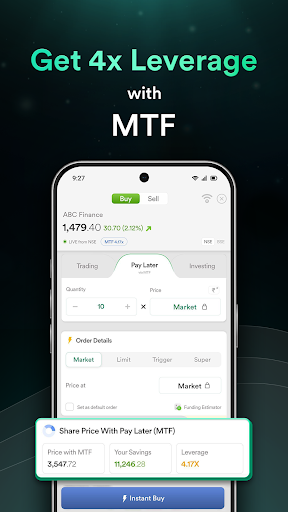

| Leverage | / |

| Spread | / |

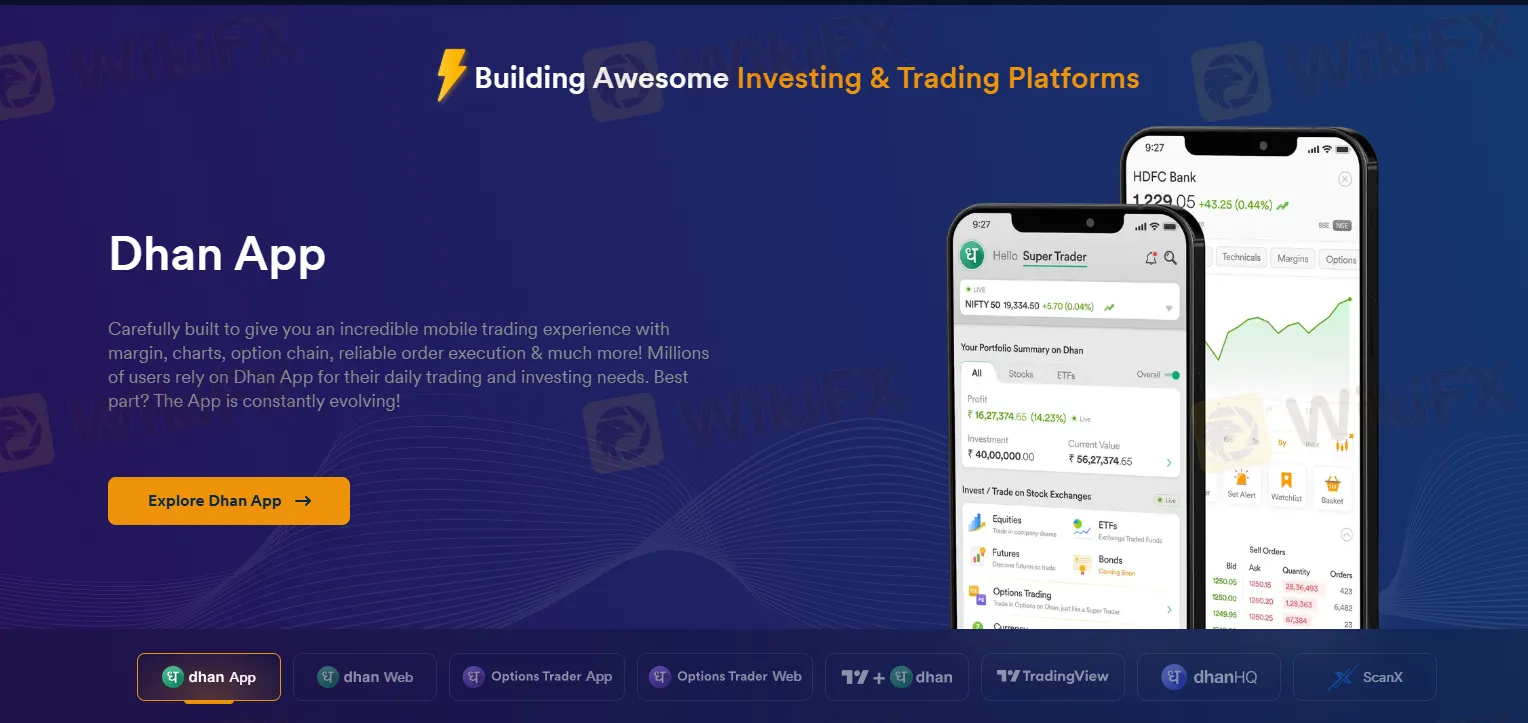

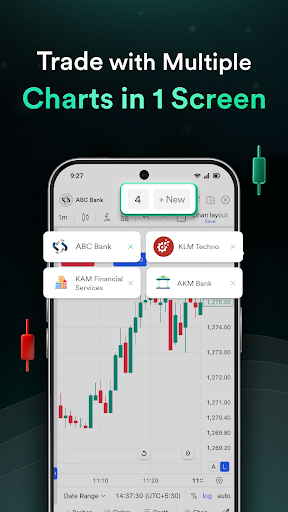

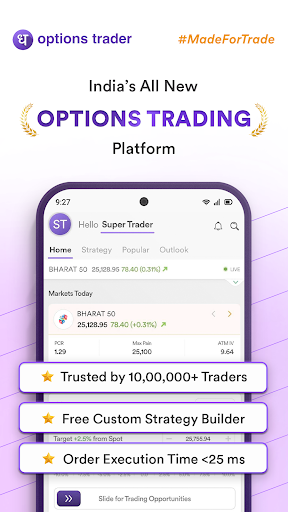

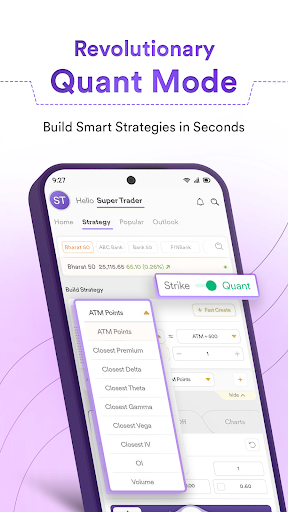

