简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. Nonfarm Payrolls Reignite Rate-Cut Expectations

Sommario:The U.S. Bureau of Labor Statistics (BLS) released the November Nonfarm Payrolls (NFP) report, delivering mixed signals to the market. Stronger-than-expected job creation coincided with a sharp rise i

The U.S. Bureau of Labor Statistics (BLS) released the November Nonfarm Payrolls (NFP) report, delivering mixed signals to the market. Stronger-than-expected job creation coincided with a sharp rise in the unemployment rate, reinforcing market expectations that the Federal Reserve (Fed) will begin cutting interest rates in 2026.

Key Takeaways from the November NFP Report

Nonfarm Payrolls: +64,000 jobs in November, exceeding market expectations.

October Revision: October NFP figures were revised downward to a decline of 105,000 jobs.

Unemployment Rate: Rose to 4.6%, the highest level since 2021.

Average Hourly Earnings: +3.51% year-over-year, indicating stable inflationary pressure.

Labor Market Revisions Largely Digested

Retail Sales and Inventory Dynamics Signal a Turning Point

Macro Environment Takes Center Stage

Valuation Adjustments: Investors will place greater emphasis on shifts in Fed rate expectations as the key force behind valuation recalibration.

Liquidity Expansion: As expectations for future rate cuts strengthen, global liquidity conditions are likely to improve, providing additional support for precious metals, particularly gold.

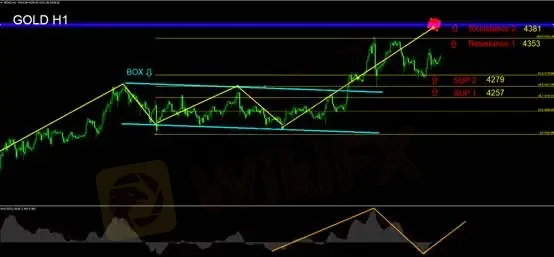

Gold Technical Analysis

Key Levels

SUP1: 4,279

SUP2: 4,257

R1: 4,353

R2: 4,381

Risk Disclaimer

Although November job gains surpassed the consensus forecast of 50,000, the notable increase in the unemployment rate has led markets to maintain expectations of two rate cuts (50 basis points) by the Fed in 2026. The current federal funds target range stands at 3.50%–3.75%.

Risk assets and gold both benefited from renewed rate-cut expectations, reversing prior declines. The report acted as a confidence booster for investors, easing short-term selling pressure.

It is worth noting that the downward revision to October employment data was primarily driven by temporary effects in the government sector, rather than a material deterioration in private-sector hiring. Markets have largely absorbed this adjustment. Overall employment conditions remain on an expansionary path, and combined with steady wage growth, expectations for rate cuts next year remain unchanged. Investor sentiment has shifted from panic-driven selling toward greater stability.

Released alongside the NFP data, U.S. October retail sales figures highlighted notable changes on the inventory side. Our focus is on business inventories, where the inventory-to-sales ratio increased year-over-year from 1.05 in September to 1.25. This suggests that retailers have begun proactively rebuilding inventories, marking a turning point driven by seasonal demand and restocking activity.

A leading indicator of end-consumer demand, e-commerce sales, rose 8.97% year-over-year in October. Combined with expectations of Fed rate cuts and persistently low oil prices, these factors support continued momentum in consumer spending. E-commerce growth is likely to extend through year-end.

Going forward, market attention should focus on the strength and sustainability of inventory restocking, which could underpin further equity market gains. Concerns about a sudden collapse in corporate ordering activity appear unwarranted at this stage.

Based on current market consensus, we believe the U.S. economy has established a bottoming process and is entering an upward inflection phase over the next six months. Capital expenditure plans and long-term growth potential of large-cap technology stocks have already been fully priced in by the market, following a significant repricing process. As a result, short-term earnings surprises are unlikely to serve as a major catalyst for further upside.

Market focus is shifting back toward macroeconomic dynamics, which remain the primary driver capable of generating meaningful volatility.

Looking ahead over the next year, market conditions may resemble the accommodative global monetary environment of 2021. With ample liquidity and improving growth expectations, equities and gold could rise in tandem, forming a “stocks-and-gold rally” scenario.

If bullish momentum carries prices above 4,381 (previous high), continued record-high performance for gold this month becomes increasingly likely. The key question is no longer whether gold will rise, but how far the rally can extend.

Support

Resistance

The above views, analyses, research, prices, and other information are provided solely for general market commentary and do not represent the position of this platform. All users assume full responsibility for any risks incurred. Please trade with caution.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

EC markets

Vantage

STARTRADER

AVATRADE

fpmarkets

XM

EC markets

Vantage

STARTRADER

AVATRADE

fpmarkets

XM

WikiFX Trader

EC markets

Vantage

STARTRADER

AVATRADE

fpmarkets

XM

EC markets

Vantage

STARTRADER

AVATRADE

fpmarkets

XM

Rate Calc