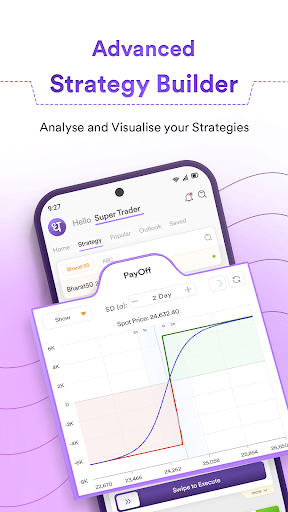

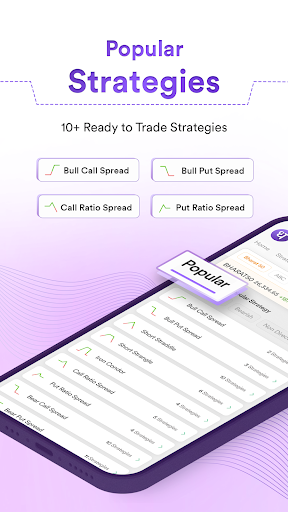

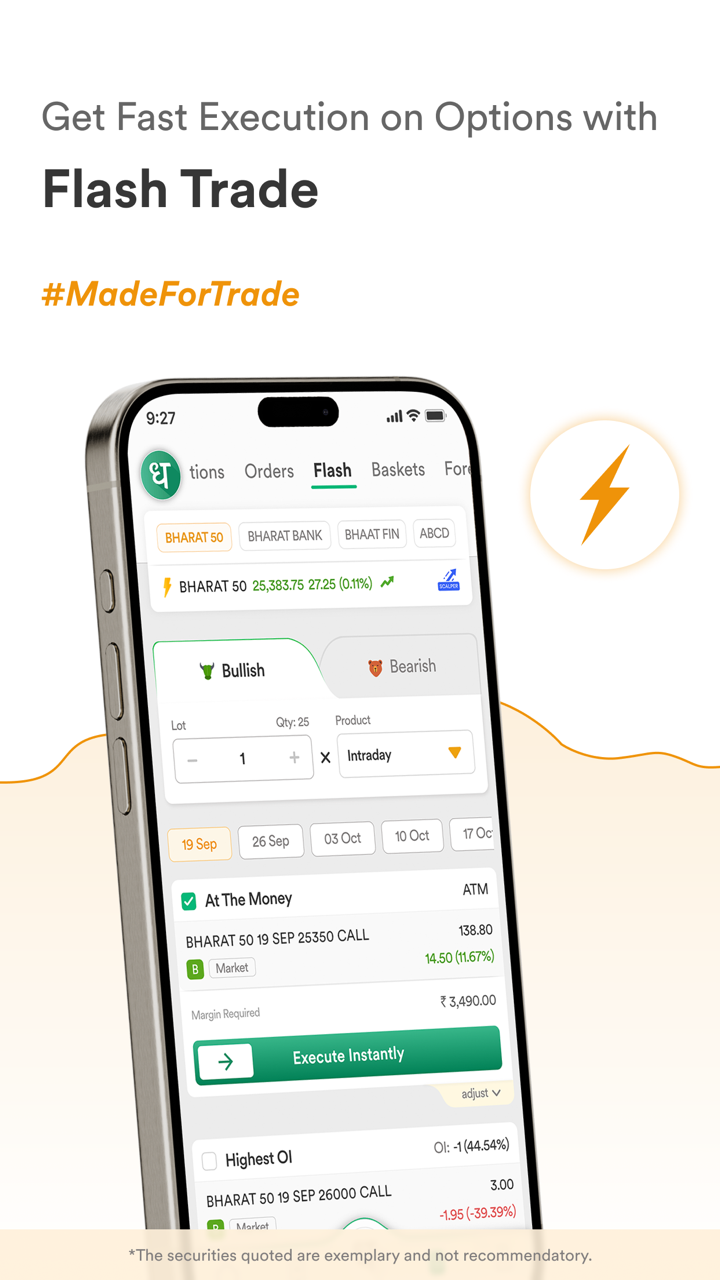

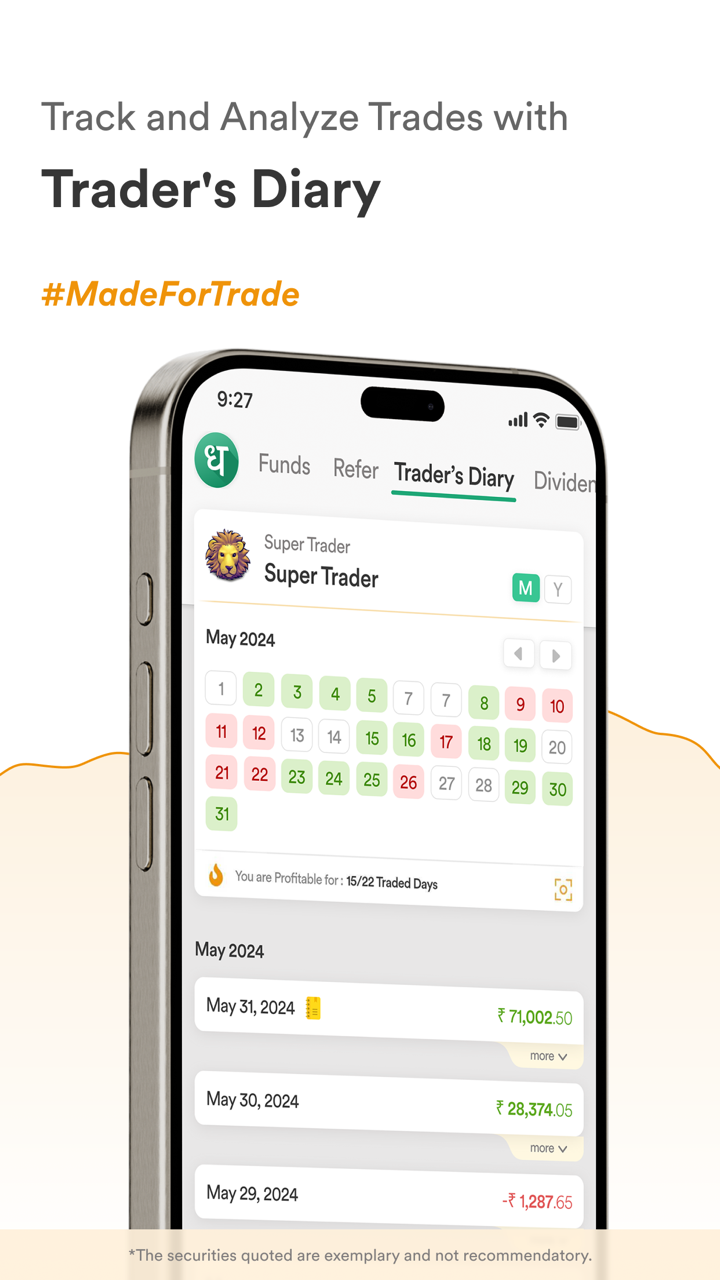

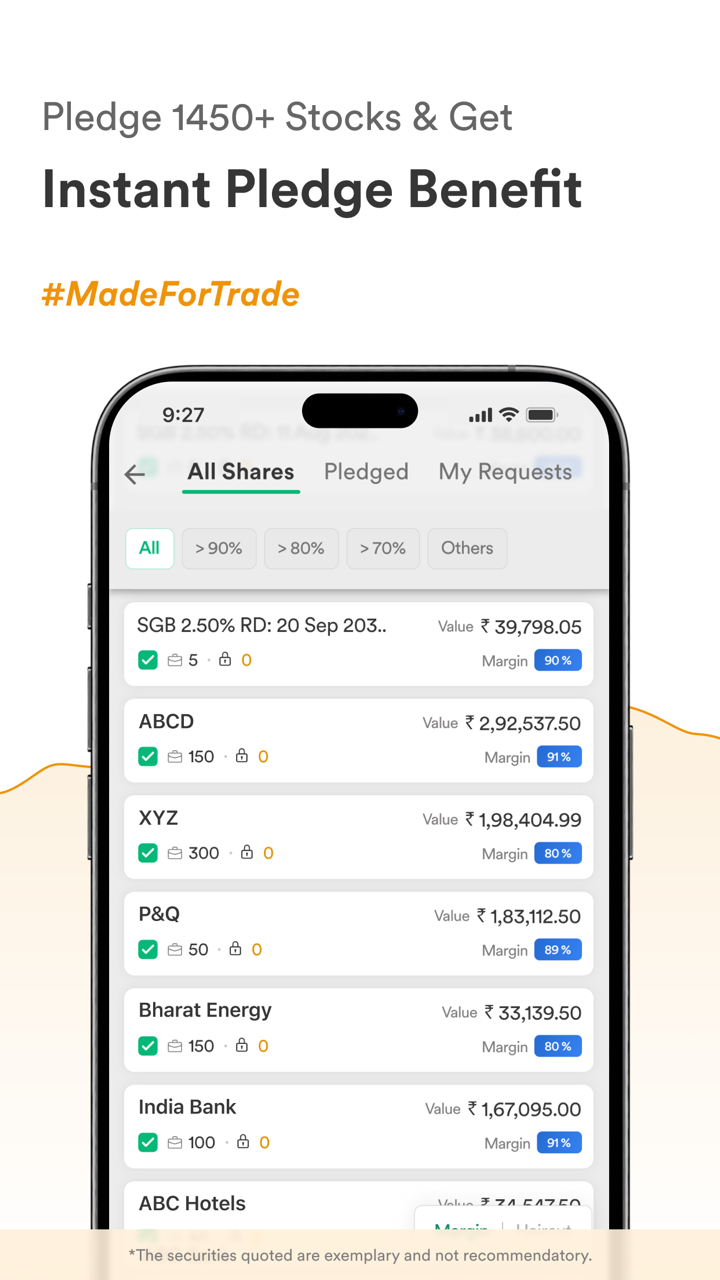

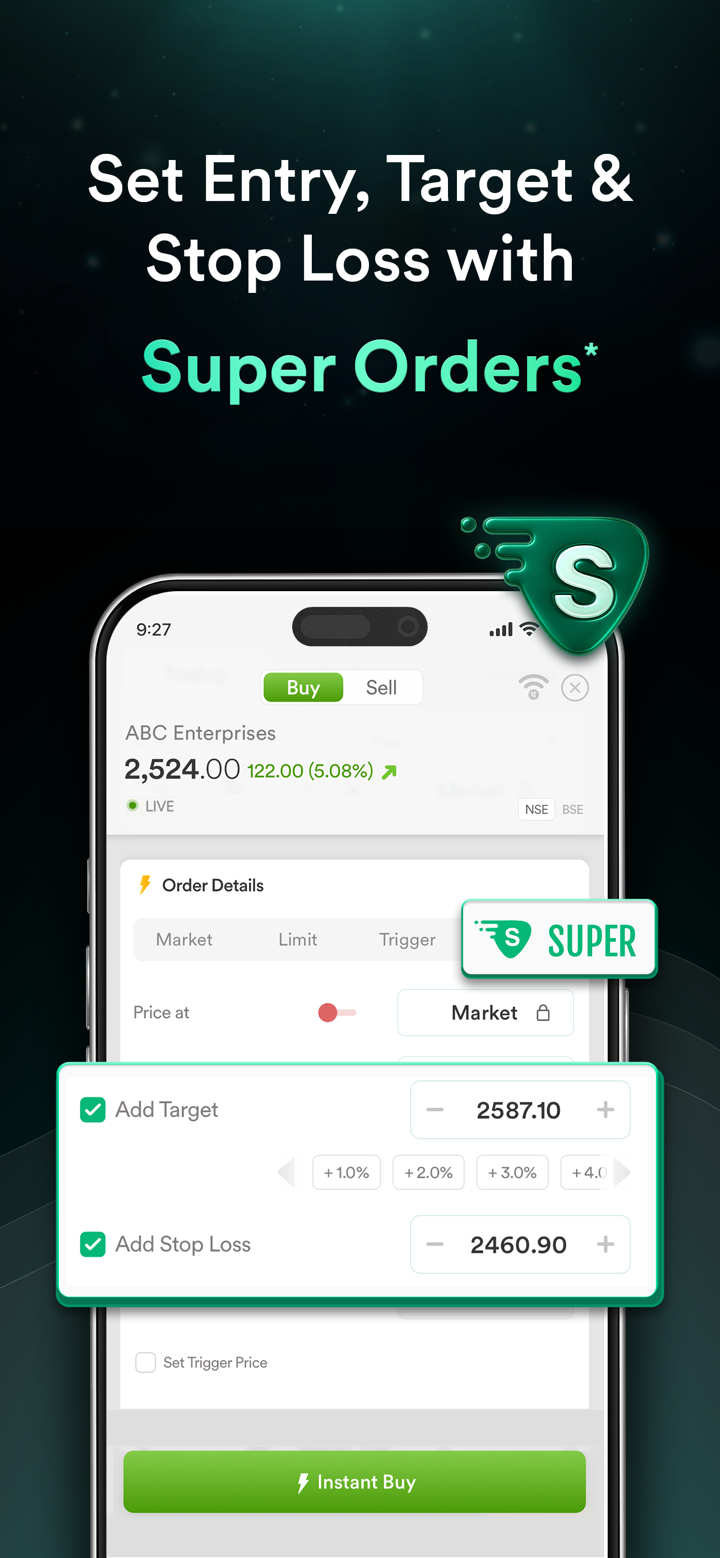

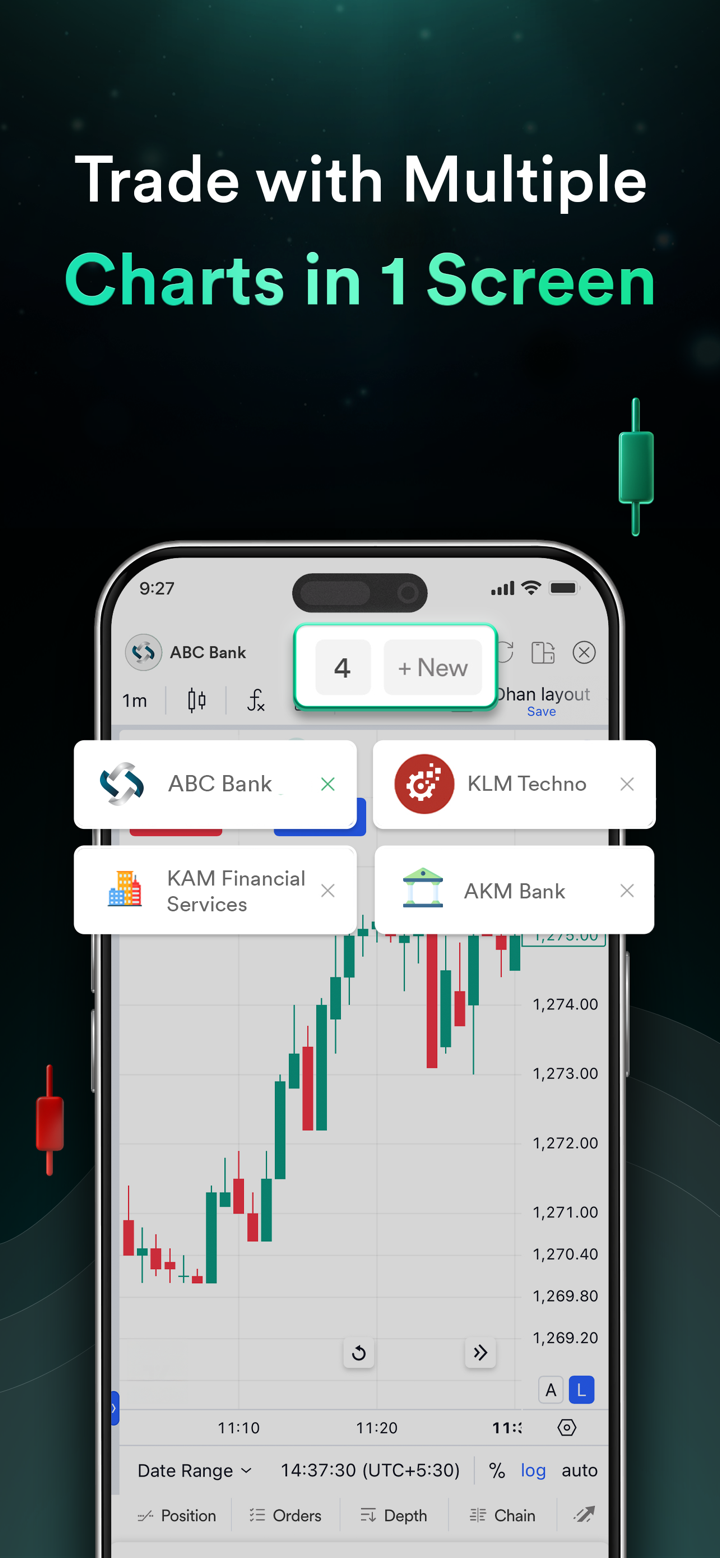

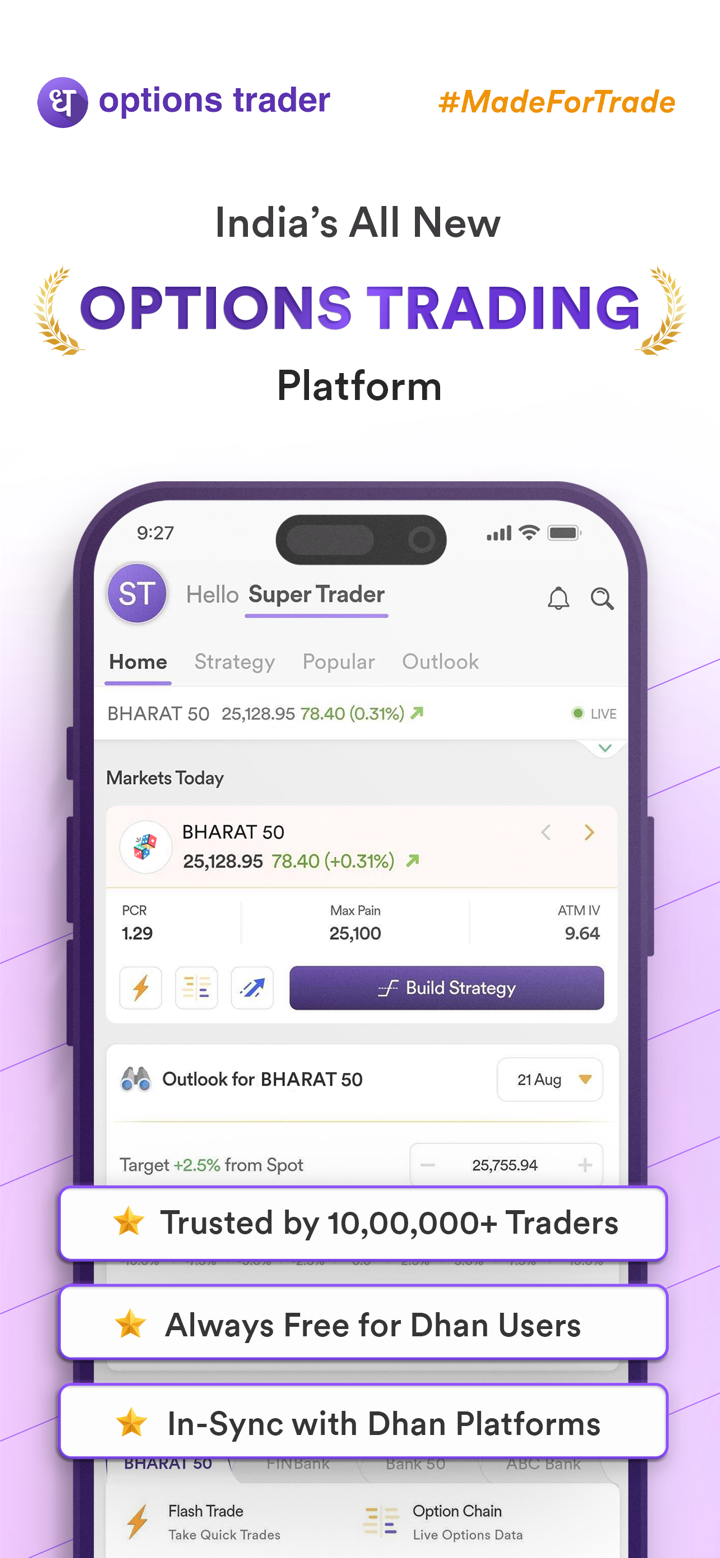

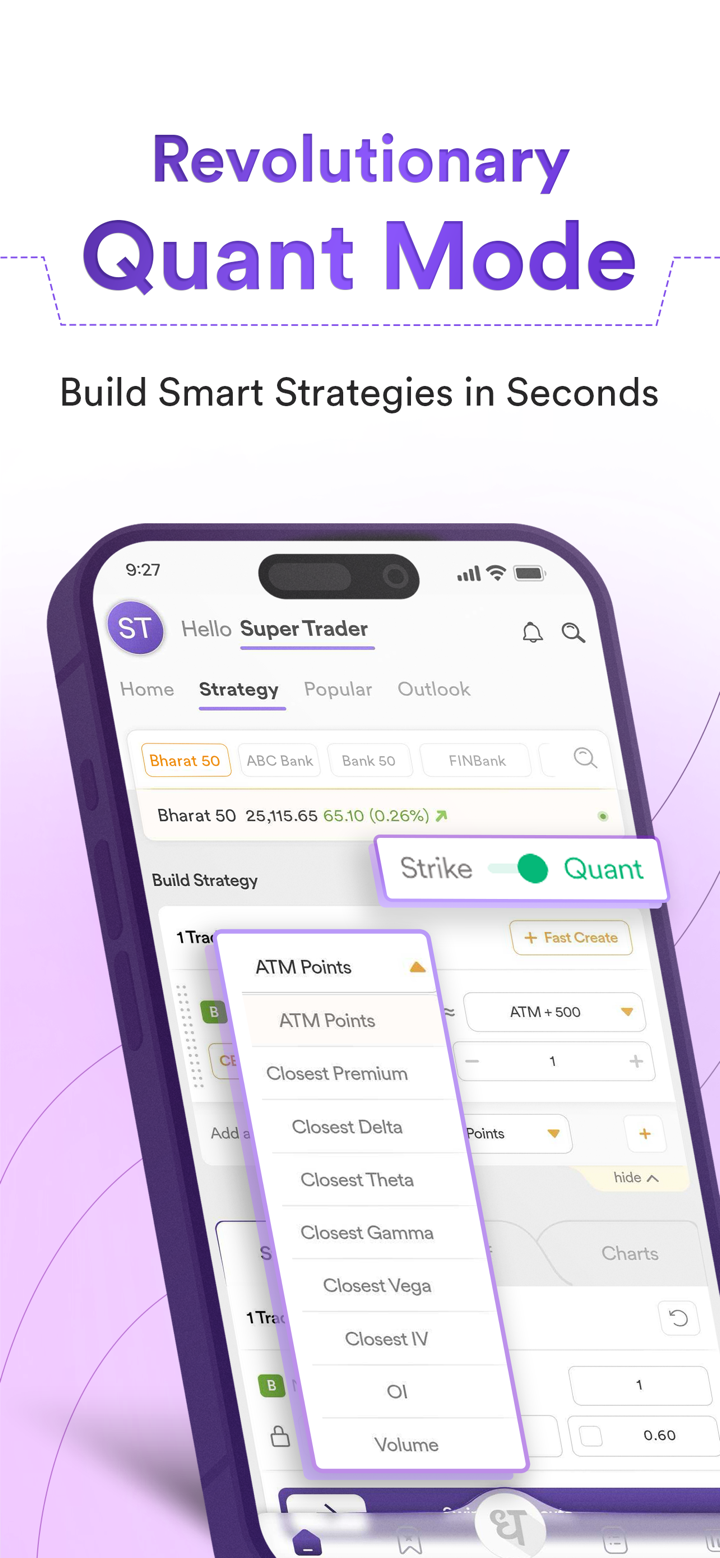

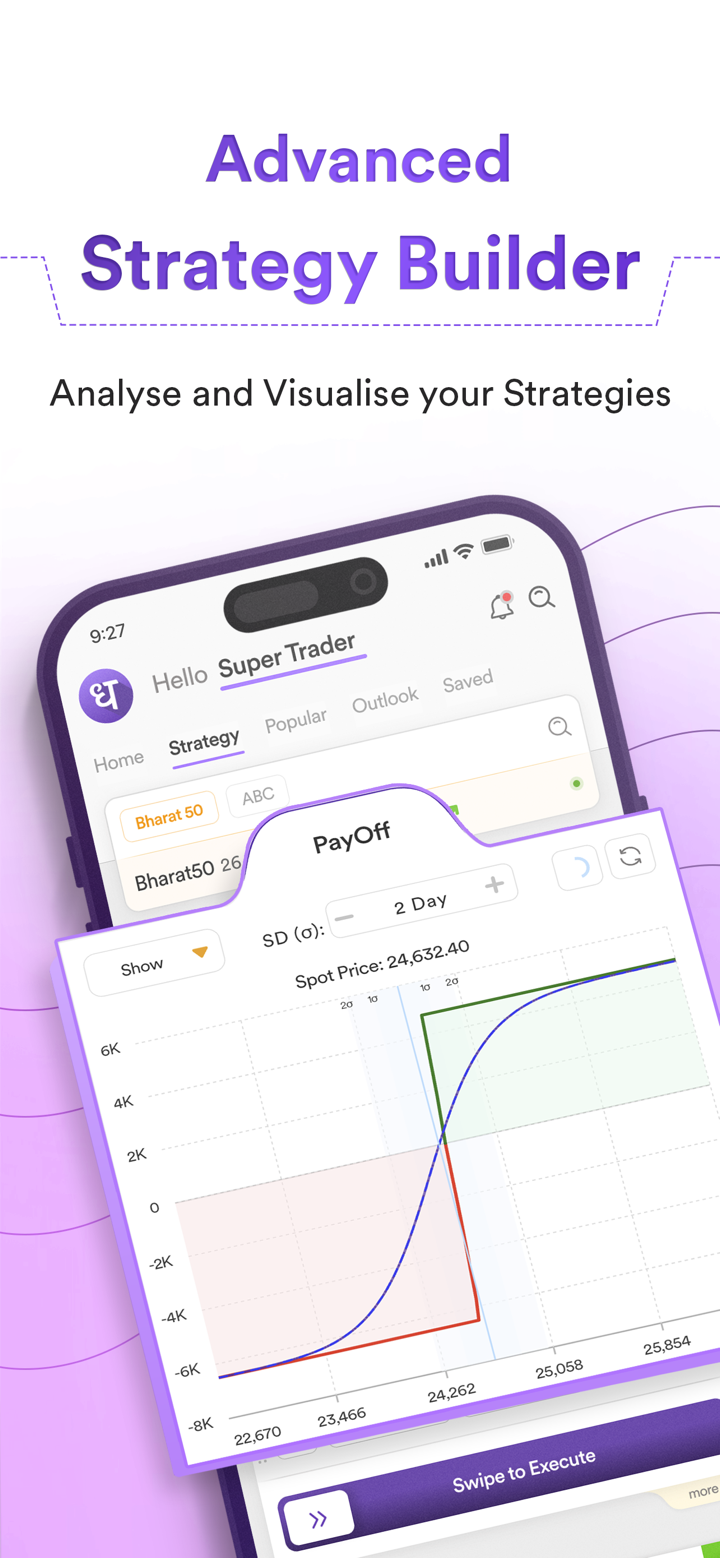

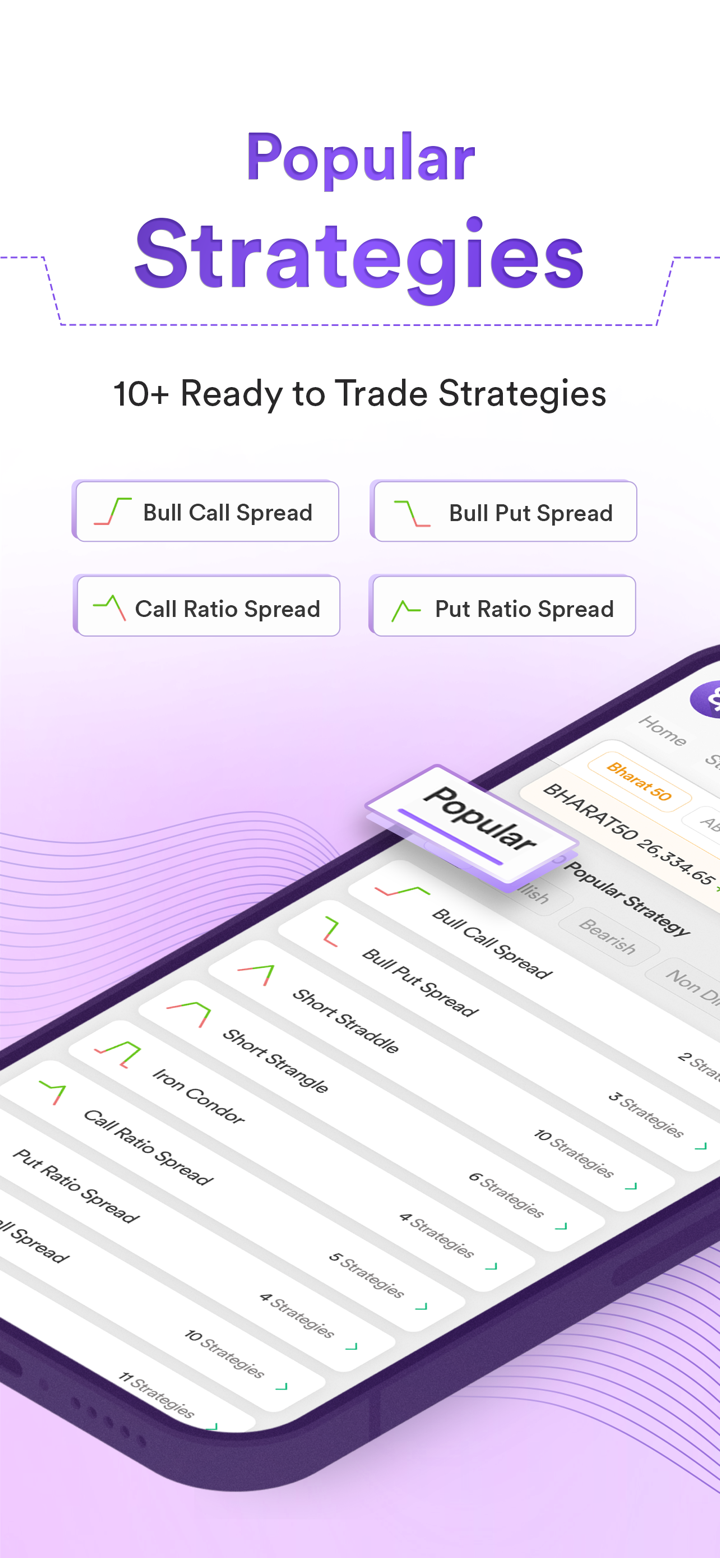

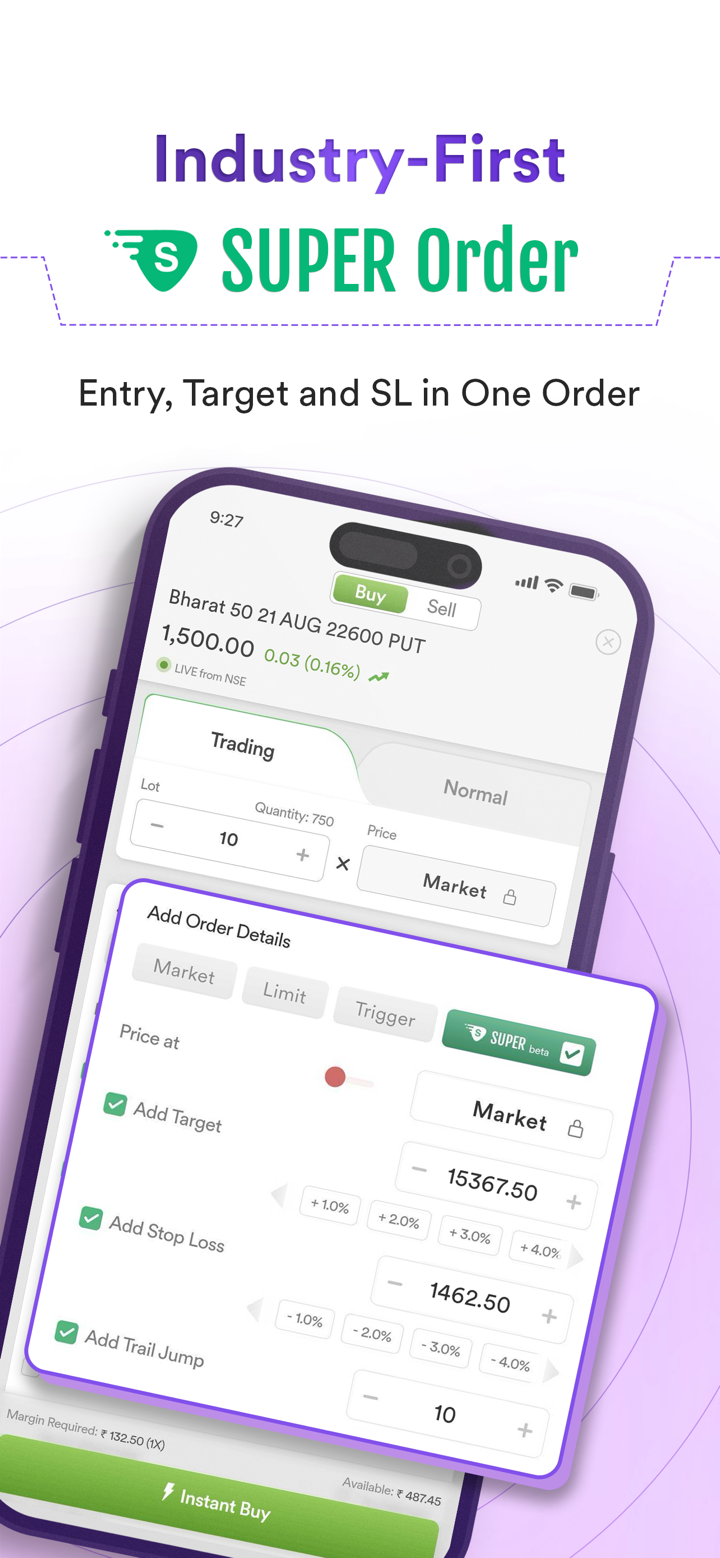

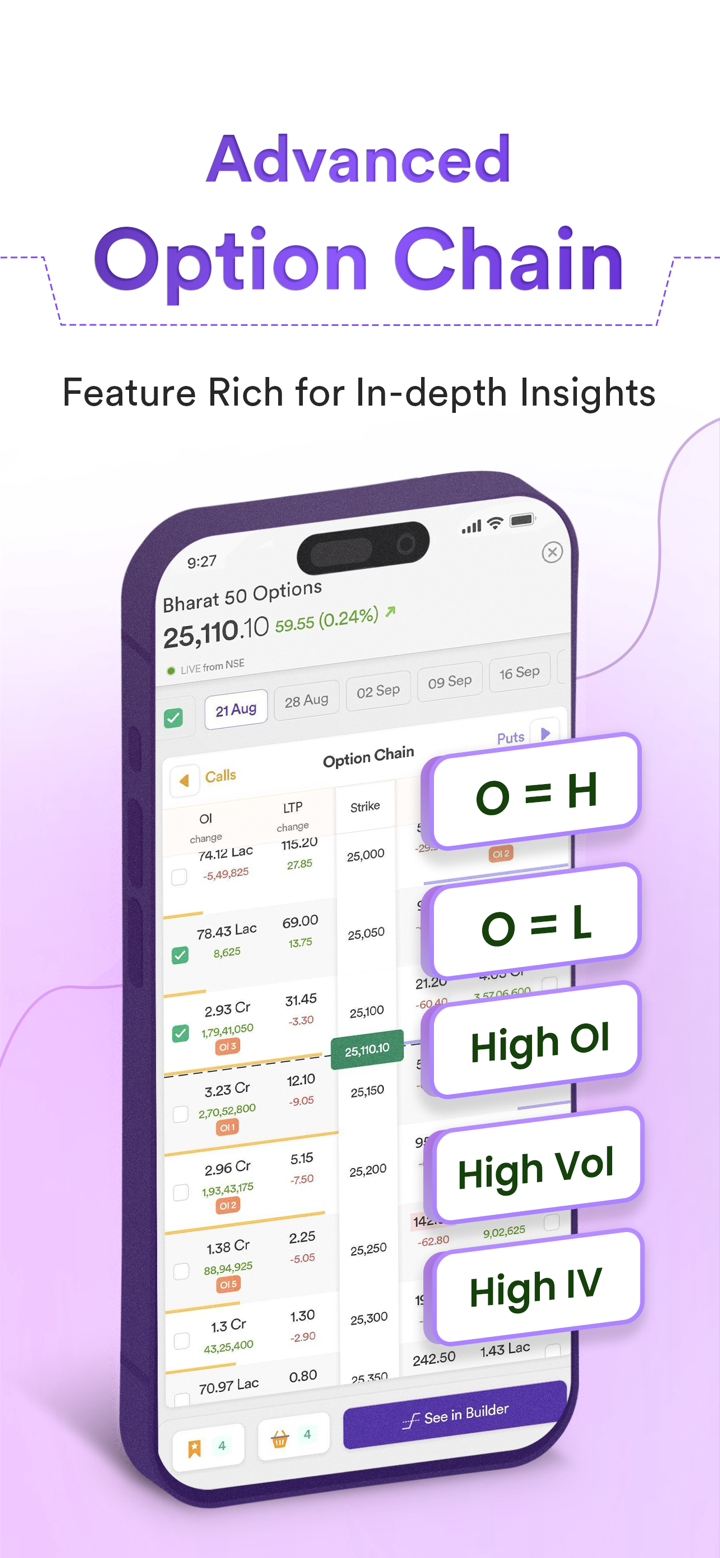

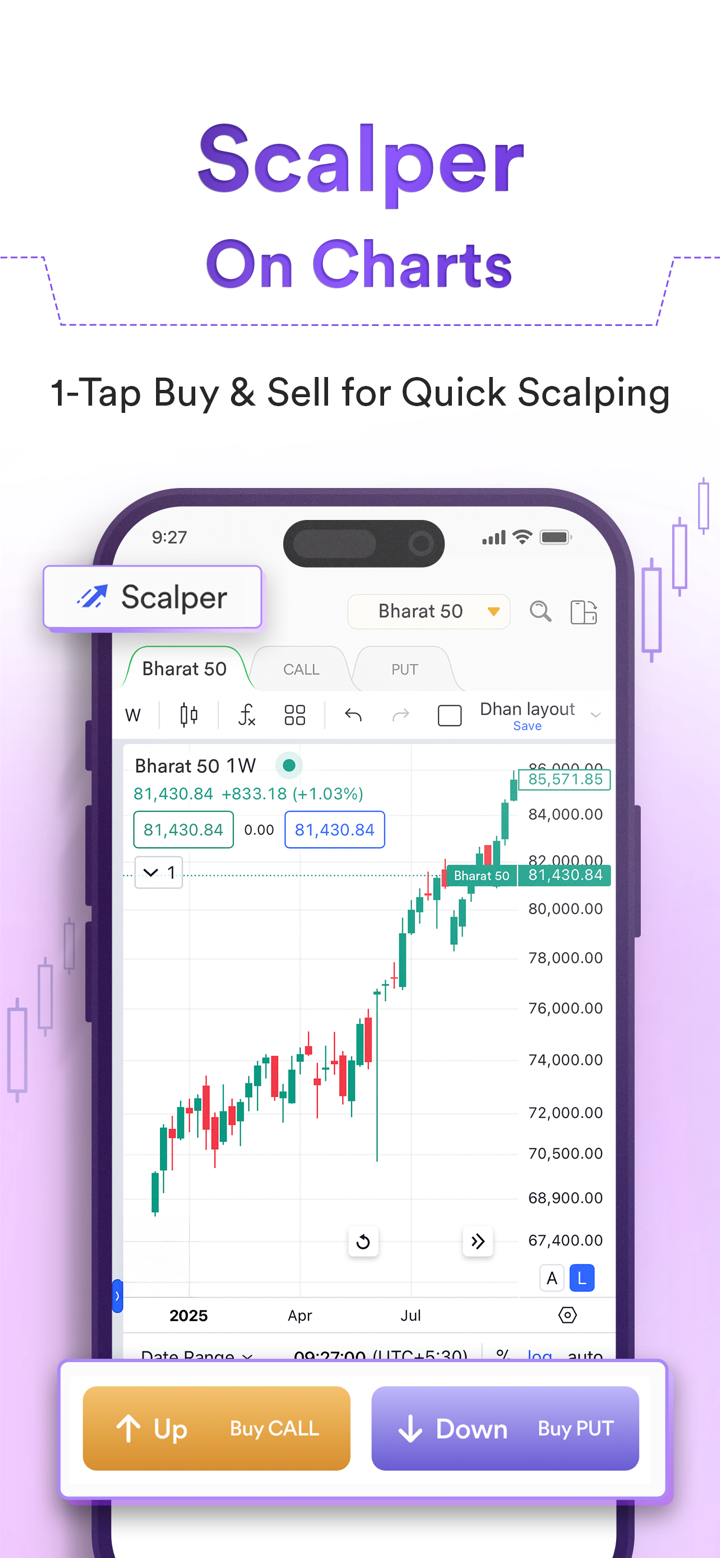

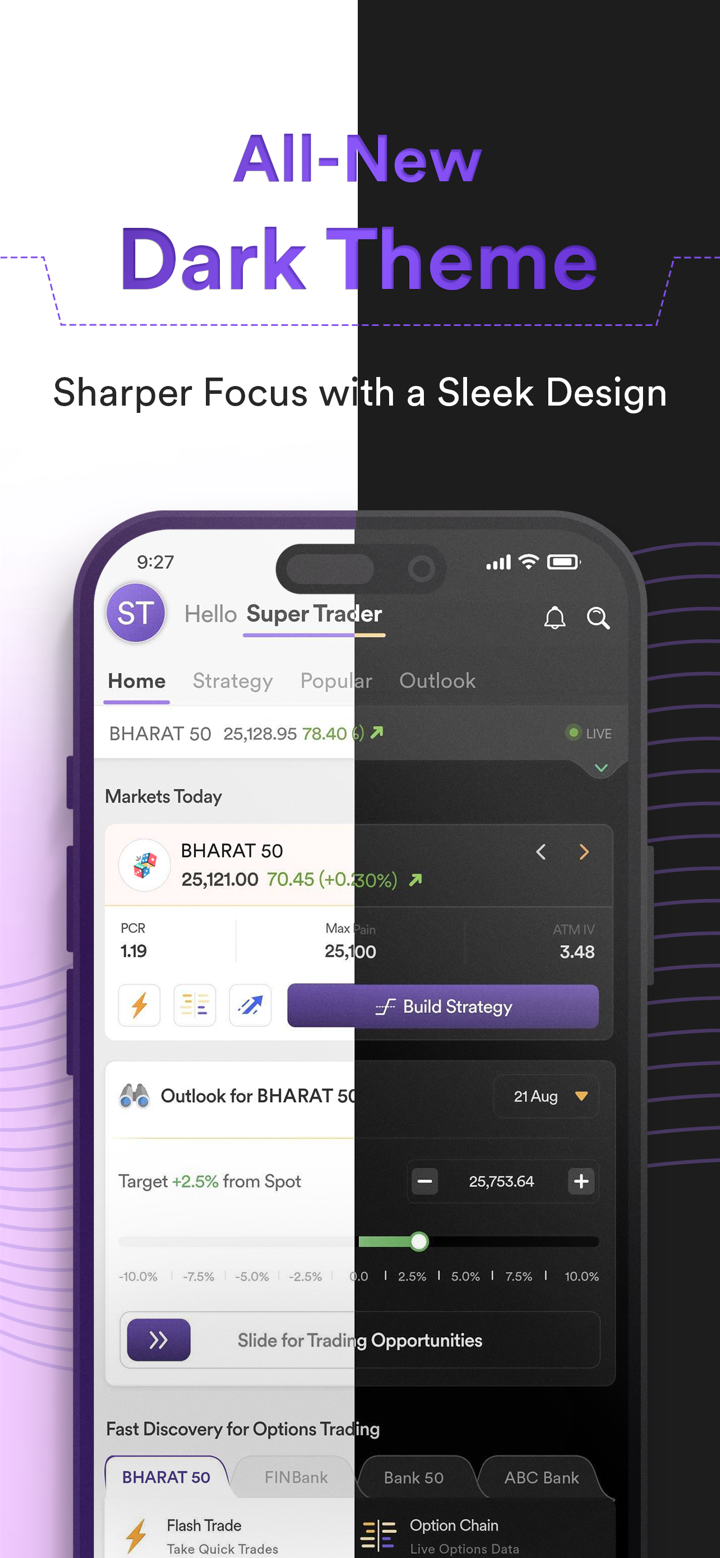

| Trading Platform | Dhan App, Dhan web, Options Trader App, Options Trader Web, Dhan + TradingView, TradingView, DhanHQ |

| Minimum Deposit | / |

| Customer Support | Tel: (+91)9987761000 |

| Email: help@dhan.co | |

| Address: 302, Western Edge l, Off Western Express Highway, Borivali East, Mumbai - 400066, Maharashtra, India. | |

| Live Chat | |

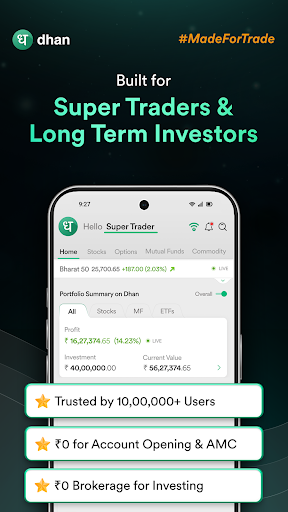

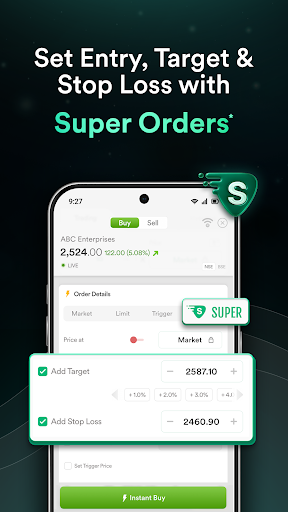

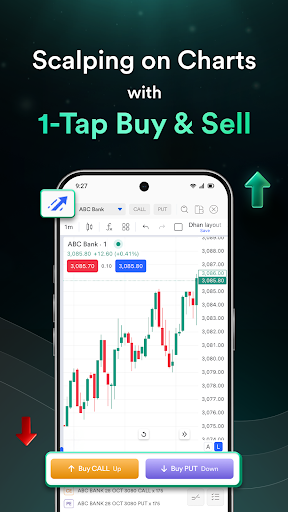

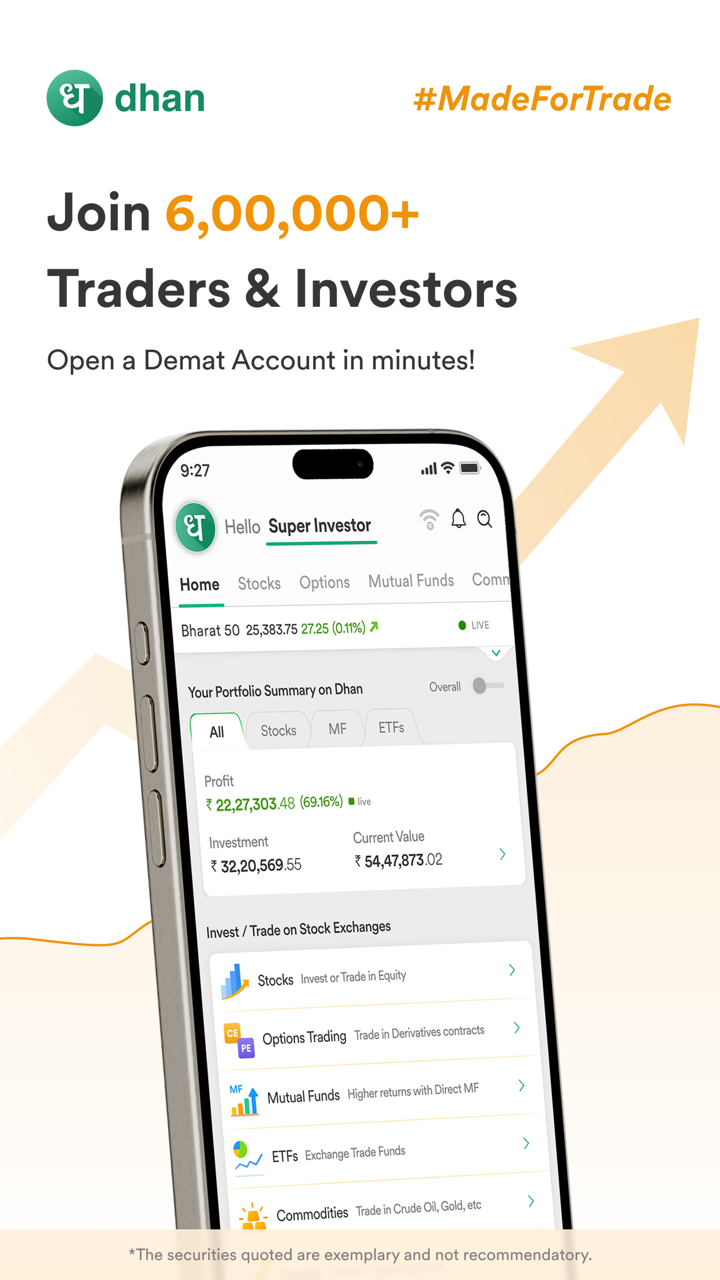

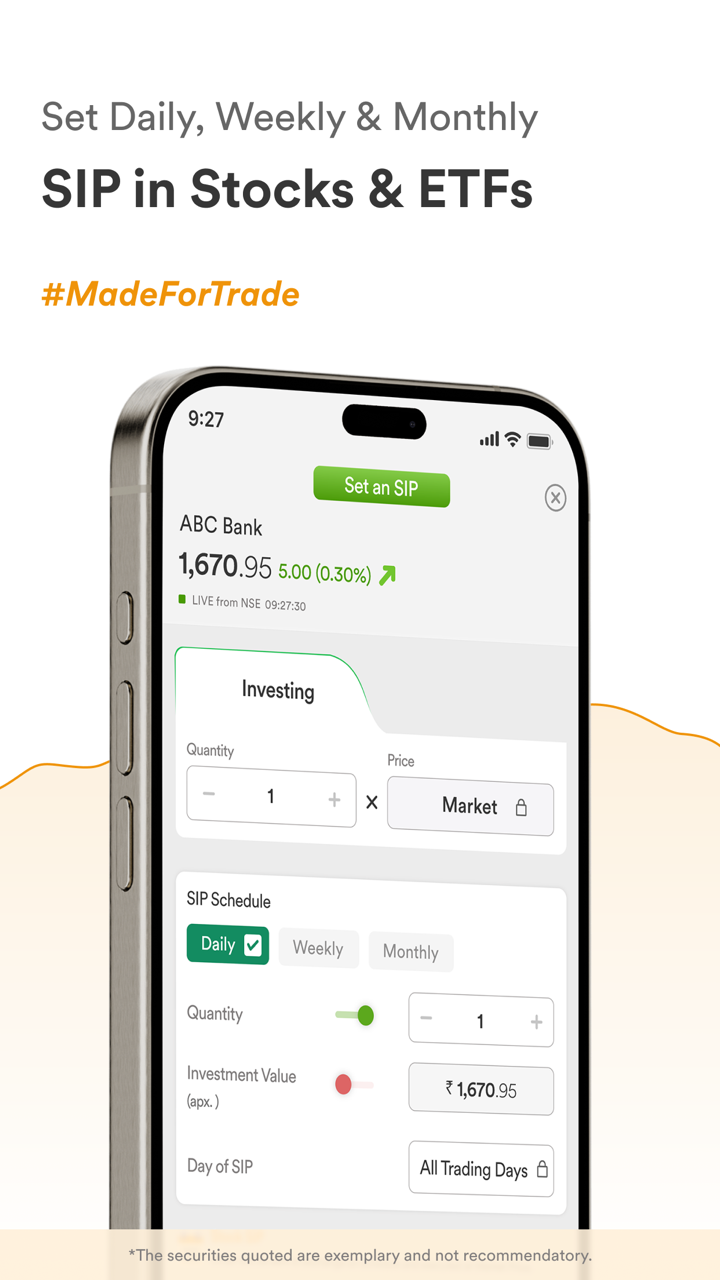

Dhan is an unregulated financial services platform based in India that offers a variety of trading instruments across different asset classes, including Stocks, Options, Futures, Commodities, Currencies, ETFs (Exchange-Traded Funds),and Mutual Funds, The platform provides traders and investors with opportunities to engage in diverse markets. It provide trading platforms, including the Dhan App & Web, Options Trader App & Web, Dhan + TradingView, TradingView, and DhanHQ.

Pros and Cons

| Pros | Cons |

| User-Friendly Trading Platforms | No Regulation |

| Various trading instruments | Demo account unavailable |

| MT4/MT5 unavailable |

Is Dhan Legit?

No. Dhan is no regulation. Please be aware of the risk!

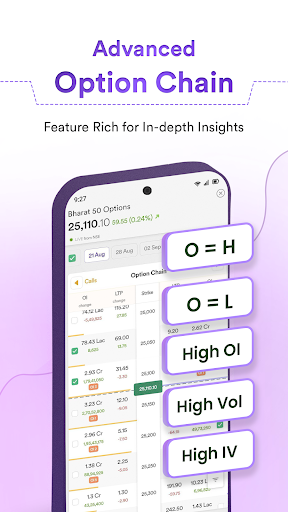

What Can I Trade on Dhan?

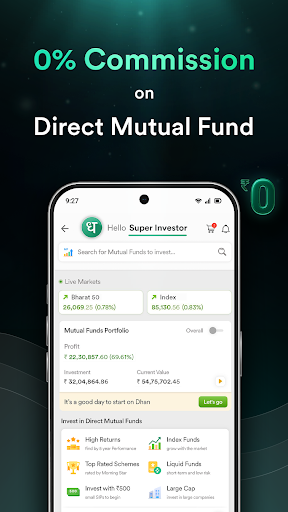

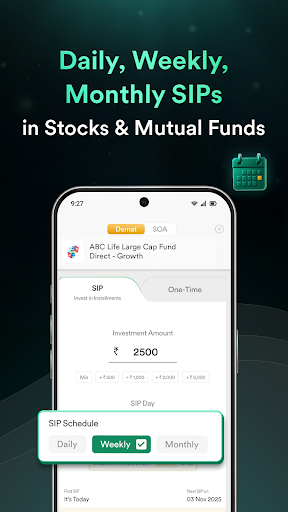

Dhan provide Stocks, Options, Futures, Commodity, Currency, ETFS, and Mutual Funds,.

There's no ETFs trading or bonds trading. But overall, you still have a good mix of investment options.

| Tradable Instruments | Supported |

| Commodities | ✔ |

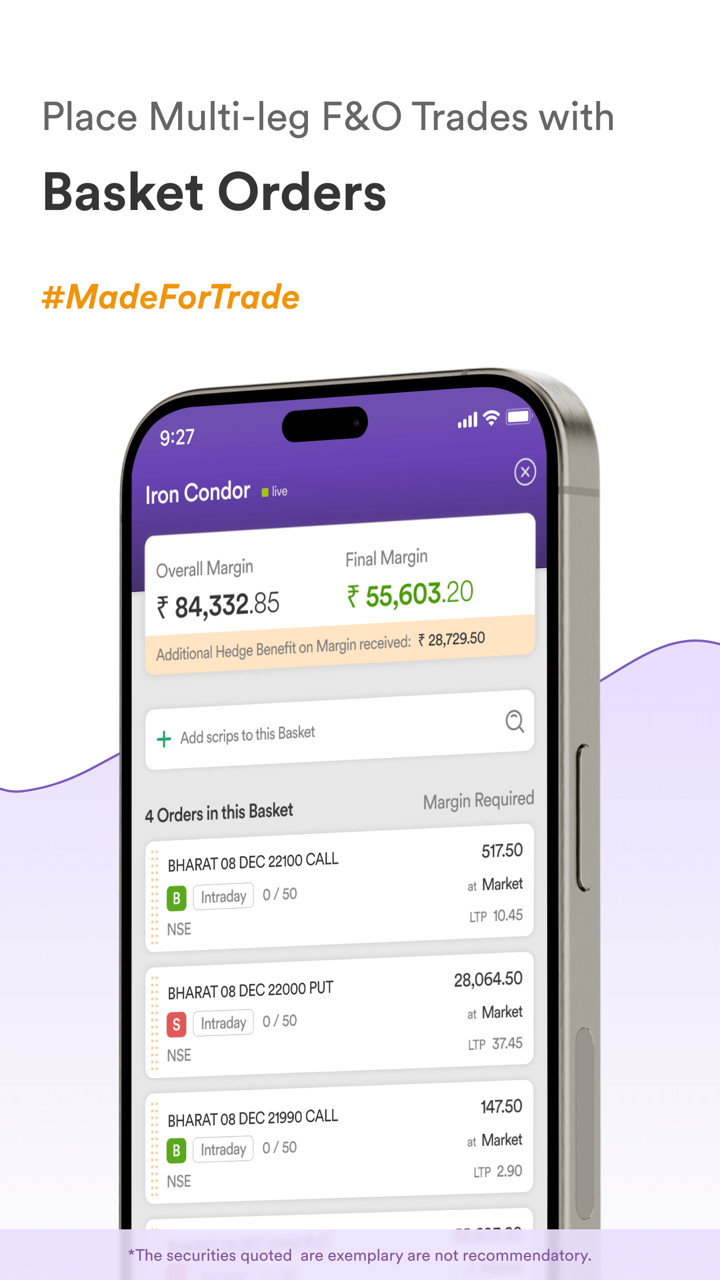

| Futures | ✔ |

| Currency | ✔ |

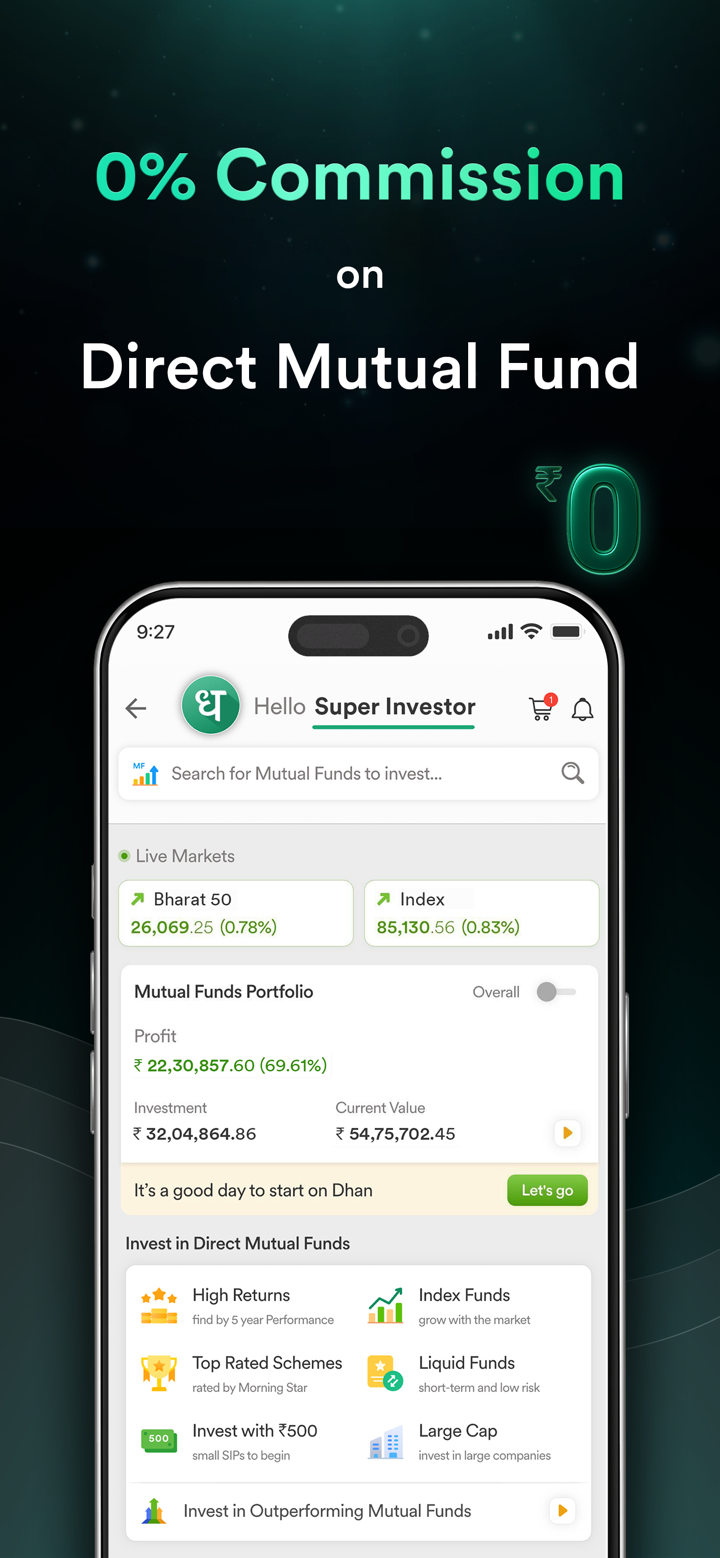

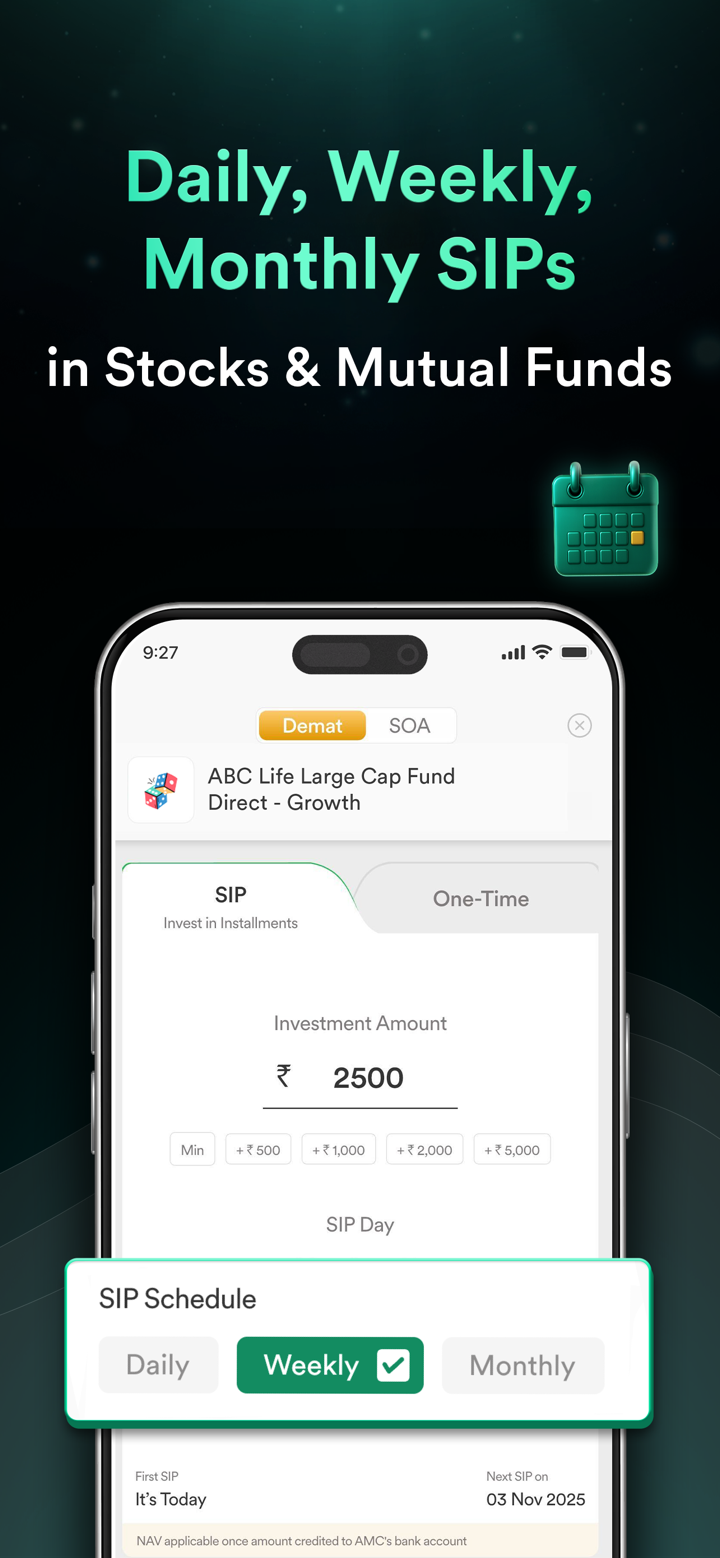

| Mutual Funds | ✔ |

| Stocks | ✔ |

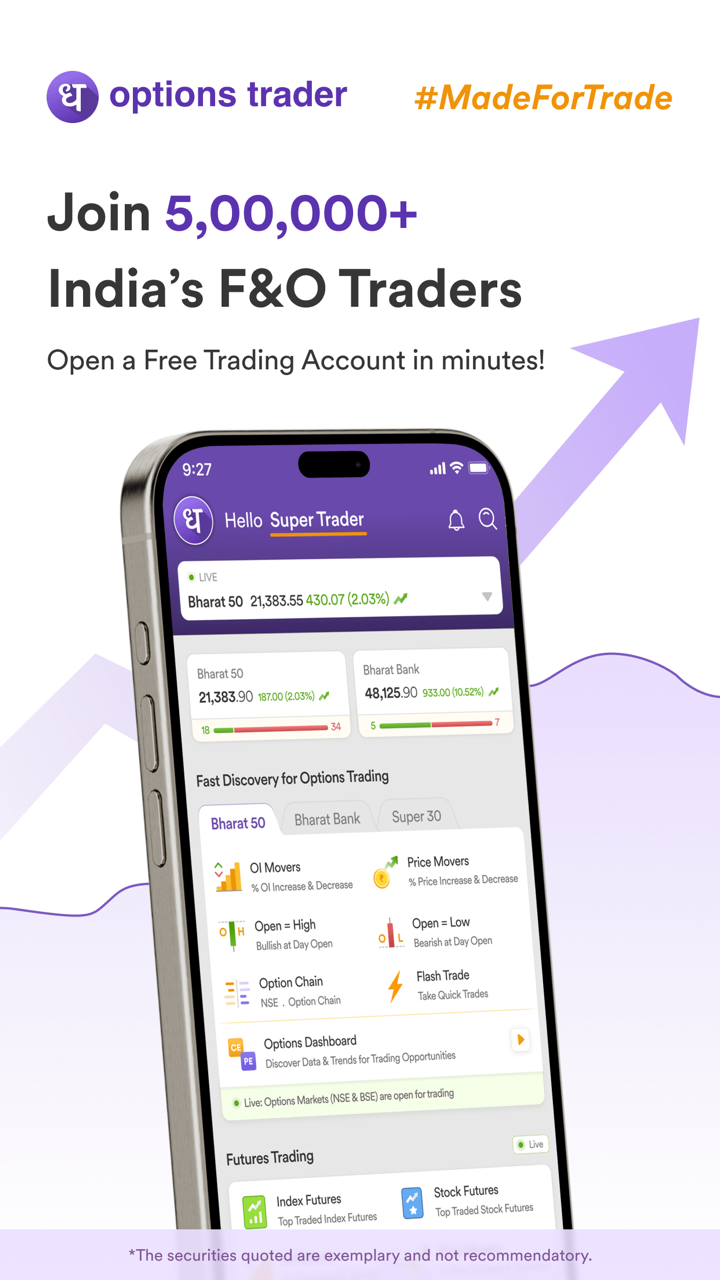

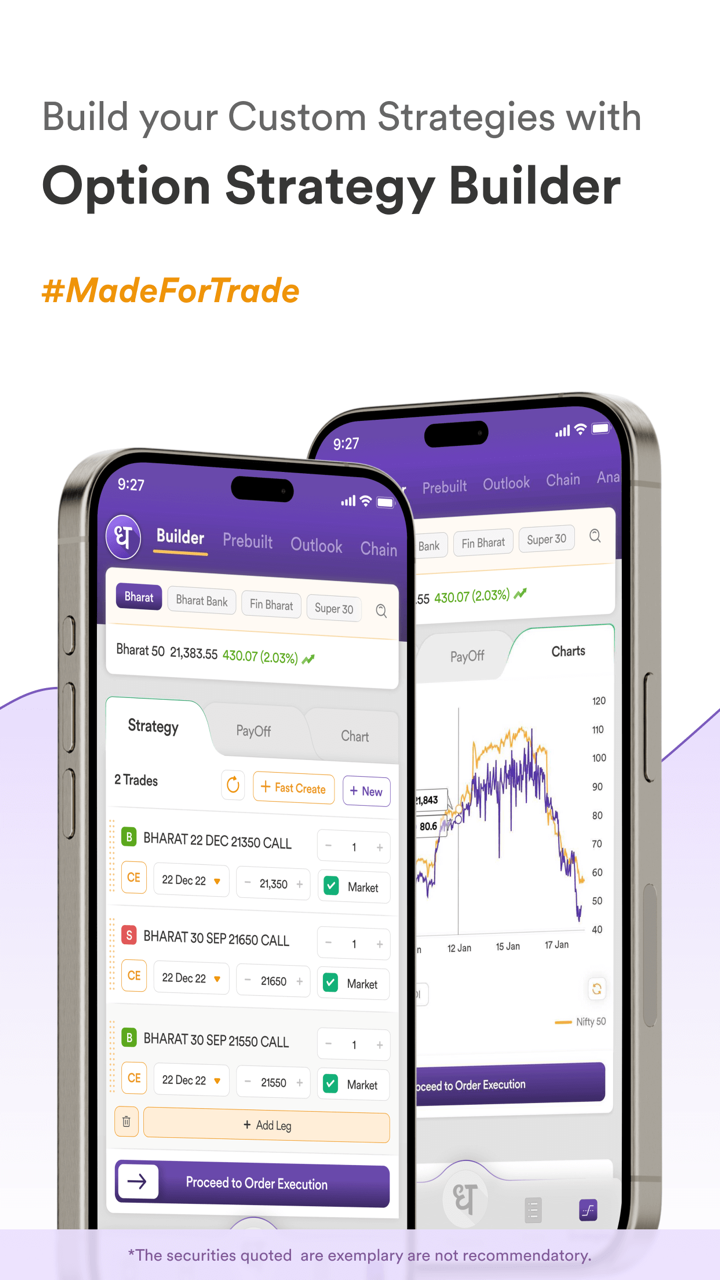

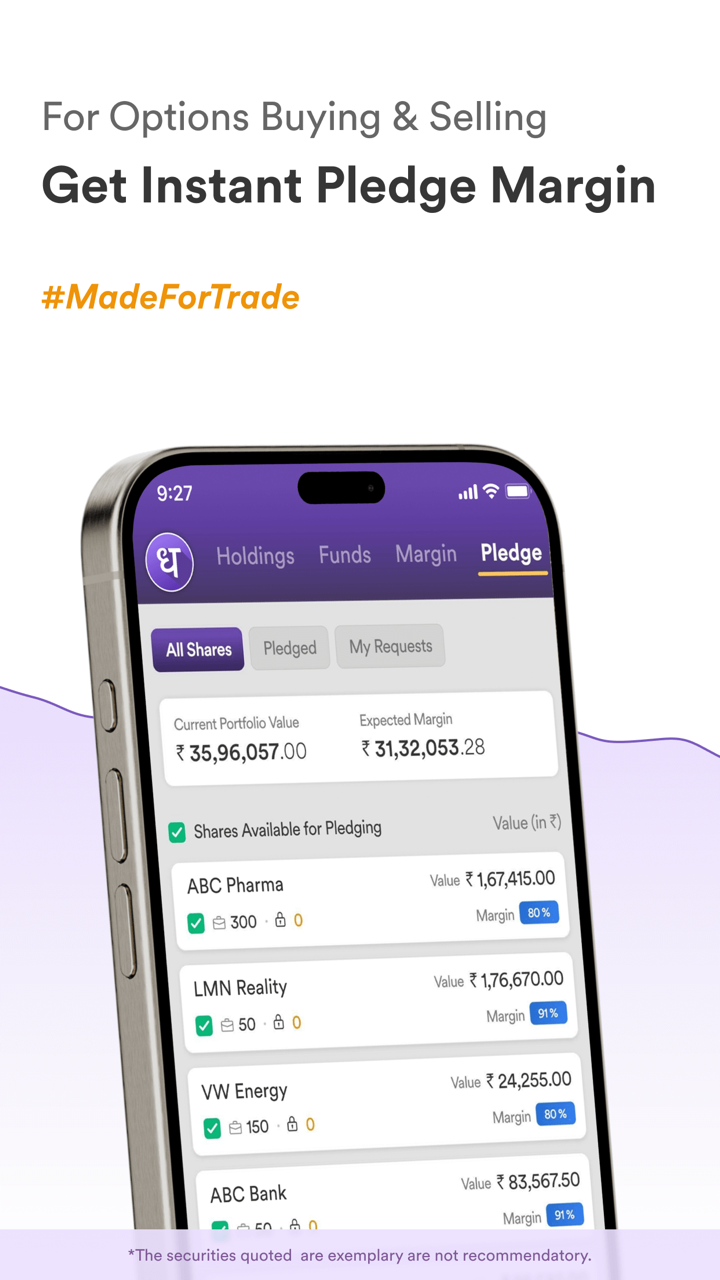

| Options | ✔ |

| ETFs | ✔ |

| Indices | ❌ |

| Forex | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

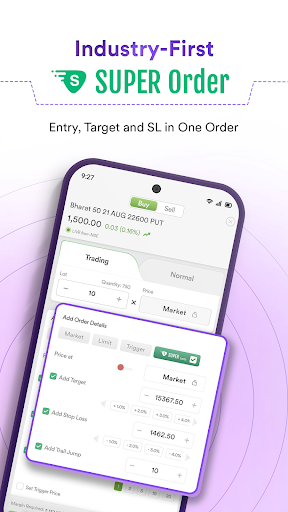

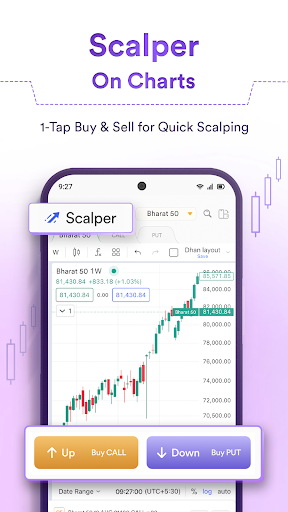

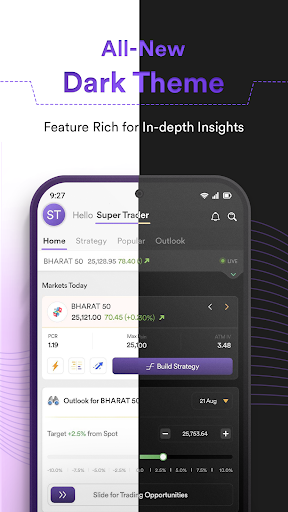

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for 适合何种类型交易者 |

| Dhan App, | ✔ | / | / |

| Dhan web, | ✔ | / | / |

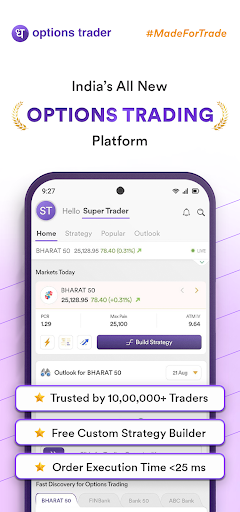

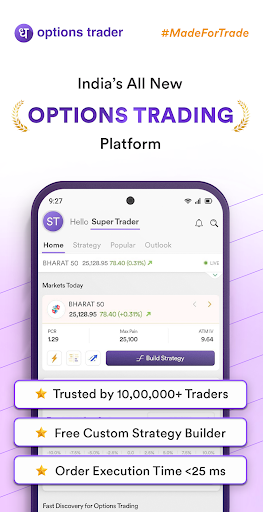

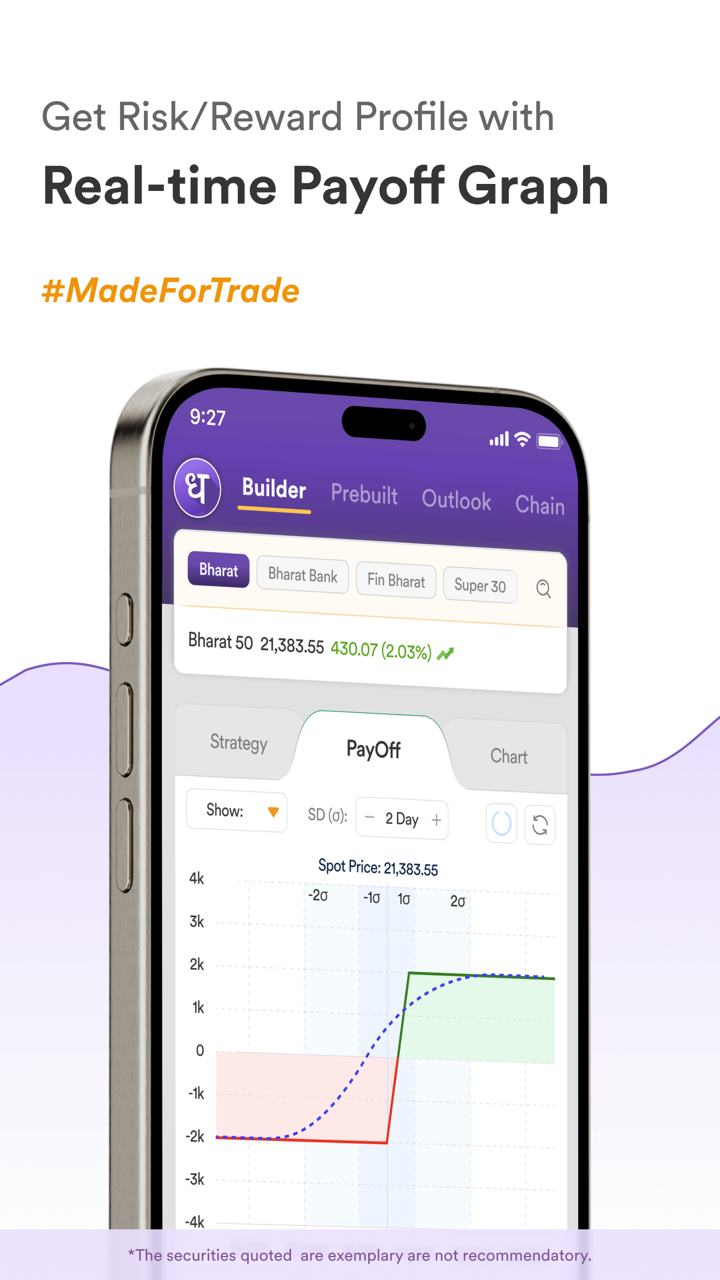

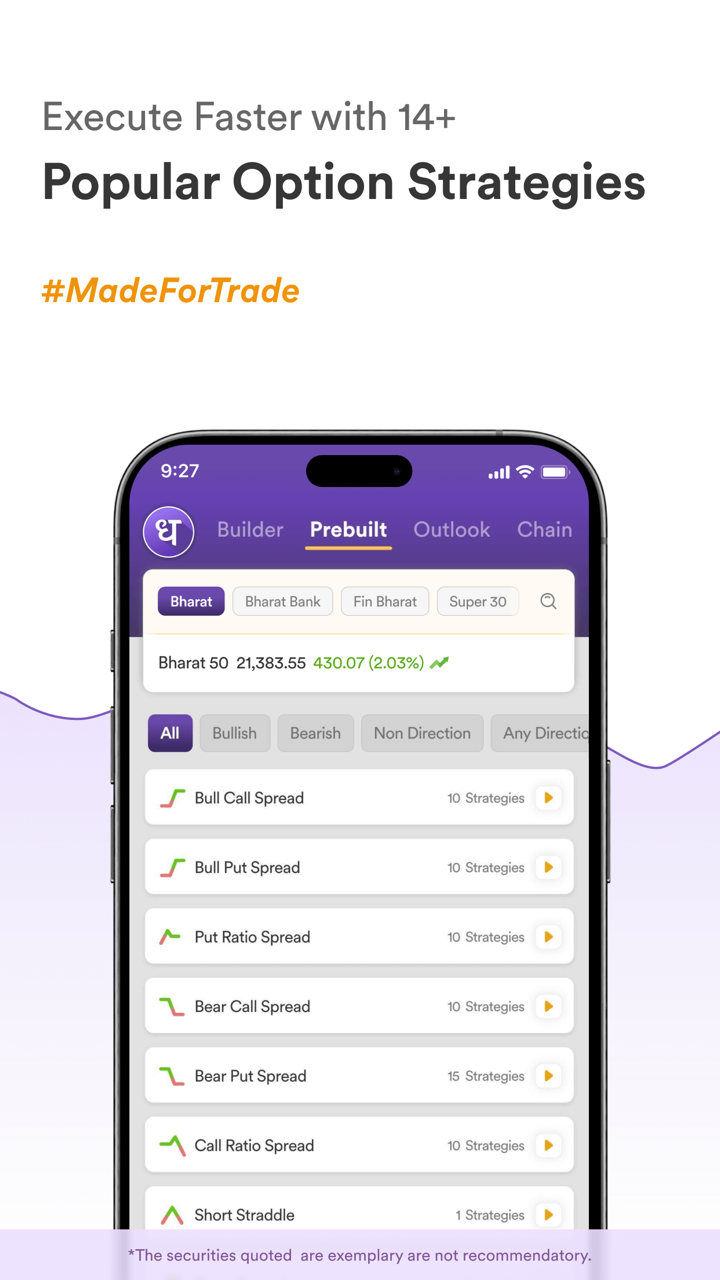

| Options Trader App, | ✔ | / | / |

| Options Trader Web, | ✔ | / | / |

| Dhan + TradingView, | ✔ | / | / |

| TradingView, | ✔ | / | / |

| DhanHQ | ✔ | / | / |

| MT4 | ❌ | / | Beginner |